What Is the Buffett Indicator?

"It is better to be roughly right than precisely wrong," writes Carveth Read in "Logic: Deductive and Inductive." That's the premise of the Buffett Indicator.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Buy low and sell high. That sounds easy, right? The problem is defining what exactly "low" means.

How do you define whether the stock market is cheap or expensive?

Precisely valuing the market is exceptionally hard. It involves making guesses on several key assumptions such as interest rates or growth in earnings per share.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So investors – even all-time greats like Warren Buffett – tend to fall back on "quick and dirty" metrics.

These metrics are designed to tell you whether the market is generally cheap or generally expensive. But they aren't intended to be used with surgical precision.

It so happens that the "Oracle of Omaha" has his very own quick-and-dirty metric, the "Buffett Indicator." The Buffett Indicator is a broad measuring stick of whether the stock market is overvalued or undervalued relative to the size of the overall economy.

Buffett famously referred to this indicator as "probably the best single measure of where valuations stand at any given moment" in a 2001 interview with Fortune magazine.

It is absolutely not a tool for short-term trading.

But it can be a really solid tool for long-term allocation decisions, such as for a 401(k) plan or even in an institutional portfolio like a pension plan.

What is the Buffett Indicator?

The Buffett Indicator is calculated by dividing the total market capitalization of a country's publicly traded stocks by its gross domestic product (GDP). Market cap is the total value of all outstanding shares of every publicly traded company.

For example, Microsoft's (MSFT) market cap is $2.6 trillion. That's the total value of all Microsoft shares in existence. We add up every other listed company to arrive at a total market cap of a country.

If we were putting the Buffett Indicator to work in the U.S., we would use the Wilshire 5000 Total Market Index. The Wilshire 5000 includes far more companies than the commonly quoted S&P 500 Index or the Dow Jones Industrial Average.

We would divide this comprehensive measure of nearly all publicly traded American stocks by U.S. GDP.

In short, the Buffett Indicator equals total market cap divided by GDP. Its utility is based on the idea that, over time, stock values should roughly move with the economy.

When this ratio is high, it suggests that the market's valuation is running ahead of the actual economic output, meaning the market is potentially overvalued. A low ratio could indicate undervaluation and possibly a good buying opportunity.

It's important to note that the number in a vacuum doesn't mean much. There is no absolute level that means the market is cheap or expensive. You have to compare it over time and look for trends.

Historically, the Buffett Indicator has hovered around 75% to 90%. Values above 100% may suggest the stock market is overvalued, although some argue that changes in interest rates, profit margins and globalization have shifted what counts as a "normal" ratio.

The Buffett Indicator has certainly trended higher over the past few decades.

The Buffett Indicator in action

Let's take a look at the Buffett Indicator today.

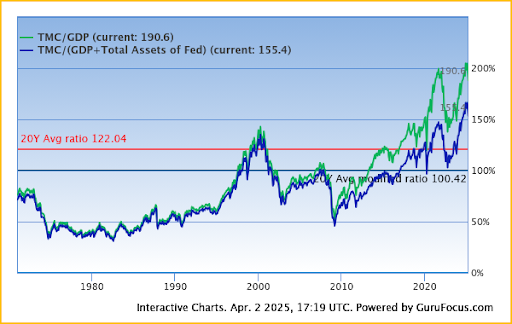

Research site GuruFocus calculated the traditional Buffett Indicator (green line) along with a modified Buffett Indicator (blue line) that attempts to adjust for the Federal Reserve's aggressive monetary policy since the 2008 meltdown.

Here's what that looks like in chart form:

A few things jump right off the chart.

If 100% is Buffett's rule of thumb for overvaluation, then the market has spent most of the past 20 years in exceptionally expensive territory. The average has been 122%.

Of course, today we're well above that level.

Even after the recent stock correction, the traditional Buffett Indicator is above 190%. And the Fed-adjusted Buffett Indicator is sitting at 155%.

When Buffett endorsed it in Forbes, the ratio had soared to record highs during the dot-com bubble. The indicator fell in the early 2000s following the market crash.

But it has climbed steadily in the decades since, often reaching levels well above its historical average.

Takeaways from the Buffett Indicator

Does the Buffett Indicator’s lofty level suggest a market crash is imminent? No, and that's not how the indicator is designed to be used.

It's exceptionally poor as a short-term timing tool. Had you dumped your stocks due to overvaluation in the index, you would have missed out on one of the longest and most extreme bull markets in history.

But it's a useful tool for understanding where we are in the broader market cycle. You should use it as you balance your portfolio between stocks, bonds, cash, gold and other assets.

If you're heavily invested in stocks right now, you might want to look at diversifying your portfolio by upping your exposure to other asset classes.

And, likewise, when the indicator dips into "cheap" territory, you might consider increasing your exposure to stocks.

Related content

- Trump to Tariffs: How Retirees Can Manage Market Turmoil

- The Best Industrial Stocks to Buy

- What Stocks Are Politicians Buying and Selling?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.