Sponsor Content Created With Robinhood

Actively Managed Portfolios: What Are They and How Do They Work?

Don't settle for a robo advisor.

Some investors refuse to settle for “average” returns. They want their portfolio to target the most profitable opportunities and to react to ever-changing market conditions. That hands-on style is called active investing.

With today’s technology, you don’t need a seven-figure net worth to tap into an actively managed portfolio. Keep reading to learn how active management portfolios work, their benefits, and why they are more accessible than ever for regular investors.

What is active investment management?

Active management is when an investor builds a portfolio of stocks, bonds, exchange-traded funds (ETFs), and other assets based on what they think will generate the highest returns for their goals. An active investor also regularly reviews and updates their portfolio in response to market trends, news, and opportunities.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In comparison, passive investment management seeks to track a market without making frequent changes and trades. They buy and hold for the long run. For example, a passive investor might buy one ETF that simply mimics the performance of the entire S&P 500, an index following the stock performance of 500 of the largest companies in the United States. The passive investor receives a similar return to the index.

On the other hand, an active investor might try to pick what they believe are the best stocks on the S&P 500 with the goal of outperforming the index.

What are actively managed portfolios?

Actively managed portfolios are created using an active management investment style. As an investor, you can build an actively managed portfolio yourself. Alternatively, you could invest in an actively managed portfolio run by a professional.

Active mutual funds and ETFs are run by portfolio managers who select the underlying investments.. Each actively managed fund has a specific strategy, such as concentrating on technology stocks, international investing, or investments that meet high environmental standards.

As an investor, you select the funds that align with your investment goals and preferences. However, you can’t change the actual investments yourself. The professional fund manager decides everything.

Alternatively, you could hire a financial advisor to create a customized portfolio tailored to your specific goals.

What are the advantages of active management?

When done well, actively managed portfolios can generate higher returns. You could earn more through research and savvy investments than a passive investor tracking an index.

Active investing can also better react to challenging market conditions, such as by shifting to more defensive investments when there is a risk of a downturn. For this reason, active strategies can perform better than passive strategies in down markets.

Finally, active investing can be more interactive ,for those who enjoy studying financial news and using that information to make trades.

What are the drawbacks?

Active management does take more work, research, and effort, especially if you run the portfolio yourself. You can’t “set it and forget it” like a passive investor, as your portfolio may need to change more frequently in response to market conditions.

Working with a professional can reduce the workload, but there are other drawbacks. Actively managed mutual funds and ETFs can charge higher fees than passive funds. You also cannot request changes to the strategy, so it may not be a perfect match to your goals.

While working with a human advisor would give you control over the specifics, the fees are often even higher than actively managed funds. Human advisors could charge between 0.5% and 2% of your portfolio balance annually as a management fee for their services, a considerable drain.

Actively managed portfolios may also have high investment minimums: several thousand dollars for certain mutual funds, and six figures or even seven figures for some human advisors.

How has technology improved access to actively managed portfolios?

Modern technology has opened actively managed portfolios to all investors.

However, pure robo advisors can be somewhat rigid and formulaic, with limited room for customization. For example, they typically restrict your portfolio to only ETFs and don’t explain why trades are made.

Robinhood Strategies takes active management to the next level. It offers actively managed investing through a digital platform guided by real human experts with over 50 years of experience. The minimum investment is just $50 for a portfolio of ETFs and $500 for a portfolio of ETFs and individual stocks. These low minimums mean Robinhood Strategies has removed barriers between active management and everyday investors.

The annual management fee is just 0.25% of your portfolio per year. Robinhood Gold subscribers have their annual management fee capped at $250 per year.* This effectively means that every dollar invested over $100,000 is not charged a management fee. (Robinhood Gold subscriptions cost $5 per month or $50 per year. Terms apply.)

More than a robo advisor

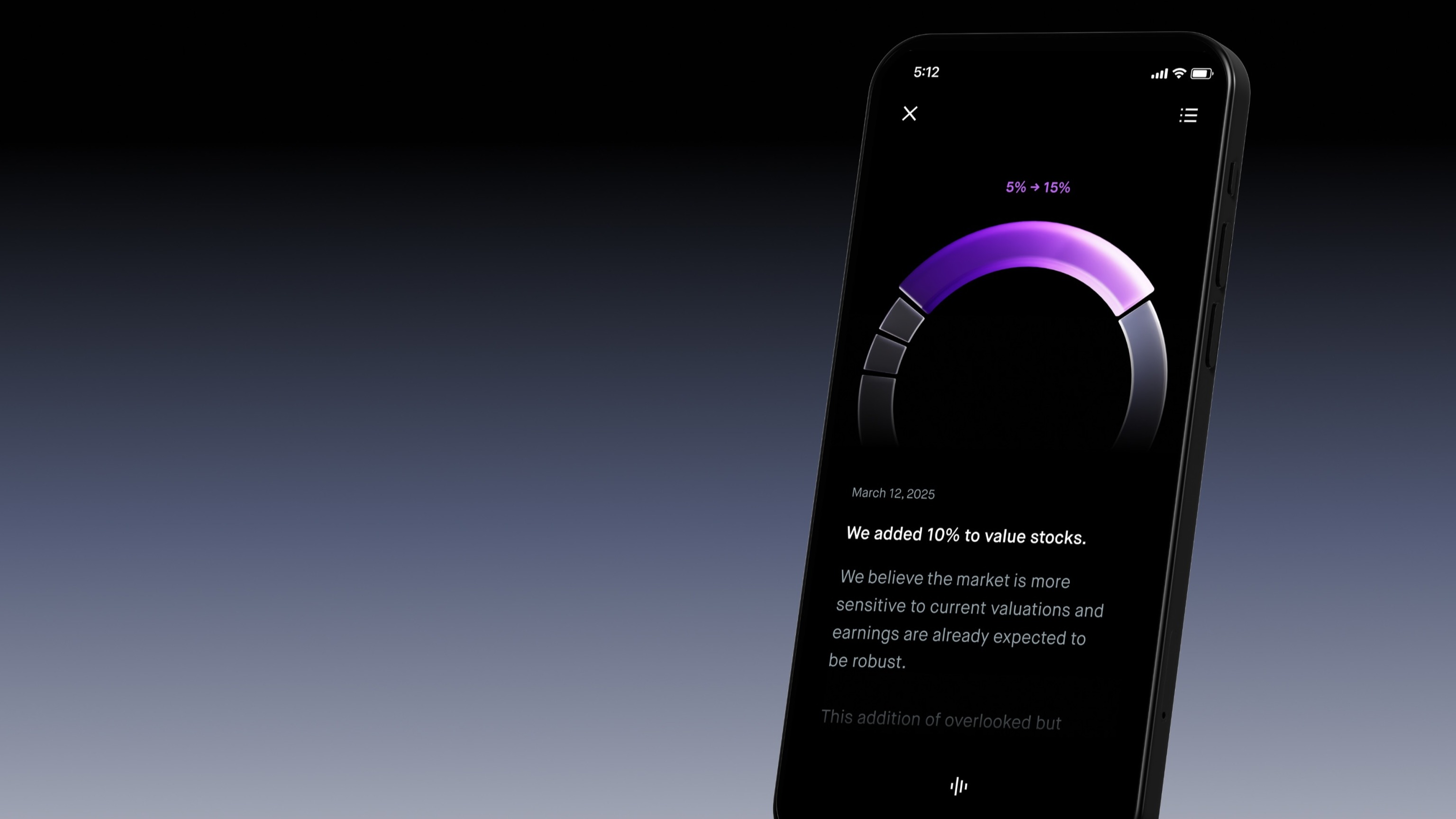

Robinhood Strategies does more than manage your portfolio. Its experienced portfolio managers develop portfolios for clients that can meet the uncertainty of today’s marketplace. Clients receive timely market and portfolio insights that provide context for trades delivered in-app, both in text and via audio recording.

Your account displays the overall asset allocation and performance through charts.

The future of actively managed portfolios

Actively managed portfolios are no longer just for the very wealthy who can afford human advisors. With competitive fees, low balance requirements, and flexible customization, Robinhood Strategies provides actively managed portfolios with financial advice to regular investors.

Learn more about making the most of your portfolio through Robinhood Strategies.

* “Portfolio management offered through Robinhood Asset Management (“Robinhood Strategies”), an SEC-registered investment advisor. Gold membership is offered by Robinhood Gold, LLC."

Non-client promotion of Robinhood Strategies. Kiplinger was compensated for the publication of this article, creating an incentive to positively promote the product. Hover for more details.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is a financial freelance writer based out of Delaware. He specializes in making investing, insurance and retirement planning understandable. He has been published in Kiplinger, Forbes and U.S. News, and also writes for clients like American Express, LendingTree and Prudential. He is currently Treasurer for the Financial Writers Society.

Before becoming a writer, David was an insurance salesman and registered representative for New York Life. During that time, he passed both the Series 6 and CFP exams. David graduated from McGill University with degrees in Economics and Finance where he was also captain of the varsity tennis team.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.