Protect Your Wealth Against Inflation in Three Easy Steps

Inflation might have fallen off the list of concerns for many investors, but history suggests that failing to protect against it could be hazardous to your wealth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Inflation fears are out of fashion within the investor community. They’re far more interested in recession spotting and next year’s presidential election.

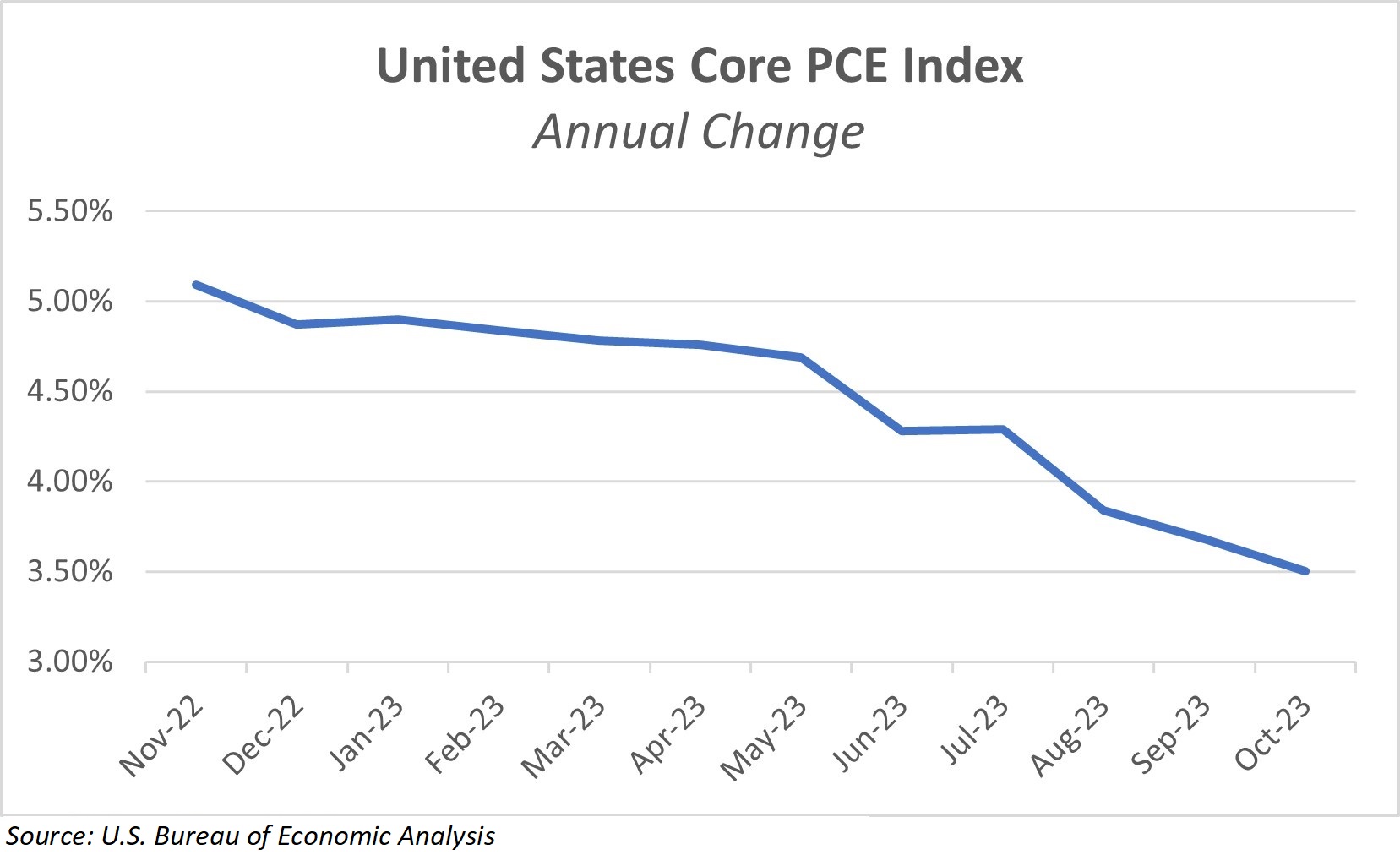

After all, the core Personal Consumption Expenditures (PCE) Index, the Federal Reserve’s preferred measure of inflation, has declined steadily over the past 12 months. “Core” simply means that food and energy prices are stripped out of the index because they tend to be volatile in the short term and can be driven by environmental issues or geopolitics.

Great news, right?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While I’d certainly rather see inflation rates declining rather than accelerating, such charts can be misleading. Ultimately, we’re still talking about inflation growth (just a slowing rate of that growth). Inflation is commonly reported by comparing the rate of inflation growth against the previous year. While the chart above demonstrates that the rate of inflation is declining, there is still inflation! Prices are still going up. Goods and services still cost more. Inflation is still chipping away at the purchasing power of your dollars.

Here is another way to think about inflation. We’re looking at the same core PCE price index from the first chart. But rather than comparing year-over-year growth, we’re simply looking at how the index has behaved over the past 60 years.

You’ll be hard-pressed to find a period when the United States had deflation. That’s because in 60 years, it hasn’t happened. To be fair, the “headline” PCE, which includes food and energy prices, did have a modestly deflationary period in 2009 after the Great Financial Crisis.

Regardless of how you choose to measure inflation, it is ubiquitous in our modern economy. Sometimes you feel it. Sometimes it is more stealthy. But it is always eroding your purchasing power by degrading the value of your hard-earned dollars over time.

When we think about wealth preservation, it would be shortsighted to simply consider present circumstances. If we look just beyond our horizon to the near future, there is a very real possibility that inflation rates pick back up. Several factors, including spending on decarbonization, reshoring manufacturing, increased military spending and a shortage of labor can all pressure prices upward.

Maybe we will experience another spike in inflation. Or perhaps inflation goes unnoticed with low-single-digit growth over a prolonged period — the proverbial boiling frog scenario.

What we do know is clear: Inflation is not going away. Your choice is how you let it impact your wealth. You can let it ravage your savings, or you can protect your portfolio and retirement with these three simple steps:

Step 1: Avoid excess cash.

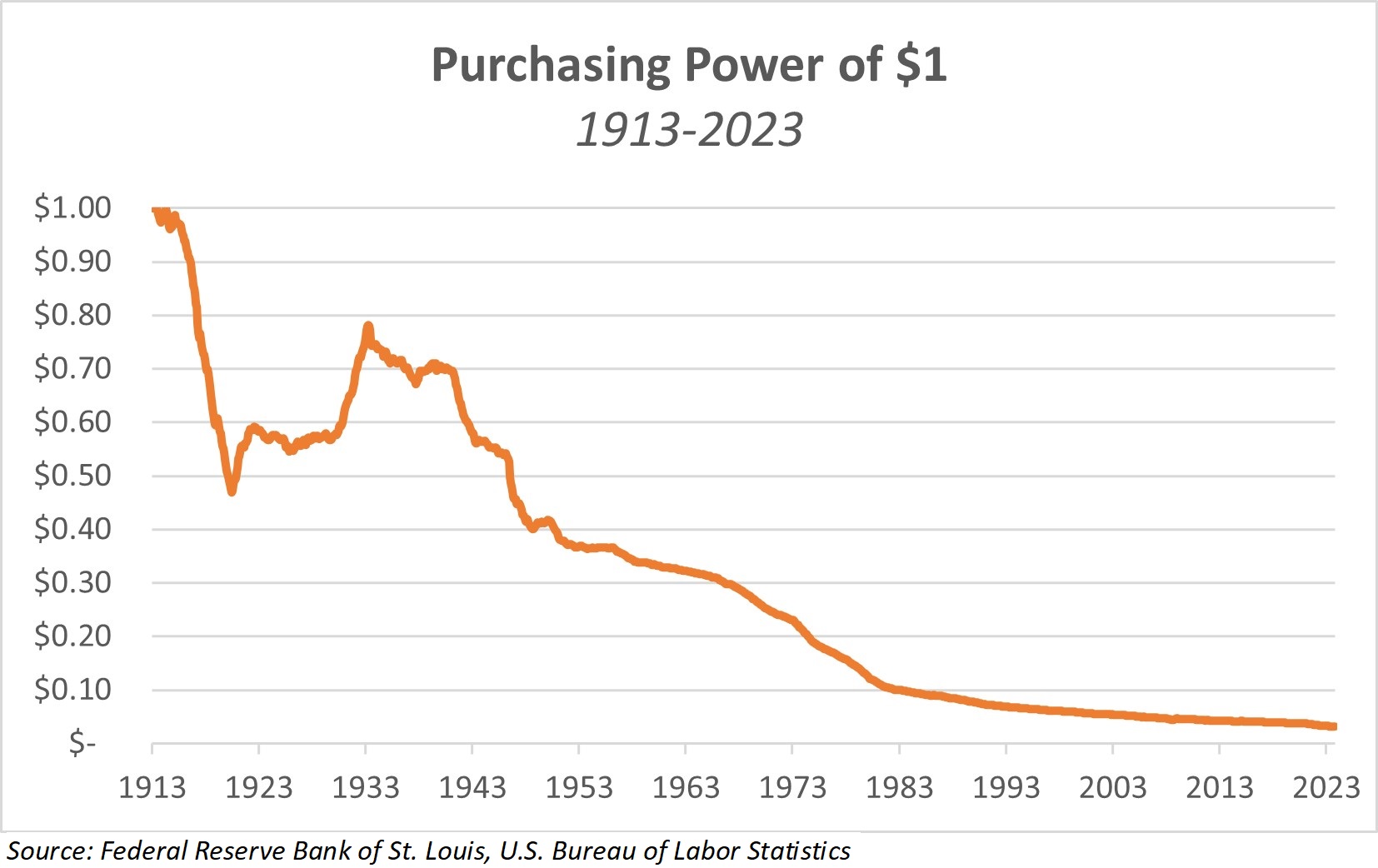

By definition, inflation is an increase in the price of goods and services. The more inflation there is, the less your cash can buy. That is to say, the purchasing power of the currency is reduced. We know that inflation has been a constant force for several decades. The chart below is a different way to think about the impact of inflation over the years. It may hit close to home.

The purchasing power of the U.S. dollar has steadily decreased over the last century. That’s what inflation does to fiat currencies like the dollar over time. The solution here is pretty simple. Beyond having some cash on hand to meet expenses, get through an emergency or as dry powder for some opportunistic investing, you should avoid having excessive amounts of cash as part of your long-term strategy. Having dollars stuffed under a mattress or locked up in a safe or bank vault is not an effective way to beat inflation.

Step 2: Own things that hurt if you drop them on your foot.

OK, there are exceptions. I don’t recommend filling your home with refrigerators or bowling balls. But the point is to own real assets. Real estate is a typical example of this strategy. However, with residential real estate affordability near a 40-year low and the office space struggling, I’m less enthused with the sector beyond a few niche areas.

Thankfully, there are other options. I’ve already professed my love for pipelines, in my article These Energy ‘Middlemen’ Are an Income Lover’s Dream. The midstream companies that own them have already spent big bucks to build out their infrastructure. Inflation should increase the value of these assets as they become increasingly more expensive to replace.

Gold is another way to protect yourself from the wealth-eroding powers of inflation. There are several different ways to invest. You might choose to own the physical metal, big gold mining companies, junior miners or gold royalty companies. They all perform differently depending on the environment. That’s why my firm, SAM, has multiple strategies with a gold weighting component.

But no matter how you choose to get your gold exposure, its track record as a store of value over thousands of years means the odds of maintaining your purchasing power in the face of inflation are in your favor.

Step 3: Invest in companies with pricing power.

Take another look at that Purchasing Power of $1 chart. While it’s jarring, the decline of value in the dollar didn’t lead to economic devastation. As you may have heard, the U.S. economy has actually grown quite a bit since 1913. Now, if you parked cash in the bank earning nominal interest rates during much of this time period, you wouldn’t be thrilled with your returns.

If you bought gold, you at least likely maintained your purchasing power. But when it comes to staying ahead of inflation, I’d urge you to consider stocks. Not just any stocks — stocks with pricing power.

Pricing power refers to a company’s ability to raise prices and maintain profit margins without losing market share. In other words, they can pass rising costs on to consumers.

The reasons a company has pricing power vary widely. They may have strong brand loyalty. They may have a monopoly on a vital product like a life-extending medication. Some businesses like the previously mentioned pipeline companies have inflation escalator clauses built right into their contracts. Whatever the reason, these are companies we want to own in an environment where inflation remains pervasive and stubborn.

Pricing power is, well, powerful. A recent study by Steve Hou, PhD, showed that stocks with pricing power consistently outperformed the stock market — not just during inflationary periods, but over long-term periods as well. Hou called companies with pricing power “quiet quality compounders.” They tend to be high-quality, lower-risk companies that compound returns steadily over time.

Inflation isn’t going anywhere. Certainly, the rate of inflation may speed up or slow down with market factors, but it’s still the standard operating environment. By limiting your cash holdings, investing in value-preserving commodities like gold and investing in companies with pricing power that can more easily navigate robust inflationary periods, you can be a better steward of your wealth and protect it from inflation. That’s a recipe for success, no matter what the future holds in store.

To learn more about how SAM works with its clients to understand the impact of inflation on their cash flow needs and their financial planning goals, please go to www.stansberryam.com.

Related Content

- Kiplinger Inflation Outlook: Inflation Reduction Still on Track for 2024

- Rising Prices: Which Goods and Services Are Driving Inflation?

- Retirement Planning in a Time of Inflation and High Interest Rates

- Inflation and Retirement: Five Ways to Soothe Your Worries

- How Inflation Hurts Retirees

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.