Five Places to Put Cash Rather Than in the Bank

There are a whole host of alternative places to stash cash instead of keeping it in the bank. We look at the options.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Very rarely do we stop to think what the balance printed on our bank statements really means. To most of us, most of the time, our bank balance means cash that’s readily available for us to withdraw and use. Rarely do we think about it as a kind of IOU that the bank will do its best, in conjunction with certain laws and oversight, to honor when we wish to redeem it.

Even more rarely do we consider the chance that the bank will not be able to make good on that IOU. The recent collapse of Silicon Valley Bank and Signature Bank has forced us to consider that the balance printed on our bank statements in certain cases can be very different from cash in our wallets.

For balances under $250,000, there is less to consider when it comes to safety, as the FDIC has proven an efficient operator when interceding in failing banks and making insured balances quickly available. However, the insurance limit has not changed since 2008 and is not indexed to inflation.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As we’ve seen, the insurance limit can, for all intents and purposes, be much higher in certain cases. But even in the case where Silicon Valley Bank and Signature Bank were deemed systemically important and all deposits were covered, there were a few hair-raising days where the value of those deposits was in question. Certainly not the type of uncertainty we typically associate with bank deposits.

Investors today may be asking themselves: Where else should I consider putting my cash? Below are a few alternatives to consider.

1. FDIC Sweep Programs

FDIC-insured sweep programs are offered by brokerage firms. These programs “sweep” client cash into FDIC-insured bank accounts. In some cases, clients’ deposits are fanned out across multiple banks to provide higher levels of FDIC protection. Like bank accounts, yield can vary across programs, with some programs offering highly competitive yields. Coupled with the potential for higher levels of FDIC insurance, brokerage sweep programs are an attractive alternative to a traditional savings account.

2. Money Market Mutual Fund

A money market mutual fund (MMMF) is a mutual fund that seeks to keep its share price fixed at $1 and generate interest income. MMMFs are different from money market accounts offered by banks and credit unions. MMMFs are investable securities and do not carry FDIC insurance. Funds invest in U.S. Treasuries and other high-quality fixed income securities.

There are also MMMFs that invest in municipal securities, where interest can be exempt from federal, state and local taxes. MMMFs generally offer competitive yields. These yields fluctuate with the market, since the yield is generated by the securities held by the fund.

While funds seek to keep their share price fixed, there is no guarantee. Though exceedingly rare, funds in the past have “broken the buck,” or seen the share price drop below $1. In times of stress, funds can institute gates on withdrawals to help preserve share value.

3. Treasuries

Generally considered one of the safest assets on the planet, U.S. Treasuries are bonds issued directly by the U.S. government. Investors should keep in mind that the value of Treasuries can fluctuate while they are being held to maturity. Interest income is also exempt from state and local taxes.

4. Short-Term Bond Funds

For investors who are willing to take a bit more risk, short-term bond funds can deliver increased yield while remaining relatively safe. These funds invest in fixed income securities that mature in the near future. The short maturities mean that there’s limited impact to the fund price when interest rates change, and the yield generated by the fund generally tracks changes in interest rates.

Investors can think of these funds as one step further on the risk spectrum compared to money market mutual funds. Similar to money market funds, there are also municipal versions that can generate tax-exempt interest.

5. Stocks?!

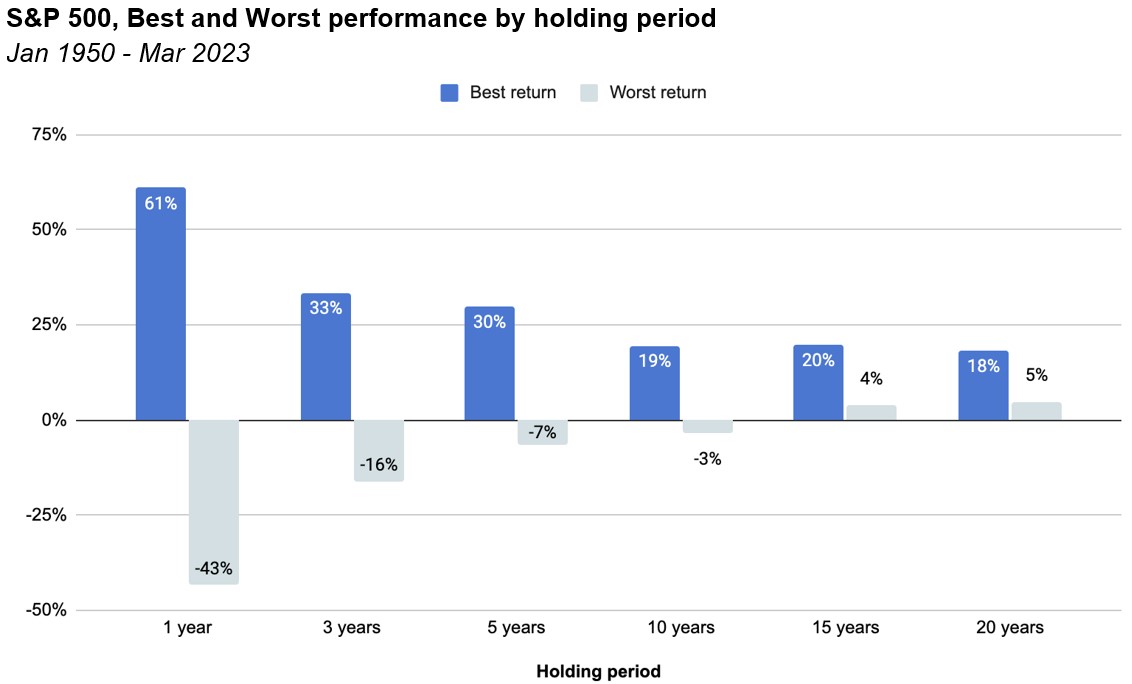

If you are holding a sizable position in cash, you might be missing out on returns. Broadly diversified stocks, measured by the S&P 500, have outperformed cash by 11% on an annualized basis since 1950.

Of course, stocks are significantly riskier, but as your holding period lengthens, the risk of loss tends to decrease. Since 1950, the worst one-year return for the S&P 500 was -43% (3/2008-3/2009). However, the worst five-year return was -6.6%. Extend your holding period to 15 years, and the worst return is actually positive (3.8%).

The last few months have surfaced risks to the traditional savings account that investors have not had to consider for some time.

Luckily, there are a number of other options for investors to park their cash that can deliver compelling yields and, in some cases, higher levels of safety.

Related articles

- How to Protect Your 401(k) From a Market Crash or Recession

- When It Comes to Cash Yields, Cash Is No Longer Trash

- Four Ways You Can Take Advantage of a Down Market

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Grealish serves as Head of Investments at Altruist, a fintech company on a mission to make great independent financial advice more affordable and accessible. With a career rooted in financial innovation, Adam most recently led Betterment's strategic asset allocation, fund selection, automated portfolio management, and tax strategies. In addition, he served as a vice president at Goldman Sachs, overseeing the structured corporate credit and macro credit trading strategies.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.