Stock Market Today: Stocks Stay Aloft as Congress Nears Stopgap Deal

The Senate appeared close to reaching a short-term solution for the debt ceiling, helping Wednesday's late rally to spill into Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A rally that started Wednesday afternoon continued throughout Thursday's session as Congress appeared poised to kick the debt-ceiling can down the road.

Yesterday's buying was sparked by Senate Minority Leader Mitch McConnell's offer for Republicans to allow a short-term lift of the federal borrowing limit. Democrats mulled the deal overnight, and this morning, Senate Majority Leader Chuck Schumer announced that "we have reached agreement to extend the debt ceiling through early December, and it's our hope that we can get this done as soon as today."

Investors should note, however, that as of publication, Senate Republicans had not yet secured the 10 votes necessary to get past a filibuster.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also buoying spirits was an unexpectedly sharp drop in initial jobless claims, to 326,000 for the week ended Oct. 2, down from 364,000 and below estimates for 348,000.

Up next: The September jobs report.

"The big event for tomorrow is the Bureau of Labor Statistics employment report. Expectations have crept a bit higher following the ADP jobs survey and this morning's initial claims both coming in ahead of expectations," says Michael Reinking, Senior Market Strategist for the New York Stock Exchange. "U.S. September economic data broadly speaking suggests that the economy is starting to pick up steam after the August lull. Analysts are projecting that ~500,000 jobs were added to the economy last month. The unemployment rate is expected to tick down to 5.1% from 5.2%."

Consumer discretionaries (+1.6%) were hot, topping the market's other sectors thanks to robust advances from the likes of Ford (F, +5.5%), General Motors (GM, +4.7%) and Nike (NKE, +2.1%).

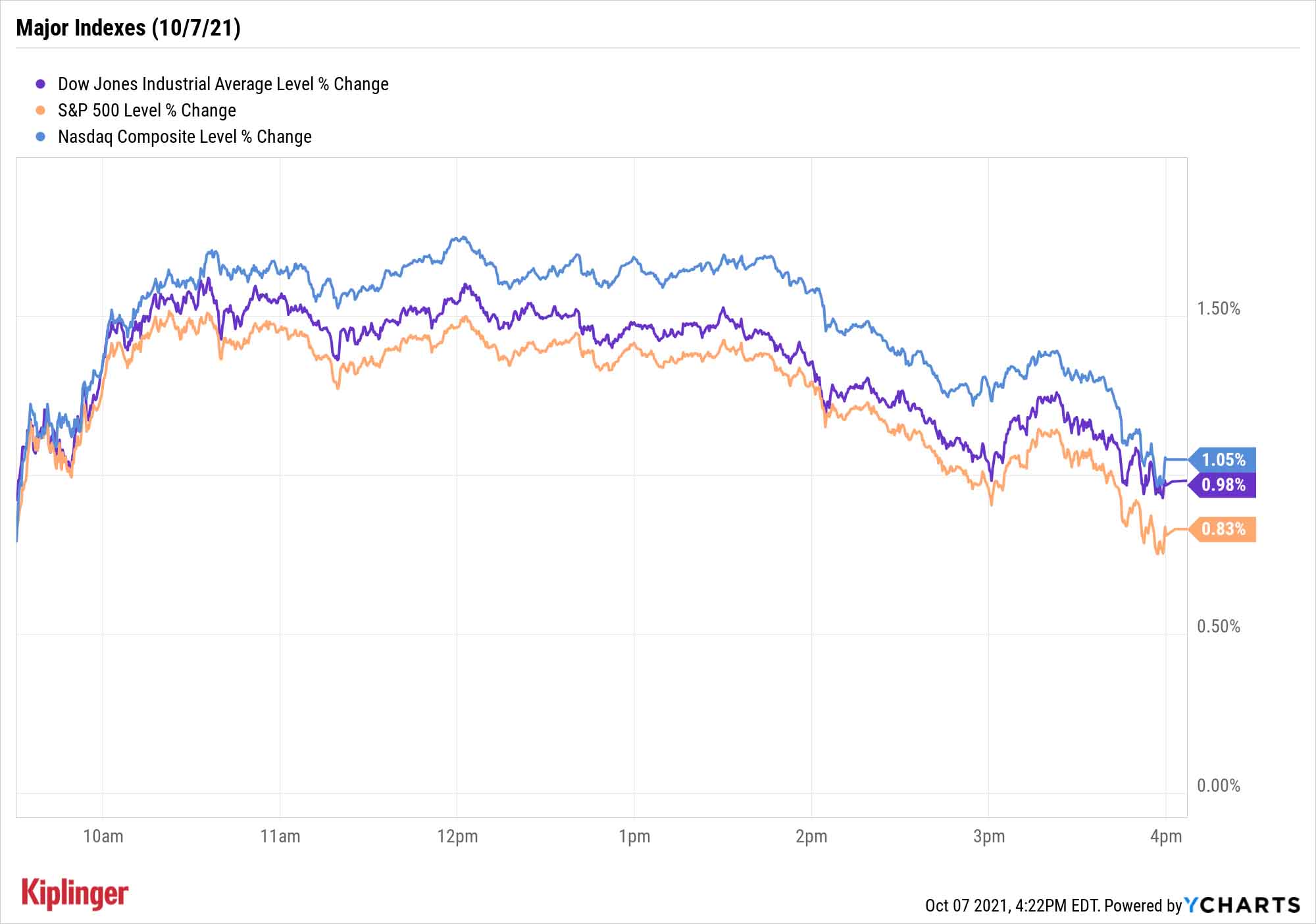

The major indexes closed Thursday with similar gains: The Dow Jones Industrial Average improved 1.0% to 34,754, the S&P 500 finished up 0.8% to 4,399, and the Nasdaq Composite rose 1.1% to 14,654.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1.6% to 2,250.

- Levi Strauss (LEVI) popped 8.5% after the apparel maker reported earnings late Wednesday. In its fiscal third quarter, LEVI reported adjusted earnings of 48 cents per share on $1.50 billion in revenues, which came in above analysts' consensus estimates for earnings of 37 cents per share on $1.48 billion in sales. Stifel analyst Jim Duffy reiterated his Buy rating on LEVI stock in the wake of the results. "Considering the high-single digit growth opportunities, structural margin potential to mid-teens and balance sheet optionality, we view the valuation compelling at current levels," he wrote in a note.

- Twitter (TWTR, +4.4%) made headlines on some M&A news. The social media name said after Wednesday's close that it is selling its MoPub mobile marketing network to AppLovin (APP) – a game developer and ad-tech firm – for $1.05 billion in cash. The selling price translates into a big return for TWTR, which bought MoPub for $350 million back in 2013. In a subsequent statement, Ned Segal, chief financial officer at Twitter, said the transaction allows the company to focus its efforts "on the massive potential for ads on our website and in our apps. We plan to accelerate product development and replenish the near-term revenue loss, with the goal of improving our time to market to deliver on our previously stated goal of at least doubling total annual revenue from $3.7 billion in 2020 to $7.5 billion or more in 2023."

- U.S. crude futures jumped 1.1% to finish at $78.30 per barrel.

- Gold futures slipped 0.1% to settle at $1,759.20 an ounce.

- The CBOE Volatility Index (VIX) slid 7.2% to 19.49.

- Bitcoin prices pulled back from their recent gains, declining 2.0% to $53,981.18. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What's on Tap Next?

For now, investors can return their focus to the economy. The next week or so will see a number of vital reports drop – most notable among them are the September jobs report (due 8:30 a.m. Friday) and the September consumer price index release (due 8:30 a.m. Oct. 13).

Broadly speaking, analysts expect signs of a recovery that still has plenty of wind in its sails, and that could influence the way some investors choose to allocate.

"This economic recovery is different than the last one, as we see more growth and more inflation," says Gene Goldman, chief investment officer at Cetera Investment Management. "Expect value and cyclicals – basically investments that didn't work in the last recovery – to work better this time."

On the latter front, that could mean outperformance for sectors such as the aforementioned consumer discretionaries, as well as materials and financial stocks. As far as value goes? Well … that is increasingly hard to find in a stock market that remains near nosebleed valuations, even after some recent setbacks.

However, there are relative bargains to be found, even in some of Wall Street's most cherished corners. To wit, the Dividend Aristocrats actually look like a bargain compared to the broader S&P 500 at the moment. These 13 Dividend Aristocrats stand out in particular, given their cheap prices compared to their own historical levels.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.