Stock Market Today: Start of Earnings Season Gets Stocks off the Ground

Delta Air Lines, Fastenal kick off Q1 earnings season with Street-beating figures, helping to spearhead a market rebound Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. equities managed to snap their slide Wednesday as the first-quarter earnings season got off to a decent start.

Delta Air Lines (DAL, +6.2%) was one of the sharpest gainers in the S&P 500 after the airline posted both strong Q1 results and delivered a cheerful Q2 forecast. DAL's $9.35 billion in revenue topped expectations for $8.92 billion, while its net loss of $1.23 per share was under the $1.27 analysts were looking for. On top of that, Delta says second-quarter revenues will recover to just 3% to 7% below the pre-pandemic levels of Q2 2019 thanks to expectations of a robust travel season.

CEO Ed Bastian told CNBC today that Americans are "done investing in their homes and their garden and want to go see someone else's garden for a change."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The positive reaction to Delta Air Lines' earnings report gave a lift to fellow airline stocks. American Airlines Group (AAL) spiked 10.6%, while Southwest Airlines (LUV, +7.5%) and United Airlines (UAL, +5.6%) also finished the day solidly higher.

Fastenal (FAST, +2.2%) shares improved as well after reporting a profit of 47 cents per share on sales of $1.7 billion, both of which beat the Street's views.

Meanwhile, BlackRock (BLK, -0.2%), was roughly breakeven after it announced Q1 revenues of $4.7 billion that slightly missed the mark, but also better-than-expected adjusted earnings of $9.52 per share thanks to lower expenses.

Struggling a bit more was JPMorgan Chase (JPM, -3.2%), which struck a sour note despite topping expectations. Profits of $2.76 per share on $31.59 billion in revenues were better than respective estimates of $2.69 per share and $30.86 billion, but also represented 42% and 5% year-over-year declines, respectively. Among the items weighing on JPM was a $524 million charge tied to market turbulence amid Russia's invasion of Ukraine.

"The financial sector in general is under pressure over the past few weeks, and banks are almost at the bottom of the list," says Julius de Kempenaer, senior technical analyst at charting platform StockCharts.com. "One would think that the recent rise in interest rates would, to a degree, help banks, but the weak earnings report from JPM this morning suggests otherwise. Apparently the impact of rising inflation and geopolitical influences is more than offsetting the benefits from rising rates."

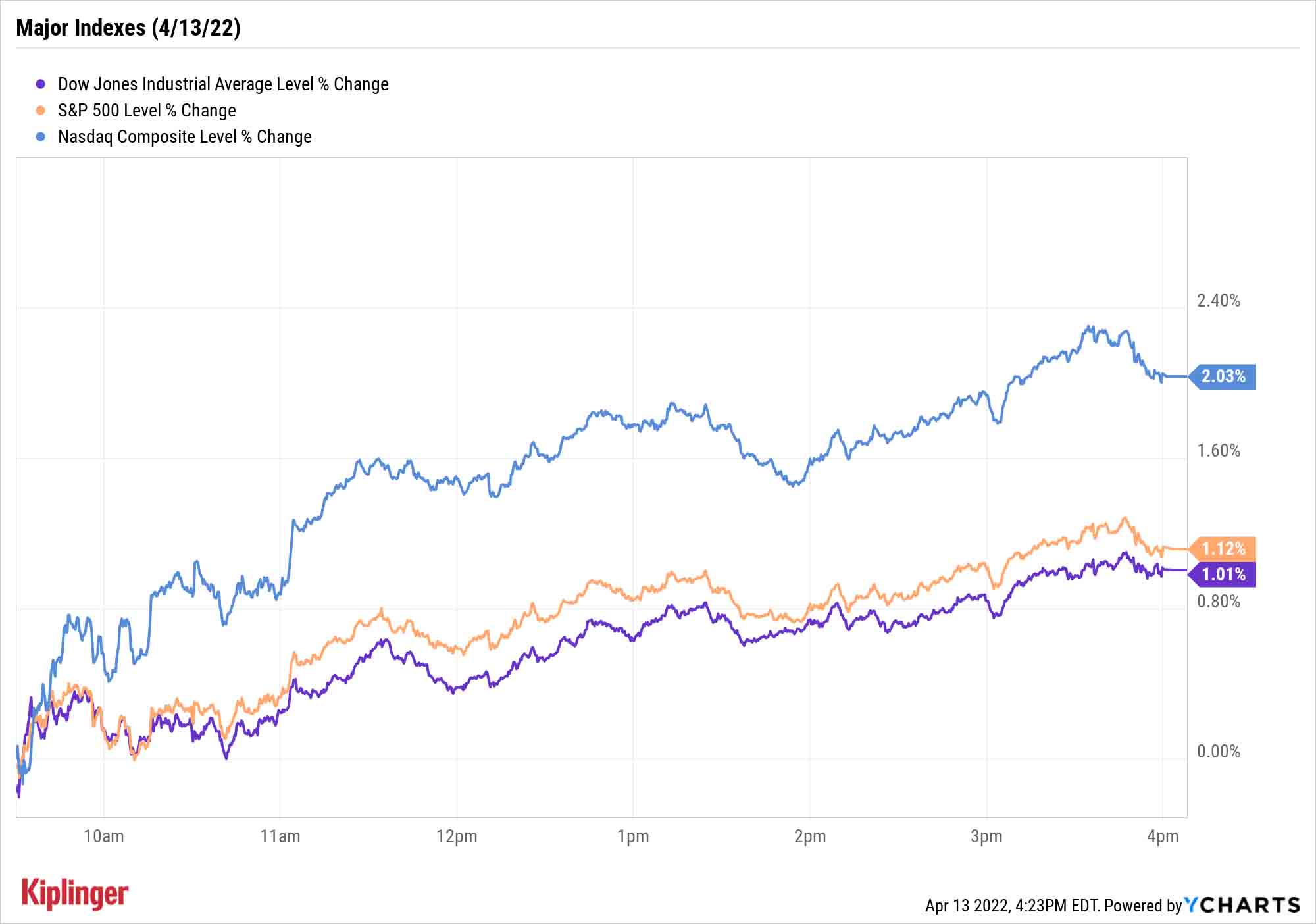

Advances in the consumer discretionary (+2.5%) and communication services (+1.5%) sectors put the Nasdaq Composite (+2.0% to 13,643) ahead of the other major indices. The S&P 500 closed 1.1% higher to 4,446, while the Dow Jones Industrial Average climbed 1.0% to 34,564.

The earnings calendar will continue Thursday, but Steve Sears, president of asset management firm Options Solutions, says that's not the only thing worth watching.

"April options expire on Thursday since the markets are closed on Friday," he says. "Options expirations have historically been mostly immaterial to the stock market, but don't tell that to investors. The growth in options trading during the COVID-19 pandemic has made options expirations as closely watched as the release of economic and inflation data."

Other news in the stock market today:

- The small-cap Russell 2000 jumped back above 2,000, gaining 1.9% to 2,025.

- U.S. crude oil futures jumped 3.6% to finish at $104.25 per barrel.

- Gold futures rose for a fifth straight day, gaining 0.4% to settle at $1,984.70 an ounce.

- Bitcoin stormed back from a recent slump, advancing 4.5% to $41,075.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Charles Schwab (SCHW) rose 4.7% after Morgan Stanley analyst Mike Cyprys elevated the financial stock to a "top pick" position. Shares are at a compelling entry point right now and SCHW should "see upward estimate revisions and greater investor appeal" as it benefits from the Federal Reserve's rate-hiking cycle and rising yields. Not only is SCHW a top pick at Morgan Stanley, but it's also one of Kiplinger's best stocks to buy for 2022.

- Walmart (WMT, +2.6%) said it has hired John Rainey to replace outgoing Chief Financial Officer Brett Biggs. Rainey, who currently serves as chief financial officer at PayPal (PYPL, -2.9%), will take over the reins on June 6.

What's the Top Dow Stock Right Now?

Where should investors be positioned as the Q1 earnings season gets underway?

Chris Haverland, global equity strategist for the Wells Fargo Investment Institute, notes that "earnings growth is expected to be concentrated in several cyclical sectors. The energy, industrials and materials sectors should lead the way, with energy earnings expected to grow by an eye-popping 255%."

However, it's possible that much of that backward-looking growth is priced into the sector right now – "forward guidance will be key as many companies continue to deal with rising input costs, a tight labor market, and continued global supply-chain constraints," Haverland adds.

More broadly speaking, however, Haverland is "most favorable" on higher-quality U.S. large-cap equities at the moment. Those wanting to follow that guidance would be hard-pressed to find much higher-quality companies than the blue chips of the Dow Jones Industrial Average – though even within the ranks of these 30 large- and mega-cap stocks, some investments look vastly superior compared to others.

Today, we've taken a fresh look at all 30 Dow Jones Industrial Average components, ranked based on the consensus analyst opinions of the dozens of pros covering each name.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.