Such Attractive Yields in High-Grade Munis Are Rare and May Not Last Long

According to this munis expert, the last time munis were this cheap was a brief period in 2023. If you kicked yourself for missing out then, you have a second chance now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

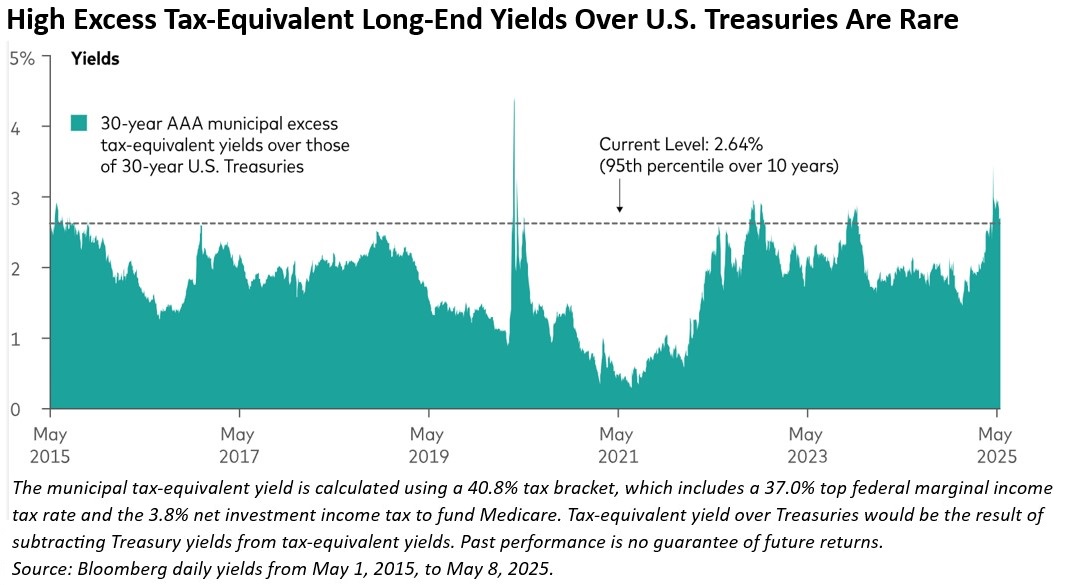

Municipal bond investors may have a rare and compelling opportunity to lock in high yields.

High-grade municipal bond yields, particularly at the long end of the curve, are near their highest levels in over a decade, according to the Bloomberg Municipal Bond Index through May 8.

And the ratio of the tax-equivalent yield on 30-year AAA-rated munis vs U.S. Treasuries is currently sitting just above 90%, according to Bloomberg's Evaluated Pricing Service as of May 8.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That means many muni bonds are practically offering tax exemption at little or no cost to investors.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

The combination of high outright yields at that ratio to Treasuries doesn’t happen very often — and when it does happen, it typically doesn’t last long.

The perfect storm: What drove munis to these levels

The reasons are technical in nature:

- Increased supply. Tax-exempt muni issuance in the first quarter of 2025 was 23% above the record pace set the previous year, according to Bloomberg through March 31, putting pressure on municipal yields.

- Treasury market volatility. In early April, the combination of high volatility in the Treasury market and moderate bond-to-equity rebalancing pushed rates for high-grade bonds up significantly at the long end of the curve.

Those headwinds have left munis relatively cheap compared to other fixed-income asset classes and have pushed their total yields up to a high-water mark.

However, as we head into summer, the typical seasonal patterns suggest that supply will decrease and demand will rise, driven by coupon and principal reinvestments.

Despite the recent technical pressures, muni credit quality remains intact at high levels. In recent years, state and local governments have applied excess fiscal stimulus wisely, building rainy-day funds and buffers for turbulent conditions.

Moreover, we expect municipal revenue sources to be largely insulated from any direct impact from tariffs.

In short, we’ll soon be entering a traditionally strong period for munis, with the added appeal of exceptionally cheap valuations and solid credit fundamentals.

Long-dated high-grade munis have become especially attractive of late. The chart below highlights the excess tax-equivalent yields that munis are offering vs Treasuries in the long end of the curve.

This differential has grown significantly since the end of last year. Not only are these opportunities rare, but they are also short-lived.

The investment case in brief

Munis are in good position to deliver strong returns this year, with tax-equivalent yields close to 7% on an after-tax basis, and provide a ballast in the event of an economic downturn, according to the Bloomberg Municipal Bond Index yield and Vanguard calculations as of May 8. (The municipal tax-equivalent yield is calculated using a 40.8% tax bracket, which includes a 37% top federal marginal income tax rate and the 3.8% net investment income tax to fund Medicare.)

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Given the current yields, valuations and technical tailwinds, longer-dated high-grade munis represent a sweet spot in the market.

Conditions are likely to shift in the coming months, so investors may want to consider seizing this investment opportunity before it’s gone. And remember that all investing is subject to risk, including possible loss of principal. (Read another timely take on muni bonds in the article Financial Analyst Sees a Bright Present for Municipal Bond Investors.)

If you’re considering investing in munis, you should be aware that although the income from a municipal bond fund is exempt from federal tax, you may owe taxes on any capital gains realized through the fund’s trading or through your own redemption of shares. For some investors, a portion of the fund’s income may be subject to state and local taxes, as well as to the federal alternative minimum tax.

Also, bond funds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates, and credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

Related Content

- Remembering Bogle: A New Standard for Municipal Investing

- GOP Eyes Taxes on Municipal Bond Interest: What You Need to Know

- This Boring Retirement Income Source Has Big Tax Benefits

- Five Considerations About Municipal Bonds if Tax Cuts Sunset

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Malloy is head of municipal investment at Vanguard. Previously, he was head of Vanguard Fixed Income Group, Europe. In that role, Paul managed portfolios that invested in global fixed income assets. He also oversaw Vanguard’s European Credit Research team. Mr. Malloy joined Vanguard in 2005, the Fixed Income Group in 2007 and has held various portfolio management positions in Vanguard’s offices in the United Kingdom and the United States.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.