9 ESG Tools for Sustainable Investors

Growing demand for sustainable investment options has more and more companies offering ESG tools for investors. Here are nine to get started with.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sustainable investments take into consideration environmental, social and governance (ESG) factors. What is a company's carbon footprint? How diverse is its management team? What efforts does it make to promote gender equality in the workforce? All of these – and so many more – are questions that ESG attempts to answer for investors.

But such queries are not easily answered without lots of data, which begs an even bigger question: What ESG tools are available for individual investors to evaluate investments – in both stocks and funds – based on their sustainability practices?

The good news is that with the growing demand for sustainable investment options is an increasing number of companies providing ESG tools and research to help investors find the strategies they seek. Although most data sets are costly and designed for institutional investors, there are a number of free or limited data sets available to individual investors.

Here are nine such free, online socially responsible investing (SRI) and ESG tools to help you start or refine your sustainable investing portfolio.

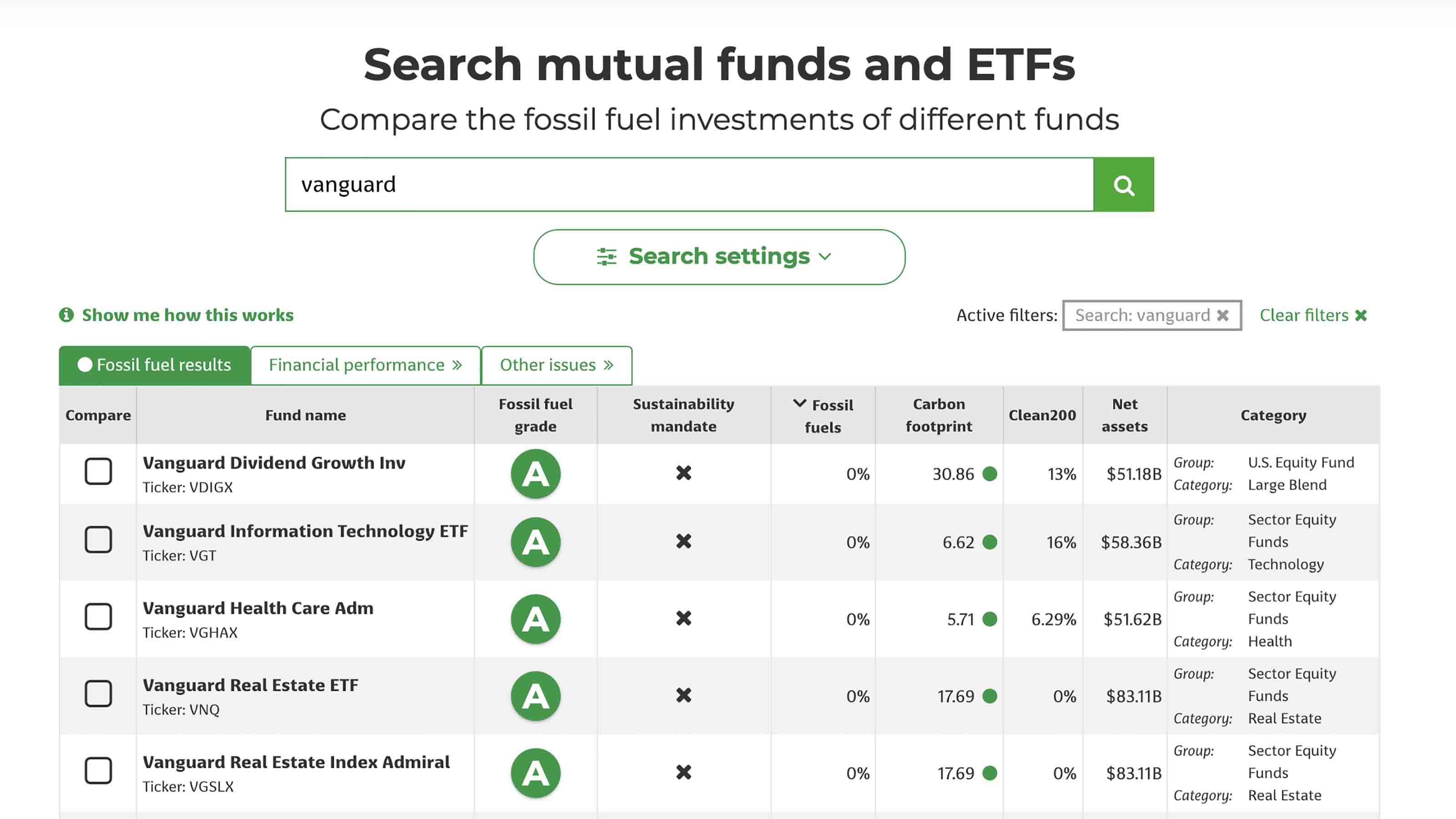

As You Sow – Invest Your Values

As a national non-profit for shareholder advocacy, As You Sow offers one of the most comprehensive SRI/ESG tools available to investors. On its site InvestYourValues.org, investors can evaluate the social responsibility of 3,000 mutual funds and ETFs, from their fossil fuel impact to gender equality and racial justice through the companies' relationships with private prisons.

One way to approach these tools is with a list of what you currently own in hand, says Andrew Behar, CEO of As You Sow. Then go to InvestYourValues.org and click on any of the screen options. This will take you to a new page where you can type the name, ticker or manager of a fund into the search box. The result will show how that fund scores on an A through F scale for the screen you chose and scrolling down will reveal the fund's score in all the other metrics As You Sow provides.

"If it is completely out of alignment with your values, start to look for something better," Behar says, which you can do by clicking "Search funds" in the upper right-hand corner navigation bar. This lets you view all funds rated by As You Sow with a "Search settings" option to refine your results by fund family, category, performance or minimum grade on any given screen.

The nonprofit's newest campaign hopes to highlight the responsible investment options – or lack thereof – in many 401(k) plans. If your 401(k) doesn't have good options, the site has tools for how you can engage with your employer and plan sponsor to help change that, including how to organize among your colleagues and a letter you can download to take to your 401(k) provider.

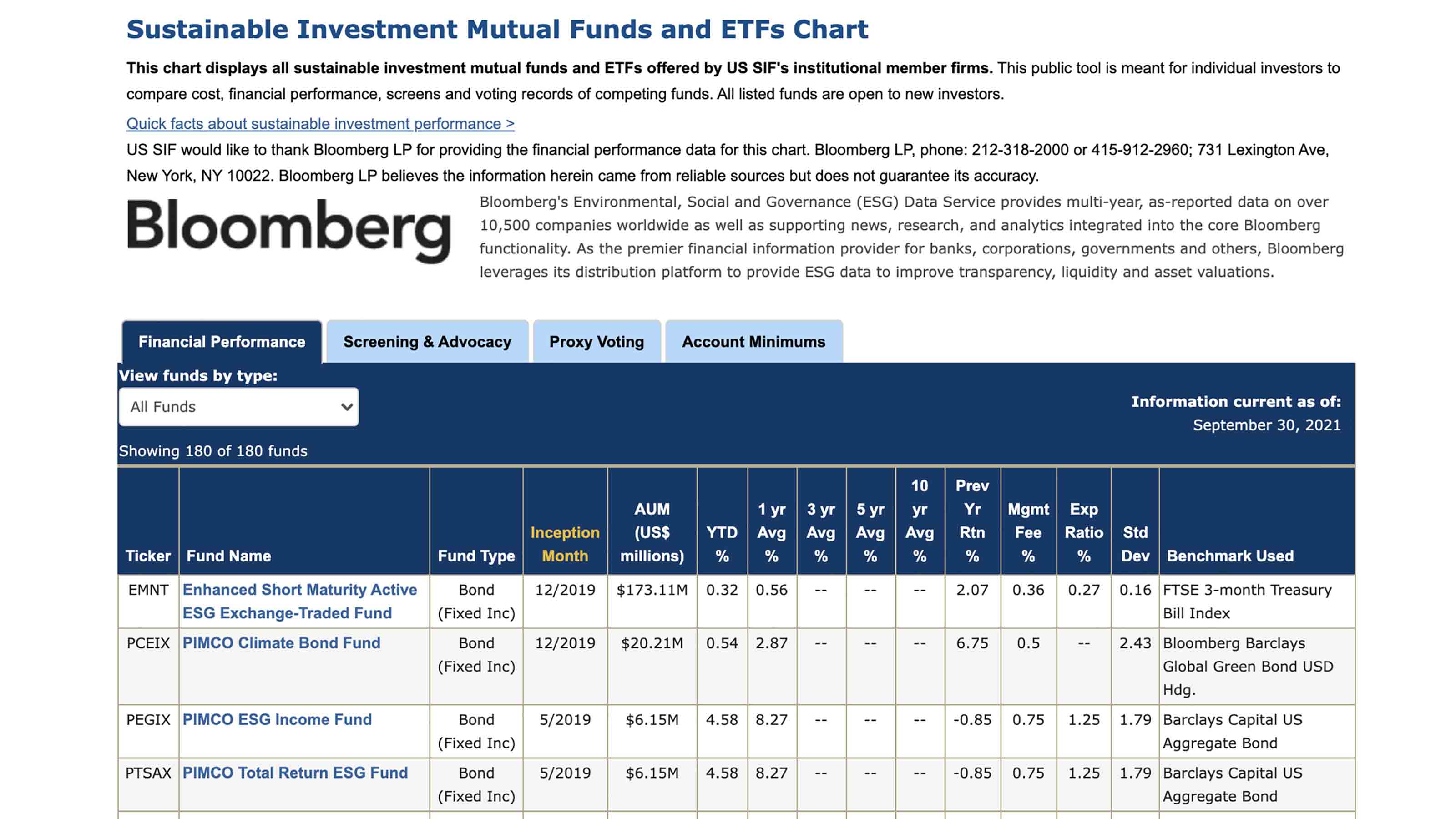

USSIF Sustainable Investment Mutual Funds and ETFs Chart

If you're interested in sustainable investing, you should know about US SIF: The Forum for Sustainable and Responsible Investment.

The Forum consists of financial institutions such as broker-dealers and investment management firms, as well as individual financial advisors, community development organizations and non-profit associations, all of whom are working together to advance long-term sustainable investment practices.

Part of that effort includes increasing investor awareness, such as through the Sustainable Investment Mutual Funds and ETFs Chart publicly available on the site. The chart shows all of the sustainable funds offered by US SIF member firms.

Using this ESG tool, viewers can compare cost and financial performance across funds. Under the Screening & Advocacy tab you can also quickly see how the fund screens companies for its portfolio and if it participates in shareholder engagement. You can also see proxy voting records for many funds.

While you can sort the data by any of the financial metrics listed on the Financial Performance tab – including assets under management, year-to-date return and expense ratio – the only other way to narrow your search is by viewing funds by type: either all cap, balanced, bond, international or equity large cap, mid cap, small cap or specialty.

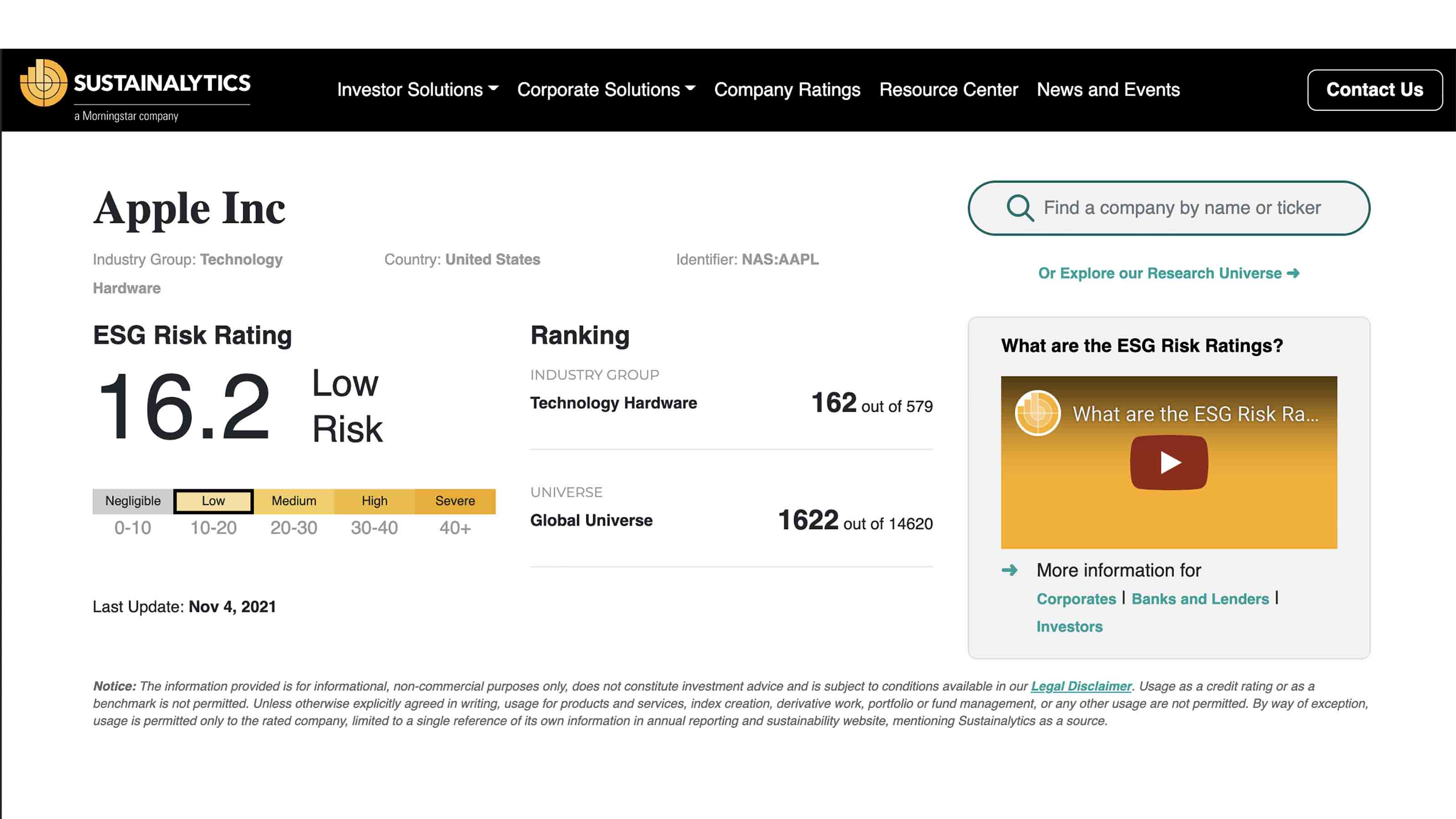

Sustainalytics ESG Ratings

Sustainable investing isn't just morally responsible; it can also be financially prudent. Companies that don't have strong ESG practices can be exposed to greater environmental, government and social risks.

For instance, a company with poor carbon practices may find itself facing pollution penalties in the future or being required to change its practices. To this end, Sustainalytics provides company ESG risk ratings for more than 4,600 companies. The ratings highlight ESG issues that Sustainalytics believes may pose a financially material risk to the company and assess the magnitude of that unmanaged risk.

Sustainalytics combines the company's exposure, or its vulnerability, to ESG risks, and the actions taken by the company's management to address the ESG issue. The firm then gets an overall ESG rating. A lower numerical ESG risk rating indicates lower overall risk of experiencing negative financial impact from ESG issues.

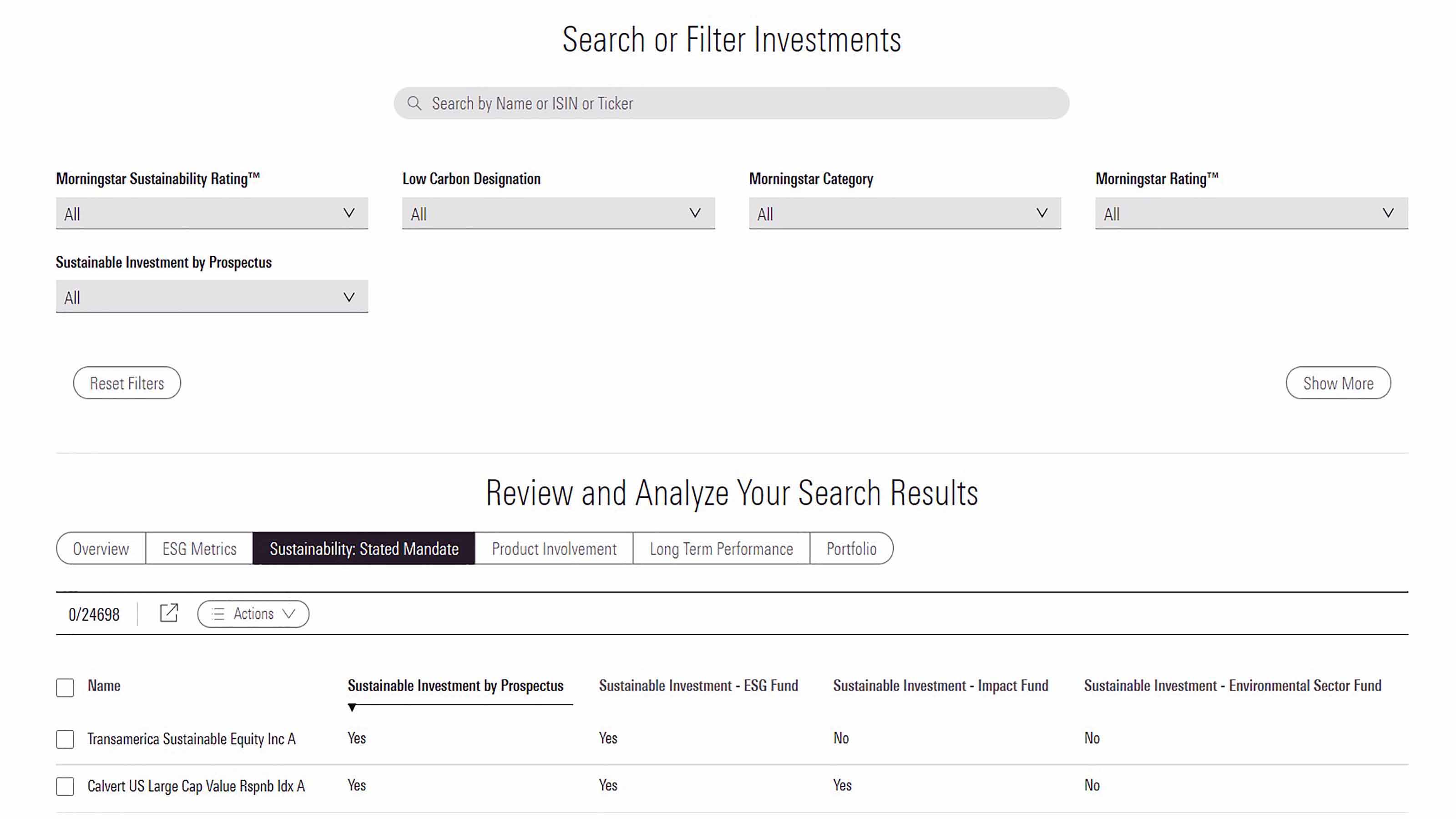

Morningstar ESG Screener

Morningstar's ESG Screener lets you search for sustainable mutual funds based on your chosen criteria. Using this ESG tool – which is supported by company-level data gathered from Morningstar-owned Sustainalytics – you can search for funds by their name or ticker.

You can also search using a variety of filters, including by which funds have sustainability or ESG focuses identified in their prospectus, if they have a low carbon designation and by Morningstar's Sustainability Rating, a measure of how well the fund is managing ESG risks relative to its peer group. Morningstar's Sustainability Rating is designated on a scale of one to five "globes," with more globes indicating the fund has a higher investment in companies identified as having lower ESG risks by Sustainalytics.

You can also view Morningstar's sustainability breakdown for a given fund under the Portfolio tab. The Historical Sustainability Score takes a weighted average of the fund's scores over the previous 12 months, with a heavier weight placed on more recent scores. Based on this historical average, funds are given ranks within their Morningstar category so you can see how they measure up to peers. The higher the score, the better the fund's performance relative to its peers.

A fund is considered a "Sustainable Investment" if management identifies sustainability or ESG metrics as a focus in its public filings. If a fund meets this criteria, it is then categorized into one of three levels: ESG funds that focus on ESG factors, Impact funds that strive to get a financial return while also driving positive change, and Environmental Sector funds that invest in environmental industries such as water or renewable energy.

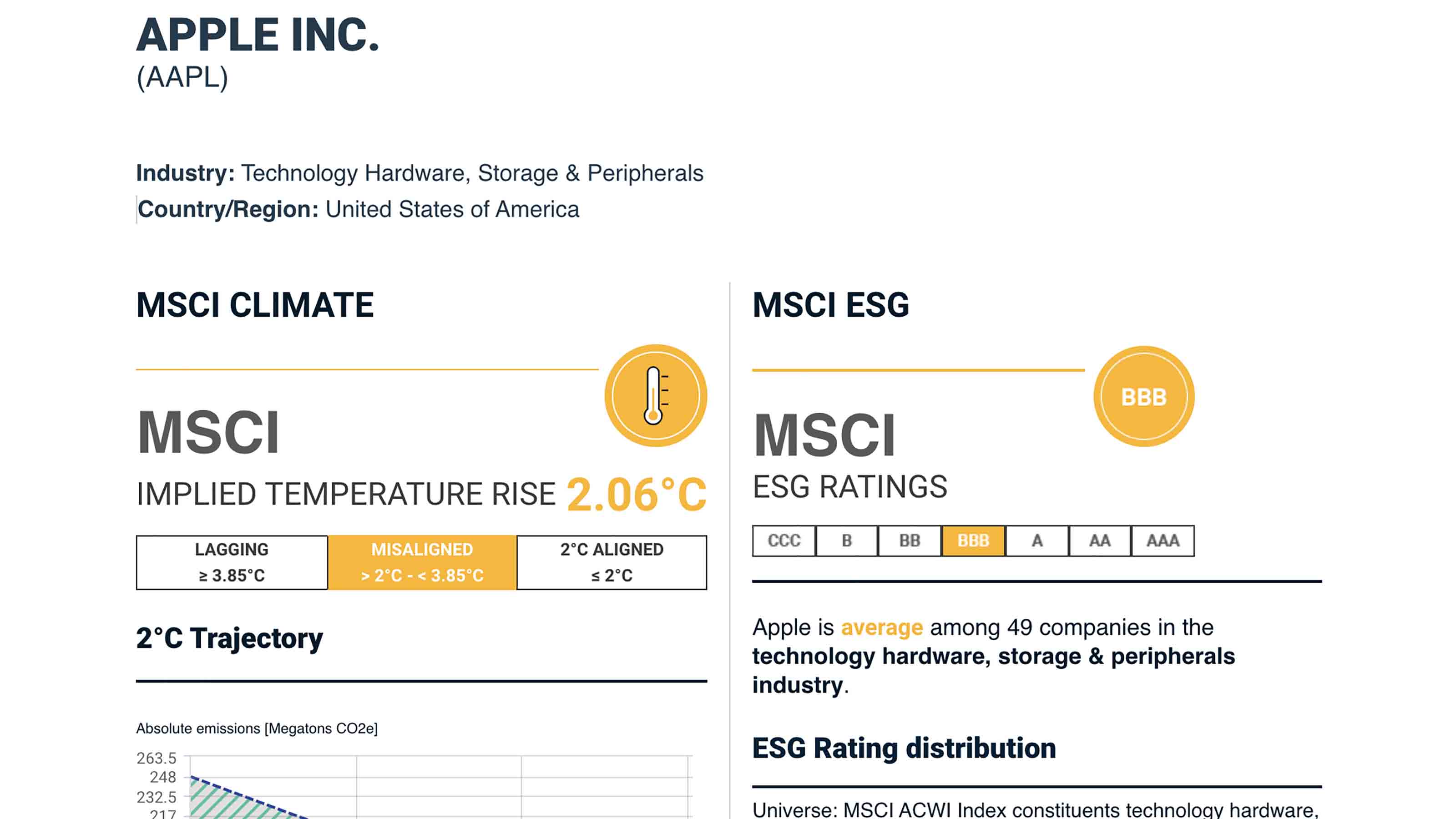

MSCI ESG Ratings & Climate Search Tool

MSCI's free ESG Ratings & Climate Risk Search Tool lets you search across the more than 2,900 constituents of the MSCI ACWI Index, the investment management firm's flagship global equity index. Type in a company name or ticker symbol to see how it aligns with global climate targets and its ESG risks and opportunities.

A firm's impact on global climate targets is indicated by its implied temperature rise, which shows how aligned it is with the target of keeping global warming this century to below 2 degrees Celsius.

This ESG tool is a forward-looking measure that converts current and projected greenhouse gas emissions from nearly 10,000 publicly listed companies based on their share of the carbon budget if we want to stay within the global target. Companies that are projected to emit below-target carbon levels are "aligned," while those projected to emit above-target levels are "misaligned" or "lagging."

You can also see if a company has issued a decarbonization target and, if it has, its target year for achieving a net-zero carbon footprint.

On the ESG ratings front, a company is assessed across key issues for both it and its industry. A firm is given a grade from AAA (leader) down to CCC (laggard) based on how it shapes up relative to peers. MSCI then shows where a company lags or leads its peers across the material ESG issues for its industry.

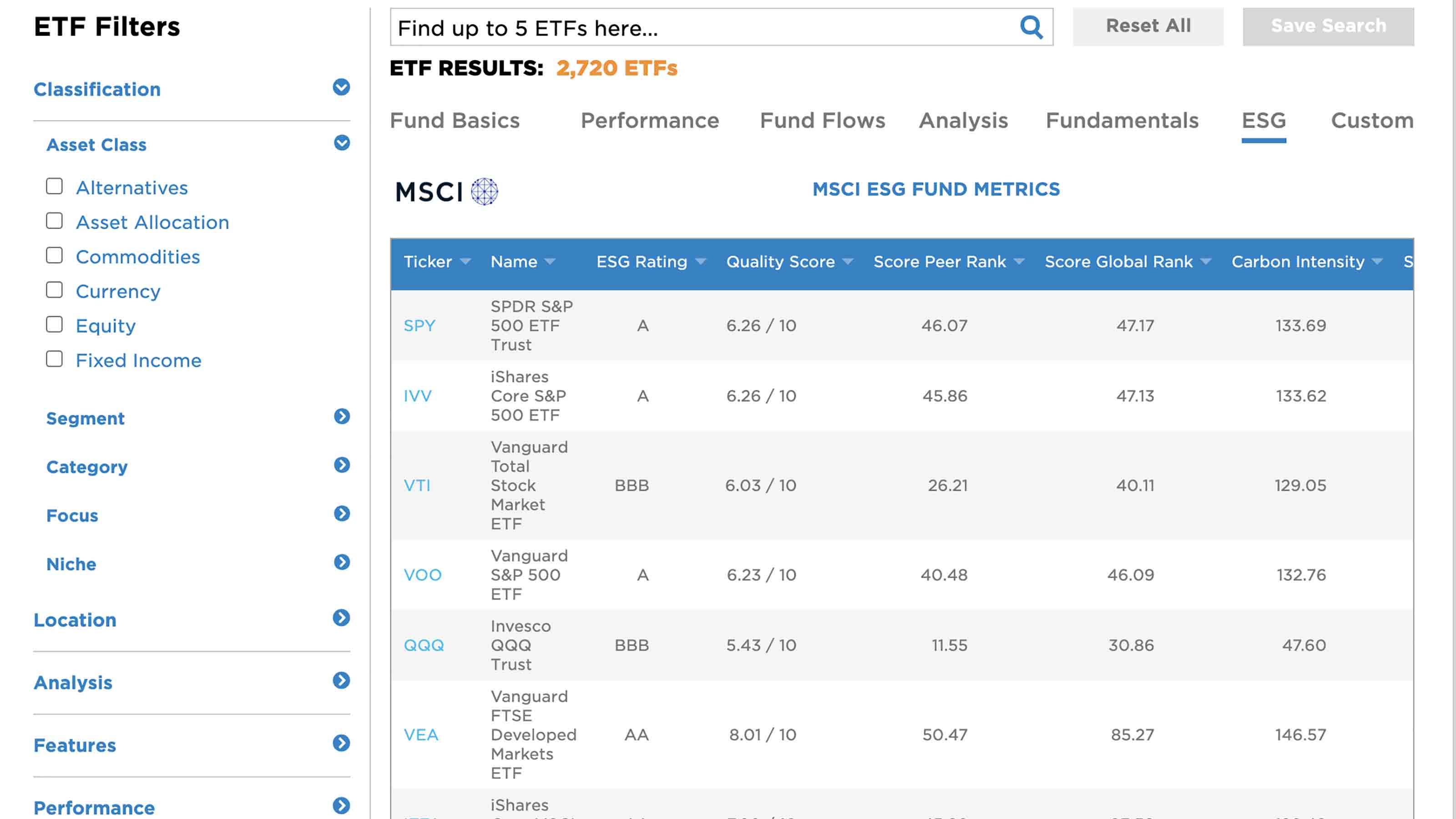

ETF.com ESG Ratings

For investors looking to conduct research on ESG ETFs, one of the best places to go is ETF.com. The ESG tab in its ETF Finder gives MSCI ESG ratings data for each fund based on its exposure to several factors, including carbon emissions, sustainability impact and governance risks.

You can see the fund's ESG rating on a scale of AAA to CCC and its quality score – the ability of the ETF components to manage medium- to long-term ESG risks – out of 10, with 10 being the highest possible score. And to help you put these numbers in perspective, ETF.com gives the percentage of the fund's peers that have an ESG score equal to or lower than the fund in question, as well as its global rank among all funds covered by MSCI.

"While it's relatively straightforward to find the ESG ETFs on the platform, there are an incredible number of different ways those ETFs are constructed," says Simon Tryzna, chief investment officer and wealth advisor at ClearPath Capital Partners. "The difficulty in investing in ESG ETFs is really just finding out how they are constructed and whether that meets the investors' definition of ESG and fits in with their overall investment thesis."

An investor's research shouldn't stop with a single ESG tool or screen. You should also understand how the ETF defines and accesses the underlying ESG investments. "Is the ETF looking to filter out and invest solely in companies that score in a top percentile of an internal factor score, or are they looking to exclude the bottom-scoring ones and allocate to the rest of the market?"

Tryzna also says to pay attention to whether the fund is targeting only one component of ESG (the E, S or G) or all three so you can get a better understanding of how it will fit into your portfolio and investment goals.

ETF.com does a great job of underlying these nuances and helping educate investors, Tryzna says. For more ESG education and insights, check out the ESG ETFs channel under the ETF Channels tab, too.

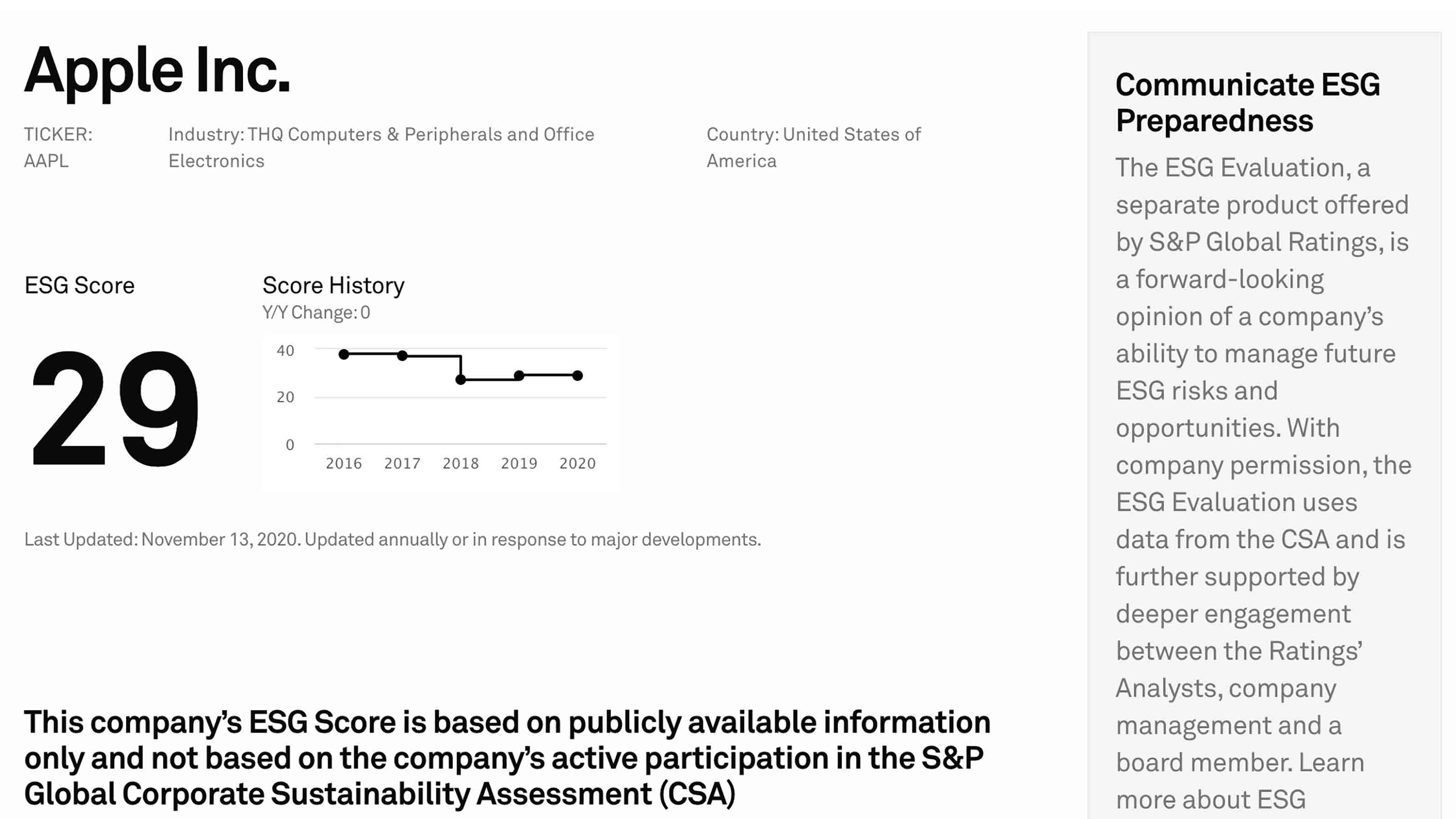

S&P Global ESG Screen

S&P Global released its company ESG Scores to the public in February 2021. This ESG tool has been the basis for selecting companies for the Dow Jones Sustainability Index (DJSI). Now all investors can go to the S&P Global website to view ESG data on 9,200 companies, and each firm is evaluated across roughly 1,000 data points.

S&P Global uses company responses to the Corporate Sustainability Assessment (CSA) industry-specific questionnaire to evaluate a company relative to its peer group.

Viewers can use the ESG tool to see how the company in question ranks on environmental, social and governance issues relative to the peer group average and the best score from within the industry.

There's also a spider chart that provides a visual representation for how the company fares relative to its peers on nine metrics, from climate strategy to labor practices and talent attraction and retention.

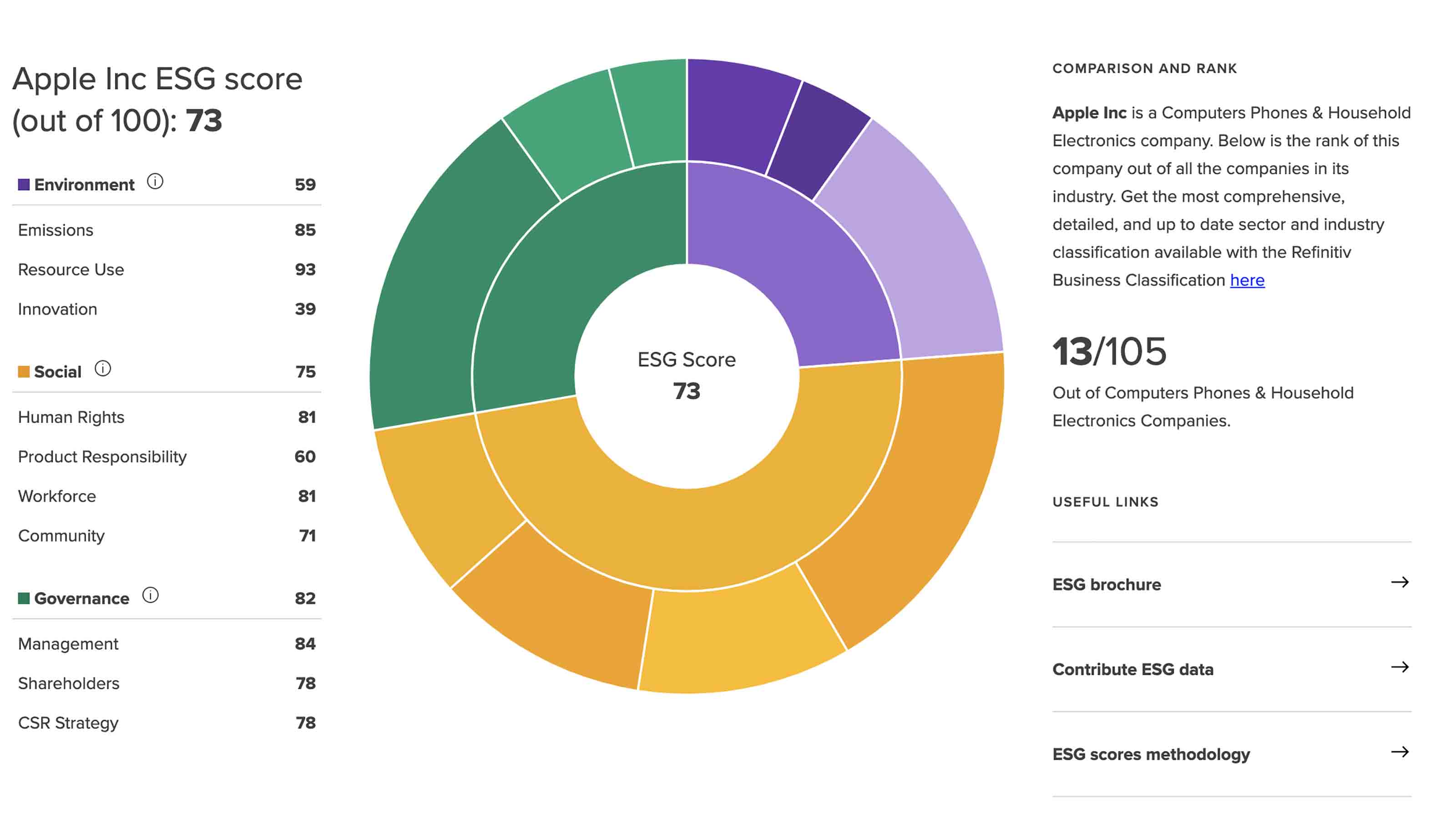

Refinitiv ESG Scores

Refinitiv, a subsidiary of the London Stock Exchange Group, is a global provider of financial markets and company data, including ESG company scores.

The company boasts the "largest ESG content collection operations in the world," which it uses to manually process verifiable publicly available data across more than 450 ESG metrics for more than 10,000 global companies. Overall company assessments are primarily based on the 186 most industry-relevant and comparable of these metrics.

To use Refinitiv's ESG tool, you can search by company name to see how it scores on a scale of 0 (poor relative ESG performance and transparency) to 100 (excellent relative ESG performance and transparency).

Companies are evaluated across 10 main themes within the E, S and G pillars. For instance, the environmental (E) pillar is broken down into emissions, resource use and environmental product innovation, while the social (S) pillar looks at human rights, product responsibility, workforce and community.

Company data is continuously updated in line with corporate reporting (usually annually) and product scores are refreshed weekly.

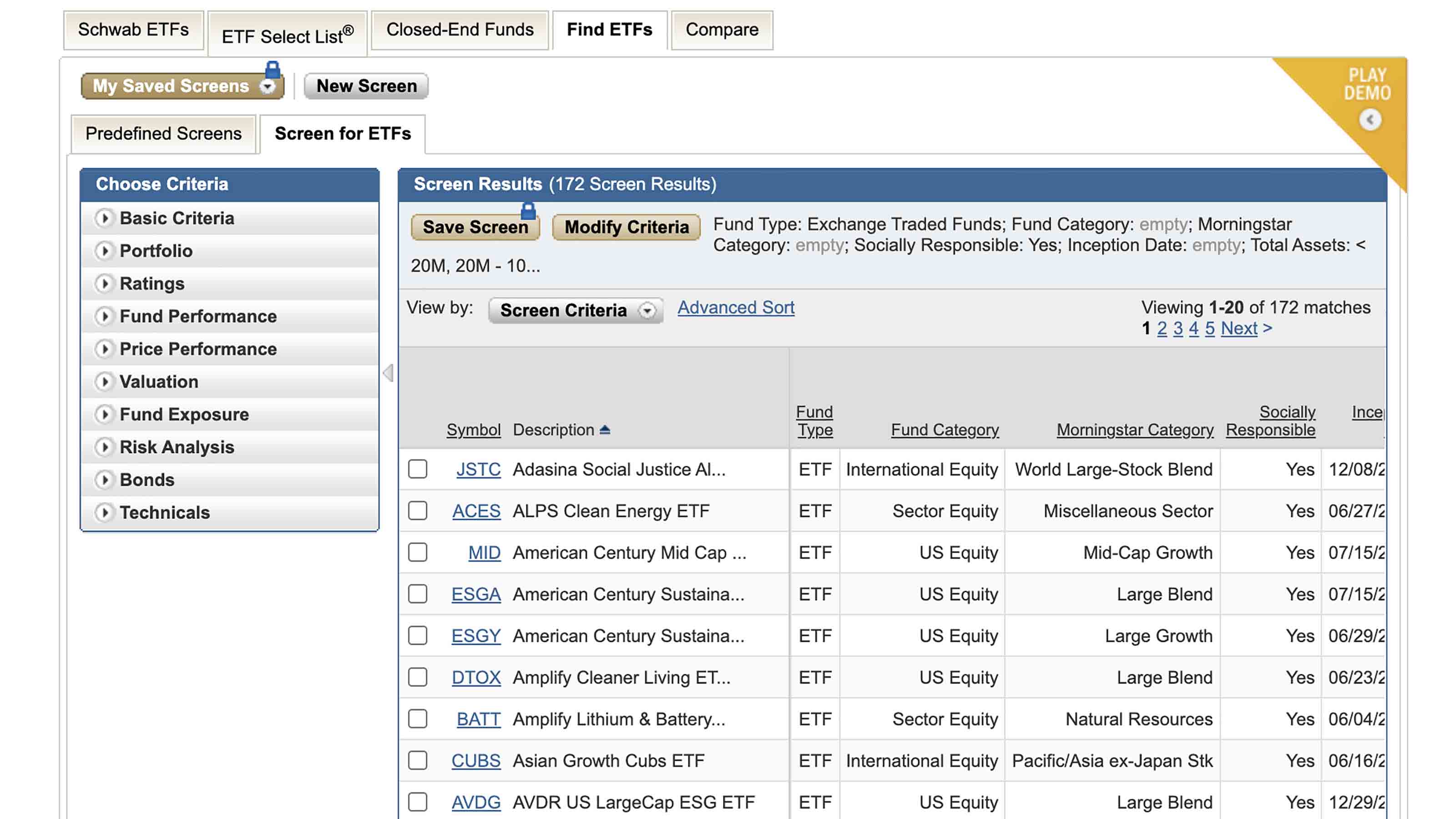

Charles Schwab SRI Screen

Individual brokerage firms also provide SRI and ESG tools and resources. Some are only available to clients, but others, such as Charles Schwab, make their search tools available to everyone.

Charles Schwab has also been making big steps in enhancing its tools for identifying socially responsible and ESG mutual funds and ETFs. Both clients and non-clients can quickly identify if a fund is socially responsible when looking at its profile. You can also compare up to five funds at a time to determine which have an SRI focus that most fits what you're looking for.

Or, if you want to see what is available in its entirety, Schwab has a prebuilt screen within its Advanced Fund Screener that lets you view only funds with an SRI mandate, as specified in the fund prospectus. You can then combine this screen with other criteria, such as fund ratings, portfolio characteristics and fees, to narrow down the SRI universe into a more defined sphere.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors. Previously, she was a fully licensed financial professional at Fidelity Investments where she helped clients make more informed financial decisions every day. She has ghostwritten financial guidebooks for industry professionals and even a personal memoir. She is passionate about improving financial literacy and believes a little education can go a long way. You can connect with her on Twitter, Instagram or her website, CoryanneHicks.com.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.