Want to Get Rich and Stay Rich? Avoid 10 Investing Mistakes

Doing everything right isn’t a guarantee, but knowing where it’s easy to go wrong can make a big difference when it comes to gaining an edge.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sometimes it’s not making all the right moves but avoiding making the wrong ones that can make all the difference. Take investing, for instance. Simply avoiding making easy mistakes can be enough to give you the edge you’re looking for.

Here are some of the most common errors I see people making.

1. Investing in a brand as opposed to trusting the data.

Just because it’s from a well-known and widely respected investment manager doesn’t mean it’s a fit for your portfolio. Be sure to look at historical returns and think critically about the nature of the investment itself. Ask yourself what might put those continued returns at risk.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

2. Chasing returns vs. “not losing money.”

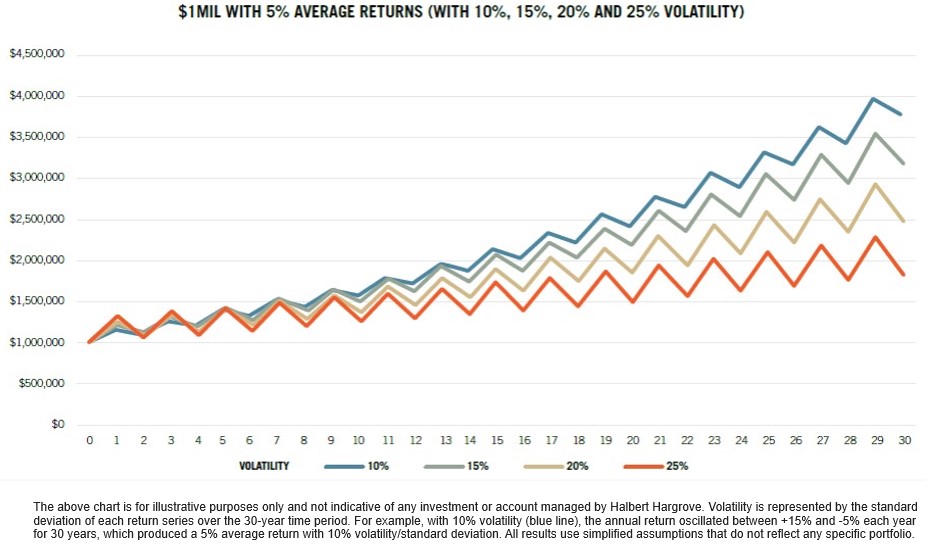

Fortunes are made by not losing money as opposed to chasing the next big thing. Take a look at the chart below from investment firm Halbert Hargrove. All of the portfolios have a starting value of $1 million and represent an average return of 5%. The difference in all four is the volatility they experience. The portfolio with the lowest volatility has a value of $3.8 million by year 30. The portfolio with the most amount of volatility has a value of $1.8 million by year 30.

3. There’s no such thing as “risk-free investing.”

If it sounds too good to be true, it typically is. This age-old adage applies to investing as well. Much like what the salesman is trying to pitch you on, if an investment professional is trying to sell you something that seems implausible, take another look. Chances are, there’s a catch.

We’ve all heard of Ponzi schemes, get-rich-quick schemes and, of course, the pump and dump, made popular by crypto and meme stocks. It's important to thoroughly research any investment opportunity and consult with a financial professional before investing your money.

4. Following the crowd leads to buying the top (hype) and selling the bottom (fear).

There’s no better example of this in recent memory than the meme stock craziness that took hold in 2020 and 2021.

One of the most well-known examples is GameStop, a struggling video game retailer that was heavily shorted by hedge funds. A group of Reddit users from the WallStreetBets subreddit encouraged others to buy GameStop stock, causing the stock price to skyrocket. It went from trading at around $18 per share in early January 2021 to a high of over $347 per share on Jan. 27, 2021.

This sudden rise caused significant losses for some hedge funds that had bet against the stock, including Melvin Capital. The fund reportedly lost around 53% of its value in January 2021 as a result of the short squeeze.

5. Not performing your own diligence.

It’s never been easier or cheaper to take the time to self-educate. Even when it comes to sophisticated alternative investments, there are resources, like the Equi Learn page. Investment diligence includes researching the company or asset, analyzing the financials, assessing management and leadership, evaluating the competitive landscape and considering the risks.

If you’re going to rely on someone else to perform your diligence for you, then you better make sure to perform your diligence on them! Ensure they’re properly qualified and experienced to do so.

6. Taking concentration risk instead of diversifying.

Concentration risk can take a number of forms. It could be investing in one company, one sector, one geography, you name it. This is also where having a strong alternative investment portfolio becomes critical. Most public-traded investments are correlated to changes in fiscal and monetary policy — just look at what happened in 2022.

For example, if an investor holds a significant portion of their portfolio in real estate assets, they are taking on a concentration risk that the performance of the real estate market could significantly impact their portfolio's returns.

To manage concentration risk, investors can diversify their portfolio across a range of different assets, sectors and geographic regions. By spreading their investments across a variety of different holdings, investors can help to reduce the impact of any one asset or sector on their overall portfolio performance.

7. Holding too much cash.

Especially in a world where inflation is higher than historical averages, sitting on cash can harm your returns. This doesn’t mean you need to put all your liquid funds in highly volatile assets, but there are plenty of low-risk options on the market today: alternative investments, index funds, treasuries and certificates of deposit are all great options.

In fact, this is the most attractive Treasuries have been in decades, meaning there’s no excuse not to take advantage of “the world’s safest borrow.” The opportunity cost of holding cash is extremely high, so don’t let a desire for “safety” destroy your chances of compounding your wealth or losing value to inflation.

8. Failing to adjust the amount of risk in your portfolio.

What’s appropriate for my 26-year-old colleagues is not appropriate for my parents or the average retiree. As you enter new stages of life, you should rethink what’s appropriate and how much risk you can afford to take.

The younger you are, the more risk you can handle since your investing horizon is very long. But as you get closer to retirement, the name of the game is preserving capital.

9. Following the advice of gurus as opposed to thinking for yourself.

Following financial gurus can be entertaining, but I never make an investment decision based on their advice. Being rich doesn’t mean you know how to help other people get rich, and their advice makes broad assumptions about human behavior.

Always be sure to check their credentials and do research for yourself, especially if their advice falls into the “too good to be true” category.

10. Don’t let your portfolio ruin your life.

You only live once. Money is simply a tool to help you accomplish your goals in life. Don’t make the pursuit of money the goal itself, because your investing and your life will suffer as a result.

This is where a partner like Equi can help. Our platform is a tech-enabled asset manager that relies on sophisticated data and a specialized diligence team to offer portfolios of what we believe to be the top alternative investment products.

This is the most “hands-off” and streamlined approach and can save you a lot of stress if trying to avoid all of these mistakes sounds like too much to handle on your own.

Please see important disclosures for Equi (Equilibrium Ventures, LLC) at www.equi.com/blog.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tory Reiss is a three-time founder of venture capital-backed financial technology startups. He’s currently the CEO of Equi, the elite destination for alternative investments. It is equal parts hedge fund and technology platform, with exclusive access to a variety of uncorrelated alternative investments.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.