Here's Why Munis Aren't Just for Wealthy Investors Now

Buyers of all levels should be intrigued by municipal bonds' steep yield curve, strong credit fundamentals and yield levels offering an income buffer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you spotted a $20 bill on the sidewalk, would you pick it up? Most of us wouldn't hesitate.

Yet in today's municipal bond market, many investors walk past what could be the fixed income equivalent of that $20 — especially in the intermediate to long end of the yield curve.

Municipal bonds offer some of the most attractive tax-exempt yields we've seen in more than a decade.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

Unlike the past, when munis were primarily a tool for the wealthiest investors, today's environment is opening the door for a broader range of U.S. taxpayers to benefit, as long as they're comfortable with intermediate or long-term strategies.

With a steep yield curve, strong credit fundamentals and yield levels that provide a meaningful income buffer, the case for embracing duration in munis has rarely been stronger.

More taxpayers can benefit from munis

A confluence of volatility in the Treasury market, combined with a robust supply of new municipal issuance, has pushed long-term tax-exempt yields to historically cheap levels.

The yield spread between 10-year and 30-year maturities is now the steepest it's been since 2013, with a difference of nearly 1.5%.

Investors are paid handsomely to invest in high-quality long-dated munis. For those in the highest tax brackets, taxable-equivalent yields on long-term munis are reaching 7% to 8% for residents in many states.

Here's the kicker: Valuations are so attractive that you don't need to be in the top bracket to benefit. Even middle-income investors can find value in municipal bonds, especially when investing through diversified funds that span the full yield curve.

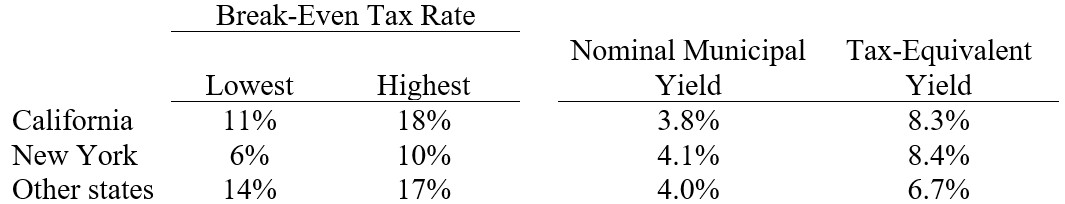

At the shorter end, for a diversified ladder of one- to 10-year munis, the break-even tax rate is around 32%. But for funds with broader exposure — particularly in the intermediate range — the break-even threshold drops, making munis compelling even for those in lower tax brackets.

The break-even tax rate is the rate (federal income tax, the 3.8% Medicare tax and applicable state income tax) at which an investor is achieving the same after-tax return, whether they choose to invest in the taxable market (using the Bloomberg US Aggregate Bond Index (pay wall) as a proxy) or the municipal market (the Bloomberg Municipal Bond Index as a proxy).

The break-even tax rate is shown as a range, as New York, California and many other states have different tax rates based on income levels. Treasury and other U.S. government agency debt being exempt from state income tax is considered.

For California and New York, an additional state tax exemption for the municipal exposure is incorporated into the analysis, given the prevalence of New York and California state-specific municipal bond funds.

Other states assume a national exposure without state tax exemption benefits.

Municipal tax-equivalent yield is calculated using a 40.8% tax rate, which includes a 37.0% top federal marginal tax rate and a 3.8% net investment income tax to fund Medicare.

The California and New York tax-equivalent yield calculation includes the highest state income tax bracket in those states.

(Source: Vanguard calculations using Bloomberg data as of July 31, 2025. Past performance is not a guarantee of future returns.)

Higher income provides a buffer

Some investors remain wary of longer-duration bonds. The scars of 2022, when inflation and rate hikes battered bond prices, are still fresh. But today's yields are a different story. They're high enough to provide a cushion against moderate rate increases.

Think of it this way: If you're earning 4% to 5% in tax-exempt income, a modest rise in rates could dent prices, but the income you collect over a 12-month period can offset much of that decline.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

If you're investing through a mutual fund or ETF, professional managers can take advantage of the steep curve by selling bonds as they "roll down" the curve — capturing additional gains in addition to coupon income.

This dynamic — income plus roll-down — can help smooth returns and shorten recovery times even if rates rise. It's a powerful combination that makes longer-duration munis more resilient than many investors assume.

The sweet spot for munis

Where should investors focus? We believe the most attractive part of the muni market today lies in high-quality bonds with maturities in the 15- to 20-year range.

These bonds sit comfortably within range of intermediate-term strategies, which generally offer a favored balance between yield and duration risk. They avoid the extreme volatility of the longest bonds while still capturing much of the yield of the steeper part of the curve.

Of course, no investment is without risk, but with their current yields, strong fundamentals and income buffer, high-quality munis are the closest thing we've seen to that $20-on-the-sidewalk scenario in a decade.

For investors willing to look beyond the short end of the curve, the opportunity is real — and it might not last forever.

If you're considering investing in munis, you should be aware that although the income from a municipal bond fund is exempt from federal tax, you may owe taxes on any capital gains realized through the fund's trading or through your own redemption of shares. For some investors, a portion of the fund's income may be subject to state and local taxes, as well as to the federal alternative minimum tax.

Also, bond funds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates, and credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer's ability to make such payments will cause the price of that bond to decline.

All investments are subject to risk, including the possible loss of the money you invest.

Related Content

- Financial Analyst Sees a Bright Present for Municipal Bond Investors

- This Boring Retirement Income Source Has Big Tax Benefits

- Why I Trust Bonds, Even Now

- Remembering Bogle: A New Standard for Municipal Investing

- Such Attractive Yields in High-Grade Munis Are Rare and May Not Last Long

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Malloy is head of municipal investment at Vanguard. Previously, he was head of Vanguard Fixed Income Group, Europe. In that role, Paul managed portfolios that invested in global fixed income assets. He also oversaw Vanguard’s European Credit Research team. Mr. Malloy joined Vanguard in 2005, the Fixed Income Group in 2007 and has held various portfolio management positions in Vanguard’s offices in the United Kingdom and the United States.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.