Zombie Mortgages Come Back to Haunt Property Owners

Here’s what to do if a letter from a law firm arrives out of the blue to warn you that you could lose your house over a mortgage you thought was long dead.

Like ghosts in a haunted house, law firms are pursuing property owners, threatening them with the loss of their property for unpaid second mortgages — known as zombie mortgages.

Some people thought their mortgages were discharged in bankruptcy. Others wanted to pay on their mortgages but couldn’t because there was no longer anywhere to send their payments when their lenders disappeared during the mortgage crisis that started in 2008.

Andy’s story of being blindsided by a zombie mortgage is typical. Here’s how it went down.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How the zombie mortgage got its start

“In 2007, I converted a small house into a commercial structure for our data recovery company,” “Andy” wrote. “There was a first and second mortgage, and I am still current on the first. Around 2009, when things fell apart in real estate, the company servicing my second just vanished! I tried mailing and even wiring payments, but everything came back. I was unable to discover who to pay. Then a letter from a law firm in Florida arrived, claiming to represent a company that had purchased my second mortgage, stating that I was in default, demanding payment in full, or they would foreclose and take my office!”

A real estate attorney explains what happened

I ran Andy’s situation by Hanford, Calif., real estate attorney Ron P. Jones, who says he is “far more familiar with these situations than I would like to be, as they are terrifying to people who are suddenly at risk of losing their home.”

He explained how and why this is happening even today, so many years after the Great Recession.

“Zombie second mortgages step out of the past, haunting property owners and threatening their ability to remain in their home or commercial building,” Jones says, describing two common situations where this occurs:

Situation No. 1: You filed for bankruptcy.

“Many property owners were under the impression that by including the second mortgage in a bankruptcy, they were no longer responsible for it,” Jones says. “They keep the first current, but stopped paying on the second.” But in reality, the lender still has a lien against the property. Mortgage debt (secured debt) generally is not dischargeable through bankruptcy. You do not own the home free and clear, so you are not off the hook for the mortgage. “So, whoever owns the mortgage has the right to foreclose unless you pay it off or negotiate an acceptable restructuring.”

Situation No. 2: The lender has disappeared, and you can’t make payments.

“As strange as it sounds,” Jones says, “the fact that you were unable to keep payments current on the second mortgage does not mean that the money isn’t owed. It is owed.”

Why is this happening all across America?

We can all recall the tsunami of foreclosures and prices of homes and commercial property falling off the face of the planet from the crash. As the value of their homes fell well below what was owed, many people just walked away.

“During those years, holders of second mortgages did not foreclose due to falling home values and little equity in the property,” Jones notes.

When real estate prices started to recover, and in some cases went even higher, that second mortgage suddenly is very valuable and worth trying to enforce, giving a successor mortgage holder a “winning lottery ticket,” enabling them to potentially own the property encumbered by the mortgage.

What about Andy’s situation? It just seems so unfair. He was trying to pay, but could not locate anyone to take his money, and then, blam, he’s threatened with losing the property. What happened?

Meet the zombie mortgage debt buyers

Attorney Jones explains that the same thing happens with mortgage debt that is in default: “Assets of a defunct lender are purchased for pennies on the dollar by one of these debt buyers. So, if $100,000 is owed, the debt buyer might pay 4% to 10% of that amount and gets the opportunity to collect $100,000. Many describe this as legalized extortion. I concur.”

I’ve written about “zombie consumer debt,” where so-called uncollectible/written-off accounts are purchased for cents on the dollar by a debt buyer who then goes about trying to collect from a consumer. It is a hugely profitable, murky business.

What to do if this happens to you

So, if you are in a similar position as Andy, what should you do? Jones recommends:

- Contact the customer service department of a title or escrow company. They have extensive resources on mortgage companies that have failed and might be able to locate who to pay.

Reach out to federal lending agencies such as Fannie Mae and Freddie Mac, which also have information on lenders and their successors. - Create a special savings account and deposit each month the same amount you would have paid on the mortgage. That way, when zombies show up, you have negotiating ability.

- Immediately contact a real estate attorney. Don’t handle this on you own!

Dennis Beaver practices law in Bakersfield, Calif., and welcomes comments and questions from readers, which may be faxed to (661) 323-7993, or e-mailed to Lagombeaver1@gmail.com. And be sure to visit dennisbeaver.com.

Related Content

- 10 Things You Should Know Before Filing for Bankruptcy

- Mortgage Calculator: Find Your Monthly Payment

- Five Ways to Shop for a Low Mortgage Rate

- Why Can’t You Ever Use Your Timeshare?

- Six Things Not to Do if You Want to Resolve a Conflict

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

After attending Loyola University School of Law, H. Dennis Beaver joined California's Kern County District Attorney's Office, where he established a Consumer Fraud section. He is in the general practice of law and writes a syndicated newspaper column, "You and the Law." Through his column, he offers readers in need of down-to-earth advice his help free of charge. "I know it sounds corny, but I just love to be able to use my education and experience to help, simply to help. When a reader contacts me, it is a gift."

-

46 Anti-Prime Day Tech Deals You Should Get from Best Buy's Black Friday in July Sale Instead

46 Anti-Prime Day Tech Deals You Should Get from Best Buy's Black Friday in July Sale InsteadApple, Blink, Garmin, Samsung and more leading tech brands are on sale at Best Buy's rival Prime Day sale this week.

-

Stock Market Today: Trump Reextends His Tariff Deadline

Stock Market Today: Trump Reextends His Tariff DeadlineWhen it comes to this president, his trade war, the economy, financial markets and uncertainty, "known unknowns" are better than "unknown unknowns."

-

I'm a Financial Strategist: This Is the Investment Trap That Keeps Smart Investors on the Sidelines

I'm a Financial Strategist: This Is the Investment Trap That Keeps Smart Investors on the SidelinesForget FOMO. FOGI — Fear of Getting In — is the feeling you need to learn how to manage so you don't miss out on future investment gains.

-

Can You Be a Good Parent to an Only Child When You're Also a Business Owner?

Can You Be a Good Parent to an Only Child When You're Also a Business Owner?Author and social psychologist Susan Newman offers advice to business-owner parents on how to raise a well-adjusted single child by avoiding overcompensation and encouraging chores.

-

How Advisers Can Steer Their Clients Through Market Volatility (and Strengthen Their Relationships)

How Advisers Can Steer Their Clients Through Market Volatility (and Strengthen Their Relationships)Financial advisers need to be strategic when they communicate with clients during market volatility. The goal is to not only reassure them but to also help them avoid rash decisions, deepen your relationship with them and build lasting trust.

-

The Hidden Costs of Caregiving: Crisis Goes Well Beyond Financial Issues

The Hidden Costs of Caregiving: Crisis Goes Well Beyond Financial IssuesMany caregivers are drained emotionally as well as financially, leading to depression, burnout and depleted retirement prospects. What's to be done?

-

Cash Balance Plans: An Expert Guide to the High Earner's Secret Weapon for Retirement

Cash Balance Plans: An Expert Guide to the High Earner's Secret Weapon for RetirementCash balance plans offer business owners and high-income professionals a powerful way to significantly boost retirement savings and reduce taxes.

-

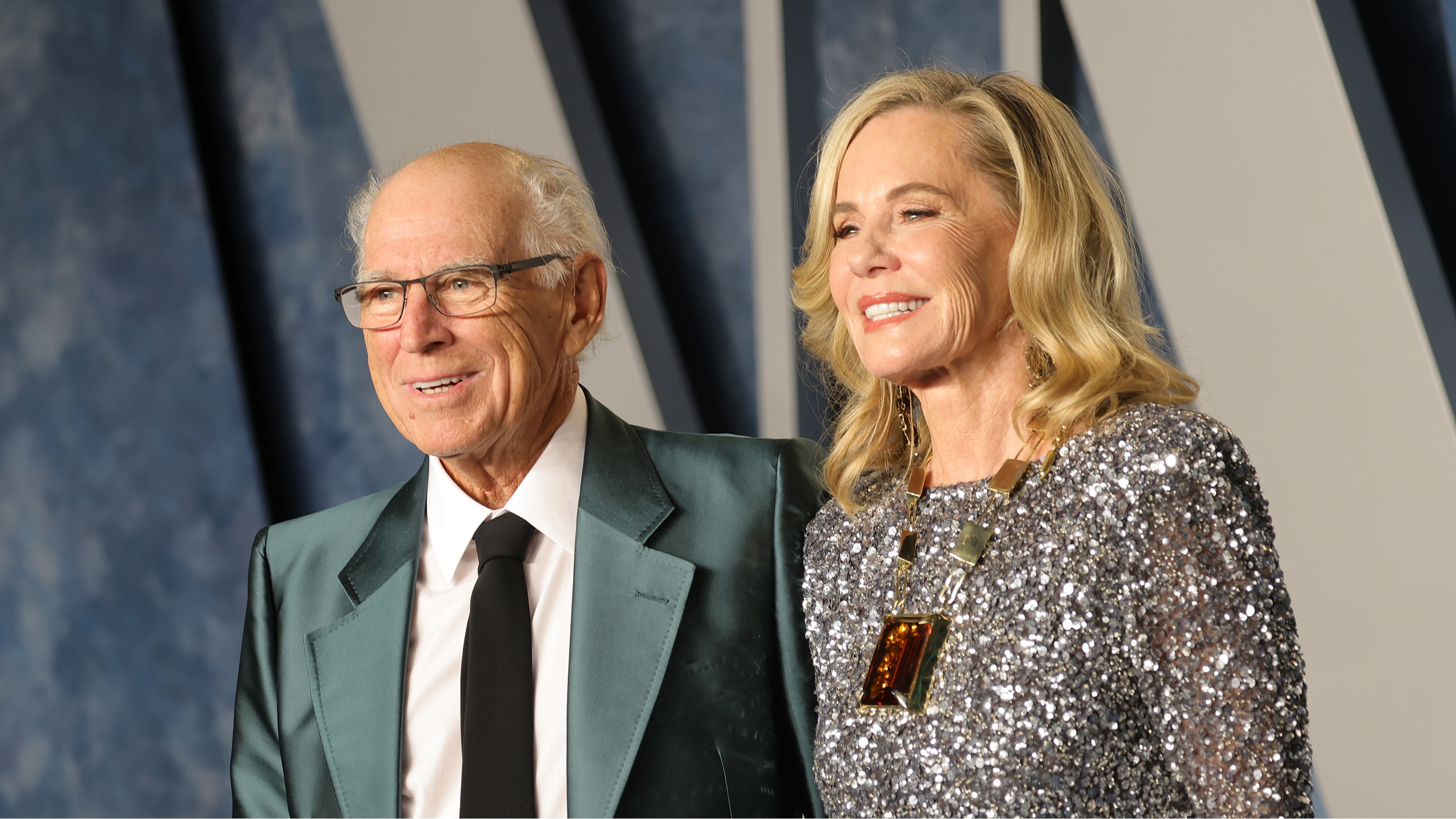

Five Things You Can Learn From Jimmy Buffett's Estate Dispute

Five Things You Can Learn From Jimmy Buffett's Estate DisputeThe dispute over Jimmy Buffett's estate highlights crucial lessons for the rest of us on trust creation, including the importance of co-trustee selection, proactive communication and options for conflict resolution.

-

I'm a Financial Adviser: For True Diversification, Think Beyond the Basic Stock-Bond Portfolio

I'm a Financial Adviser: For True Diversification, Think Beyond the Basic Stock-Bond PortfolioAmid rising uncertainty and inflation, effective portfolio diversification needs to extend beyond just stocks and bonds to truly manage risk.

-

I'm a Retirement Psychologist: Money Won't Buy You Happiness in Your Life After Work

I'm a Retirement Psychologist: Money Won't Buy You Happiness in Your Life After WorkWhile financial security is crucial for retirement, the true 'retirement crisis' is often an emotional, psychological and social one. You need a plan beyond just money that includes purpose, structure and social connection.