10 "Strong Buy" Stock Picks You Shouldn't Overlook

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The market may be in turmoil, but there still are some compelling stock picks out there for the savvy buyers willing to dig a little deeper.

Amazon.com (AMZN) and Google parent Alphabet (GOOGL) recently posted disappointing third-quarter earnings results, dragging down the rest of the market. It appears Wall Street is checking out of large-cap growth stocks for a moment; perhaps now is time to take a breather from them.

We used TipRanks data to identify 10 promising stocks with a “Strong Buy” Street consensus – and what sticks out is how little these companies stick out. While Wall Street likes a few big, blue-chip names you’re familiar with, it also is awfully bullish on some under-the-radar companies.

Here are 10 stock picks that you may not know, but are definitely worth checking out. Wall Street sees these as stocks to buy right now, garnering a significant percentage of buy ratings over the past three months. We also can get an idea of the growth potential via the average analyst price target.

Data is as of Oct. 30, 2018.

Rapid7

- Market value: $1.7 billion

- TipRanks consensus price target: $39.86 (17% upside potential)

- TipRanks consensus rating: Strong Buy (Get RPD Research Report)

- Rapid7 (RPD, $34.09) is a fast-growing cybersecurity stock that offers services such as vulnerability assessments, phishing simulations and penetration testing. Its technology already helps secure the business operations of more than 7,000 organizations.

This little-known software stock has surged 83% year-to-date. In these current market conditions – the S&P 500 is essentially flat – that’s pretty impressive.

From a Street perspective, the outlook is extremely bullish. In the last three months, seven analysts have published back-to-back buy ratings on RPD’s shares. Notably, top-rated Needham analyst Alex Henderson (Track Record & Ratings) recently reiterated his “Buy” rating on Rapid7 with a $42 price target (23% upside potential).

“With new technology being deployed faster than security can keep up, we believe orchestration and automation is a critical feature that helps offload menial tasks from resource-constrained teams,” the analyst wrote.

Indeed, Rapid has just launched its InsightConnect orchestration and automation feature, alongside multiple platform updates. This new solution allows businesses to create custom workflows to accelerate security and IT processes. Henderson expects these new features to drive greater up-sell/cross-sell and sees them as perfect complements to RPD’s existing detection and response capabilities.

At Home Group

- Market value: $1.7 billion

- TipRanks consensus price target: $43.29 (60% upside potential)

- TipRanks consensus rating: Strong Buy (Get HOME Research Report)

- At Home Group (HOME, $26.99) is a big-box retail chain specializing in fast-fashion home décor – one that is taking the bold move of focusing purely on brick-and-mortar retail sales. This means you can’t buy products through the website, and delivery is run by a third party. Some have even gone so far as to dub HOME the “anti-Amazon” of the home decorating world.

Shares have pulled back 12% in the past month, but HOME now looks like one of the best stocks to buy given analyst views on potential upside. From current levels, top Wells Fargo analyst Zachary Fadem (Track Record & Ratings) Fadem sees shares surging 56% to $42. He argues that investors are overlooking HOME’s strong underlying demand.

Fadem recently met up with At Home COO Peter Corsa and Investor Relations Director Bethany Perkins at the firm’s Consumer Forum in California. He left the meeting with his bullish take on the stock firmly intact: “We view HOME as a top (small- to mid-cap) idea in all of retail, and see opportunities to move beyond recent noise as the focus shifts to comp reacceleration potential, strong (long-term) growth prospects and a 49% valuation discount vs high growth peers.”

Goldman Sachs’ Matthew Fassler echoed this message in a recent note in which he upgraded HOME to “Buy” because of the “steep discount” for a “high potential growth franchise.”

Evolent Health

- Market value: $1.9 billion

- TipRanks consensus price target: $32.50 (45% upside potential)

- TipRanks consensus rating: Strong Buy (Get EVH Research Report)

Healthcare IT stock Evolent Health (EVH, $22.40) is among rare stock picks that have 100% Wall Street support at the moment. EVH has received 10 recent buy ratings, and not a single hold or sell. Better still, analysts collectively see 45% upside from current prices.

EVH helps delivery networks take on reimbursement risk under different models. “In our coverage universe, we believe that Cerner (CERN, Overweight) and Evolent Health (EVH, Overweight) represent the two best stocks leveraged to the transition to value-based reimbursement,” writes Cantor Fitzgerald’s Steven Halper (Track Record & Ratings).

This Top 20 analyst has a Street-high price target on the stock of $37 (65% upside potential). So it’s no surprise that he believes that the stock’s risk/reward trade-off is compelling at current levels.

Plus he believes EVH’s recent issue of $150 million convertible debt was a savvy move, writing, “The latest capital raise solidifies the company’s balance sheet, in our opinion, especially after it used approximately $120 million to complete the New Century Health (NCH) acquisition.”

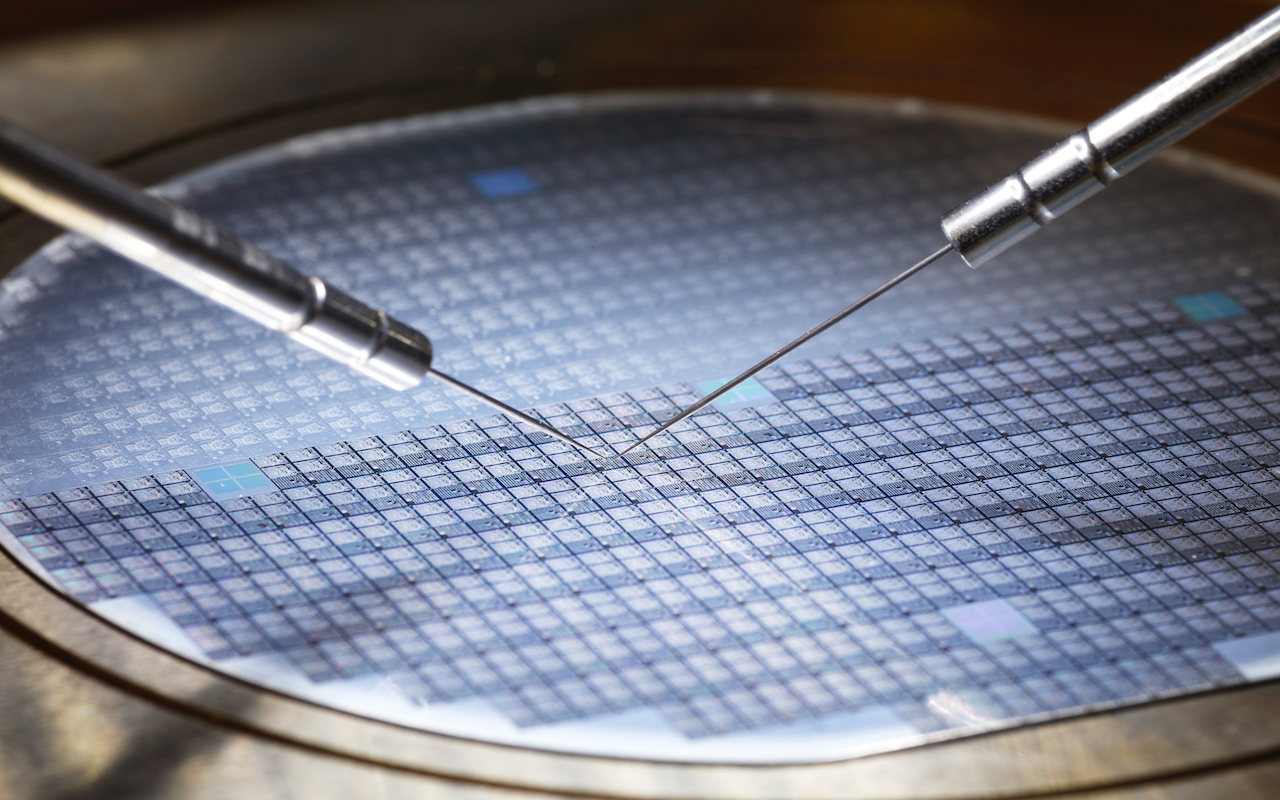

Tower Semiconductor

- Market value: $1.5 billion

- TipRanks consensus price target: $24.20 (62% upside potential)

- TipRanks consensus rating: Strong Buy (Get TSEM Research Report)

- Tower Semiconductor (TSEM, $14.94) isn’t a stock for the fainthearted. Shares in this semiconductor foundry have plunged 55% year-to-date. But the Street remains confident that TSEM has what it takes to stage a turnaround.

“Year-to-date, TSEM has significantly underperformed relative to the SOX, but we contend the stock is bottoming out,” writes five-star Needham analyst Rajvindra Gill (Track Record & Ratings).

For a start, Gill notes several positive press releases around automotive sensors, military and space. This is encouraging because “The automotive segment is one of the largest growth drivers in the Analog IC market and TSEM is well-positioned to capitalize on this secular trend,” the analyst writes.

Meanwhile, “We believe the RF smartphone segment (20% of sales) is bottoming out and that consensus estimates are calibrated appropriately.” Gill also is modelling for a significant ramp in (silicon germanium) capacity in the fourth quarter, which would lead to a higher-margin profile exiting the year.

“Trading at close to 10x P/E (on 2019 earnings estimates), we would be buyers at these levels in anticipation of a (2018 second-half) ramp and good setup heading into 2019.”

Angi Homeservices

- Market value: $9.7 billion

- TipRanks consensus price target: $23.40 (22% upside potential)

- TipRanks consensus rating: Strong Buy (Get ANGI Research Report)

If you are looking for any kind of home services, chances are high you’ve stumbled across HomeAdvisor and Angie’s List. ANGI HomeServices (ANGI, $19.16) owns both leading consumer platforms and has a “Strong Buy” consensus from the Street.

“We believe ANGI HomeServices Inc … is extremely well positioned to take advantage of the secular offline to online shift in advertising,” cheers Oppenheimer’s Jason Helfstein (Track Record & Ratings). “Using its scale, we expect ANGI to dominate scheduling and discovery of home service professionals.” He adds that the company is targeting an impressive long-term EBITDA margin of 35%.

Also worthy of note: Raymond James’ Justin Patterson just upgraded ANGI HomeServices while boosting his price target from $20 to $25 (30% upside potential). The double whammy of growth potential in both traffic and pricing make ANGI one of the small- to mid-cap internet’s cleaner growth stories, Patterson writes.

PVH Corp

- Market value: $9.3 billion

- TipRanks consensus price target: $173.57 (47% upside potential)

- TipRanks consensus rating: Strong Buy (Get PVH Research Report)

- PVH Corp. (PVH, $118.06), which holds the Calvin Klein and Tommy Hilfiger brands, among others, is one of the world’s largest global apparel companies with over $8 billion in revenues. The company is now beginning to see the positive effects of preventing heavily discounted goods from flooding the market and denting its premium brand image.

According top B. Riley FBR analyst Susan Anderson (Track Record & Ratings), PVH is demonstrating strong topline growth across both brands and geographies. She writes: “We believe Calvin Klein and Tommy Hilfiger are both benefiting from the start of a more fashion driven cycle, which they are capitalizing on through their dynamic marketing campaigns.”

Anderson expects PVH to continue to drive top-line growth through Calvin Klein and Tommy Hilfiger, particularly in Europe and Asia, as well as North America. For example, in the second quarter, CK revenues grew 16% year-over-year while Tommy revenues improved by 15%.

She reiterates her “Buy” rating on this stock pick, adding, “we would be significant buyers on the pullback in the stock.” Indeed, shares are currently down 13% year-to-date. But also note that this comes after a 52% surge in shares for 2017.

Canopy Growth

- Market value: $8.2 billion

- TipRanks consensus price target: $63.62 (87% upside potential)

- TipRanks consensus rating: Strong Buy (Get CGC Research Report)

Marijuana stocks are buzzing this year for several reasons, among them the fact that Canada has just legalized marijuana for recreational use. Leading the way is Canopy Growth (CGC, $33.97). This Canadian company aims to be the No. 1 cannabis company in the world.

So far events are heading in the right direction: In May 2018, Canopy Growth became the first cannabis-producing company to be listed on the New York Stock Exchange. It develops both recreational and medical marijuana, and has just received a hefty $4 billion investment from drinks giant Constellation Brands (STZ).

Constellation CEO Robert Sands said in the company’s earnings call that with its new 38% stake in CGC (up from 9.9% previously), STZ will now be able to “capitalize on what is absolutely without a doubt going to be a huge market over the next 10 years, hundreds of billions of dollars.”

With such a large market to play for, pot stocks can provide an appealing opportunity for investors. “We are convinced that CGC is the best way to play the rapidly growing Cannabis market,” says Pivotal Research’s Timothy Ramey.

Vail Resorts

- Market value: $10.1 billion

- TipRanks consensus price target: $296.67 (23% upside potential)

- TipRanks consensus rating: Strong Buy (Get MTN Research Report)

Founded in the 1950s by a pair of visionary skiers, Vail Resorts (MTN, $242.11) claims to offer “The Experience of a Lifetime.” This is a company with 13 premier mountain resorts and urban ski areas in the U.S., Canada and Australia, including British Columbia’s famous Whistler Blackcomb, the largest ski resort in North America.

In the past couple weeks, Macquarie’s Matthew Brooks (Track Record & Ratings) upgraded the stock from “Hold” to “Buy.” This came with a $300 price target, suggesting shares can soar 24% from current levels. According to Brooks, MTN justifies a premium valuation for three key reasons: lack of new ski resorts from rivals; increasing recurring revenue and impressive free cash flow.

As a result, Brooks isn’t too concerned about the weather (which hasn’t been ideal), and instead expects solid growth that could see Vail beat its $734 million full-year EBITDA guidance midpoint. Also keep an eye out for potential bolt-on acquisitions in the U.S., driving further growth, he says.

Snap-On

- Market value: $8.6 billion

- TipRanks consensus price target: $192.07 (27% upside potential)

- TipRanks consensus rating: Strong Buy (Get SNA Research Report)

Forget Snapchat. There’s another “snap” you should be looking into.

- Snap-on (SNA, $150.73) is a manufacturer and marketer of high-end tools and equipment for the transportation industry. This covers the whole range of automotive, heavy duty, equipment, marine, aviation and railroad industries.

In the last three months, SNA has received only buy ratings, including one from five-star Tigress Financial analyst Ivan Feinseth (Track Record & Ratings). “We reiterate our Buy rating on SNA and view the recent pullback as a buying opportunity as the company continues to benefit from gains in the repair market penetration and expansion into other industry verticals,” he wrote.

Although the company is facing near-term headwinds, these can be overcome, Feinseth says. He describes multiple catalysts, including emerging-market growth in Asia Pacific, ongoing innovation and the increasing complexity of new vehicles. SNA’s ability to create more technologically advanced vehicle equipment places the company in prime position to meet this growing auto demand.

The analyst doesn’t publish a price target on this stock pick, but he does write: “We believe significant upside exists in the shares from current levels and continue to recommend purchase.”

Mimecast

- Market value: $2.1 billion

- TipRanks consensus price target: $48.17 (46% upside potential)

- TipRanks consensus rating: Strong Buy (Get MIME Research Report)

The final option in this list of stock picks is Mimecast (MIME, $32.99), a company focused on email protection and security. Even if you haven’t heard of Mimecast, there’s a high chance you’ve used its products. That’s because Mimecast provides email management for Microsoft’s (MSFT) Exchange and Office 365.

The company’s email security and other services represent a nearly $15 billion total addressable market. And analysts believe a 30%-plus annual growth rate is sustainable.

“We are initiating coverage of Mimecast with an Outperform rating and $45 price target,” writes five-star Baird analyst Jonathan Ruykhaver (Track Record & Ratings). This translates into upside potential of about 36%.

“Despite recent noise from (foreign exchange), we calculate short-term billings continues to grow nicely, driven by consistent new customer growth and broader adoption of services,” the analyst tells investors. He cites channel feedback that suggests consistently larger customer wins alongside targeted threat protection (TTP) adoption.

“Longer term, the company is building out an infrastructure platform to capitalize on the cloud deployment model, which should prove fruitful,” Ruykhaver writes.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 4,800 Wall Street analysts as well as hedge funds and insiders. You can find more of TipRanks’ stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.