Stock Market Today: Stocks End Lower Ahead of Tech Earnings, Fed Meeting

Consumer discretionary stocks lagged after grill maker Weber (WEBR) warned of ongoing macroeconomic headwinds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks were choppy Monday as investors looked ahead to a busy week. In addition to Big Tech earnings slated for release over the next several sessions, the Federal Reserve's latest policy decision is due out Wednesday afternoon.

"The Fed is still in a very good position to deliver another 75 basis-point hike as inflation stays around a four-decade high and as the economy is still adding jobs at a healthy clip," says Edward Moya, senior market strategist at currency data provider OANDA. "Since the Fed was late to fight inflation, it should not come as a surprise that they will try to remain aggressive with tightening as the [economic] outlook dims."

The energy sector (+3.7%) outperformed today as U.S. crude futures jumped 2.1% to $96.70 per barrel, while consumer discretionary stocks (-0.9%) lagged on a sharp selloff in Weber (WEBR, -12.7%) shares. The grill maker issued preliminary fiscal third-quarter sales figures that came in well below analysts' consensus estimate and withdrew its full-year guidance, citing "rising inflation, supply-chain constraints, fuel prices and geopolitical uncertainty." Weber also said it is replacing its CEO, effective immediately, as it looks to better position itself "to navigate historic macroeconomic challenges."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

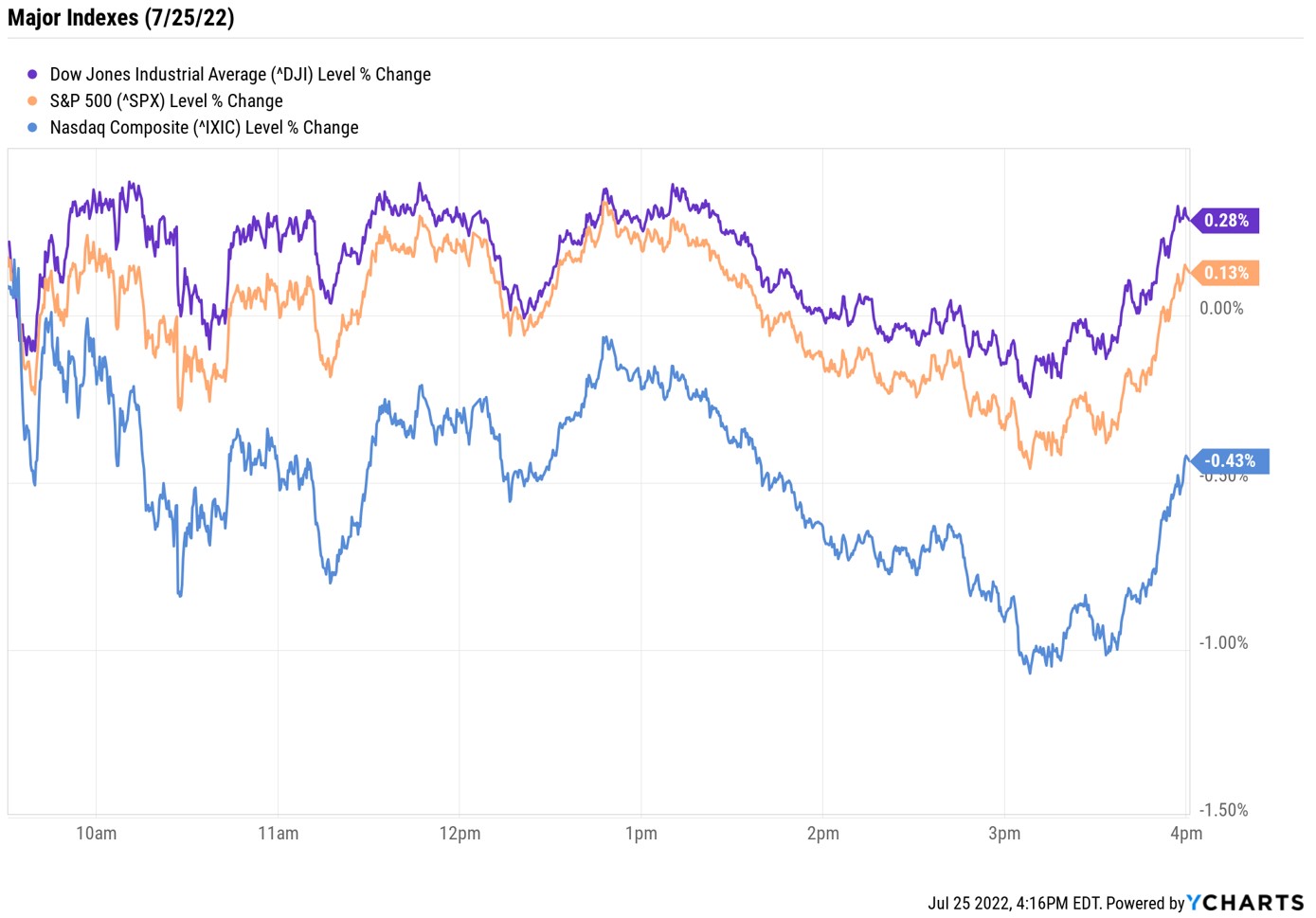

As for the broader markets, the Dow Jones Industrial Average ended the day up 0.3% at 31,990 and the S&P 500 Index gained 0.1% to 3,966. The Nasdaq Composite, meanwhile, shed 0.4% to 11,782 as semiconductor stocks like Marvell Technology (MRVL, -2.5%) and Nvidia (NVDA, -1.7%) sold off.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.6% to 1,817.

- Gold futures fell 0.5% to $1,719.10 an ounce.

- Bitcoin slumped 3% to $21,906.41. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Newmont (NEM) spiraled 13.2% after the mining company reported second-quarter adjusted earnings of 46 cents per share on revenue of $3.06 billion, falling short of analysts' consensus estimates. The company also said costs applicable to sales (CAS) were up 23.4% year-over-year for the three-month period, due to higher labor and fuel costs. Several other gold stocks fell in sympathy with NEM, including Agnico Eagle Mines (AEM, -4.6%) and Barrick Gold (GOLD, -2.78%).

- Travelers (TRV, +2.3%) was the second-best Dow Jones stock today – coming in just behind energy giant Chevron (CVX, +3.0%) – after Raymond James analyst C. Gregory Peters upgraded the insurance name to Strong Buy from Market Perform (Neutral). The analyst listed several reasons why TRV "could be positioned to continue outperforming on a relative basis," including a solid uptrend in its Business Insurance segment's renewal pricing, upcoming rate increases in both auto and homeowners' insurance and the stock's attractive valuation. "TRV is an industry leader in the independent agency channel and has averaged a return on equity above 13% over the last 10 years," Peters says.

Watch for Dividend Hikes This Earnings Season

As earnings season starts to heat up, investors will certainly be watching how companies are doing on their top and bottom lines, but they'll also be looking for dividend announcements. Many corporations tend to announce shareholder-friendly initiatives, such as stock buybacks or dividend hikes, in conjunction with their quarterly updates.

And given the turbulent market we've seen so far this year, "investors should be focused on the industry leaders," says Nancy Tengler, CEO and CIO of asset management firm Laffer Tengler Investments, particularly those with "strong free cash flow and dividend growers if possible."

Naturally, the best place for investors to find companies boosting their annual payouts is among the Dividend Aristocrats – the elite group of names in the S&P 500 Index that have raised their dividends for at least 25 consecutive years. Here, we take a closer look at the S&P 500's best dividend stocks. While they are scattered across nearly every sector, they share one thing in common: a commitment to dependable dividend growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.