How a Roth Conversion Can Spare You From Medicare’s IRMAA and Taxes

If you've been a good saver and face large required minimum distributions (RMDs), then you need to plan for how to head off or limit higher Medicare premiums.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

How does it feel to know that some people will pay less for Medicare coverage than you do, but you will all get the same benefits?

It can be tough to understand, especially when you have been a diligent saver over the years, have worked hard to accumulate what you have and have really embraced the “millionaire next door” concept. Meanwhile, another person, possibly paying less for the same coverage, did not work as hard as you over the years and was not as much of a diligent saver as you.

Unfortunately, paying a higher price tag doesn't get you better coverage when it comes to IRMAA and Medicare premiums.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

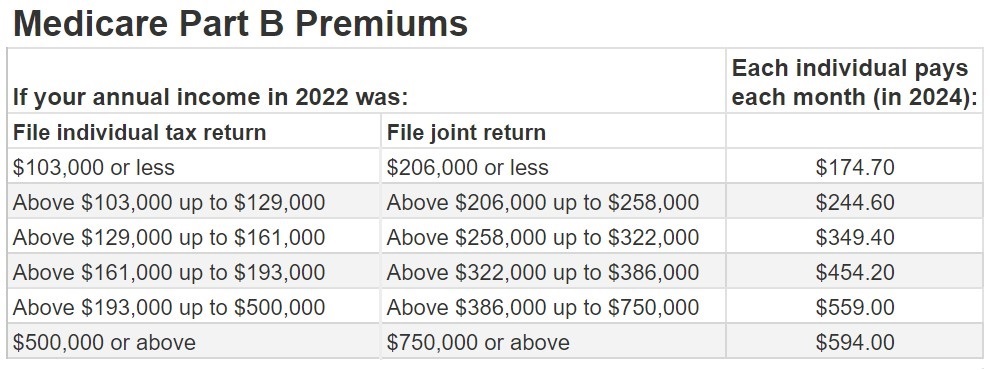

Let's first explain what IRMAA is and how this all works together. IRMAA stands for “income-related monthly adjustment amount.” It’s an add-on cost that some Medicare Part B and Part D beneficiaries may be required to pay. The chart below outlines what 2024 Medicare Part B premiums will cost based on income. You can see that the more you earn, the more your Medicare coverage costs you.

Remember that this chart goes back two years, so the income you have when you are 63 will determine your costs when you turn 65. So, for example, let's say that you sold a business at the age of 63. Then, at age 65, you would have to pay the consequence of that, so that's why it's important to be aware of your income starting as soon as 63 — even though you're not on Medicare yet. The good news is that you can appeal and request a redetermination, especially if you’ve had a life-changing event, such as lowered income due to retirement.

Dealing with a retirement tax bomb

Our goal for most of the clients we work with is to keep them in that first tier, so they have to pay only the $174.70. This can be tough, considering that we primarily work with people who have been diligent savers and are likely to have high required minimum distributions (RMDs) that they must take when they turn 73 or 75.

We call this a retirement tax time bomb because RMDs, combined with your Social Security and, potentially, a pension, may force you into higher Medicare tiers as time goes along. Our clients get good news, though, because we are able to help them plan for this.

We do this with strategies to help lower their income when the time comes. One popular strategy that many people are looking into right now is a Roth conversion, in which you move money from your tax-deferred investment to your tax-free investment.

For example, let's say you have a traditional IRA. You can convert some or all of it to a Roth IRA and pay the taxes now. Why would you want to do that? Because taxes are lower now than what we expect them to be in the future.

If you are 63 and younger, then the planning is a bit cleaner for you since you don't have to worry about Medicare premium increases when doing the Roth conversions. If you are 63 or older, then you need to be careful. We’re often asked if it makes sense to convert knowing that we will have to pay more in Medicare premiums now. This is not always smart to do, but you have to ask yourself: Would you rather pay higher Medicare premiums during a shorter amount of time or defer this problem to the future and have to pay increased Medicare premiums for potentially the rest of your life? Many of our clients prefer to pull the bandage off quickly rather than bringing on pain slowly over time.

What if Medicare premiums rise?

Something that really concerns me is that the cost of Medicare is likely to rise in the future. Why do I think this? Because it has generally risen steadily over the last 20 years, and it's projected to continue rising. This means that people will be paying more for Medicare as their retirements continue. It also means that the income tiers shown in the chart above could go even lower, making more people subject to income-related adjustments, making it even more important to ensure lower income in retirement, when it means the most.

My last thought on IRMAA: Do not lose the majority of your Social Security benefit as you progress throughout retirement. As most of us know, Medicare premiums are taken out of our Social Security payments. With the cost of Medicare continuing to increase, those who are in the higher income tiers may find themselves without any Social Security check left. In fact, they may actually have to pay the government above and beyond their Social Security benefit to cover their Medicare costs.

Also, keep in mind that Social Security cost-of-living adjustments (COLAs) have not kept up with inflation or rising Medicare costs over time, which makes this even more of a concern. Why work for 40 years, pay into a system and then not see the rewards? The good news is that there are ways you can preserve your Social Security check and ensure that you maximize your retirement savings — and make your money last as long as you do.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Related Content

- Is a Roth Conversion for You? Seven Factors to Consider

- Benefits of Doing Roth IRA Conversions Early in Retirement

- Are You Ready to ‘Rothify’ Your Retirement?

- This Trust Can Protect Your Assets From Long-Term Care Costs

- Will You Pay Higher Taxes in Retirement?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.