Financial Analyst Sees a Bright Present for Municipal Bond Investors

High-tax-bracket investors have an excellent opportunity to secure low-volatility, high-quality returns at yield levels rarely seen in over a decade.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For over a decade, fixed-income investors navigated a barren yield environment shaped by an era of relentless monetary intervention.

The Federal Reserve’s prolonged near-zero interest rate policy and aggressive bond-buying programs — designed to resuscitate economic growth — effectively suppressed yields, leaving investors starved for cash flows.

However, the bond market landscape has changed significantly, giving investors new opportunities to generate meaningful income. We see this clearly in the municipal bond market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

Investment-grade municipal bonds are providing notably attractive taxable-equivalent yields for investors in high tax brackets, and sharp fund outflows in early April, resulting from the recent trade policy shocks and tax season, have created an even brighter entry point for investors.

Liberation Day and market reaction

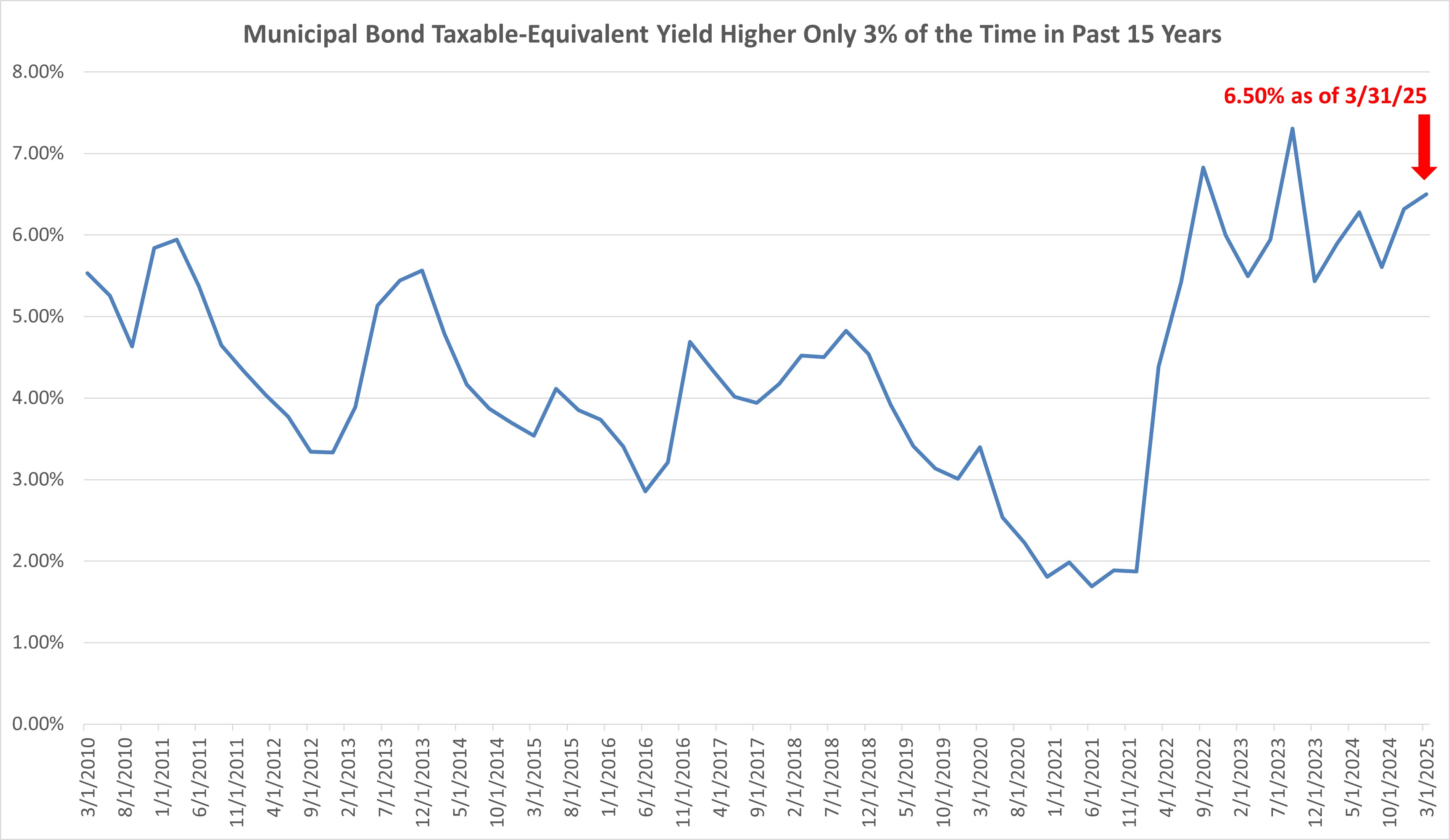

Even before municipal rates increased abruptly in April, investment-grade municipal bond yields appeared attractive. As of March 31, the Bloomberg Municipal Bond Index’s 6.50% taxable-equivalent yield for top taxpayers had been surpassed only 3% of the time over the past 15 years.

Additionally, real yields, or yields after adjusting for inflation, rivaled levels not seen since 2013 and were strongly positive, in contrast to the negative real yields seen in 2021 and 2022.

Source: As of 3/31/25. Bloomberg Municipal Bond Index yield to worst; for taxable-equivalent yield, assuming a top tax bracket of: 40.8% (37% plus 3.8% investment income tax) for 2018-2025, 43.4% (39.6% plus 3.8%) for 2013-2017 and 35% for 2010-2012

The market sell-off after the tariff threat announced on April 2, which President Trump called Liberation Day, has only increased the attractiveness of this opportunity.

Following the tariff threat and the resulting global market turmoil, municipal funds experienced significant outflows, the most seen in several years, which sent yields for high-quality municipal issuers soaring by nearly 100 basis points in just three days, mirroring moves seen during the onset of the COVID pandemic in early 2020.

The timing also coincided with tax payment season, when municipal funds have witnessed outflows in the past.

The combination of these factors has created an excellent opportunity for investors to lock in high levels of tax-exempt income at a time when the credit fundamentals of municipal issuers remain broadly strong. The index taxable-equivalent yield climbed to 6.86% as of May 14.

Municipal bond relative value: An even greater opportunity

While the historic appeal of municipal yields is evident, our relative value analysis demonstrates a compelling case for municipals.

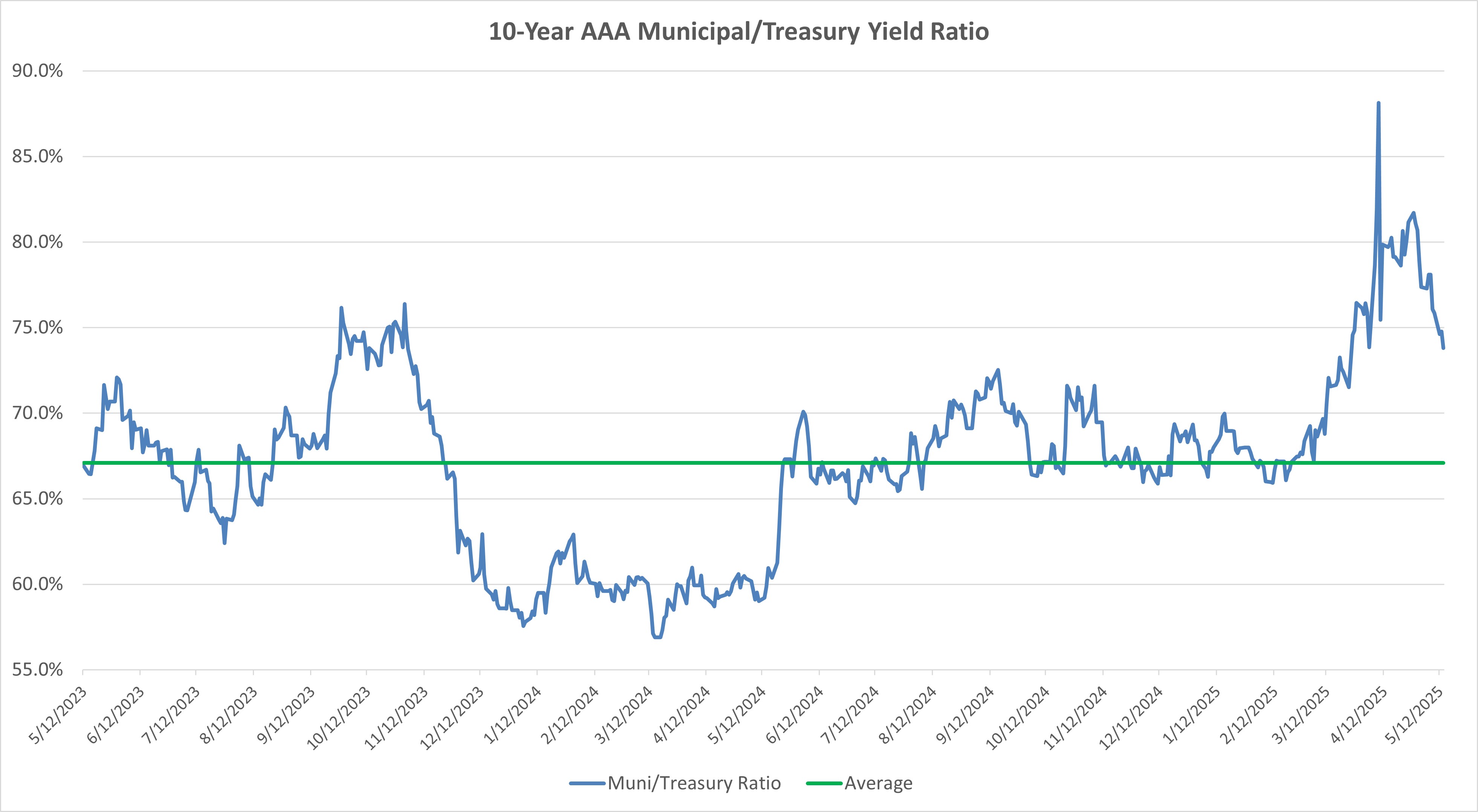

One relevant valuation measure shown in the chart below is the municipal/Treasury yield ratio, which helps assess the value of municipals relative to taxable fixed-income bonds.

The 10-year AAA municipal/Treasury yield ratio has averaged 67% over the last two years but rose well above this average during the last month, driven by the recent municipal fund outflows. A higher ratio indicates increased relative value for municipal bonds.

While the ratio has started to decline, normalizing from the dislocated peak seen in April, at 74% it is still particularly attractive compared to the average over the last two years.

Source: Bloomberg, AMPWP as of 5/14/25

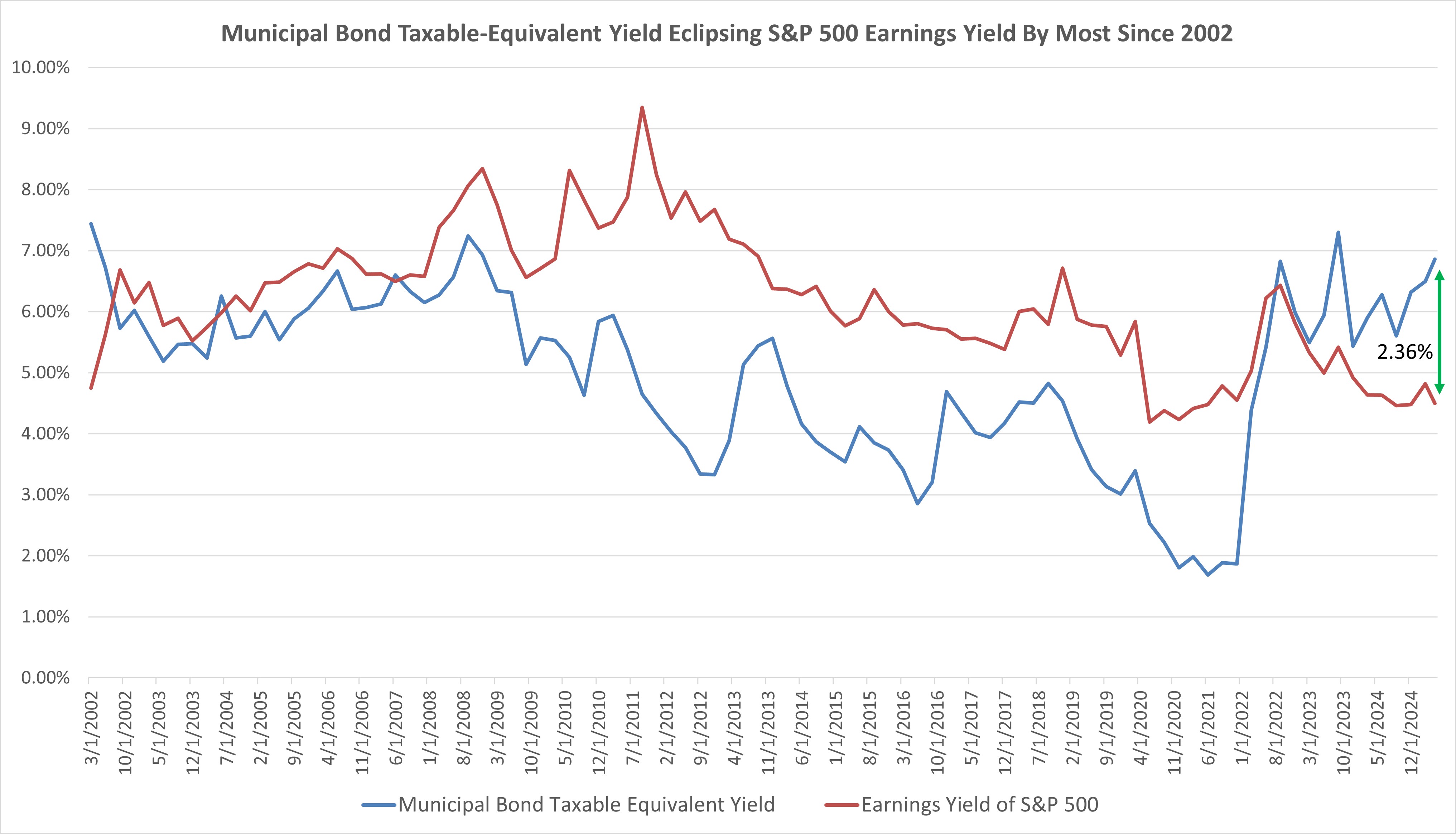

Another traditional valuation metric to consider compares municipals vs equities, using the taxable-equivalent yield of municipal bonds in relation to the stock market's earnings yield.

The current earnings yield of the S&P 500 Index is about 4.5%, based off the forward price-to-earnings ratio at roughly 22 (investors are essentially paying $22 for every $1 of corporate earnings, resulting in an earnings yield of 4.5% ($1 divided by $22)).

Due to the extended period of low interest rates over the past 15 years, it has been uncommon for municipal bond taxable-equivalent yields to exceed the earnings yield of the S&P 500 Index.

The chart below illustrates that, until recently, the last time municipal bonds had a valuation advantage over equities this significant was in 2002.

Source: As of 5/14/25. Bloomberg Municipal Bond Index yield to worst; for taxable-equivalent yield assuming a top federal tax bracket of: 40.8% (37% plus 3.8% investment income tax) for 2018-2025, 43.4% (39.6% plus 3.8%) for 2013-2017, 35% for 2003-2012 and 38.6% for 2002; earnings yield based on Bloomberg forward price-to-earnings multiple based on earnings estimates for the next four quarters.

Conclusion

Municipal bond instruments, no longer hampered by suppressed yields, offer high-tax-bracket investors an excellent opportunity to secure low-volatility, high-quality returns at yield levels rarely seen in over a decade.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Municipal bonds present a compelling value proposition with taxable-equivalent yields near 7%, outpacing inflation and rivaling equities on a risk-adjusted basis.

While economic and policy uncertainties persist, the convergence of rising real yields and sound credit fundamentals suggests that municipal bonds should be a strategic cornerstone in portfolio construction to provide tax-advantaged income and wealth preservation. (Read another timely take on muni bonds in the article Such Attractive Yields in High-Grade Munis Are Rare and May Not Last Long.)

A&M Private Wealth Partners, LLC is an SEC-registered investment adviser. Please note that SEC registration does not denote any particular competence or ability and no inference to the contrary should be made. For complete information on the services we provide and our fees, please review our Form ADV at adviserinfo.sec.gov, call 561-437-6738, or mail us at 3825 PGA Blvd, Suite 1005, Palm Beach Gardens, FL 33410.

The information contained in this article reflects A&M’s views as of the date of this publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. A&M has obtained the information from various third-party sources believed to be reliable, but such information is not guaranteed. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. A&M is not responsible for the consequences of any decisions or actions taken as a result of information provided in this newsletter and does not warrant or guarantee the accuracy or completeness of this information.

Past performance is not indicative of future performance. The information in this report is for informational purposes only and should not be relied upon as the basis of an investment or liquidation decision. Nothing in this report shall be construed to be a solicitation to buy or offer to sell any security, product or service to any non-U.S. investor, nor shall any such security, product or service be solicited, offered or sold in any jurisdiction where such activity would be contrary to the securities laws or other local laws and regulations or would subject A&M to any registration requirement within such jurisdiction. See www.ampwp.com/disclosures.

Related Content

- GOP Eyes Taxes on Municipal Bond Interest: What You Need to Know

- This Boring Retirement Income Source Has Big Tax Benefits

- Five Considerations About Municipal Bonds if Tax Cuts Sunset

- Remembering Bogle: A New Standard for Municipal Investing

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Peter Aloisi is a fixed income portfolio manager at A&M Private Wealth Partners (AMPWP), where he focuses on tax-advantaged intermediate and short-duration strategies tailored to the unique needs of ultra-high-net-worth clients. Throughout his career, he has enhanced client value by identifying optimal risk-reward opportunities within the municipal bond landscape, leveraging market dislocations across various cycles.

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

More Tools to Build a Bond Ladder

More Tools to Build a Bond LadderVanguard aims to launch a line of target-maturity corporate bond ETFs.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.