Pros' Picks: The 13 Best Dividend Stocks for 2020

The bull market went into overdrive in 2019.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The bull market went into overdrive in 2019. The S&P 500 rushed ahead by 29% – its best showing in six years. But as much as investors will always welcome such returns, it does make it tougher to be an income investor.

When dividend stocks go up in price, their yields go down. The dividend yield on the S&P 500 started 2019 at more than 2% but finished the year at 1.8%. Yes, the market keeps setting new all-time highs, but the rally that seems to never end also makes it difficult to find excellent dividend stocks with generous or even decent payouts.

High-quality dividend stocks with better-than-average yields do exist, however. We're here to help you find them.

We scoured the S&P 500 for dividend stocks with yields of at least 2%. From that pool, we focused on stocks with an average broker recommendation of Buy or better. S&P Global Market Intelligence surveys analysts' stock ratings and scores them on a five-point scale, where 1.0 equals Strong Buy and 5.0 means Strong Sell. Any score of 2.0 or lower means that analysts, on average, rate the stock a Buy. The closer the score gets to 1.0, the stronger the Buy call. Lastly, we dug into research and analysts' estimates on the top-scoring names.

Here are the 13 best blue-chip dividend stocks for 2020, then, based on the strength of their analyst ratings.

Analysts’ ratings, stock prices, dividend yields and other data are as of Dec. 31, unless otherwise noted. Companies are listed by strength of analysts’ average rating, from lowest to highest. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Mondelez International

- Market value: $79.3 billion

- Dividend yield: 2.1%

- Average broker recommendation: 8 Strong Buy, 8 Buy, 6 Hold, 0 Sell, 0 Strong Sell

The packaged food business is notoriously competitive, and even analysts who call Mondelez International (MDLZ, $55.08) a mere Hold applaud its strategy.

"The company is investing heavily back into the business and remains in the early stages of executing its playbook behind the business emphasizing reinvestment across the world and particularly behind its local jewels (local brands with strong presence in their markets), say Stifel analysts, who rate MDLZ a hold.

Mondelez, which was spun off from what was then known as Kraft Foods in 2012, is an international snacks company whose brands include Cadbury, Oreo and Trident. The dividend stock has raised its payout every year since the spinoff.

And while Mondelez does compete in a difficult business, some analysts are more bullish than Stifel, including Buckingham analyst Eric Larson. Larson, who rates shares a Buy with a $62-per-share price target, lauds its marketing investments and exposure to emerging markets, calling the stock "well-positioned long-term."

Of the 22 analysts covering MDLZ tracked by S&P Global Market Intelligence, 16 give it a Buy rating or better, while six have it Hold.

CVS Health

- Market value: $96.6 billion

- Dividend yield: 2.7%

- Average broker recommendation: 13 Strong Buy, 5 Buy, 10 Hold, 0 Sell, 0 Strong Sell

Analysts think CVS Health's (CVS, $74.29) triple-role as a pharmacy chain, pharmacy benefits manager and now health insurance company – after acquiring Aetna in 2018 for $69 billion – give it a unique profile among health-care stocks.

JPMorgan analysts put CVS atop their best health-care stocks to buy as the sector becomes more consumer-centric. Patients are taking a greater role in their health and are increasingly paying for their own care. CVS's combination of retailer, pharmacy benefits manager and health insurer makes it the company best positioned to capitalize on this trend, says JPM, which rates shares at Overweight (Buy).

CVS Health's yield might not stand out among other dividend stocks, and the company upset some investors in 2018 by putting a brake on its string of payout hikes. Still, the dividend is dependable. For the 12 months ended Sept. 30, CVS spent $2.5 billion on dividends and had free cash flow of $15.7 billion. And as a percentage of profits, the stock's payout ratio comes to only 28%. The S&P 500's payout ratio is north of 40%.

Morgan Stanley

- Market value: $82.7 billion

- Dividend yield: 2.7%

- Average broker recommendation: 12 Strong Buy, 8 Buy, 7 Hold, 1 Sell, 0 Strong Sell

- Morgan Stanley (MS, $51.12) – Wall Street's second-largest investment bank after Goldman Sachs (GS) – isn't getting enough respect from the market, some analysts say.

Sandler O'Neill upgraded MS to Buy from Hold in October, saying the bank was trading too cheaply compared with its peers. The low valuation is "unwarranted," Sandler's analysts say.

Goldman Sachs finished 2019 up nearly 38%, while Morgan Stanley lagged with a roughly market-matching gain of 29%. Where MS really stands out, from a valuation perspective, is price/earnings-to-growth (PEG), which factors growth expectations into the company's P/E. Morgan Stanley trades at a PEG of 1.4, where anything over 1 is considered overpriced – but GS trades at nearly twice that, with a PEG of 2.7.

MS shares, at a 2.7% yield, also offer more income than Goldman's 2.2% at the moment.

Longer-term, analysts see Morgan Stanley delivering average annual earnings growth of more than 10%. Goldman Sachs, its closest peer, has a growth forecast of 8.4% over the next three to five years.

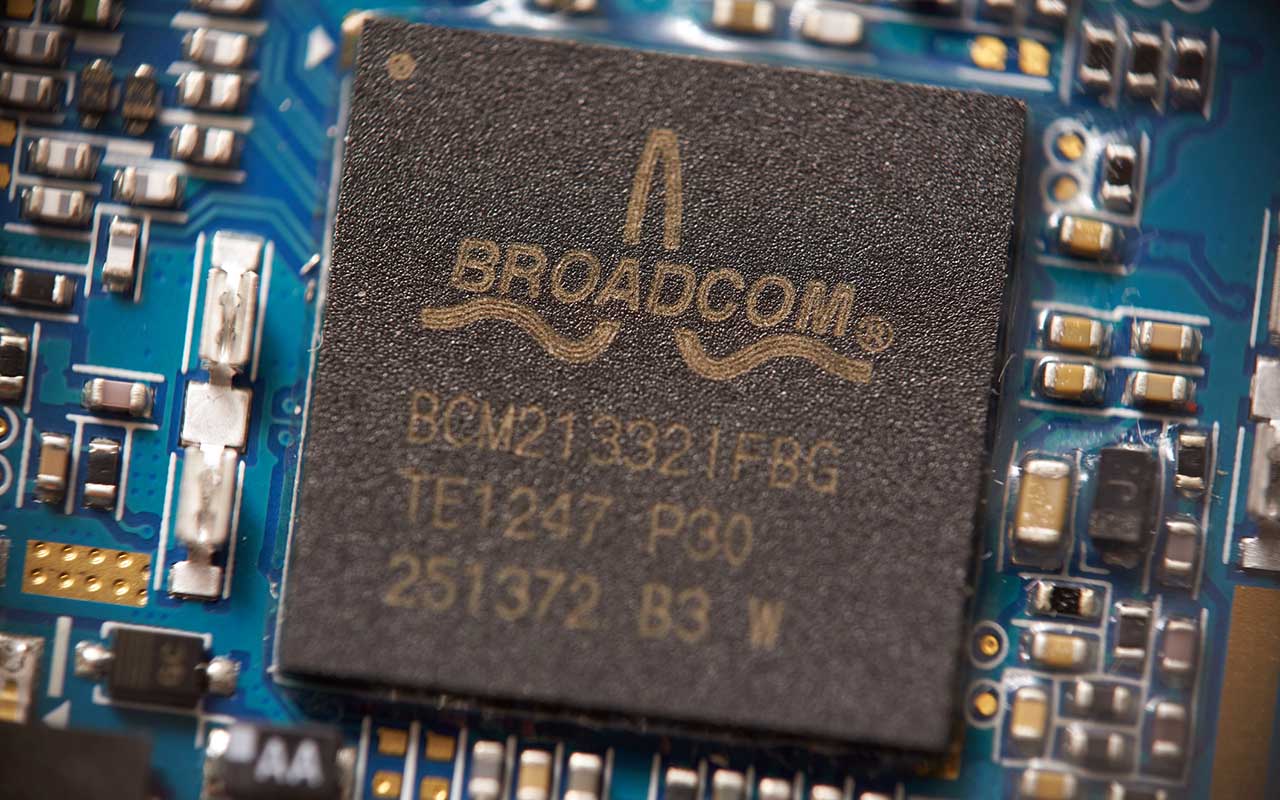

Broadcom

- Market value: $125.7 billion

- Dividend yield: 4.1%

- Average broker recommendation: 17 Strong Buy, 5 Buy, 13 Hold, 0 Sell, 0 Strong Sell

Semiconductor manufacturer Broadcom's (AVGO, $316.02) recent payout growth has sizzled compared to even the best dividend stocks. Since 2014, the payout has exploded by more than 1,000%, from 29 cents per share quarterly to its current $3.25.

The China-U.S. trade war has been trouble for semiconductor companies, but now the impasse appears to be headed toward at least a partial resolution. Craig-Hallum analysts, who rate AVGO at Buy, write that "stronger than expected iPhone sales and continued strength in their software infrastructure business offset the Huawei ban impact."

JPMorgan analyst Harlan Sur calls Broadcom his top pick in the semiconductor industry, raising his price target from $350 per share to $380 following the company's "solid" October-quarter results and dividend hike.

Twenty-two analysts tracked by S&P Global Market Intelligence rate AVGO a Buy or better, while 13 say it's a Hold. Those same analysts, on average, say Broadcom will deliver long-term earnings growth of almost 13% a year. That should help support AVGO's bid to keep raising its dividend.

Bristol-Myers Squibb

- Market value: $150.5 billion

- Dividend yield: 2.8%

- Average broker recommendation: 8 Strong Buy, 2 Buy, 6 Hold, 0 Sell, 0 Strong Sell

You'll typically find at least a few Big Pharma names in most annual lists of the best dividend stocks. Pharmaceutical companies are known for their good-to-great dividends, and Bristol-Myers Squibb (BMY, $63.74) is no exception.

Analysts are largely optimistic about Bristol-Myers following its $74 billion merger with fellow pharmaceutical giant Celgene (CELG), which closed in November 2019. They cite Celgene's drug pipeline as a key reason to buy this cheap stock.

William Blair analysts, who rate the stock at Buy, note that the Celgene acquisition makes BMY "well positioned to remain a leader in the multiple myeloma space and further penetrate into additional hematological indications such as non-Hodgkin lymphoma and myelofibrosis."

Celgene's blockbuster drugs include a pair of multiple myeloma treatments: Pomalyst and Revlimid, the latter of which also treats mantle cell lymphoma and myelodysplastic syndromes.

The rollup strategy has served BMY well since Bristol-Myers merged with Squibb three decades ago. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for type 2 diabetes.

It's also worth mentioning that Bristol-Myers is one of the best stocks of all time.

BlackRock

- Market value: $78.0 billion

- Dividend yield: 2.6%

- Average broker recommendation: 7 Strong Buy, 7 Buy, 3 Hold, 0 Sell, 0 Strong Sell

Analysts see a decent runway for shares of BlackRock (BLK, $502.70) over the next 12 months or so.

Citigroup calls BLK a Buy, citing its "customization and technology differentiation" in the wealth management industry. Its analysts affixed a 12-month price target of $565 on the stock in mid-December, giving shares in the world's largest asset manager – responsible for BlackRock mutual and closed-end funds (CEFs), as well as iShares exchange-traded funds (ETFs) – implied upside of 13%.

Meanwhile, BlackRock's earnings are forecast to grow at an average annual pace of almost 10%, while shares trade at a reasonable a forward-looking price-to-earnings ratio of only 16.5. It's clear Wall Street thinks BLK is a bargain at current levels, given 14 ratings of Buy or better versus just three Holds and zero Sells.

On the dividend front: BLK has hiked its payout every year without interruption for a decade and is expected to lift it again in 2020.

Citigroup

- Market value: $174.4 billion

- Dividend yield: 2.6%

- Average broker recommendation: 12 Strong Buy, 10 Buy, 4 Hold, 1 Sell, 0 Strong Sell

Analysts expect good things from Citigroup (C, $79.89), the nation's fourth-largest bank by assets, and the biggest of the financial-sector dividend stocks on this list.

Sandler O'Neill, which rates C shares at Buy, notes that the money-center bank is racking up one good quarter after another. Revenues are up, costs are down and credit metrics are solid, analysts say.

"C reported solid 3Q19 results. Credit metrics remain strong, Branded Cards continue to deliver revenue and profit growth, and operating efficiency was in-line with our expectations," Sandler O'Neill's analysts write.

Wells Fargo analysts say that the extension of Citigroup's information-sharing agreement with hedge fund ValueAct Capital should "help them to continue to push and prod management behind the scenes for more strategic evolution and better performance."

All told, 22 analysts rate Citigroup a Buy or better, versus four Holds and one Sell. S&P Global Market Intelligence data says Citigroup is forecast to deliver average annual earnings growth of almost 13% over the next three to five years. The dividend, meanwhile, continues to recover from its post-Great Recession slashing, now at 51 cents per share quarterly after sitting at a penny per share five years ago.

McDonald's

- Market value: $148.8 billion

- Dividend yield: 2.5%

- Average broker recommendation: 18 Strong Buy, 8 Buy, 9 Hold, 0 Sell, 0 Strong Sell

- McDonald's (MCD, $197.61), a Dow component, has an average target price of $223.69. In other words, analysts are looking for the stock to rise more than 13% over the next 52 weeks, which is better than most S&P 500 outlooks.

Not bad for a stock with a market value of about $150 billion.

Stephens analysts reiterated their Overweight rating and $225 price target after tests in Houston and Knoxville showed strong consumer demand for McDonald's Crispy Chicken Sandwich. (Fellow fast food retailers Popeyes and Chick-fil-A are currently in a lucrative fight over which chain has the best fried chicken sandwich.)

"We believe the high-quality chicken sandwich market is a place MCD wants to become more relevant and anticipate a mid-year national launch," Stephens analysts write.

As for the dividend, you can't beat MCD for reliability. McDonald's is a member of the Dividend Aristocrats – 57 dividend stocks that have raised their payouts every year for at least a quarter-century. The world's largest hamburger slinger's dividend dates back to 1976 and has gone up every year since. MCD last raised its payouts in September, by 8% to $1.25 a share. That marked its 43rd consecutive annual increase.

NextEra Energy

- Market value: $118.4 billion

- Dividend yield: 2.1%

- Average broker recommendation: 9 Strong Buy, 6 Buy, 2 Hold, 1 Sell, 0 Strong Sell

- NextEra Energy (NEE, $242.16) – an electric utility with wind, natural gas, nuclear, pipeline and storage assets – isn't a sexy stock by any means. But it had one heckuva 2019. Shares gained 39% last year to trump not only the utility sector's 22%, but the S&P 500, which is quite a feat during a roaring bull market.

Analysts remain bullish on NextEra Energy's infrastructure programs in Florida. KeyBanc, which rates NEE at Buy, says the company's strong record of regulatory relations and Florida's "constructive" regulatory environment should lead to "significant growth."

Guggenheim's Shahriar Pourreza (Buy) is optimistic about the company's regulated and unregulated businesses, as well as the project pipeline for its Energy Resources green-energy division.

NEE has a long-term growth forecast of almost 8% a year for the next three to five years, which is pretty hot for a utility stock. The dividend is no slouch, either. While the stock yields just 2.1%, the payout has jumped 72% over the past five years.

Schlumberger

- Market value: $55.7 billion

- Dividend yield: 5.0%

- Average broker recommendation: 17 Strong Buy, 8 Buy, 7 Hold, 0 Sell, 0 Strong Sell

Oilfield services companies have been struggling ever since oil prices crashed in 2014. But some of them, such as Schlumberger (SLB, $40.20), are coming back, analysts say.

"International oilfield-service markets are firmly in recovery mode, signaling the start of a much needed multiyear growth cycle," Deutsche Bank says, slapping a Buy rating on the stock. "SLB is the primary beneficiary of this, with nearly four times the international earnings power of its nearest competitor."

Analysts at Tudor Pickering & Co. applaud Schlumberger's belt-tightening, noting that the company is "already well down the path of lowering the capital intensity of its business portfolio." They double-upgraded SLB, from Sell to Buy, in December.

The drop in oil prices has resulted in SLB's dividend being stuck at 50 cents a share quarterly since April 2015. And it's far from the only energy stock feeling the sting of commodity pricing.

The flip side? Share-price declines have turned many energy plays into high-yielding dividend stocks … and perhaps a pickup in growth after years of lackluster performance will enable the board to start padding the payout once more.

ConocoPhillips

- Market value: $71.4 billion

- Dividend yield: 2.6%

- Average broker recommendation: 11 Strong Buy, 9 Buy, 3 Hold, 0 Sell, 0 Strong Sell

- ConocoPhillips (COP, $65.03) spun off its transportation and refining business in 2012 as Phillips 66 (PSX) to focus solely on exploration, development and production. That's what differentiates it today from major integrated energy companies such as Chevron (CVX), which also transport and refine oil and natural gas.

The leaner profile is supposed to help ConocoPhillips deliver superior long-term profit growth. Analysts expect the firm to deliver average annual earnings growth of 6.5% for the next three to five years. Chevron, for comparison's sake, has a long-term growth forecast of 4.5%.

MKM Partners initiated coverage of COP stock with a Buy rating and $72 price target in early December. Its analysts like ConocoPhillips' Eagle Ford and Alaska assets as core growth drivers over the next several years.

If you're looking for dividend stocks to hold you the next decade, and not just 2020, JPMorgan's Phil Gresh (Overweight) seems to think ConocoPhillips is on the right track. He calls the company's 10-year business plan "impressive" and in November raised his 12-month price target from $70 per share to $74, implying a 14% run through late 2020. The average analyst price target of $73.18 isn't far off.

Prologis

- Market value: $56.3 billion

- Dividend yield: 2.4%

- Average broker recommendation: 10 Strong Buy, 4 Buy, 2 Hold, 1 Sell, 0 Strong Sell

- Prologis (PLD, $89.14), a real estate investment trust (REIT) specializing in industrial properties and assets, is analysts' No. 2 among blue-chip dividend stocks thanks to its global footprint and favorable economics.

A quick snapshot: Prologis owns nearly 800 million square feet of logistics real estate (think warehouses and distribution centers) across 19 countries on four continents. PLD is well-situated to take advantage of the evolving retail economy, in which companies increasingly must distribute directly to consumers rather than brick-and-mortar retail stores.

Stifel, which has shares at Buy, notes that "industrial fundamentals within the U.S. and internationally remain strong," and "as the largest industrial REIT globally and with a deep team in the U.S. and abroad, it is well positioned to execute on all fronts with a high degree of selectivity."

Analysts expect Prologis, which recently acquired competitor Liberty Property Trust (LPT) for $12.6 billion, to grow its profits by 6.6% annually over the next three to five years. That means good things for PLD's dividend, which has swelled by more than 60% over the past half-decade.

Merck

- Market value: $231.6 billion

- Dividend yield: 2.7%

- Average broker recommendation: 12 Strong Buy, 3 Buy, 3 Hold, 0 Sell, 0 Strong Sell

Pharma giant Merck (MRK, $90.95), a Dow stock, has the strongest analyst rating among large-cap dividend stocks.

That's partly due to Keytruda, MRK's blockbuster cancer drug that's approved for more than 20 indications, as well as the company's vaccines business not being properly valued by the market.

"Our (sum of the parts) valuation analysis indicates a highly inexpensive valuation when incorporating a premium for the company's Animal health and Vaccines franchises," says JPMorgan, which has MRK at Overweight.

While shares lagged the broader market in 2019, they trade at around 16 times next year's earnings estimates. The S&P 500, meanwhile, trades for nearly 20.

And MRK's dividend, which had been growing by a penny per share for years, is starting to heat up. Merck upgraded its payouts by 14.6% in 2019, then followed that up with a nearly 11% improvement for 2020, starting with the quarterly dividend scheduled to be paid Jan. 8.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.