Stock Market Today: S&P 500 Sets Record Despite Sizzling Inflation

November's CPI report showed consumer prices rising at rates last seen decades ago. Investors waffled early Friday but bought into the afternoon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

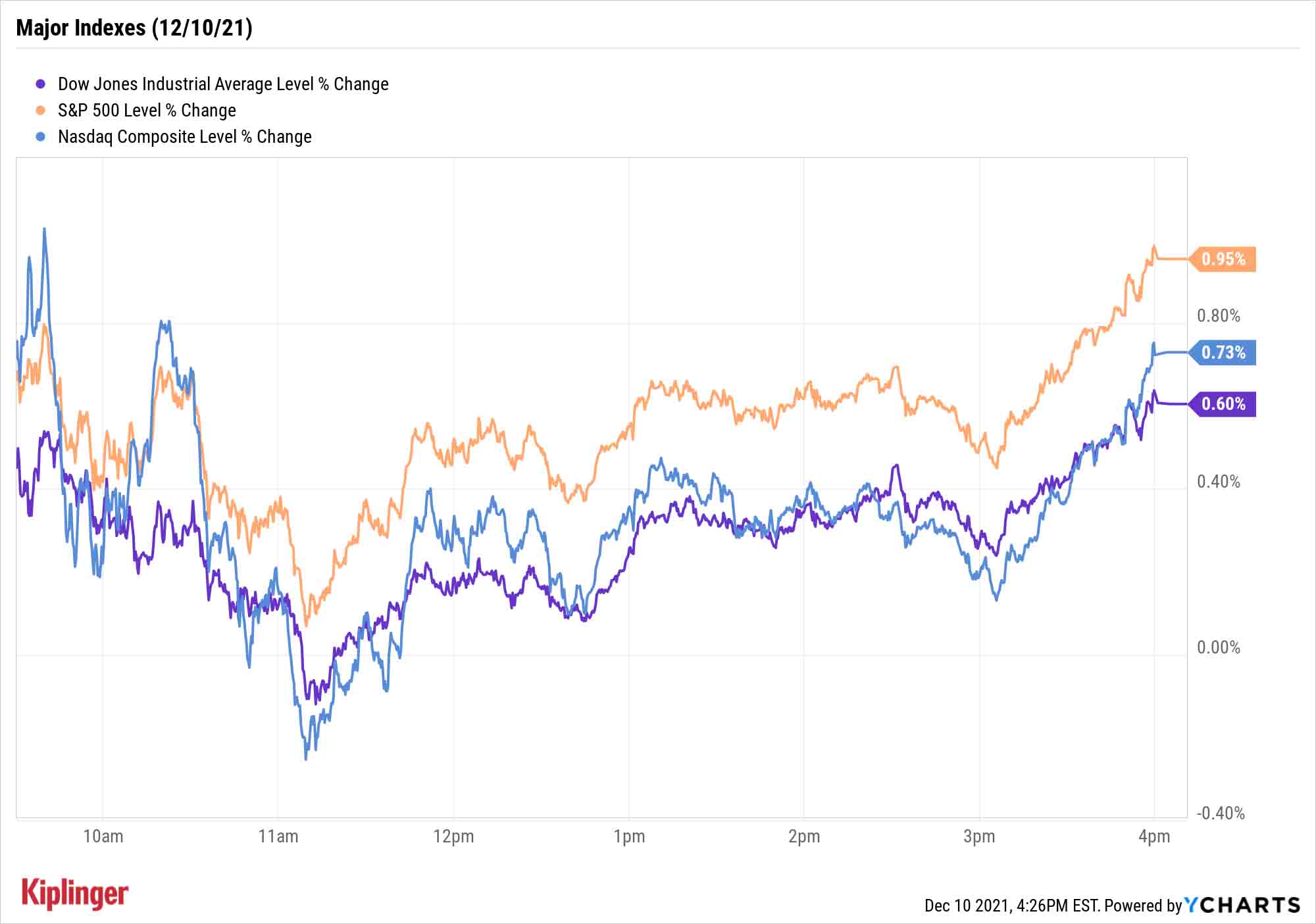

A white-hot November consumer price index report had the market seeking direction for most of Friday's session, but the bulls overcame the bears and the S&P 500 set new highs by the time the week's final closing bell rang.

The Bureau of Labor Statistics reported that headline inflation for November was up 0.8% month-over-month and 6.8% year-over-year – the latter was the highest such reading in 39 years. Core inflation (backing out volatile energy and food costs) was blistering as well, up 0.5% MoM and 4.9% YoY, the quickest rate in three decades.

Thing is, the numbers largely didn't come as a shock.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Friday's consumer price index print was surprising in its lack of surprise, as the number was exactly what Wall Street was expecting," says George Ball, chairman of investment firm Sanders Morris Harris, adding that "high inflation has been priced into markets for many months now."

The gaudy numbers nonetheless drew widespread attention, drawing parallels between today and the 1970s. "But we think the comparison dubious, despite some similarities," says Rick Rieder, BlackRock's chief investment officer of global fixed income.

"In fact, from the standpoint of real wage growth, the most recent period would appear to be precisely the opposite of what occurred during much of the 1970s and 1980s," he says.

Rieder adds that BlackRock sees headline and core CPI in the 2% to 3% range by the end of 2022. Kiplinger economists peg 2022 inflation at 2.7%.

Nonetheless, several strategists believe November's reading will force the Federal Reserve's hand.

Anu Gaggar, global investment strategist for Commonwealth Financial Network, says this morning's print "will reinforce the Fed's resolve to accelerate tapering. With the strength in the economic recovery, it is time to take the crutches away."

The technology sector (+2.0%) led the way today, thanks in part to its two largest components: Microsoft (MSFT, +2.8%) and Apple (AAPL, +2.8%), the latter of which scored another all-time high and is now worth $2.9 trillion by market value.

The S&P 500 surged 1.0% to 4,712, eclipsing its previous all-time high set in November. The Nasdaq Composite finished up 0.7% to 15,630, while the Dow Jones Industrial Average gained 0.6% to 35,970.

Coming up next week is a thin earnings calendar, but one that includes reports from Adobe (ADBE), FedEx (FDX) and Darden Restaurants (DRI). You can check out our earnings previews here.

Other news in the stock market today:

- The small-cap Russell 2000 still managed to finish in the red, off 0.5% to 2,210.

- U.S. crude oil futures gained 1.0% to settle at $71.67 per barrel. For the week, crude futures jumped 8.2%, marking their best weekly performance since late August.

- Gold futures rose 0.5% to finish at $1,784.80 an ounce. Week-over-week, gold managed a 0.1% gain.

- Bitcoin recovered by 1.5% to $48,386.14. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Oracle (ORCL, +15.6%) was a notable gainer today following the software company's earnings report. In its fiscal second quarter, ORCL reported adjusted earnings of $1.21 per share on $10.36 billion in revenue – besting the $1.11 per share and $10.21 billion analysts were expecting. Oppenheimer analyst Ray McDonough also waxed optimistic about the company's total cloud revenue, which grew 22% year-over-year and fiscal 2022 cloud guidance, which is expected to reach the mid-20% range. However, McDonough maintained his Perform (Hold) rating on the shares. "While we remain attracted to Oracle's accelerating growth and cloud momentum, we remain on the sidelines as we look for a greater margin of safety," he wrote in a note.

- Chewy (CHWY), on the other hand, plunged 8.1% in the wake of earnings. The online pet supplies retailer reported revenue of $2.21 billion, which was in line with what Wall Street pros were projecting. However, CHWY also recorded a per-share loss of 8 cents for its third quarter – wider than the per-share loss of 8 cents analysts were anticipating – amid labor shortages, higher inflation and supply-chain disruptions, and lowered the top end of its full-year revenue forecast. UBS Research analyst Michael Lasser maintained his Sell rating on CHWY and slashed his price target to $46 from $71, well below today's close at $51.76. "A number of new and existing headwinds were brought to light with CHWY's third-quarter print," Lasser says. "We continue to believe that the risks facing the stock outweigh the rewards at current levels."

Another Big Year for Transports?

Corporate America will have some difficult year-over-year comparisons to deal with in 2022, but by and large, Wall Street still has rosy expectations.

"Analysts still expect the S&P 500 to report high, single-digit earnings and revenue growth in calendar year 2022," says John Butters, senior earnings analyst for FactSet, in a 2022 outlook. Specifically, analysts are projecting 9% growth in profits and 7.3% growth in sales.

"Analysts also expect a record-high (annual) net profit margin of 12.8% in CY 2022," he adds.

This earnings enthusiasm is one reason for bullishness on the part of professional stock pickers, and a prevalent theme among many of our 22 best stocks to buy for 2022.

But strategists are also looking over their shoulders, and it shows. For instance, some of the top healthcare picks for the year to come are bets on the necessity for additional COVID-19 vaccines and treatments over the next 12 months.

Similarly, several beloved transportation plays hinge on a not-so-great outcome. The world's transportation infrastructure woes have penetrated everyday life to the point where most Americans have had the words "supply chain" pass through their lips at least once in recent months.

The following five transportation stocks represent five popular industry plays heading in 2022, and for the most part, continued supply-chain disruptions next year will add to that bull case.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.