Stock Market Today: Powell's Presser Pumps the Market's Brakes

The Federal Reserve expectedly kept rates near zero Wednesday, but Fed Chair Jerome Powell's ensuing commentary took traders for a small whirl.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

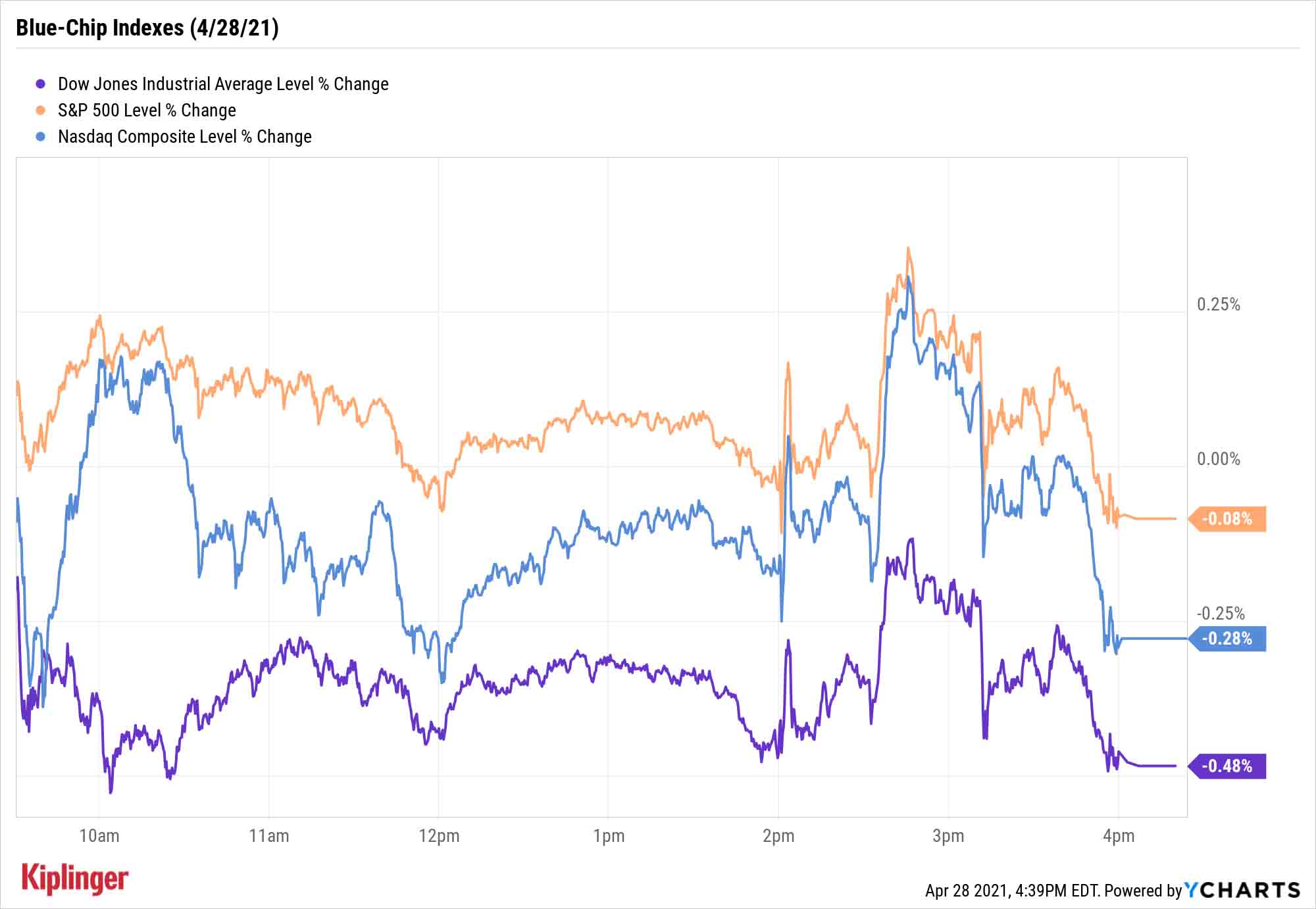

Federal Reserve Chair Jerome Powell gave investors reason for pause on Wednesday afternoon in a modestly lower day for stocks.

The Fed itself, following its latest two-day policy meeting, announced it would keep its benchmark rate near zero, stating that "indicators of economic activity and employment have strengthened" amid policy support and progress on COVID vaccinations.

"With no meaningful change to monetary policy or communication, this meeting was simply a message to market participants to sit back and observe as the economic recovery continues to unfold," says Charlie Ripley, senior investment strategist for Allianz Investment Management.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But Powell managed to get traders to zigzag a bit in his ensuing press conference.

Investors cheered after he said it could be "some time" before the economy hits its targets, and that the Fed is "not thinking about thinking about tapering" (emphasis ours). But those quick gains reversed after Powell dropped an F-bomb – "froth" – when describing U.S. equity markets.

All the major indices lost ground by the closing bell. The Dow Jones Industrial Average dropped 0.5% to 33,820, weighed down by Amgen (AMGN, -7.2%) and Boeing (BA, -2.9%), which both reeled in the wake of disappointing earnings reports. The S&P 500 (off marginally to 4,183) and Nasdaq Composite (-0.3% to 14,051) also finished in the red.

Other action in the stock market today:

- Visa (V, +1.6%) was one of the Dow's best performers. The payments giant reported stronger-than-expected fiscal second-quarter earnings and revenue, and said payments volume jumped 11% over the three-month period.

- F5 Networks (FFIV, -9.1%) took a notable dive after the tech name last night reported earnings. For its fiscal second quarter, FFIV beat on both the top and bottom line, but the company's guidance for the current quarter came in below estimates.

- The small-cap Russell 2000 actually finished in the black, gaining 0.1% to 2,304.

- U.S. crude oil futures jumped 1.5% to settle at $63.86 per barrel. Boosting prices to their highest finish in six weeks was data that showed a smaller-than-anticipated weekly rise in domestic crude inventories and a commitment from OPEC+ to continue easing back on oil production.

- Gold futures slipped 0.3% to $1,773 an ounce.

- The CBOE Volatility Index (VIX) declined 1.2% to 17.35.

- Bitcoin prices improved by 1.2% to $55,470. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Run, Economy, Run!

Powell might keep Wall Street guessing, but economic improvement seems a settled matter.

In addition to the Fed's nod of confidence, Barclays economists on Wednesday upwardly revised their official Q1 GDP growth forecasts by half a percentage point to 5.5% – aligning it with Kiplinger economists' expectations.

"At the time of our previous Q1 GDP forecast revision (see US GDP Tracking , April 16, 2021), we were still missing some key source data for private inventory investment and international trade," say Barclays economists. "We had viewed risks to those forecasts as being to the downside and refrained from fully reconciling our official forecast with the tracking estimates until these components were informed by hard data.

"With the March estimates in hand, we now fully reconcile our official forecast with the tracking estimate."

Largely speaking, this continues to augur well for the prospects of so-called "recovery stocks," barring any exogenic shocks. Yes, that's bound to be a boon for restaurants, airlines, cruise lines and other consumer-facing businesses. But if it powers a vehicle or helps get something built, chances are its fortunes could continue to improve, too.

Take these five commodity picks, for instance, that include a wide range of mining and even forestry opportunities.

Oil stocks should be on the menu, too. U.S. crude oil has shot up by more than 30% year-to-date, translating to much more profitable operations for a host of energy plays that have spent years slimming down operations amid far leaner prices. These seven plays in particular have managed to attract a horde of bullish calls of late.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.