Stock Market Today: New Market Records Despite 2 Mega-Cap Misses

Apple (AAPL) and Amazon.com (AMZN) both dropped after disappointing quarterly reports, but the major indexes closed Friday at new heights regardless.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The major indexes managed to squeeze out new highs Friday, even though a so-far strong earnings season closed out the week with a thud.

John Butters, senior earnings analyst at FactSet Research Systems, says that 56% of S&P 500 companies have reported earnings so far this quarter, and of those, 82% have beaten earnings per share (EPS) expectations. If that figure stands, it would be the fourth-highest figure since FactSet began tracking it in 2008.

However, two lousy mega-cap reports threatened to hamper the market today.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Apple (AAPL, -1.8%) CEO Tim Cook said late Thursday that supply-chain issues likely cost it $6 billion in revenues during its fiscal fourth quarter, causing the company to miss sales expectations, though it did match analysts' consensus estimates for profits.

Amazon.com (AMZN, -2.2%) also felt the pinch of supply-chain chaos, as well as consumers' return to brick-and-mortar shopping, reporting Q3 revenues and earnings (as well as Q4 guidance) that widely missed the mark.

"Two consistent themes with both of these stocks are the ongoing impact of supply-chain issues as well as the implication of higher interest rates and increased inflationary concerns," says David Keller, chief market strategist at StockCharts.com. "The latter could be a significant headwind for growth stocks going into 2022 and suggests that investors should look to sectors like financials that are better suited for that environment."

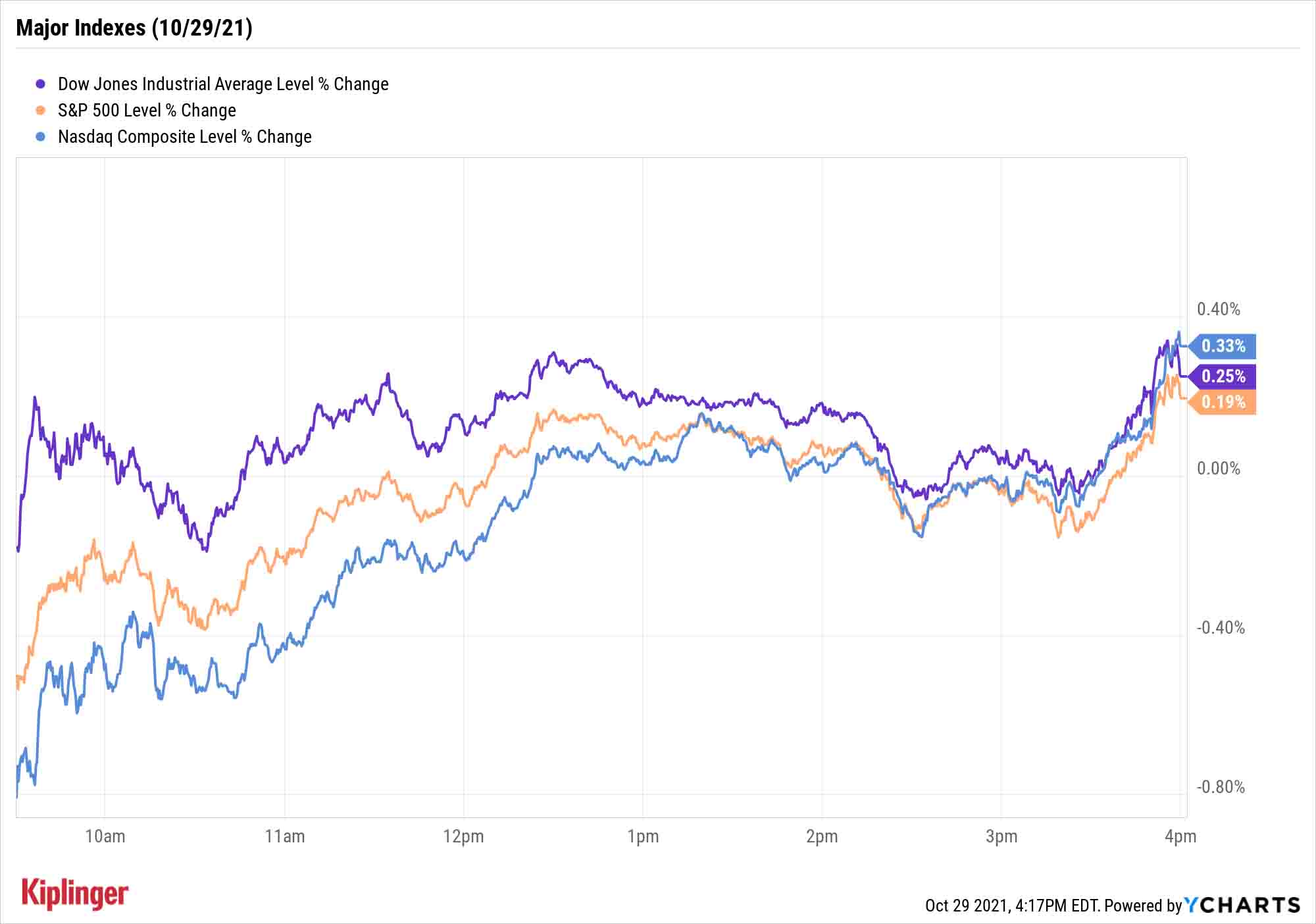

The Dow Jones Industrial Average (+0.3% to 35,819), S&P 500 (+0.2% to 4,605) and Nasdaq Composite (+0.3% to 15,498) all wavered between gains and losses throughout the day, but a short burst in the session's waning minutes sent all three to record-high finishes.

Other news in the stock market today:

- The small-cap Russell 2000 was marginally lower at 2,297.

- U.S. crude futures rose 0.9% to finish at $83.57 per barrel.

- Gold futures fell 1% to settle at $1,783.90 an ounce.

- The CBOE Volatility Index (VIX) was off 1.2% to 16.33.

- Bitcoin managed a 2.0% gain to $62,527.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- U.S. Steel (X) surged 12.9% in the wake of its quarterly earnings report. In its third quarter, the steelmaker brought in adjusted earnings of $5.36 per share compared to its year-ago loss of $1.06 per share. Revenue, meanwhile, swelled 150% year-over-year to $2.3 billion. Both figures came in above analysts' consensus estimates. X also raised its quarterly dividend by 25% to 5 cents per share. Argus Research analyst David Coleman maintained his Buy rating after earnings. "We expect the company to benefit over time from recent efforts to strengthen its balance sheet, and note that business fundamentals remain strong," he says. "U.S. Steel is seeing increased demand and higher pricing for steel as global economic conditions improve."

- Starbucks (SBUX) was another post-earnings mover, only its shares fell 6.3% in response to its results. For its fiscal fourth quarter, the coffee chain reported higher-than-expected adjusted earnings of $1.00 per share, but revenue of $8.1 billion fell short of the consensus estimate. SBUX also said same-store sales in China contracted 7% from the year prior. Baird analyst David Tarantino kept his Outperform (Buy) rating on SBUX, but lowered his price target by $16 to $128. While he is "incrementally negative" on Starbucks following last night's report, "with top line momentum strengthening in the U.S. and China exiting the fiscal fourth quarter, we are optimistic SBUX can produce revenue metrics in upcoming periods that support gradual improvement in investor sentiment as the focus returns to the scarce growth characteristics the company is capable of delivering in F2023 and beyond."

A Social Gathering

Social media stocks have been front and center over the past week-plus.

On Thursday, we mentioned here that Facebook (FB) was changing its name to Meta as part of a concerted effort by CEO Mark Zuckerberg to pivot his ship toward the "metaverse."

A few days earlier, PayPal Holdings (PYPL) shot down rumors that it would buy social media platform Pinterest (PINS) with a terse statement on its website claiming "that it is not pursuing an acquisition of Pinterest at this time" – since then, PINS shares have lost a quarter of their value.

And late last week, Snapchat parent Snap's (SNAP) results showed significant turbulence from an Apple privacy update.

Those are a lot of moving parts in what is a very niche but lucrative industry whose components still have at least the potential for spectacular growth. But will they achieve it?

We take a magnifying glass to the most prominent social media players (yes, including the newly renamed "Meta") to discover which stocks still have a favorable outlook … and which ones are receiving a much cooler reception.

As of this writing, Kyle Woodley was long AMZN.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.