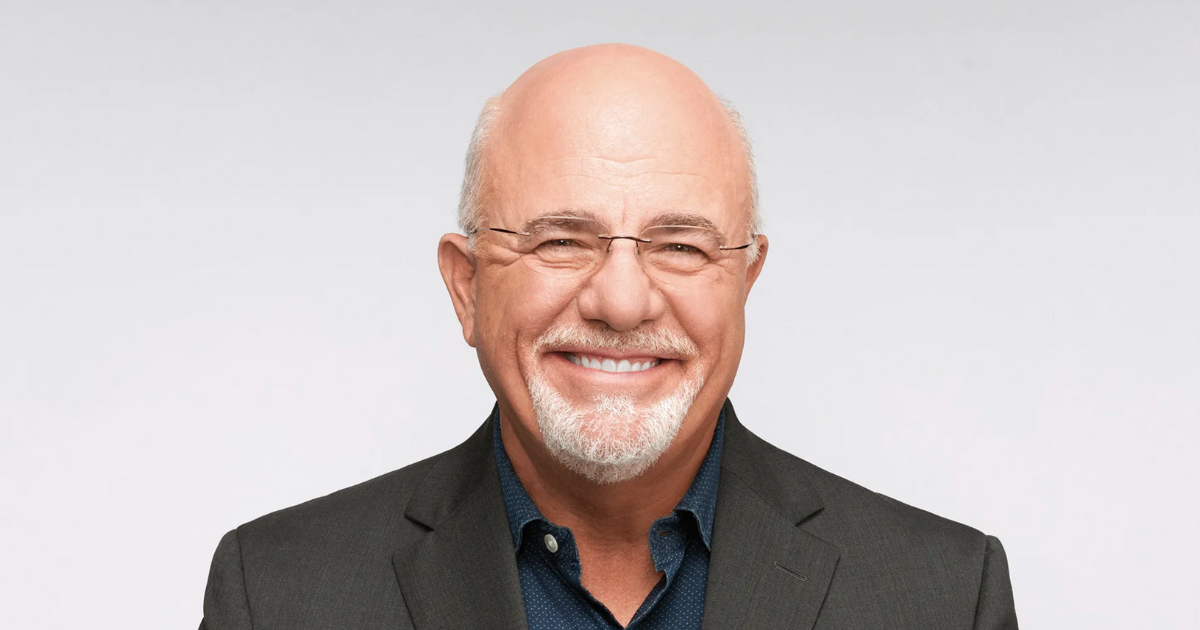

Dave Ramsey Tells Us the Biggest Retirement Mistake You Can Make

The talk-show host, author and podcaster tells Kiplinger what people can do to ensure a happy retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor's note: This article is part of an ongoing series in which we ask influential personal finance figures to share their opinion on the biggest retirement mistake you can make. Other articles feature Suze Orman and Grant Cardone.

Sixty-two seems like the perfect age to retire. After all, you can start collecting Social Security. Plus, you're still young enough to enjoy it.

It's no wonder 62 is the average age of retirement in America. But retiring at that age or earlier could be one of the biggest mistakes a person can make.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At least according to retirement expert, author and podcaster Dave Ramsey.

“People underestimate how long they’ll live and how much money they’ll need,” Ramsey tells Kiplinger.com. “They retire broke or way too early. It's like jumping out of a plane without checking your parachute.”

This applies to the millions of people who choose to retire early, not the ones who are forced out of their jobs because of an illness, disability, workforce reduction, or a sick family member they have to care for.

Been There, Done That

Ramsey has seen it before. For over twenty years, the author, founder and CEO of Ramsey Solutions and host of “The Ramsey Show,” has helped millions of people get out of debt, take charge of their financial lives and achieve their retirement goals.

He speaks from experience. After running up thousands of dollars in debt and being forced to declare bankruptcy at age 26, Ramsey not only climbed out of the financial hole he created but went on to build a career teaching others how to achieve financial freedom.

The knock on retiring early

Retiring early is the dream of millions of Americans, regardless of whether that means exiting the workforce in their 50s or early 60s. While there are advantages to early retirement, there are also some clear disadvantages that make Ramsey staunchly against it.

For starters, if you retire before Medicare kicks in at 65, you will have to fund your own health care, which can get expensive. Plus, if you don’t plan to work at least part-time, you’ll have to figure out how to grow your savings and generate cash flow. With so many years without a steady income, there is a chance you could run out of money. If you retire at 62 and collect Social Security, be willing to take up to a 30% reduction in benefits for your lifetime.

All of this may be fine if you’ve saved enough for retirement and you're flush with cash. But if you rely on Social Security to supplement your monthly income, a reduction in your benefits because you retired early could impact your quality of life. Additionally, retiring early means less money saved, plus more years you have to draw from your savings.

“Don’t retire until you’re truly ready,” says Ramsey. “That means zero debt, a fully funded nest egg, and a clear monthly budget. Work longer if you need to, and budget like your future depends on it — because it does.”

When it comes to debt, Ramsey says get rid of it before retirement.

Retire debt-free

Retiring with debt is another one of the biggest retirement mistakes Ramsey encounters. People think they can handle the monthly mortgage payment and/or car payment, but one unexpected illness or accident, and all of a sudden, they are in over their heads.

That’s why Ramsey says people should be entirely debt-free in retirement, including paying off their mortgage, regardless of a low interest rate. When you owe money, you can’t achieve financial freedom and security in retirement.

"They hang onto debt. Especially mortgages and car payments. Then they assume they’ll just ‘manage it’ in retirement,” says Ramsey. “The fix is simple. Attack that debt with intensity now, before you step into your golden years.”

It’s never too late to fix your retirement mistakes

Retirement isn’t the end of the road. If you make mistakes, such as retiring too early or with too little money, you have options to fix them. You can go back to work, downsize or reduce your budget.

If you haven’t retired yet, you can put in the work now to prepare for it or delay retiring to get yourself in a better position later.

"It’s never too late to start doing the right thing,” says Ramsey. “You may not have 40 years left, but you’ve got today. And that’s enough to start turning the ship around.”

Related Content

- Suze Orman Tells Us the Biggest Retirement Mistake You Can Make

- My Great Retirement Dream: Sell My House, Downsize, Live off the Proceeds and Dabble in Stocks. Here's How I’m Doing So Far.

- I’m 53, Make $500,000 a Year and Live Paycheck to Paycheck. I Want to Retire At 65, But We Only Have $200,000 Saved.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.