These Energy ‘Middlemen’ Are an Income Lover’s Dream

Midstream energy companies, which connect producers and end users, service the industry itself, rather than being tied to commodity prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investing in the energy sector has been quite a roller coaster. Energy was the worst performing S&P 500 sector in 2018. And 2019. And 2020.

But then it flipped. Energy was the top performing sector in both 2021 and 2022.

But in 2023, it’s back to its old ways — competing for last place with utilities.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Energy returns are chronically trapped in the cycle of boom and bust because they’re tied to volatile oil and natural gas prices. So, what’s an investor to do who wants to invest in energy but also seeks steady and reliable income?

DON’T focus upstream. Energy exploration and production (E&P) companies engage at the beginning of the supply chain. They identify energy deposits, drill wells and recover raw materials from the ground. This segment of the industry is most directly tied to oil and gas prices, so their stocks typically experience the biggest swings.

DON’T focus downstream. Crude oil and natural gas refineries take raw products and turn them into products like gasoline and heating oil. These businesses face a different source of volatility: the price difference between raw energy (their input) and refined products (their output) can be wild and unpredictable.

DO focus midstream. All those hydrocarbons pouring out of the ground must get to the refiners somehow. That’s done by midstream companies. Their business involves transporting crude oil, natural gas and refined products across a vast network of pipelines, rails, barges and tankers — connecting producers to end users. They service the industry itself, rather than being tied to commodity prices.

Midstream companies are the “middlemen” of the energy business. They connect producers and end users. Owning a pipeline can resemble owning a toll bridge. Once a pipeline is built, the heavy lifting is done. You can then sit back and collect fees from those wanting to use the infrastructure you’ve put in place.

So why isn’t everyone “in” on the midstream companies? Well, some investors got burned during the U.S. shale boom of the last decade. During the rush to build out infrastructure, midstream companies prioritized growth over profitability. They took on projects with poor return prospects and paid for it in 2015. They’ve been out of favor with investors ever since.

It has largely gone unnoticed, but midstream companies are in much better shape today. They are steadily paying down the debt they took on to build infrastructure during the shale boom. The large, capital-intensive projects are largely complete, and now they’re prioritizing profits and shareholder returns.

What kind of returns do I mean? Many of the leading midstream companies like Enterprise Products (EPD), Kinder Morgan (KMI) and ONEOK (OKE) are paying dividends north of 6%. Compared to the S&P 500’s trailing 12-month yield of 1.58%, midstream companies are looking generous.

These pipelines have more going for them than nice dividends. They are well insulated from competition. Getting government approval for a new pipeline isn’t a slam dunk these days. That hinders growth. But it also keeps capital spending and potential new players in check.

That’s great for now, but how long will we really be using this infrastructure? Won’t it become obsolete as we transition to cleaner, greener energy sources?

Perhaps someday. But even forecasts that are incredibly optimistic about the clean energy transition still typically show demand for fossil fuels rising in the years ahead. Even more important, oil and especially natural gas are projected to be critical components of the global energy mix for decades to come.

If you’re thinking there must be a catch … you’re right. Many midstream companies are structured as master limited partnerships (MLPs). That means they issue K-1s, which can be a major headache when it comes to tax preparation.

If you’re interested in midstream companies but prefer to avoid the dreaded K-1, you have a few choices. There are some great midstream companies structured as C-corps. Or you can turn your attention to closed-end funds that specialize in energy MLPs. Instead of buying individual MLP stocks and dealing with the hassle of K-1s, you can own those same stocks through a closed-end fund and receive the simple and more familiar 1099 for your tax reporting.

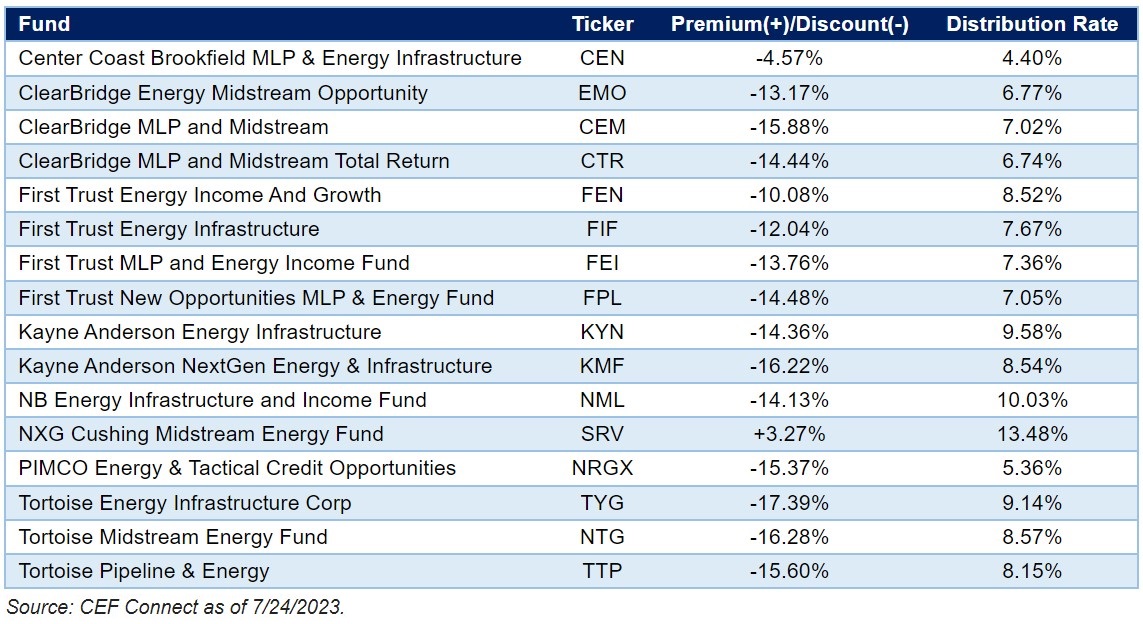

You have plenty of choices — there are 16 midstream-focused closed-end funds listed today.

Those distribution rates should be juicy enough to get your attention, even in today’s interest rate environment where U.S. Treasury bonds actually yield something.

But what about the premium/discount? This feature is unique to closed-end funds. When you buy or sell a mutual fund, you do so at a price on par with the net asset value (NAV) of the fund.

Closed-end funds are different. Unlike mutual funds, closed-end funds don’t continually issue and redeem shares. You trade them with other investors. And they rarely trade at par. Sometimes they trade at a premium to the underlying asset value of the fund. Often, they trade at a discount.

All but one of the closed-end funds above trade at a discount today. That’s typically what happens when a fund specializes in part of the market that has fallen out of favor with investors. If you buy a fund at a 15% discount, you are essentially buying $1 of assets for 85 cents.

To recap: Midstream companies are resilient businesses not at the mercy of volatile commodity prices. They are reducing their debt, paying great dividends, and they’re insulated from competition. And if you own them through a closed-end fund, you avoid the K-1 hassle and get to buy these great assets on sale.

It’s an income lover’s dream. But no need to pinch yourself.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.