Stock Market Today: Dow Nabs Win in Choppy Start to June

It was a choppy session for the broader indexes, but oil made a beeline higher on OPEC+ news.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

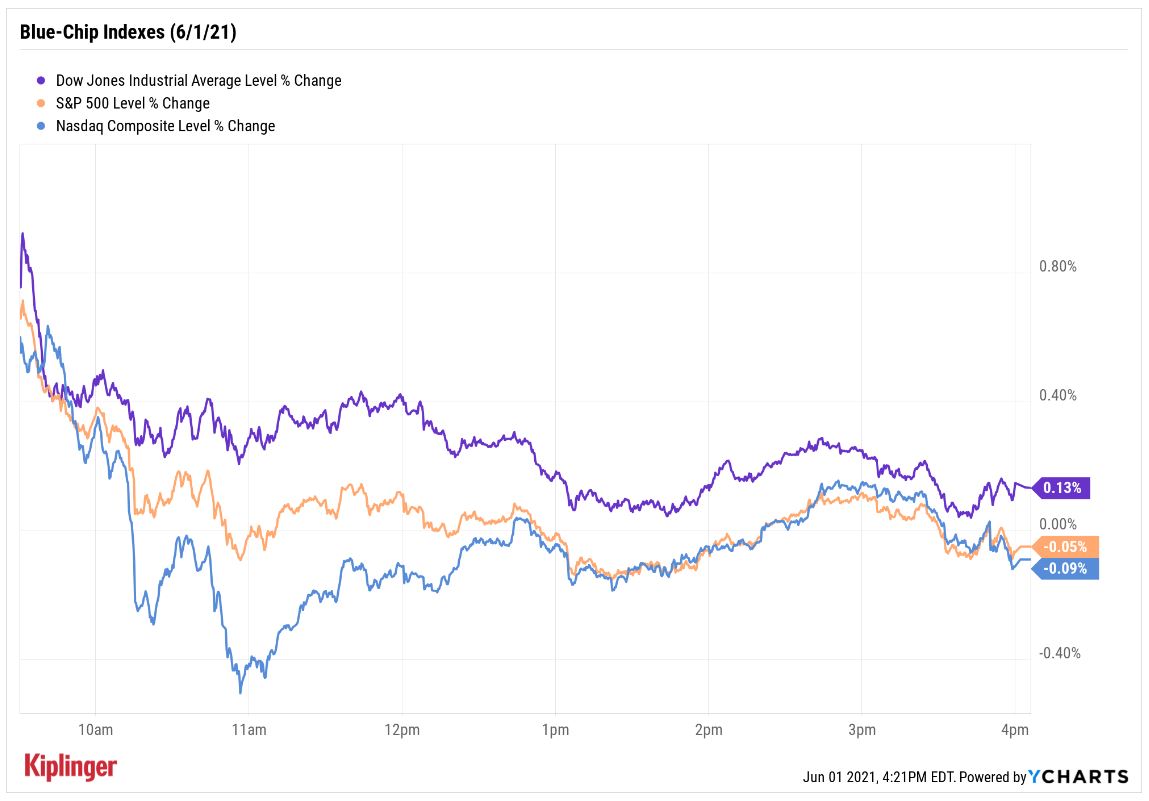

The major indexes opened comfortably higher on the first trading day of June, but the latest factory data took some wind out of the bulls' sails in intraday action.

"The Institute for Supply Management's manufacturing purchasing managers index rose 0.5 point, to 61.2, in May, reflecting a strengthening of new orders," says Jonathan Millar, deputy chief U.S. economist at Barclays Investment Bank. "Even so, May's report shows a widespread effect from supply bottlenecks, as manufacturers struggle to boost production to keep pace with orders."

However, in an interview with Politico, Fed vice chair of supervision Randal Quarles suggested there will be "different speeds at which supply chains unblock," and that any inflationary pressures that come as a result will likely be temporary.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This appeared to help ease investors' worries, with the Dow Jones Industrial Average ending up 0.1% at 34,575, while the S&P 500 Index slipped 0.05% to finish at 4,202 – though well off its session lows.

Other action in the stock market today:

- The Russell 2000 jumped 1.1% to close at 2,294.

- Cloudera (CLDR, +23.9%) was one of the biggest movers on Wall Street today on M&A news. Specifically, investment firms KKR and Clayton said they will take the software company private in an all-cash deal valued at $5.3 billion, or $16 per CLDR share – a 24.4% premium to where it closed last Friday.

- It was another volatile session for AMC Entertainment Holdings (AMC, +22.4%) after it sold 8 million shares to investment firm Mudrick Capital Management – which raised $230.5 million for the movie theater chain. The meme stock more than doubled in price in last week's trading.

- U.S. crude oil futures spiked 2.1% to settle at $67.72 per barrel – their highest close since October 2018 – the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to gradually increase oil output.

- Gold futures ended marginally lower at $1,905.00 an ounce.

- The CBOE Volatility Index (VIX) jumped 6.8% to 17.90.

- Bitcoin prices slipped 0.3% to $35,959.82(Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Count Growth Out

The Dow outperformed the Nasdaq (-0.1% at 13,736) today, continuing a recent rotation into value stocks and out of growthier names, of which tech makes up a large part.

However, it's not time to count growth out.

"After a strong finish to 2020 ... shares have been more volatile in 2021 as investors balance positive fundamentals with premium valuations," say Canaccord Genuity analysts Maria Ripps and Michael Graham.

"While we recognize that many covered companies will face more difficult growth comps over the next few quarters, zooming out to a medium-term view shows not only strong top-line momentum but improving profitability, which should reward patient investors that can ride out near-term volatility."

For those looking to position for a resurgence in growth stocks, check out these five value-priced tech stocks or these five large-cap stocks with high upside potential.

Another way to find potential investing opportunities is to see what top stock picks billionaires and other smart-money investors are homing in on. Here, we've compiled a list of 30 high-profile stocks billionaire investors bought in the first quarter – several of which are popular growth names.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.