11 S&P 500 Stocks That Could Soar 20% or More in 2020

Here, then, are 11 of the best S&P 500 stocks you can buy for outsize gains in 2020. Based analysts’ projected price returns, Wall Street expects these names to rally from 20% to more than 35% this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Never say never, but it's hard to see stocks follow their amazing 2019 returns for a second straight year.

S&P 500 stocks sent the index a whopping 29% higher in 2020. That's a big deal. Keep in mind that the market's long-term average annual gain comes to about 7.7%, then factor in the tendency for share performance to revert to the mean, and the odds of another boffo year are slim.

Indeed, years in which the S&P 500 rises at least 20% generate an average gain of only 6.6% the following year, according to Bespoke Investment Group.

But that doesn't mean investors can't try to replicate 2019's party by seeding their holdings with stocks expected to blow away the broader market. To find stocks primed to outperform, we scoured the S&P 500 for stocks with expected price gains of at least 20% this year. We supplemented that research by limiting ourselves to stocks that are Buy-rated or better by Wall Street analysts, as well as boast promising fundamentals, attractive valuations and other bullish features.

Here, then, are 11 of the best S&P 500 stocks you can buy for outsize gains in 2020. Based analysts’ projected price returns, Wall Street expects these names to rally from 20% to more than 35% this year.

Share prices, price targets, analysts’ ratings and other data are courtesy of S&P Global Market Intelligence as of Jan. 9, unless otherwise noted. Companies are listed by implied upside, from lowest to highest. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

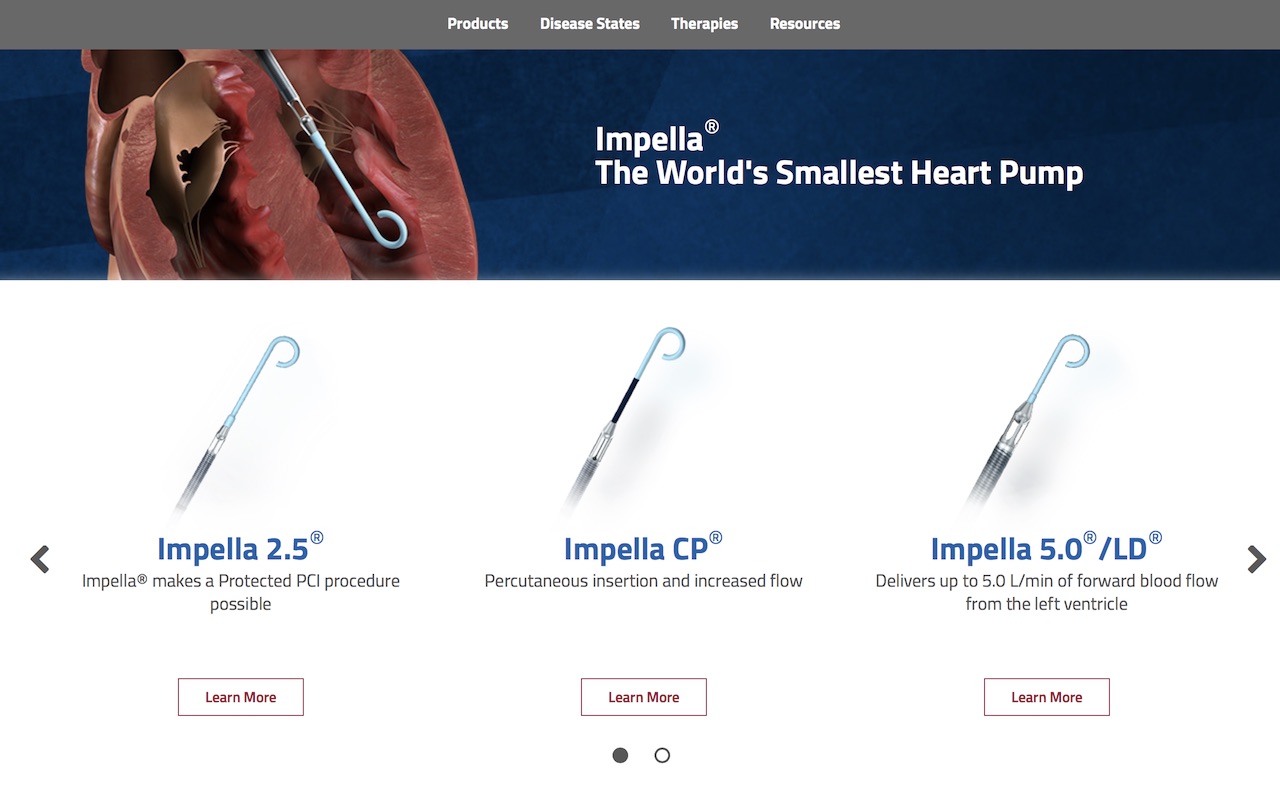

Abiomed

- Market value: $8.0 billion

- Dividend yield: N/A

- Implied upside: 20.2%

- Abiomed (ABMD, $183.60) is one of the best-performing stocks of the past 10 years, but the medical device maker has stumbled of late. ABMD's shares cratered last year amid concerns over the safety of its temporary heart pump, Impella, that improves blood flow during surgery. The Food and Drug Administration gave the company a clean bill of health, but it's still trying to regain its footing.

Analysts are split on whether shares are a Buy at current levels, with some calling ABMD a "show-me" stock until revenue growth re-accelerates.

William Blair's Margaret Kaczor maintained an Outperform (Buy) rating on shares in November following the release of damaging data sets comparing Impella to intra-aortic balloon pumps, but did call it "likely another hurdle that Abiomed will need to overcome as it looks to reaccelerate adoption and utilization of its products." Around the same time, Raymond James cut its recommendation to Market Perform (Hold) from Outperform, taking a more cautious stance until U.S. growth gets back on track.

The 10 analysts covering ABMD who are tracked by S&P Global Market Intelligence are split: five Buys and five Holds. Still, their average price target of $220.67 gives the stock implied upside just north of 20% over the next 12 months.

Mylan

- Market value: $10.8 billion

- Dividend yield: N/A

- Implied upside: 21.3%

- Mylan (MYL, $20.93), a pharmaceutical company perhaps best-known for generic drugs, is poised to deliver big-time returns in 2020. Be forewarned, however, that most of the projected upside will come in the second half of the year.

Mylan is in the middle of closing a deal with Pfizer (PFE) to combine their off-patent drugs into a new company, which will then be spun off to shareholders. Analysts applaud the move, but it could put handcuffs on Mylan until the deal closes. RBC Capital's Randall Stanicky, who has MYL at Outperform (equivalent of Buy), figures shares will be rangebound until the Pfizer deal closes in mid-year.

However, after getting over the deal-close hump, the RBC analyst sees Mylan shares rallying during the second half of 2020. Indeed, it remains one of RBC's top stock picks for the next 12 months, projecting 29% upside in that time.

The analyst community's average price target isn't as robust, but at $25.40, it still suggests MYL will be among S&P 500 stocks that can generate more than 20% upside in 2020.

United Airlines

- Market value: $22.3 billion

- Dividend yield: N/A

- Implied upside: 24.6%

- United Airlines (UAL, $87.95) is one of a couple S&P 500 stocks in the airline business that are expected to fly high in 2020.

"Our Best Idea in the group for 2020 is UAL, which we believe has unique company-specific catalysts that should enable the company to better weather the softer conditions," writes Stephens analyst Jack Atkins, who has an Overweight rating on United with no price target.

Earnings momentum and cost controls also help fuel optimism in United. Argus rates shares at Buy, citing low fuel prices, solid U.S. flight demand and improving margins at airport hubs.

Those are among the 14 analysts who say investors should buy UAL stock, versus seven in the Hold camp. Moreover, United gets an average price target of $109.58, equating to potential upside of nearly 25% over the next 52 weeks.

Furthermore, the stock looks like a bargain. UAL trades at a mere 7 times forward earnings, solidly below its own five-year average of 8, according to StockReports+.

All this is more good news for Warren Buffett. Berkshire Hathaway holds 8.5% of UAL shares outstanding, making it the airline's second-largest shareholder. United's stock has delivered an annualized total return of about 20% since the end of Q3 2016, when Berkshire established its stake.

Nielsen Holdings

- Market value: $7.1 billion

- Dividend yield: 1.2%

- Implied upside: 25.0%

- Nielsen Holdings (NLSN, $20.09), the ubiquitous media-ratings firm, is in fact far more than just TV numbers. It's a global measurement and data analytics firm that helps retailers and packaged-goods companies in more than 100 countries better understand their consumers.

Analysts are encouraged of late that Nielsen is showing improvement in parts of the business that have been under pressure.

The company's retail measurement business in China is picking up, note William Blair analysts, who rate shares at Outperform. "And Nielsen continues to see growth in national TV measurement and digital measurement," they write.

Nielsen admittedly has been a dog over the past three years, losing more than half its value over that time and slashing its dividend by 83% late in November. But the company's plans to spin off the Global Connect business may unlock value and drive optimism in the year ahead.

Hanesbrands

- Market value: $5.1 billion

- Dividend yield: 4.3%

- Implied upside: 27.1%

- Hanesbrands (HBI, $14.05) – which makes a wide range of basic apparel for men, women and children – is not a sexy business. True, it makes innerwear, but Hanes underwear will never be mistaken for Victoria's Secret.

What is attractive about HBI is its potential for serving up market-beating gains this year.

For investors interested in the bull case, Stifel sums it up nicely: "HBI enjoys a leadership position in the U.S. basic apparel landscape and has the opportunity to return to growth in the innerwear category," Stifel's analysts write in a note to clients. The potential for cost cuts and underlying free cash flow point to a favorable risk-reward scenario, they add.

The Street's opinion on the stock averages out to a Buy recommendation, but just barely. Five analysts rate Hanesbrands at Buy, seven call it a Hold and two slap a relatively rare Sell rating on shares. Be that as it may, HBI's target price of $17.86 gives it implied upside of 27% over the next 12 months or so.

Moreover, Hanesbrands is trading at bargain levels. Shares currently fetch just 8.2 times forward earnings – cheaper than the average among S&P 500 stocks by more than half, and well below HBI's own five-year average of 12.3, according to StockReports+.

American Airlines

- Market value: $12.2 billion

- Dividend yield: 1.4%

- Implied upside: 30.1%

Shares in American Airlines (AAL, $27.95) have been grounded for a long time. The stock is off more than 14% over the past year, and it has lost roughly half its value since early 2015.

But for new money, that pain also sets shares up for a big rebound over the next 12 months or so, analysts say.

"We believe shares of American are fundamentally mispriced, given the value of its loyalty program, which is underappreciated by the market as a result of limited transparency into the economics of that business," says Stifel, which calls shares a buy. "We expect disclosures to improve over the next 12-18 months, which should result in investors more appropriately valuing the distinct marketing business of selling miles to third parties."

The pros add that the airline's core hub growth strategy is off to a good start and it will be winding down capital spending over the next two years.

Put it all together, and Wall Street is looking for upside of 30% over the next 12 months – roughly triple even some of the most optimistic outlooks for the S&P 500 in 2020.

Diamondback Energy

- Market value: $15.1 billion

- Dividend yield: 0.8%

- Implied upside: 30.1%

Crude oil prices rose more than 35% in 2019. While they're not expected to repeat that feat again this year, the outlook is nonetheless stable enough to put Diamondback Energy (FANG, $94.15) on the path to outsize gains.

The oil exploration-and-production (E&P) firm operates solely in the Permian Basin in West Texas. "With presence across more than 394,000 net acres (and) more than 7,000 drilling locations in the basin, the company's production outlook looks promising," says Zacks Equity Research, which calls the stock a Buy.

Raymond James analyst John Freeman said that while the company's 2020 oil volume guidance "spooked" Wall Street last year, he's optimistic about its oil-volume growth and ability to generate free cash flow. He has a Strong Buy rating on shares and a $110 price target.

The average analyst PT is even higher, at $122.51, giving FANG implied upside of roughly 30% over the next 52 weeks. The pros believe its stock price will be driven by earnings growth of roughly 37% this year.

Alexion Pharmaceuticals

- Market value: $24.5 billion

- Dividend yield: N/A

- Implied upside: 32.2%

- Alexion Pharmaceuticals (ALXN, $110.74) has a huge blockbuster drug on its hands and the stock is undervalued, which should lift the stock by about a third in 2020, say Wall Street's pros.

Alexion's runaway success, Soliris – for blood diseases paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS) – has been called the most successful rare-disease medicine in history, racking up $3 billion in sales last year alone.

Soliris might face new competition from Apellis (ALPS), whose pegcetacoplan topped Soliris in a late-stage study. JPMorgan analysts point out that any impact to earnings estimates would be "rather modest." That's in part because the company is seeing success in switching patients to its follow-up drug, Ultomiris.

Cowen, which includes Alexion on its 2020 best ideas list, says it is one of the few large-cap biotechnology companies with visible revenue growth. And Zacks Equity Research notes that the S&P 500 stock's shares are cheap, cheap, cheap. The stock trades at just 9.4 times expected earnings, versus an industry average of 25.6.

Meanwhile, Buy calls outpace Holds by a wide 18 to five.

Marathon Petroleum

- Market value: $38.6 billion

- Dividend yield: 3.6%

- Implied upside: 33.2%

- Marathon Petroleum (MPC, $59.39) is among a few energy-sector S&P 500 stocks set up for a hot 2020, analysts say. Adjusted earnings are forecast to rise a whopping 75% this year. The long-term growth rate sits at almost 8% annually for the next three to five years.

Like many analysts, Mizuho Securities, which rates shares at Buy with a $90-per-share price target, says the oil refiner's stock is undervalued. The solution? Spinoffs. Mizuho cheered activist Elliott Management's call in September for management to break up the so-called downstream business into three separate companies: refining, midstream and retail. While Marathon didn't adopt that exact plan, it did agree to spin off its retail operations and change out its CEO.

Marathon Petroleum is one of Mizuho's top picks, and that goes for Jefferies as well. Jeffries calls the stock a Buy with a $75 price target, calling the company a "diversified, vertically-integrated cash machine with premier assets." Jefferies also likes that MPC has "clear channels to funnel excess cash to shareholders."

On Wall Street, 15 analysts have Buy-equivalent ratings on the stock, while three call it a Hold. Their average target price of $79.11 means they expect shares to rise 33% in the next 12 months or so.

General Motors

- Market value: $50.1 billion

- Dividend yield: 4.4%

- Implied upside: 35.2%

It's pretty counterintuitive that General Motors (GM, $35.08), having suffered its biggest-ever drop in sales in China, is expected to deliver upside of 37% over the next 12 months or so.

But although Chinese economic growth remains lackluster, an end to the U.S. trade war with China could prove to be a powerful catalyst. And let's not forget about the engines driving GM's performance. Citigroup, with a Buy rating, praises General Motors' "unique" North American franchise led by high demand for higher-margin trucks and SUVs.

In fact, even though GM is suffering sluggish sales in China, the Street still forecasts a 5% improvement in General Motors' revenues in 2020.

And with an eye toward the not-so-distant future, GM plans to unveil 10 electrified or new-energy vehicles in China in 2020 and beyond. That could potentially give it a boost in the country.

It also helps that GM is dirt-cheap. The stock trades at just 5.4 times projected earnings for 2020. That's a discount even by GM's inexpensive standards – over the past five years, the S&P 500 stock has traded at 6.3 times forward earnings, according to StockReports+.

TechnipFMC

- Market value: $9.3 billion

- Dividend yield: 2.5%

- Implied upside: 35.7%

You can add lesser-known TechnipFMC (FTI, $20.85) to the list of energy stocks forecast to deliver smoking returns in 2020. The U.K.-based company provides engineering and construction services for oil-and-gas exploration on land and at sea.

It recently strengthened its footprint in Europe after being awarded a contract to construct a new naphtha complex for Greek refiner Motor Oil Hellas. FTI didn't specify the terms, but reports say the contract could be worth as much as $250 million.

Additionally, analysts note that TechnipFMC could be a tempting acquisition target after the planned spinoff of its engineering business later this year. And even if a deal is not on the horizon, the Street says splitting FTI into two separate publicly traded companies will unlock value.

The pros expect the stock to hit $28.29 over the next 52 weeks, up almost 36% from current levels. That's tops among S&P 500 stocks for 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.