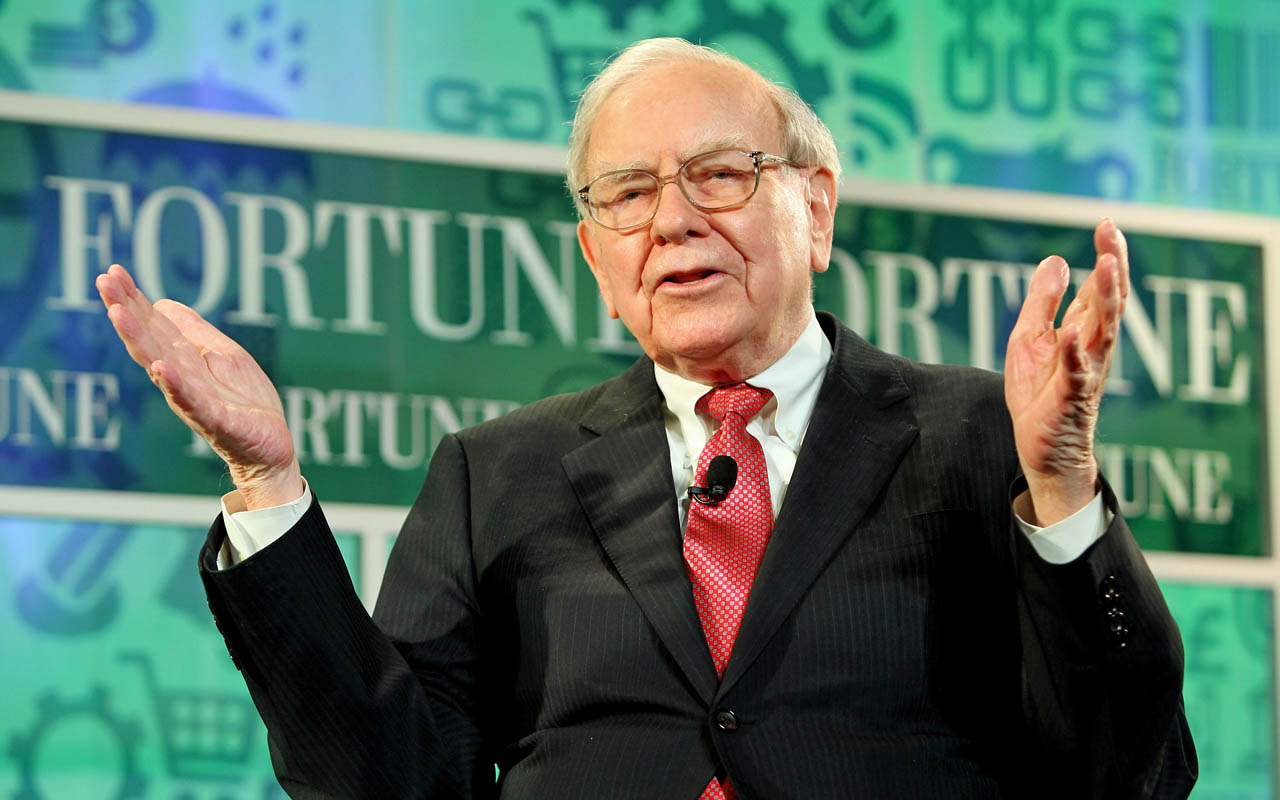

7 Stocks Warren Buffett Is Buying or Selling

Berkshire Hathaway (BRK.B, $198.31) Chairman and CEO Warren Buffett hasn’t found much to his liking in 2019.

The Oracle of Omaha bought and sold left and right at the end of 2018. He used the fourth quarter’s near-bear market to snap up bargains and exit a few underperforming investments, amassing a total of 17 common-stock trades. But thanks to significantly higher prices across 2019, Buffett has dialed things down, making 10 such moves in Q1 and just six in the three months ended June 30.

Nonetheless, we can gleam a few things from what Buffett is doing, so today we will take a look at the most recent changes to Berkshire Hathaway’s equity portfolio.

The U.S. Securities and Exchange Commission’s own rules require Buffett to open up about these moves. All investment managers with more than $100 million in assets must file a Form 13F every quarter to disclose every change in stock ownership. That’s an important level of transparency for anyone well-funded enough to significantly impact a stock with their investment. And in this case, it helps people who appreciate Buffett’s insights track what he’s doing – some investors view a Berkshire buy as an important seal of approval. (Just remember: A few of Berkshire’s holdings are influenced or even outright decided by lieutenants Ted Weschler and Todd Combs.)

Here’s what Warren Buffett’s Berkshire Hathaway was buying and selling during the second quarter of 2019, based on the most recent 13F that was filed on Aug. 14. The list includes six changes to the equity portfolio, and a notable seventh investment.

Current price data is as of Aug. 15. Holdings data is as of Aug. 14. Sources: Berkshire Hathaway’s SEC Form 13F filed Aug. 14, 2019, for the reporting period ended June 30, 2019; and WhaleWisdom.

Amazon.com

- Action: Added to stake

- Shares held: 537,300 (+11% from Q1)

- Value of stake: $1,017,447,000

Berkshire Hathaway didn’t open up any new positions during the three months ended June 30, so that makes its purchase of 54,000 Amazon.com (AMZN, $1,776.12) shares its most significant addition of the second quarter. Buffett’s holding company increased its stake by 11%.

Interestingly, this position has absolutely nothing to do with Buffett.

Berkshire’s CEO told CNBC in May, when Berkshire initially brought AMZN into the fold, that “one of the fellows in the office that manage money” made the call. That’s a reference to Weschler and Combs.

Good on Buffett, however, for admitting that even he can make mistakes. He also said back in May that he didn’t believe in Amazon.com as much as he should have.

“(Amazon) far surpassed anything I would have dreamt could have been done. Because if I really felt it could have been done, I should have bought it,” he said. “I had no idea that it had the potential. I blew it.”

Amazon is having a good, albeit not explosive, 2019, with its roughly 18% returns outpacing the S&P 500 by about five percentage points. That said, it’s possible that the significant dip in AMZN between early May and early June (the stock fell roughly 10% in a month) provided another attractive buying point for Buffett.

Bank of America

- Action: Added to stake

- Shares held: 927,248,600 (+3% from Q1)

- Value of stake: $26,890,210,000

Warren Buffett’s love affair with American banks continued in the second quarter with a few more pecks on the cheek. Berkshire added to its positions in two giant U.S. financial stocks – including a 3% bump-up in its Bank of America (BAC, $26.25) stake.

Buffett really ramped up his bank-buying in the second half of 2018, starting or adding to positions to the likes of Bank of New York Mellon (BK), Goldman Sachs (GS), JPMorgan (JPM) and Wells Fargo (WFC). But Bank of America’s role in the Berkshire portfolio goes back seven years further.

In 2011, Warren Buffett made a $5 billion investment in BofA, which like most other bank stocks was reeling from the wake of the Great Recession and financial crisis. But his investment started out in preferred stocks yielding 6%, as well as warrants that allowed him to buy discounted BAC shares (the company’s common stock). In 2017, he cashed out of those preferreds and exercised the warrants, making a tidy $12 billion profit to become BofA’s largest shareholder.

Meanwhile, BRK.B’s current holdings work out to a 9.1% stake in the big bank.

U.S. Bancorp

- Action: Added to stake

- Shares held: 132,459,618 (+2% from Q1)

- Value of stake: $6,940,884,000

The other bank addition? U.S. Bancorp (USB, $51.28). Berkshire Hathaway grew its position by about 2% during the second quarter.

U.S. Bancorp is America’s fifth-largest bank by assets, and its largest regional bank (dubbed a “superregional”). And like many other large financial institutions in America, USB has had a moderately fruitful but still frustrating year.

What appeared to be a backdrop of rising interest rates (which allow banks to charge more for products such as mortgages and auto loans while still not having to pay out much more interest on savings and other accounts) has quickly changed. The Federal Reserve switched its stance earlier this year to keeping rates level, then decided to reduce its benchmark interest rate in July. That has weighed on the financial sector, including USB, which is up a good 12% or so in 2019 but lags the S&P 500 by more than a percentage point.

Berkshire’s recently bolstered position translates into an 8.3% stake in U.S. Bancorp and accounts for 3.3% of the Berkshire portfolio.

Red Hat

- Action: Added to stake

- Shares held: 5,171,890

- Value of stake: $971,074,000 (+1% from Q1)

In October 2018, International Business Machines (IBM) announced it would pay $34 billion in cash to buy Red Hat, which would bolster IBM’s cloud offerings. “This acquisition brings together the best-in-class hybrid cloud providers and will enable companies to securely move all business applications to the cloud,” Red Hat said in the initial news release that disclosed the acquisition.

The announcement started the clock on the eventual disappearance of Red Hat, which came this July as the deal finally closed.

But the inevitable disappearance of Red Hat didn’t deter Buffett, who initiated his stake during the fourth quarter of 2018, then added to it during this year’s first and second quarters.

His most recent purchase was a small uptick – 61,419 shares, or a 1% increase from Berkshire’s Q1 position. At a total stake of about 5.2 million shares, Berkshire owned roughly 2.9% of Red Hat as of the end of Q2 – a few days before IBM took over.

Charter Communications

- Action: Reduced stake

- Shares held: 5,426,609 (-4% from Q1)

- Value of stake: $2,144,487,000

The second quarter of 2019 ushered in yet another haircut for Berkshire’s Charter Communications (CHTR, $380.94) stake.

Charter Communications is the company behind Spectrum, which is the second-largest cable operator in the U.S. behind Comcast (CMCSA). Spectrum also offers internet, telephone and other communications services. Charter grew significantly in 2016 via a pair of acquisitions, for Time Warner Cable and sister company Bright House Networks.

This isn’t a terribly old Berkshire position (Buffett entered in 2014), but it has been trimmed often since early 2017, including another 5.4 million shares in Q2. That’s down considerably from the 9.4 million shares it owned a little more than two years ago, but still good enough for a 2.4% ownership stake.

It's difficult to fault Charter for this year’s selling, however. CHTR has more than doubled the S&P 500 with a nearly 34% gain year-to-date. That includes a sizable stumble since late July, too – partly on the broader market swoon, but also a reflection of a disappointing Q2 earnings report that saw revenues and profits fall short of expectations.

USG Corp.

- Action: Exited stake

- Shares held: 0 (-100% from Q1)

- Value of stake: $0

On its face, the biggest shake-up of the Berkshire Hathaway portfolio was the full exit from one of its lesser-known names: USG Corp. (USG, $380.94).

USG Corp. – or United States Gypsum Corporation, if you’re not into the whole brevity thing – is as boring as drywall. Which is appropriate, because that’s one of its primary products. USG is a construction material specialist that makes, among other things, drywall and joint compound. (Joint compound is just one of numerous products USG makes from gypsum, hence the name).

But while the move looks dramatic, this was in the cards for more than a year. Germany’s Knauf, which is also in the drywall business, announced in June 2018 that it would buy USG for $7 billion. Berkshire Hathaway, which held a 31% stake at the time, put significant pressure on USG to accept the deal – what ended up being Buffett’s way out on what he called a “disappointing” investment.

The deal closed in April 2019, effectively ending Berkshire’s involvement.

Occidental Petroleum

- Action: Investment

- Shares held: 100,000*

- Value of stake: $10 billion*

This final deal technically isn’t part of the Berkshire Hathaway equity portfolio, and it has been news for months. But it’s still a noteworthy action from the second quarter.

Warren Buffett hasn’t had much involvement in energy stocks over the past few years. But in late April 2019, he said he would invest $10 billion in integrated oil-and-gas play Occidental Petroleum (OXY, $43.96) to help finance its bid for exploration-and-production firm Anadarko Petroleum. In return, Berkshire received 100,000 preferred shares yielding 8%.

Occidental entered its $38 billion bid to buy out Anadarko after the latter had already agreed to a $33 billion offer from Chevron (CVX). Anadarko agreed to the higher offer, and on Aug. 8, its shareholders green-lit the deal. While the deal was still in the air, activist investor Carl Icahn – who owned a 5% stake in OXY – loudly voiced his criticisms, calling the deal “one of the worst I’ve ever seen” and “hugely overpriced.”

But Buffett must have done well for himself. Icahn told CNBC that Buffett essentially pulled a fast one on CEO Vicki Hollub. “Warren did a great job for himself and Berkshire … but they didn’t have to give him a $1.5 billion gift,” he said.

* The other purchases on this list are of common stock. Buffett received 100,000 shares of preferred stock for his investment in Occidental.

Kyle Woodley was long AMZN as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

AI vs the Stock Market: How Did Alphabet, Nike and Industrial Stocks Perform in June?

AI vs the Stock Market: How Did Alphabet, Nike and Industrial Stocks Perform in June?AI is a new tool to help investors analyze data, but can it beat the stock market? Here's how a chatbot's stock picks fared in June.

-

Stock Market Today: A Historic Quarter Closes on High Notes

Stock Market Today: A Historic Quarter Closes on High Notes"All's well that ends well" is one way to describe the second quarter of 2025, at least from a pure price-action perspective.

-

Stock Market Today: A Historic Quarter Closes on High Notes

Stock Market Today: A Historic Quarter Closes on High Notes"All's well that ends well" is one way to describe the second quarter of 2025, at least from a pure price-action perspective.

-

Stock Market Today: S&P 500, Nasdaq Near New Highs

Stock Market Today: S&P 500, Nasdaq Near New HighsThe S&P 500 hasn't hit a new high since February. It's been since December for the Nasdaq.

-

7 Essential Investing Rules We All Should Know

7 Essential Investing Rules We All Should KnowThe best time to start investing is right now. That's just one vital rule investors should be familiar with. Here are six more.

-

Stock Market Today: Stocks Struggle to Sustain Gains

Stock Market Today: Stocks Struggle to Sustain GainsMixed messages from multiple sources continue to make for a messy market for investors, traders and speculators.

-

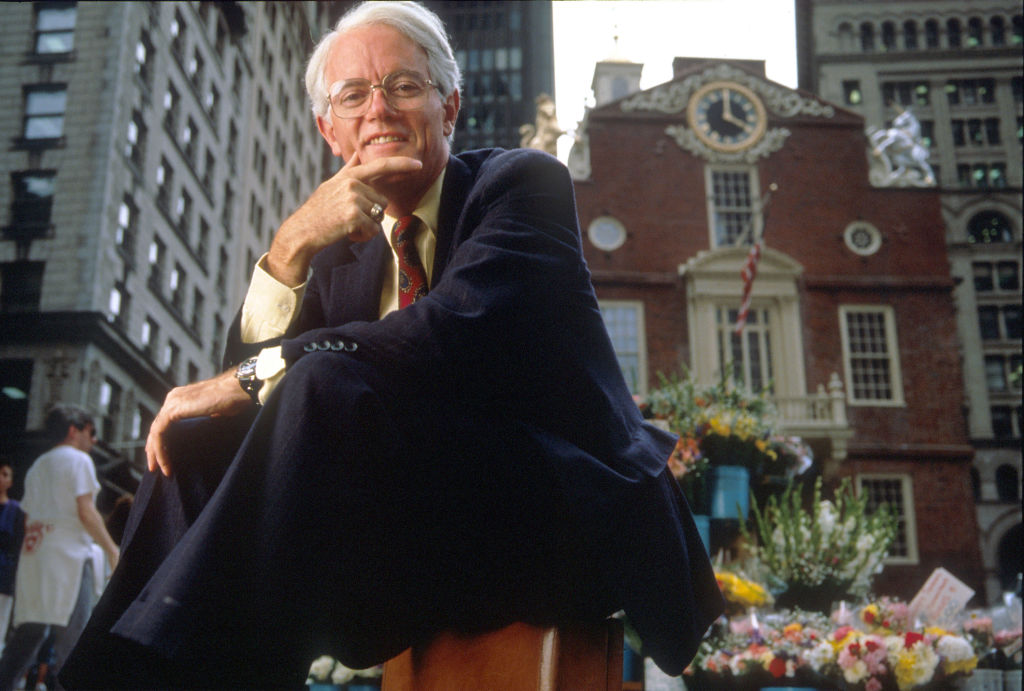

We Are Peter Lynch: How to Invest in What You Know

We Are Peter Lynch: How to Invest in What You KnowTake a look around, go to a free stock market data website, and get to work.

-

Stock Market Today: Stocks Stable as Inflation, Tariff Fears Ebb

Stock Market Today: Stocks Stable as Inflation, Tariff Fears EbbConstructive trade war talks and improving consumer expectations are a healthy combination for financial markets.

-

AI vs the Stock Market: How Did Tech Stocks, Palantir and Albemarle Perform in May?

AI vs the Stock Market: How Did Tech Stocks, Palantir and Albemarle Perform in May?AI is a new tool to help investors analyze data, but can it beat the stock market? Here's how a chatbot's stock picks fared in May.

-

Stock Market Today: Stocks Chop After House Passes Trump's Tax Bill

Stock Market Today: Stocks Chop After House Passes Trump's Tax BillThe bill, which was narrowly approved by the House of Representatives, will now move to the Senate.