Gold Investing: What's Next After Recent Gold Price Highs?

If you're hesitant about gold investing simply because prices have run up so much already, here are a few points to consider.

Karee Venema

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

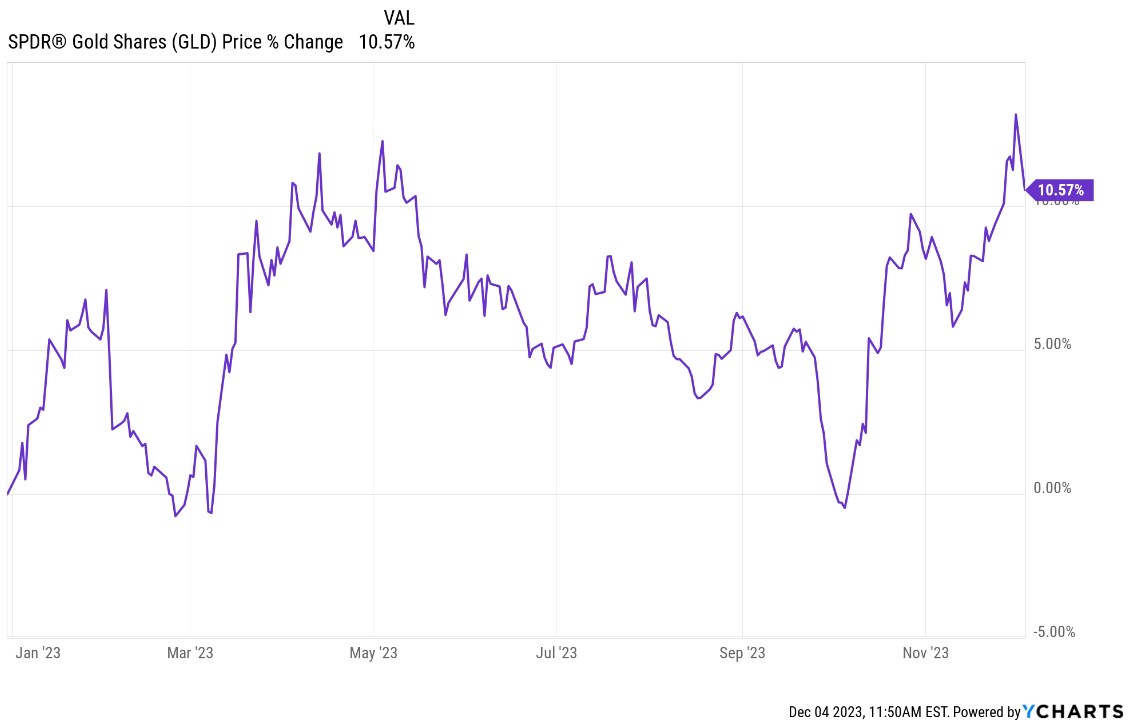

Gold investing has become a hot topic on Wall Street these days. This is because gold prices (GOLD) recently hit new all-time highs.

The yellow metal has been trending sharply higher since early October and many are wondering if it can continue this momentum into the new year.

Year-to-date chart of the SPDR Gold Shares ETF (GLD)

Most gold is held in central bank vaults or held as jewelry, so the investable market for gold isn't exceptionally large. Take for instance these two gold ETFs: the SPDR Gold Shares (GLD) and the iShares Gold Trust (IAU). The former is the largest and most liquid gold ETF at $58 billion in assets under management (AUM), while the latter has just $26 billion in AUM.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For perspective, the three largest S&P 500 Index ETFs have $1.2 trillion dollars in combined assets, and the market cap of the S&P 500 Index itself is around $38 trillion.

So those worried about investing in gold at new highs, take a little heart. Given the relatively small size of the investable gold market, it wouldn't take much in the way of new inflows to send the price of gold sharply higher from here.

But why is gold trending higher, and can it continue?

Gold investing: Why is the gold price trending higher?

Inflation. The Fed flooded the capital markets with virtually unlimited liquidity for nearly two full years during the pandemic, expanding its balance sheet by almost $5 trillion in the process.

This massive monetary stimulus – along with government assistance and a global supply chain that still isn't fully untangled – helped to push inflation to the highest levels in four decades. Consumer Price Index (CPI) inflation touched 9% in mid-2022.

Remember, gold is traditionally an inflation hedge. While its price is often volatile, gold has done a good job of maintaining purchasing power over the centuries. And while inflation is down from its highs, registering at 3.2% in the most recent report, it is still a long way from the Fed's target of 2%. All else equal, sticky inflation bodes well for gold.

But gold's rise is not exclusively an inflation phenomenon. If that were the case, we wouldn't have seen gold prices weaken in the summer of 2022, when inflation was the highest. There are other elements at play here.

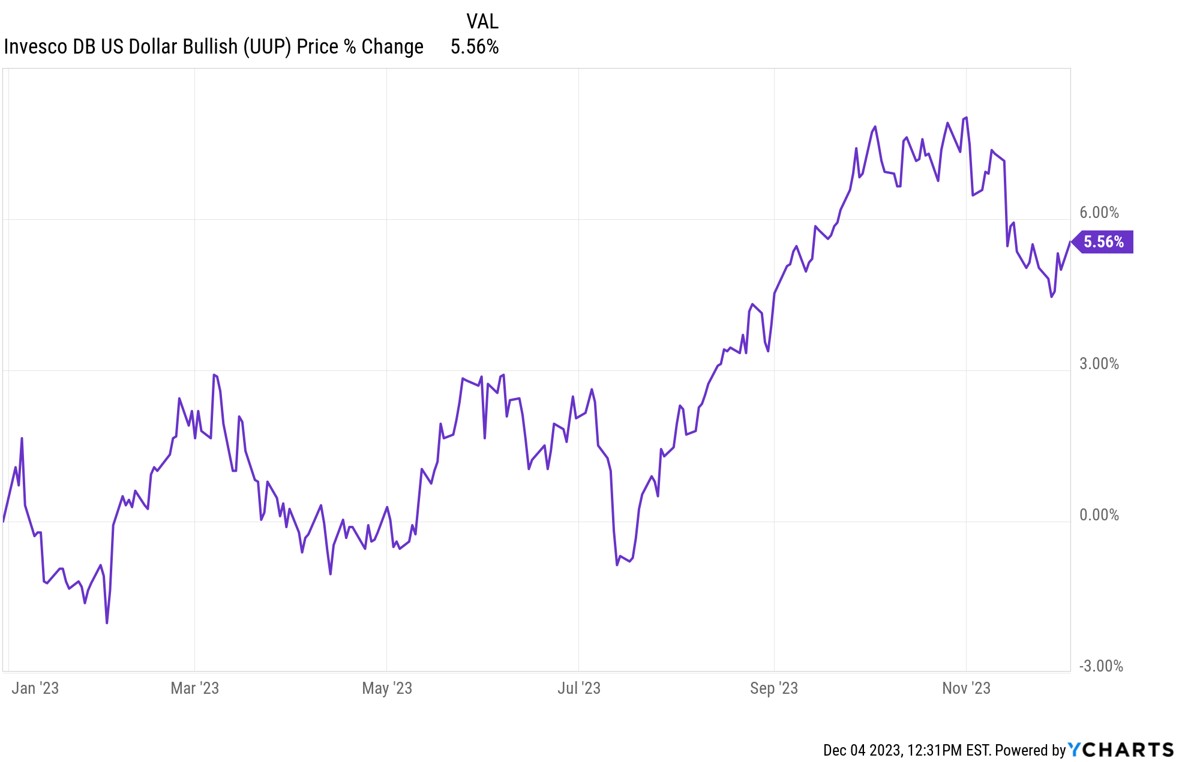

The weak dollar. The U.S. dollar has been one of the world's stronger currencies over the past decade. The turmoil of the pandemic accelerated the dollar's rise, but that was only the beginning. As the Fed scaled back its asset purchases and started aggressively raising interest rates, the dollar soared to multi-decade highs against many world currencies, including the euro and British pound.

But more recently the dollar's strength has started to fade amid expectations the world's central banks have reached peak rates and will soon start to ease monetary policy.

You can see this in the performance of the Invesco DB US Dollar Index ETF (UUP), which tracks the performance of the dollar against a basket of major world currencies.

Year-to-date chart of the Invesco DB US Dollar Index ETF (UUP)

Gold's rise started the same time that the dollar's strength started to fade. That's no coincidence. Gold is priced in dollars, so dollar weakness is, by definition, gold strength.

The U.S. dollar has a history of trending higher versus other major world currencies for years or even decades at a time, but these periods of strength are generally followed by comparable stretches of dollar weakness. We may be in the early stages of one of those stretches … and that's bullish for gold.

Geopolitical risk. Gold is often seen as a safe-haven asset class during times of uncertainty. The recent turmoil in the Middle East and the ongoing war between Russia and Ukraine likely contribute to investors seeking out the yellow metal.

"The reason the price [of gold] can move in different directions is because when things become uncertain in stock markets, investors sell shares and want to buy something with a value that's considered 'safer,'" says Hal Cook, senior investment analyst at Hargreaves Lansdown. Gold, in particular is a popular choice "because it's recognized globally as something of value," the analyst notes, adding that "it can be a useful diversifier in a portfolio, particularly during periods of market stress."

And Cook says that "while the potential for the Israel – Hamas conflict to escalate further may have reduced more recently, fundamentally geopolitical risks are higher now than they were six weeks ago."

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

- Karee VenemaSenior Investing Editor, Kiplinger.com

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.