Stock Market Today: Walmart Inflation Woes Give Stocks a Scare

The nation's largest retailer cut its second-quarter and full-year profit forecasts, citing higher fuel and food prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

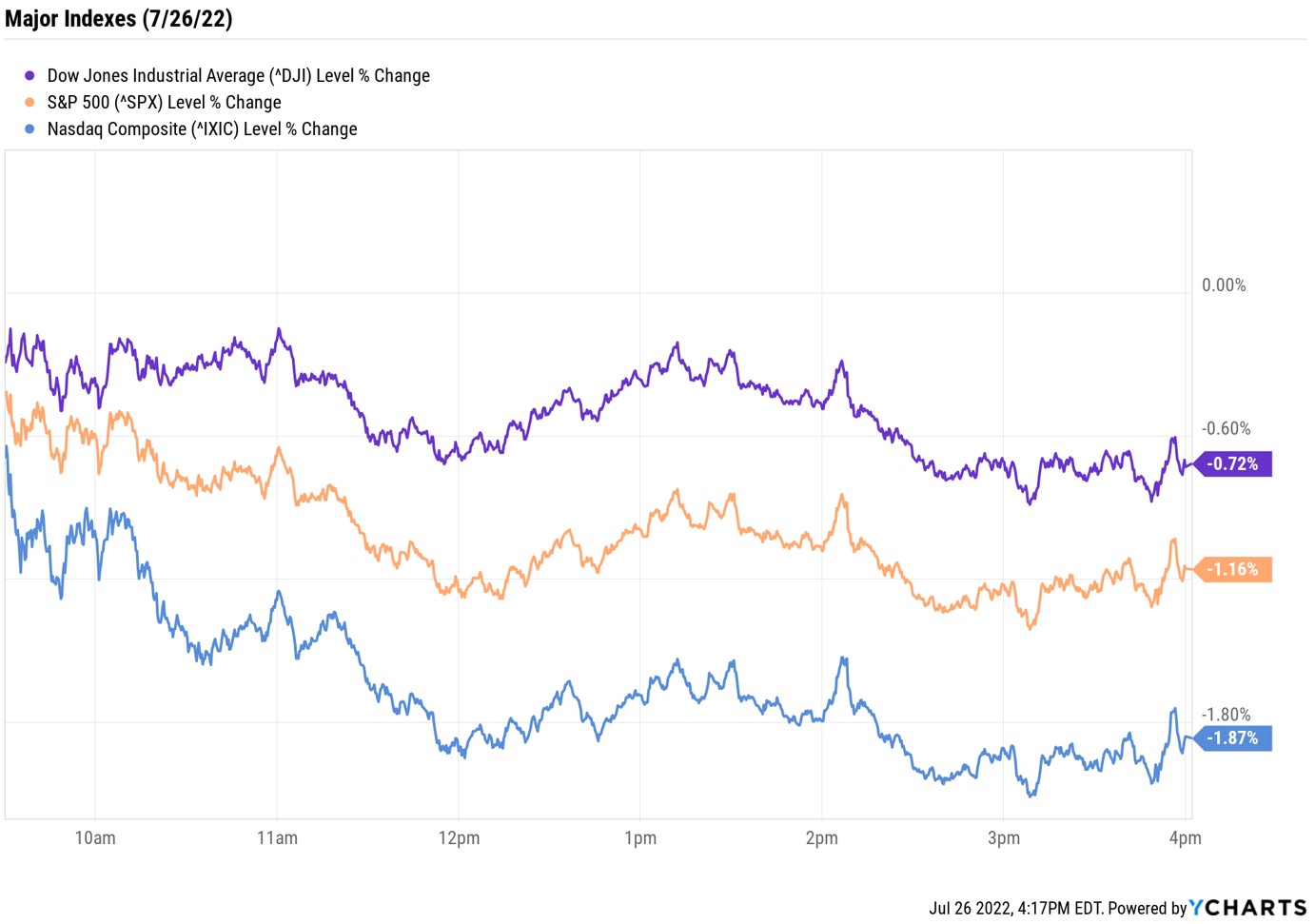

A profit warning from the nation's largest retailer ahead of a busy stretch of corporate earnings sent stocks lower at the start of Tuesday's trading, and the selling continued as the session wore on.

Late Monday, Walmart (WMT) said that it now expects second-quarter earnings per share to be down 8% to 9% year-over-year and operating income to fall at least 13%, compared to May guidance for both metrics to be flat to up slightly.

"The increasing levels of food and fuel inflation are affecting how customers spend, and while we've made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars," said Doug McMillon, CEO at Walmart, in the company's press release. The company also cut its full-year profit forecast, as it expects even more pressure on general merchandise over the next two quarters.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

WMT stock slid 7.6% on the news – making it easily the worst-performing Dow Jones stock today – and other retailers like Target (TGT, -3.6%) and Dollar Tree (DLTR, -6.3%) fell in sympathy.

The selling weighed on the broader benchmarks as well, with the Dow Jones Industrial Average shedding 0.7% to end at 31,761, while the S&P 500 Index gave back 1.2% to 3,921. The Nasdaq Composite was the biggest decliner, though, sinking 1.9% to 11,562, as cybersecurity stocks Zscaler (ZS, -9.1%) and Palo Alto Networks (PANW, -7.9%) tumbled.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.7% to 1,805.

- U.S. crude futures fell 1.8% to $94.98 per barrel.

- Gold futures finished marginally lower at $1,717.70 an ounce.

- Bitcoin plummeted 4.7% to $20,914.14. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Shopify (SHOP) plunged 14.1% after the e-commerce platform said it is laying off 10% of its global workforce. In a letter to staff, CEO Tobi Lutke said management misjudged the growth e-commerce would see after the pandemic boom faded and now the company must adjust to meet slowing demand. SHOP will unveil its second-quarter earnings report before tomorrow's open.

- General Motors (GM) shed 3.4% after the carmaker reported second-quarter adjusted earnings per share of $1.14, falling short of analysts' consensus estimate. GM also said it was not able to ship roughly 100,000 vehicles by the end of the quarter due to parts shortages. On the upside, the company's Q2 revenue of $35.8 billion came in higher than expected and it maintained its full-year forecast. "We now see full-year results coming in at the lower end of guidance as it struggles with inflation, supply-chain issues, and weaker volumes than a year ago," says CFRA Research analyst Garrett Nelson, who lowered his rating on GM to Hold from Buy. "We think still more patience is going to be required of investors before shares begin to turn the corner – and its EV transition could see some speed bumps.

Play Defense With Low-Vol Stocks

Ongoing concerns about inflation were also evident in the latest consumer sentiment data that hit the Street today. Specifically, the Conference Board's consumer confidence survey for July fell to 95.7 from June's 98.4, marking its third straight monthly decline and the lowest reading since February 2021. Survey participants continued to cite rising gas and food prices as their main worries.

"As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July. Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months," the report indicated.

The latest rate hike from the Federal Reserve is due out tomorrow, with the market pricing in a 75 basis-point (a basis point is one-one hundredth of a percentage point) increase. However, "the Fed has indicated nothing's off the table for this Wednesday's meeting and that will sway markets one way or another," says Jeff Klingelhofer, co-head of investments at Thornburg Investment Management. The central bank has to nail this, he adds. "Too high of a hike will send markets spiraling and too low will keep inflation burning hot."

For investors, the uncertainty can be unnerving, but Klingelhofer says the best thing they can do in today's market is to get defensive via high-quality fixed-income plays and dividend-paying stocks. Another way for investors to prioritize defense is with low-volatility stocks, which can provide stability to portfolios amid the market's twists and turns. Here, we take a look at 10 top-rated names that fit this bill.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.