Stock Market Today: Dow Edges Higher as Jobless Claims Keep Sliding

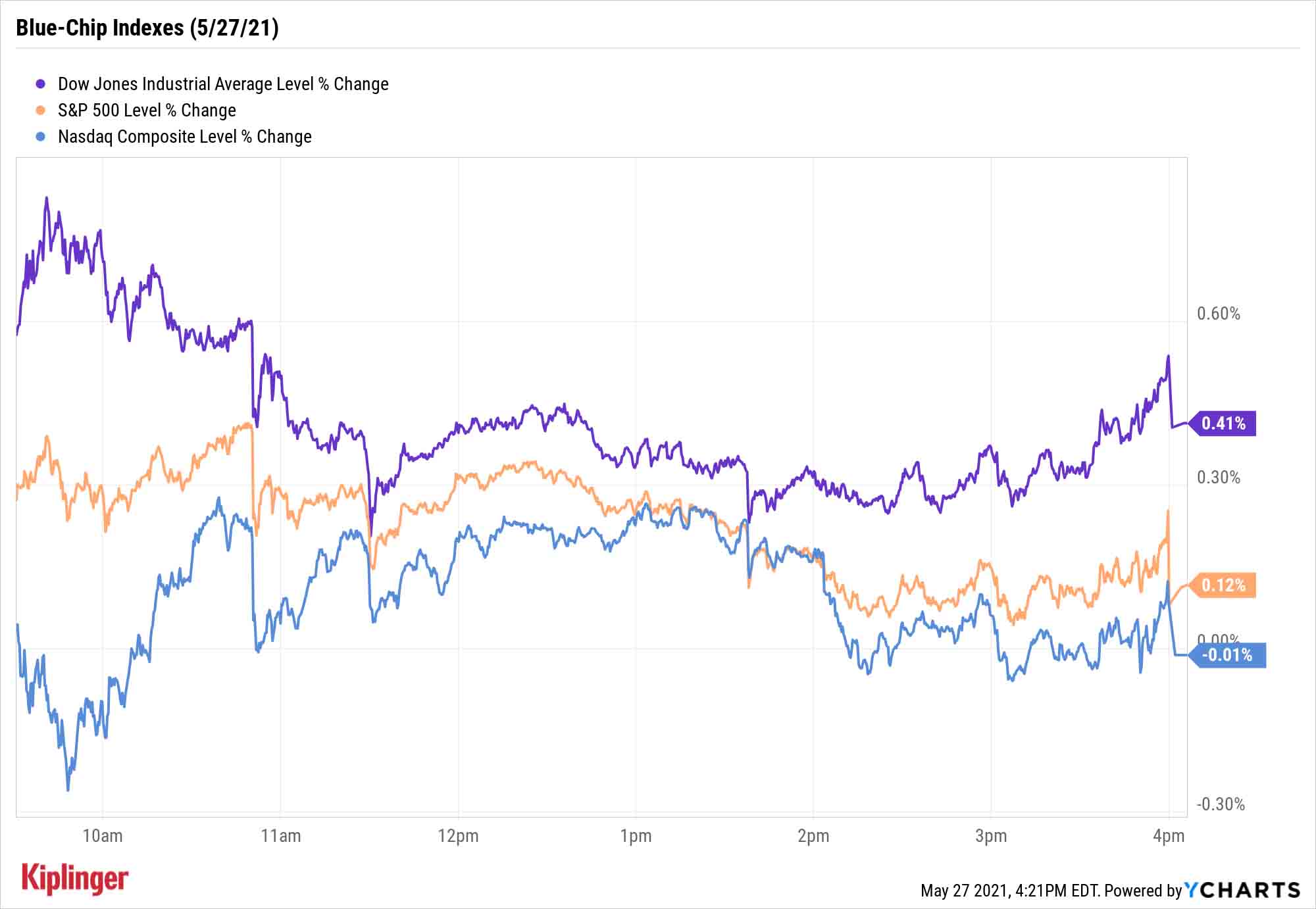

Another week of lower-than-expected unemployment filings failed to move the blue-chip needle much Thursday, though small caps had another strong day.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Fresh data out Thursday continued to paint a rosy picture of the American economy's resurgence, but it prompted little response on Wall Street, where a modest morning rally became even more meager by the close.

Weekly jobless claims declined yet again, with filings for the week ended May 22 lower by 38,000 claims to 406,000, easily coming in under estimates for 425,000.

Also Thursday, the Bureau of Economic Analysis' second estimate of first-quarter U.S. GDP growth came in unchanged at a robust 6.4%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The overall picture of economic activity in Q1 remains the same as that reported in the advance GDP report, with personal consumption spending anchoring growth, and business investment responding to strong domestic demand," says Barclays economist Pooja Sriram. "As a result, our outlook for growth in the coming quarters remains unchanged."

But while the small-cap Russell 2000 enjoyed another boisterous day of gains, advancing 1.1% to 2,273, the blue-chip indexes barely budged. The Dow Jones Industrial Average climbed 0.4% to 34,464, the S&P 500 eked out a 0.1% improvement to 4,200, and the Nasdaq Composite recorded a marginal loss to 13,736.

"Higher GDP numbers typically move stock markets and bond yields higher ... but today's GDP estimate was largely expected," says Chris Zaccarelli, chief investment officer for registered investment advisor Independent Advisor Alliance.

Other action in the stock market today:

- Okta (OKTA, -9.8%) reported a smaller adjusted per-share loss than expected on Street-beating revenues in its first quarter. However, the cybersecurity stock slumped as it guided for a wider per-share loss in the current quarter and full year to reflect the closing of its Auth0 purchase. OKTA also said its chief financial officer, Mike Kourey, is leaving. Nevertheless, Canaccord Genuity reiterated its Buy rating on Okta. "Longer term, work from home is likely to settle at higher levels with accelerating digital transformation, which should continue to drive demand for identity security accordingly. We also view the recently closed acquisition of Auth0 as accretive to growth and strengthening Okta's leadership position in the large and fragmented IAM (identity and access management) market," says Canaccord analyst T. Michael Walkley.

- Dollar Tree (DLTR, -7.7%) took a hit as the discount retailer's disappointing full-year forecast and a warning of increased freight costs offset top- and bottom-line beats for its Q1 results. The shares of sector peer Dollar General (DG, +2.2%), on the other hand, gained ground today after it reported earnings per share and revenues above estimates and boosted its fiscal 2021 guidance.

- U.S. crude oil futures climbed 1% to settle at $66.85 per barrel after data from the Energy Information Administration showed domestic crude inventories declined last week. It was the fifth consecutive win for black gold, the longest such streak since February.

- Gold futures notched their first loss of the week, slipping 0.3% to end at $1,898.50 an ounce.

- The CBOE Volatility Index (VIX) declined again, by 3.5% to 16.75.

- Bitcoin prices were also modestly higher Thursday, crawling 0.7% higher to $38,838.82. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Just the Start for Value?

Analysts and fund managers continue to bang the drum for underappreciated stocks.

"Growth stocks in the U.S. have been on a multi-year run, and they are looking expensive relative to U.S. value. Value stocks have started to show signs of perking up, and valuations suggest that it is likely overdue," says Meb Faber, CEO of Cambria Funds. "It's nearly impossible to say with certainty that value is back. But if we are truly seeing a shift in fundamental factor performance, there could be a lot more room to run.

"1999, the worst year for the value factor prior to 2020, was followed by the best year on record for value."

If you prefer to let someone else do the driving, you actually have a wealth of value-oriented funds at your disposal, with flavors ranging from vanilla S&P 500 bargains to deeply undervalued mid- and small caps.

Conversely, if you prefer to take the wheel, you'll have to look around a bit – after all, by several metrics, this is one of the most expensive stock markets in history. But there are deals to be found.

As we mentioned yesterday, income investors can tap into several Dividend Aristocrats on the cheap at present. But today, we're looking on the growthier side of things with these five value-priced tech stocks. Technology is one of the priciest market sectors at the moment, but these five picks look inexpensive through a number of valuation lenses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.