W-4 Form: Tax Withholding Tips to Optimize Your Taxes This Year

What is a W-4? What does it tell your employer? Knowing how this IRS form works can help with new jobs, tax refunds, and avoiding estimated tax payments.

Kate Schubel

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When you start a new job, your employer will ask you to complete a W-4 form. The IRS W-4 helps determine the correct amount of income tax your employer will withhold from your wages.

But how does it do that? And where do you go if you want to update your W-4?

We'll cover what this important tax document is, and then list ten key items stressing the importance of correctly filling out and updating the W-4 form. After that, we’ll briefly mention common mistakes with the W-4, how state withholding forms may differ from federal, and a couple of ways to avoid over-withholding in 2026.

In the news: Several new changes are coming to federal tax withholding next year that could get you well over $1,000 in tax savings, if you qualify. For more information, check out Kiplinger's report, Three Critical Tax Changes Could Boost Your Paycheck in 2026.

What is a W-4?

The IRS Form W-4, Employee's Withholding Certificate, is a tax document you fill out so your employer knows how much tax to withhold from every paycheck.* Information like expected filing status, family income from other jobs, and number of dependents are used to calculate how much taxes must be withheld from your payment and remitted to the applicable tax agency.

*Note: Self-employed individuals and those with other tax situations may also use the W-4 form to calculate withholding; more on that below.

1. You can correct a W-4 tax form at any time

You can correct a W-4 form anytime, but you are not required to file one yearly. If you are happy with your current tax withholding, you can leave your current Form W-4 in effect with your employer.

However, you must complete a W-4 form to….

Start a new job. This is the only way your new employer will know how much federal income tax to withhold from your wages.

“Correct” a W-4. If you want to adjust the amount of tax your current employer withholds from your paycheck.

Ideally, you want your annual withholding and tax liability for the year to be close so that you don't owe a lot or get back a lot when you file your return. (Remember, a large tax refund means you gave the IRS an interest-free loan).

If your tax withholding is off track, submitting a new W-4 can help. That is especially important if you have a significant change in your life, such as getting married, having a child, or buying a home.

2. What is the easiest way to fill out a W-4?

The W-4 form can be relatively easy if you only have one job, and your taxes are simple. “Simple” means:

- You are not filing a joint return with a working spouse.

- You don’t have dependents.

- You’re not itemizing or claiming deductions other than the standard deduction.

- You’re not claiming any tax credits.

- You don’t have non-employment income.

If all those are true, you only have to provide your name, address, Social Security number, and filing status. Then you must sign and date the W-4 form.

Your employer will compute your tax withholding based on the standard deduction and income tax rates for your filing status, with no other adjustments.

3. Will I need my W-4 from last year to fill out a new form?

Yes, if your taxes are more complicated, completing a W-4 form will probably take you more time, and you may need your prior year’s filing.

For example, when new hires fill out a W-4 form, they may need to look up information from their last tax return to get information about total deductions from the previous tax year, the child tax credit, and how much non-wage income they reported.

4. What you can claim on a W-4 with two jobs or a working spouse

Having multiple jobs or a working spouse can affect the tax withheld from your wages. This is because, as income rises, so do tax rates. But only one standard deduction can be claimed on each tax return (regardless of the number of jobs).

As a result of this, you’ll see more money being withheld from the combined pay for all the jobs your household has (than would be withheld if each job was considered by itself).

This may cause you to make adjustments to your withholding to avoid owing additional tax and perhaps penalties when filing your tax return.

Fortunately, the W-4 form has a section where you can provide information about additional jobs and working spouses so that your withholding can be adjusted accordingly.

Note: The IRS recommends completing a W-4 for all your jobs to get the most accurate withholding. (By “accurate,” the agency means having total withholding as close to your expected tax liability as possible.)

5. How do I claim a child on my W-4 and can I claim other tax deductions?

The W-4 form allows you to adjust your withholding to account for certain tax credits and deductions. You can add these amounts by filling out the provided lines on the W-4 form:

Step 3. Workers can factor in the child tax credit and the credit for other dependents on this step of the form. You can also include estimates for other tax credits, such as education credits or foreign tax credits.

Line 4(b). For deductions, it's important to note that you should only enter deductions other than the basic standard deduction. So, you can include itemized deductions on this line. If you take the standard deduction, you can also include other deductions, such as those for student loan interest and IRAs.

If you have multiple jobs or a working spouse, complete Step 3 and Line 4(b) on only one W-4 form. It should be the form for the highest-paying job to get the most accurate withholding.

Including tax deductions and credits on the form will decrease the amount of tax withheld, which will increase the amount of your paycheck and reduce any refund you may get when you file your tax return.

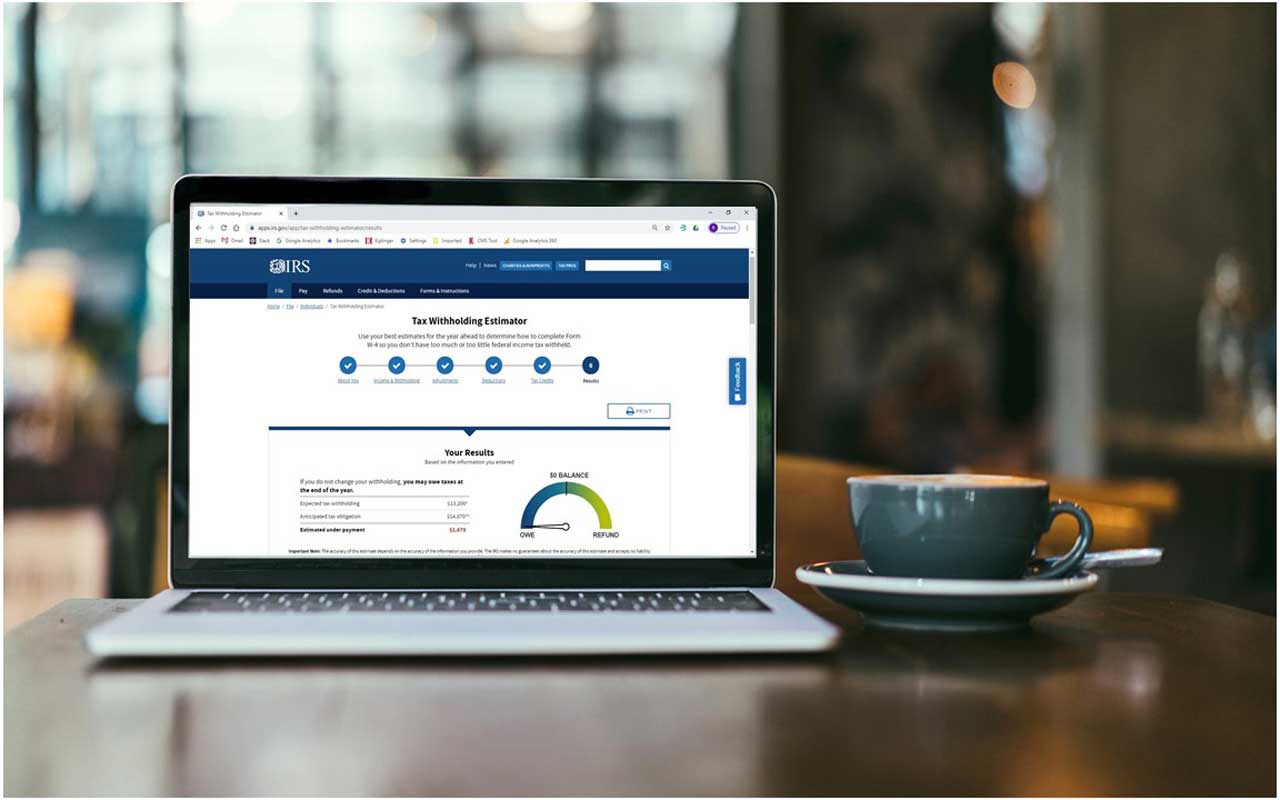

6. The IRS withholding estimator can be a helpful tool for the W-4

To get the most accurate withholding, you can use the IRS's Tax Withholding Estimator to help you fill out the W-4 form. You will also want to use this tool for a variety of reasons:

- If you expect to work only part of the year.

- Have dividend income or capital gains subject to additional taxes (e.g., the additional Medicare tax).

- Have self-employment income.

You will also want a few things by your side before you start using the tool — you'll need them as a source of information.

For example, have your most recent federal income tax return handy. You will also need your most recent pay stub (your spouse's, too, if you're married).

Collect information for other sources of income as well, such as invoices, statements, and 1099 forms.

7. How to change the W-4 to withhold more

If you receive taxable income that isn't from wages, like interest, dividends, or distributions from a traditional IRA, you can have your employer withhold tax from your paycheck to cover the extra taxes.

Just put the estimated total amount of this income for the year on Line 4(a) of your W-4 form, and your employer will calculate the proper withholding amount for each pay period. Don't include income from a side gig on Line 4(a).

For self-employment income where you still need to pay your taxes — keep reading! We’ll cover more information on how to get your boss to withhold tax from your regular paycheck.

8. Can you fill out a W-4 for a side hustle?

Suppose you have a side job as an independent contractor (i.e., not an "employee"). In that case, you can use the W-4 form to have extra taxes withheld from your regular job's paycheck to cover your side job, too (instead of making estimated tax payments for your second job).

To do this, you can follow these steps:

- Pay self-employment taxes through withholding from your regular job wages.

- Don’t include self-employment income as "other income" on Line 4(a) — that line is only for income, not from a job.

- Be sure to use the IRS's Tax Withholding Estimator tool if you need a preview of your withholding.

9. Claiming an exemption from withholding

You can claim an exemption from withholding on a W-4 form. However, you should make sure you qualify.

You qualify for an exemption in 2025 if:

- You had no federal income tax liability in 2024, AND

- You expect no federal income tax liability in 2025 (if your total expected income for 2025 is less than the standard deduction amount for your filing status, then you satisfy the second requirement).

While there isn't a particular line for this on the form, you can claim an exemption by writing "Exempt" in the space below Line 4(c) if you qualify. You must also provide your name, address, Social Security number, and signature.

Note: If you claim an exemption, you will not have income tax withheld from your paycheck, and you may owe taxes when you file your return. You might be hit with an underpayment penalty. Additionally, an exemption is good for only one year, so you must reclaim it yearly.

10. Getting a tax refund for excess withholding

If you wish, you can adjust your W-4 form to generate a larger tax refund (or refund in general).

Although the tax withholding system aims to produce the most accurate withholding, you can add an extra amount on Line 4(c) for "extra withholding" to increase your income tax withholding and reduce your paycheck. That will either increase your tax refund or decrease any tax you owe when you file your tax return.

If you have a specific refund amount, let the IRS's Tax Withholding Estimator tell you how much to put down on Line 4(c). You can even download a W-4 form with the appropriate amount preloaded on Line 4(c).

Common mistakes with the W-4

While filling out a W-4 can be straightforward, accidents may occur. For instance, you could:

- Misremember claiming a credit on last year’s tax filing and accidentally enter invalid data on this year’s.

- Mistakenly fill out inapplicable sections of the W-4 (you’re only required to complete sections one and five – all others depend on your individual tax situation).

However, some common mistakes for W-4 forms happen at the employer level.

Employers should never fill out your form for you. Nor should they tell you how to enter your information. Your employer may also miskey information when typing up your paper form, or accept incomplete W-4s accidentally.

If you have any doubts about how your W-4 was filed, email your payroll department and ask to see a copy of your withholding certificate. You can also follow up with them on any questions you may have.

Avoid over-withholding taxes in 2026

If you're a tipped employee or someone who typically works overtime, you'll definitely want to revisit your W-4 Form next year. That's because the big GOP tax cut and spending bill, dubbed the "one big beautiful bill," has introduced new temporary IRS deductions:

- The "no tax on tips" deduction is for tipped employees who receive "voluntary cash and charge tips." The tax break is worth up to $25,000, though certain income rules and other eligibility requirements apply.

- The overtime tax deduction is for employees who work more than 40 hours a week and is also worth up to $25,000 (income rules and other eligibility requirements apply).

While both tax breaks will be effective for the 2025 tax year, the IRS has not released a new 2025 W-4 Form.

Instead, the IRS will add specific lines to the 2026 W-4 to account for these deductions. So if you qualify for the tipped income or overtime tax deduction next year, you'll need to adjust your withholding in 2026. Otherwise, you could be giving the federal government an interest-free loan until tax filing time.

Note: Only specific jobs qualify for the overtime and tip tax deductions. See IRS guidance for more information.

State tax withholding

It’s important to note that you may be subject to more than just federal withholdings. State W-4s can apply to your taxes and depend on your state’s rules for tax withholding.

For example, New Mexico doesn’t have a state-specific W-4, so the federal withholding form is used for state tax collections. Other states, like Alabama and Oklahoma, have their own withholding tax forms.

Of course, states with no income tax don’t have a withholding certificate at all. Visit your state’s Department of Taxation website to see if you’re required to complete one, or ask your employer for more information.

Read More

- A Guide to All 1099 IRS Tax Forms to Know

- Types of Income the IRS Doesn't Tax

- What is Taxable Income?

- How to Lower Your Tax Bill Next Year

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

- Kate SchubelTax Writer

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

2026 Tax Refund Delays: 5 States Where Your Money Is Stuck

2026 Tax Refund Delays: 5 States Where Your Money Is StuckState Tax From New York to Oregon, your state income tax refund could be delayed for weeks. Here's what to know.

-

Paper Tax Filers Face Long Wait as IRS Digitization Effort Stalls

Paper Tax Filers Face Long Wait as IRS Digitization Effort StallsTax Filing Last April, the IRS launched its Zero Paper Initiative to speed up paper tax return processing. The project isn’t going well.

-

How One Extra Dollar of Income Can Cost You Thousands in Retirement

How One Extra Dollar of Income Can Cost You Thousands in RetirementRetirement Even modest changes in retirement income can raise Medicare premiums under IRMAA. Here’s how a small increase can affect your retirement costs.

-

First the Penny, Now the Nickel? The New Math Behind Your Sales Tax and Total

First the Penny, Now the Nickel? The New Math Behind Your Sales Tax and TotalRounding Tax A new era of "Swedish rounding" hits U.S. registers soon. Learn why the nickel might be on the chopping block, and how to save money by choosing the right way to pay.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.