Remembering Bogle: A New Standard for Municipal Investing

Improvements in technology, data, systematic trading and risk analytics have led to more successful municipal indexing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Multiple decades have passed since John “Jack” Bogle revolutionized investing and taught us that index-like returns should be the bare minimum our clients should expect from their portfolios. High-fee products that couldn’t generate long-term outperformance no longer met “the standard.”

Since then, indexing strategies have grown exponentially, particularly within ETFs. If an investor felt their manager was not meeting their expectations of index-or-better returns, there were many substitutes that could.

Municipal bonds, a fragmented asset class, was slower to mature in the passive trend. For a long time, many considered the concept of “municipal indexing” an oxymoron.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Because with nearly 1 million bonds in this market, every buy decision within a portfolio presents a large benchmark-relative overweight and therefore benchmark-relative risk.

Even Vanguard offered only active strategies for municipals for decades.

However, recent improvements in technology, data, systematic trading and risk analytics have enabled a more effective set of conditions for municipal indexing to be successful.

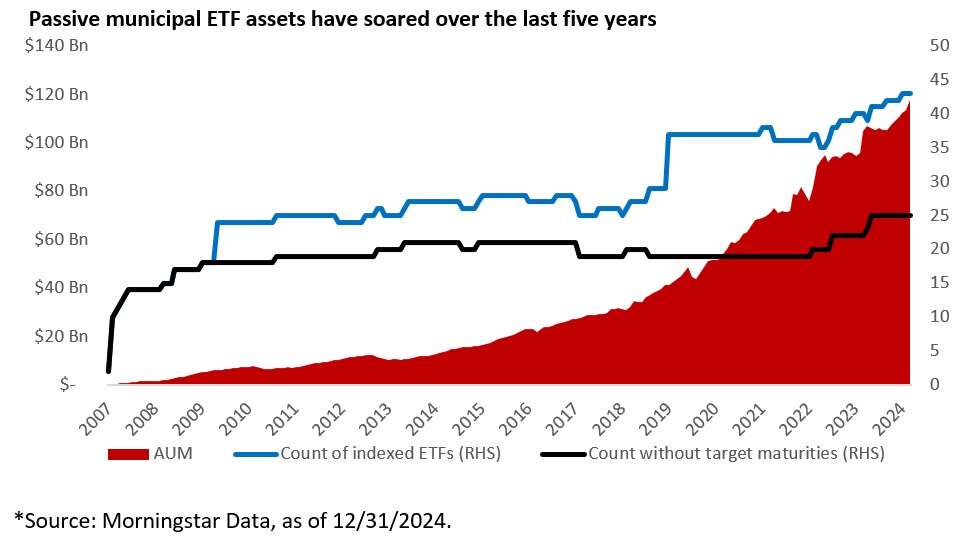

Flows have acted accordingly. Assets in passively managed municipal ETFs stand at $118 billion, nearly tripling over the last five years.

Over this time, the number of ETF products hasn’t expanded as rapidly. Instead, the rise in assets is attributable to incumbent products becoming larger, more diversified and more liquid.

Just as it did for other asset classes decades ago, indexing is now setting the “Bogle standard” for municipal investing: Do not settle for less than index-level returns!

Investors now have a variety of at-scale passive municipal strategies at their fingertips across investment-grade state and national exposures.

Regardless of vehicle (mutual funds, ETFs, direct bond purchases and SMAs), high earners should recognize the evolution of this market, with this new standard for municipal investing, and reassess their expectations for investment outcomes.

Our clients should now be asking for more from their municipal investments, unwilling to compromise for anything less than index-or-better returns.

A few last thoughts to round out the picture:

- We use the phrase “index-or-better returns” to capture the idea that active managers are still highly valuable in this fragmented market, but investors should require such managers to outperform over full market cycles net of fees.

- Some managers will deliver excess beta within supposed investment-grade strategies and call it alpha. Be discerning, look at benchmark-relative drawdowns and ensure the strategy is what you think it is.

All investing is subject to risk, including the possible loss of the money you invest.

Although the income from a municipal bond fund is exempt from federal tax, you may owe taxes on any capital gains realized through the fund's trading or through your own redemption of shares. For some investors, a portion of the fund's income may be subject to state and local taxes, as well as to the federal Alternative Minimum Tax.

Related Content

- Five Considerations About Municipal Bonds if Tax Cuts Sunset

- How to Survive Market Mayhem

- Four Ways to Invest in Quantum Computing

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Malloy is head of municipal investment at Vanguard. Previously, he was head of Vanguard Fixed Income Group, Europe. In that role, Paul managed portfolios that invested in global fixed income assets. He also oversaw Vanguard’s European Credit Research team. Mr. Malloy joined Vanguard in 2005, the Fixed Income Group in 2007 and has held various portfolio management positions in Vanguard’s offices in the United Kingdom and the United States.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.