10 Best Stocks of the Past 10 Years

These companies powered through the past decade. Can they keep it up?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

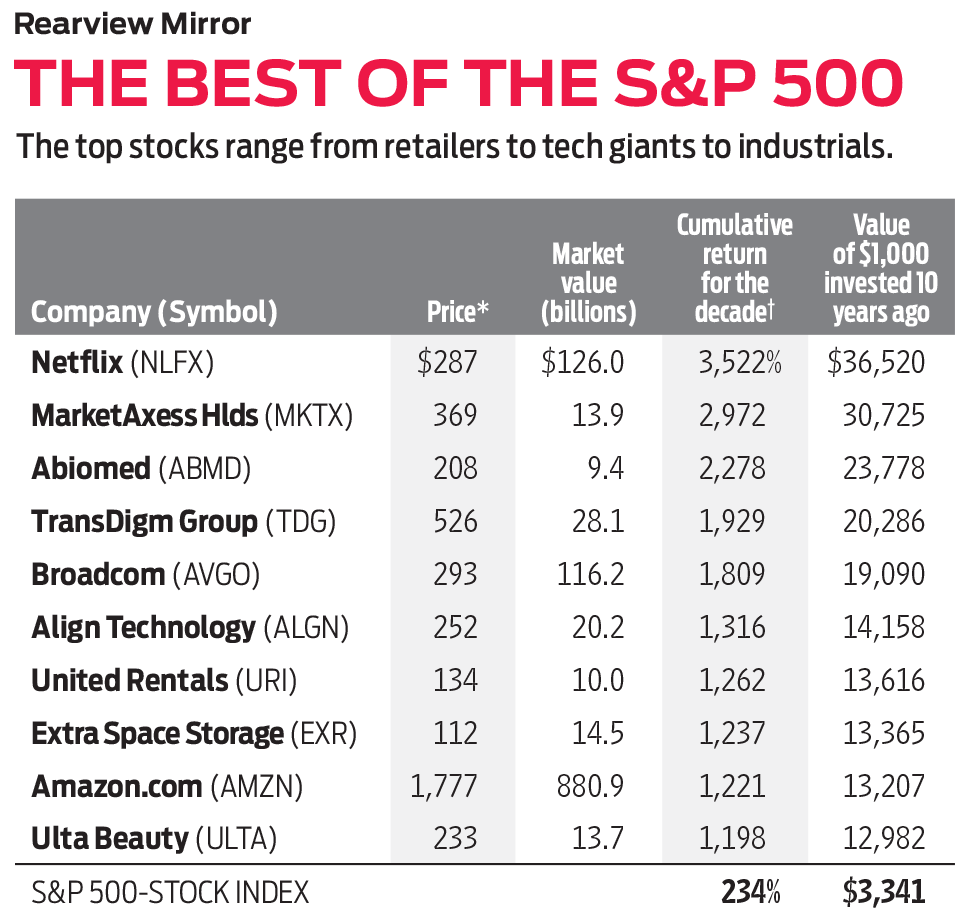

At the close of any decade, we're often compelled to look back—especially at investment returns. Below, we highlight the 10 stocks in Standard & Poor's 500-stock index with the best 10-year records. The list has a few surprises, as well as some household names. Read on to learn why they soared and whether the good times will continue. Stocks are listed in order of total return; returns and other data are through October 31.

Netflix

10-year cumulative return: 3,522%. Netflix (symbol NFLX) started streaming video in 2007, and the rest is history. Today, more than 158 million subscribers in 190 countries pay a monthly fee to watch its content, providing Netflix with a steady revenue stream. Although we still like the stock for patient investors with a speculative bent, they should definitely buckle up for a bumpy ride. Competition is getting stiff, with traditional media heavies, such as Disney and NBC, entering the business with their own streaming services.

MarketAxess Holdings

10-year cumulative return: 2,972%. Bonds are one of the last major asset classes to shift to electronic trading, and MarketAxess Holdings (MKTX) is a leader in this change. The company commands 80% of electronically executed trades of investment-grade corporate bonds and has stakes in high-yield, European and emerging-markets bond trading, too. A boost came from post-recession regulations that squeezed bond-trading volume at big banks. A focus on lower trading fees helped, too. MarketAxess is on track to report its 11th straight year of record revenue, operating income and bond-trading volume. Yet, "it's still early days," says Gary Robinson, a comanager of Baillie Gifford U.S. Equity Growth fund, who recommends the stock for the long term. The firm "is as strong as ever."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Abiomed

10-year cumulative return: 2,278%. Abiomed (ABMD) makes a temporary heart pump that improves blood flow and lets the heart rest, which lowers risk during heart procedures. Shares were flying high until a Food and Drug Administration letter in early 2019 warned that the pumps posed a risk for certain patients. In May, the FDA issued a second letter, stating that Abiomed's products were safe to use, but the damage was done. Sales fell short of analysts' expectations in the two most recent quarters, and the firm lowered its expectations for revenue and earnings for the current fiscal year, which ends in March. Shares are down 51% from their 52-week high. But overseas sales of pumps are rising fast, a sign the stock still has some room to run. Consider buying on further dips.

TransDigm Group

10-year cumulative return: 1,929%. Whether it's a Boeing or Airbus airliner or a Gulfstream jet, chances are, TransDigm Group (TDG) made many of the plane's parts—seatbelts, pumps in the mechanical system and door locks. Growth in air traffic and defense spending fueled the stock's rise, as did the firm's purchase of some smaller companies. Aftermarket demand for its parts provides an annuity-like revenue stream, considering planes fly for decades. TransDigm stock is up 64% since the start of 2019, in part because of a one-time special $30-a-share dividend it paid in August. But the firm's acquisition strategy may be tapped out. TransDigm sports a high, 110% long-term-debt-to-capital ratio and a below-investment-grade single-B credit rating. We'd pause before buying shares.

Broadcom

10-year cumulative return: 1,809%. Broadcom (AVGO) makes chips for computer networks, data storage, smartphones, smart home devices and more. It has grown through acquisition of other chip firms, such as Bell Labs and Brocade. But Charles Lemonides, chief investment officer of hedge fund ValueWorks, sees little internally generated revenue growth and says the recent purchase of CA Technologies, for $18.9 billion in cash, was too pricey. Slumping demand for Broadcom's chips has hurt sales, and higher tariffs have weighed on the stock. Analysts expect average earnings of 12% annualized over the next three years, just par for the industry. Lemonides sees Broadcom shares heading lower, and he has sold the stock short.

Align Technology

10-year cumulative return: 1,316%. If Align Technology (ALGN) gets its way, braces will go the way of the VCR. The company makes Invisalign, those orthodontic trays called clear aligners that have spawned a dozen copycats. Align shares are down 36% from a high of $391 in 2018 thanks to increased competition, a slowdown in sales in China and a disappointing third quarter. Even so, trading at 49 times expected earnings over the next 12 months, the shares are still expensive based on historical measures and compared with peers. Align is growing fast, but we'd wait for a lower entry point to buy shares.

United Rentals

10-year cumulative return: 1,262%. These days, many industrial and construction firms would rather rent an earthmover or power tool than buy their own. United Rentals (URI), which rents thousands of types of equipment at 1,172 locations in North America, provides "the right piece of equipment at the right time for the right company," says Brian Sponheimer, a portfolio manager at Gabelli Funds. United, the biggest player in its business, has lately been investing in technology to track its equipment—how often each item is used and when service is needed. Recession fears and slower growth at the firm have weighed on the stock since 2018, making it compellingly cheap.

Extra Space Storage

10-year cumulative return: 1,237%. Extra Space Storage (EXR) is one of the biggest operators of self-storage facilities. Dividends helped lift shares in this real estate investment trust, but there were other boosts, too. A dearth of new facilities, thanks to a post-recession squeeze in building loans, helped the firm log double-digit annual gains in revenue and funds from operations (a profitability measure for REITs) between 2011 and 2015. Deft management, high operating margins and low capital expenses helped, too. But growth expectations have dimmed. Value Line analyst Sharif Abdou expects annual revenue growth of just 7% to 9% over the next three years, and an average gain in FFO of 5% to 7%. There are better growth opportunities in REIT-land.

Amazon.com

10-year cumulative return: 1,221%. Now that Amazon.com (AMZN) has revolutionized the way Americans shop, the firm is eyeing shoppers overseas. Its U.K. and German businesses are already profitable, says Ramiz Chelat, a portfolio manager at Vontobel Asset Management. Amazon is No. 1 in e-commerce in Japan and is gaining ground in India. Meanwhile, Amazon's cloud computing business continues to thrive. Analysts expect 27.5% annual earnings growth over the next three years. Amazon's future, in other words, is rosy, says Chelat, who deems the stock an attractive opportunity.

Ulta Beauty

10-year cumulative return: 1,198%.Vanity sells. At Ulta Beauty (ULTA), which offers cosmetics, skin and hair-care products at 1,213 stores nationwide and online, sales increased 20% or more every year between 2010 and 2016. But competition from Amazon and others is rising, and sales growth is slowing. In late summer, the company trimmed its expectations for this fiscal year, which ends in January. The stock fell 28% and has not yet recovered. Analysts forecast 17% annualized earnings growth over the next three years—less than the glittery, 28% pace of the past five years. Although shares trade at a lower price-earnings multiple than the stock has commanded historically, we'd wait for more of a share-price markdown before buying.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.

-

Stocks Slip to Start Fed Week: Stock Market Today

Stocks Slip to Start Fed Week: Stock Market TodayWhile a rate cut is widely expected this week, uncertainty is building around the Fed's future plans for monetary policy.

-

Stocks Keep Climbing as Fed Meeting Nears: Stock Market Today

Stocks Keep Climbing as Fed Meeting Nears: Stock Market TodayA stale inflation report and improving consumer sentiment did little to shift expectations for a rate cut next week.