Should You Keep Your 401(k) When You Retire?

Here are three primary reasons you might want to consider moving your retirement money from your 401(k) to an IRA once you retire.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

You’ve probably heard that your 401(k) is a great investment for retirement. After all, a 401(k) offers a host of benefits: You’re able to get the company match, which is free money for you, if you contribute a certain amount. You can benefit from the power of compound interest through substantial market returns. Plus, many 401(k)s are low-cost for retirement savers.

Your options for what to do with your 401(k) during your working years are extremely limited, especially while you’re still working for an employer. But now that you’re retired, you have the option of either leaving your 401(k) where it is or moving it into an IRA.

This generally raises two questions: Should you leave the money where it is, or move it? And what’s the upside of moving your retirement money into an IRA if a 401(k) offers so many benefits?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There are three primary reasons why moving a 401(k) to an IRA could make sense for your retirement:

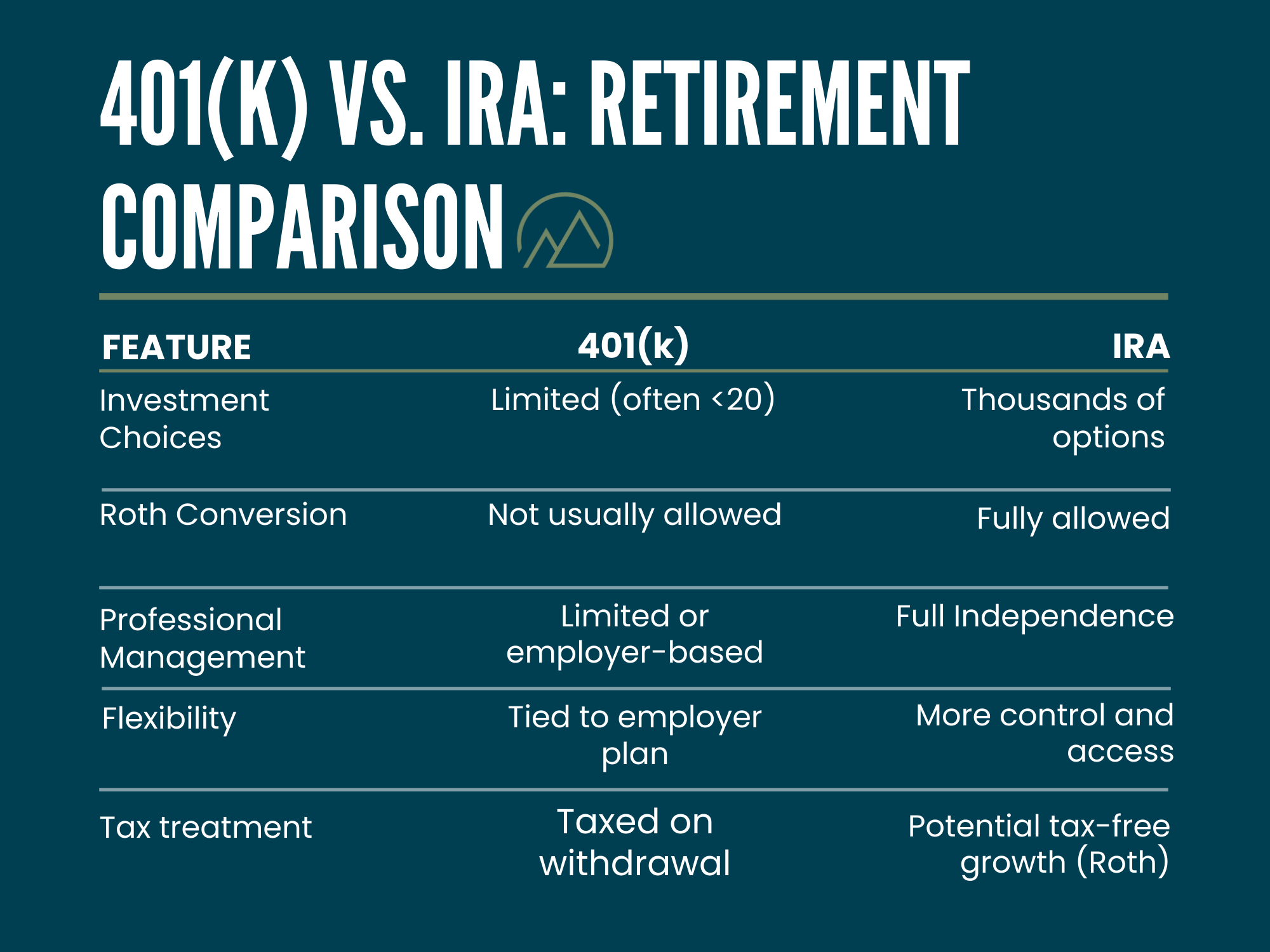

1. An IRA offers more investment options.

Some 401(k)s have less than 20 investment options to choose from, while most IRAs have thousands of investment options to match your goals and risk tolerance.

Through an IRA, you may also be able to find protected vehicles with a potentially higher return than the stable value option within your 401(k). Let’s say your stable value option is guaranteed to increase at a fixed rate of 3% per year.

What if you could find another investment option that produces a fixed return of 5% to 6%? This is something we see often and is an area we are able to help many with.

Even a 2% increase on $1 million in retirement savings could provide an additional $20,000 in returns being added to your account each year. That money is then compounded annually to grow your retirement savings more quickly.

2. You can complete a Roth conversion.

Most 401(k) plans don’t allow for a Roth conversion, and distributions from your 401(k) are taxed at the time you take them. When you roll your 401(k) into an IRA and then convert it to a Roth, you pay taxes on the converted amount now, but future distributions are made on a tax-free basis.

Remember, no tax is due when rolling over your funds from your 401(k) to an IRA. The tax consequence occurs when you decide to do a Roth conversion which can be any amount you choose.

A Roth conversion can make sense right now if you believe tax rates will be higher in the future and want to lock in today’s lower tax rates. For example, let’s say you want to convert $100,000 to a Roth this year.

If the total tax on the conversion is 25%, you’ll pay $25,000 in taxes today. But what if you wait 10 years to convert? By that time, the account could double to $200,000 — but tax rates may increase to $30,000. In that case, you’re now paying $60,000 in taxes on those funds.

Many retirees see the benefit of doing a Roth conversion now, especially if they have been diligent savers. If you don’t have as much saved for retirement, a Roth conversion may not make as much sense for you because you’ll be able to take withdrawals at a lower tax rate.

Retirees with more saved may want to consider a conversion now, especially since Social Security is taxable for many people age 73 and up who must take required minimum distributions (RMDs). If the money is in a Roth, it can help lower your tax burden in retirement.

3. You can get access to professional investment management and financial planning.

Some firms will charge a fee to help with investment management. My advice? Find a financial planning team that does comprehensive retirement planning for a fee of 1% of assets or less.

The financial planning firm should provide more value than the 1% fee, especially when they help with areas such as investments, taxes and retirement income. They may also provide guidance on health care, long-term care and estate planning.

While some 401(k) plans may offer the option to work with a financial planner, in some cases this person only manages investments for a much higher cost or the same cost. I recommend working with an independent team who will act in your best interest and provide comprehensive planning.

Remember: You get only one retirement. With a little planning, you can avoid costly mistakes and make sure you have enough money to enjoy the rest of your retirement.

Related Content

- The Average 401(k) Balance by Age

- Using Your 401(k) to Delay Getting Social Security and Increase Payments

- How a Roth Conversion Can Spare You From Medicare’s IRMAA and Taxes

- Are You a DIY Retirement Planner? Four Things You Need to Know

- Do You Have the Five Pillars of Retirement Planning in Place?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?