Stock Market Today: Boffo Jobs Report Spurs Fresh Dow Highs

Investors cheered better-than-expected October payroll gains and a possible breakthrough COVID-19 treatment by vaccine leader Pfizer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A pair of bullish headlines had the major indexes poised to end the week on a euphoric note, but investors had to settle for more pedestrian gains.

This morning, the Bureau of Labor Statistics delivered a nonfarm payrolls report that was, by most measures, simply outstanding. Not only did the U.S. add 531,000 jobs in October to easily beat estimates for 450,000, but September's weak 194,000 jobs added was revised higher to 312,000, and August also was revised higher (to +483,000 from +366,000).

The unemployment rate also declined, to a better-than-expected 4.6% from 4.8% in September.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Payrolls surged in October with the trifecta of waning COVID concerns, back-to-school season, and declining unemployment benefits contributing to a strong uptick in hiring," says Peter Essele, head of portfolio management for Commonwealth Financial Network. "Notable increases came from goods-producing industries like construction and manufacturing, a sign that the recovery is permeating industries beyond the work-from-home segments of the economy."

Lindsey Bell, Ally Invest's chief markets and money strategist, added that wages continue to rise quickly, with average hourly earnings up 4.9% year-over-year. But she adds "wage increases are a double-edged sword: they help the consumer, but they can also increase costs for businesses (and eventually, costs for customers). So far, consumer demand remains strong despite higher prices and corporate margins have yet to be dented.

"Going forward, wages and productivity could be the most interesting metrics to watch on the labor market front, with inflation worries top of mind."

It wasn't all roses. A team of BofA Securities strategists points out that there are still 4.2 million fewer people employed today than in February 2020. The labor force participation rate was unchanged at 61.6%, as well.

"We know that retirements have played a big role in the decline in participation, but the question is, what about those who left the labor force for other reasons (e.g. COVID concerns and childcare responsibilities)?" BofA team's asks.

Also Friday, as we discussed in our free A Step Ahead newsletter, Pfizer (PFE, +10.9%) announced that a key clinical trial demonstrated that its drug Paxlovid reduced risk of death or hospitalization by 89% in high-risk patients.

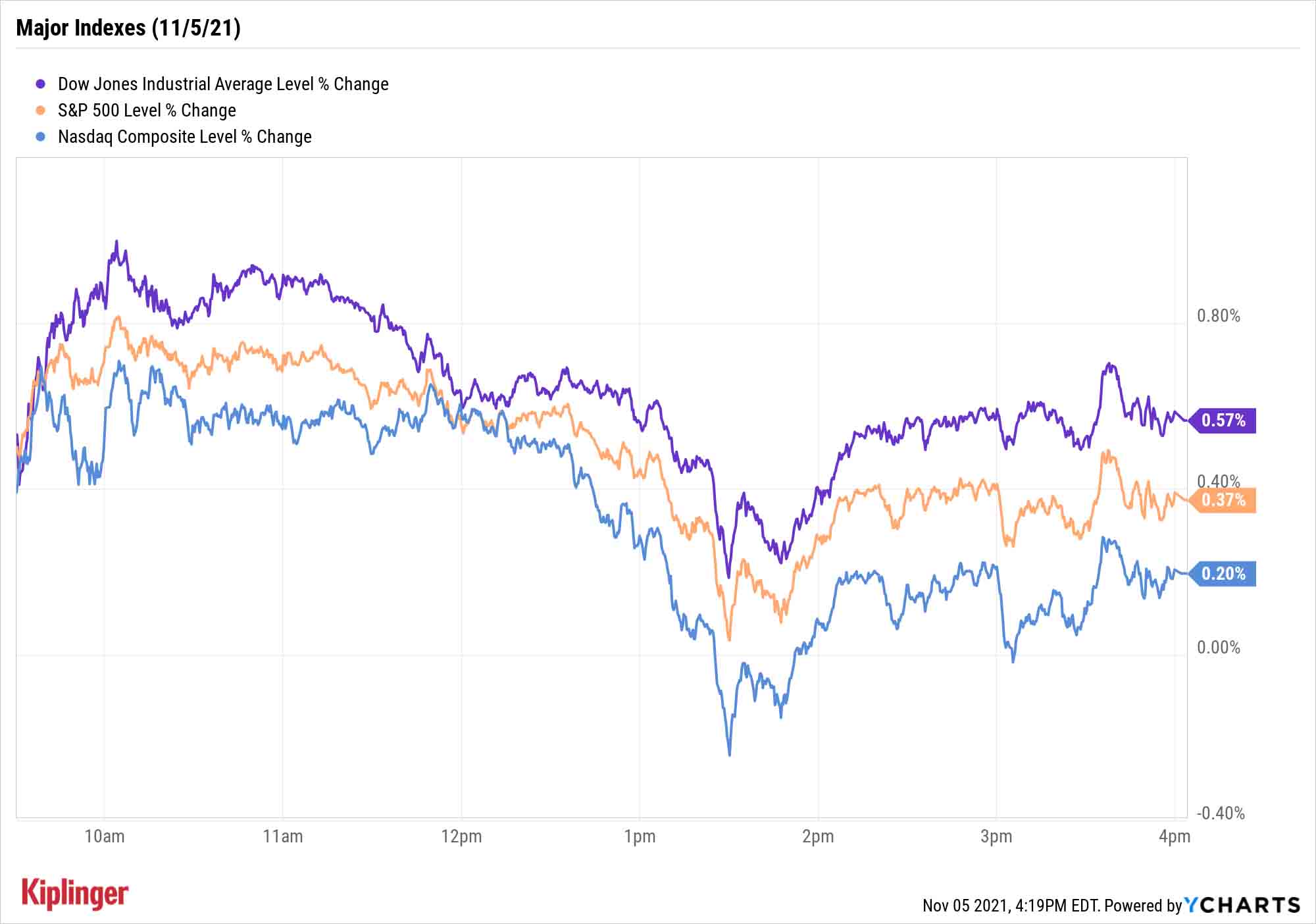

The double shot of pleasant news triggered heavy morning buying, but some of the enthusiasm waned by the close. The Dow Jones Industrial Average, for instance, gained as much as 360 points (1.0%) before finishing up 203 points (0.6%) – still good enough for a record close.

There was similar action in the S&P 500 (+0.4% to 4,697), Nasdaq Composite (+0.2% to 15,971) and the small-cap Russell 2000 (+1.4% to 2,437), all of which notched new highs.

Other news in the stock market today:

- U.S. crude futures jumped 3.1% to finish at $81.27 per barrel.

- Gold futures rose 1.3% to settle at $1,816.80 an ounce.

- The CBOE Volatility Index (VIX) headed sharply higher, up 6.5% to close the week at 16.44.

- Bitcoin lost a sliver of its value, declining 0.1% to $61,138.64. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Peloton Interactive (PTON) was one of the worst stocks today, sinking 35.3% following its quarterly report. In its fiscal first quarter, the at-home fitness equipment maker recorded a wider-than-expected loss of $1.25 per share on lower-than-anticipated revenue of $805.2 million. The company also lowered its full-year forecasts for subscribers (to a range of 3.35 million-3.45 million vs. its previous estimate of 3.63 million) and sales (to a range of $4.4 billion-$4.8 billion vs. prior guidance of $5.4 billion). There were a number of Wall Street pros that chimed in on PTON after earnings, including Argus Research analyst John Staszak who downgraded the stock to Hold from Buy. "We expect losses over the remainder of fiscal 2022 driven by higher input prices and increased freight costs," he says. "Moreover, the reopening of gyms and a growing number of competitors are likely to weigh on results." Nevertheless, Staszak adds that over the long term, "we see significant growth as demand for in-home fitness products remains solid and operating leverage improves."

- Shake Shack (SHAK) was another big post-earnings mover, only its shares surged 16.3% on the day. The burger chain reported an adjusted loss of 5 cents per share on $197.5 million in revenues in its third quarter compared to analyst expectations for a per-share loss of 6 cents on $193.9 million in sales. Additionally, Shake Shack CEO Randall Garutti said in the earnings call that "in the fourth quarter, we expect to surpass $1 billion in system-wide sales for the year, a first for us." Oppenheimer analysts Michael Tamas and Brian Bittner reiterated their Outperform (Buy) rating in the wake of the results. "SHAK is not immune to the industry's sales and margin challenges," they wrote in a note. "However, we remain highly attracted to its new unit designs and outsized growth opportunity, particularly into 2022 as unit growth could be near 20% (45-50 new units)."

What's Really Driving the Market?

Celebrate the jobs report, but don't hang your hat on it. That's the advice from Jay Pestrichelli, CEO of investment firm ZEGA Financial.

"Friday's jobs report isn't likely to mean much for the stock market, as the jobs report is a lagging economic data point, and the stock market currently is focused on corporate earnings and a continued reopening of the economy," he says.

Earnings look especially healthy, with FactSet's John Butters reporting that with its Q3 results, the S&P 500 is delivering its second-highest revenue growth rate since his firm started tracking the data in 2008.

No wonder, then, that Pestrichelli still sees stocks as "one of the most attractive assets."

Investors jolted by a rush of confidence often will sample smaller companies like many of these 12 lesser-known names, or scintillating trendsetters like the stocks in these "futuristic" funds. But you might also want to consider some of Wall Street's true juggernauts.

There are large companies, and there are large companies. Mega caps – typically viewed as firms worth $200 billion or more in market value – are clearly the latter. And while some businesses tend to hit inertia at that size, several mega-cap stocks are hold growth potential.

Read on as we look at Wall Street's five favorite mega caps.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.