Stock Market Today: Energy Rises, Comms Fall on Mixed Monday

Stocks broadly slip amid a slow-news Monday, but earnings and a pivotal CPI report are on deck later this week.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market followed up on its best weekly performance of 2022 with an up-and-down Monday session.

A slow day on the data front allowed investors to further process last week's better-than-expected January jobs report; that benefited cyclical sectors including energy stocks (+1.3%), which led the way despite a 1.1% decline in U.S. crude oil futures, to $91.27 per barrel. However, communication stocks including Meta Platforms (FB, -5.1%) and Google parent Alphabet (GOOGL, -2.9%) weighed on the major indexes.

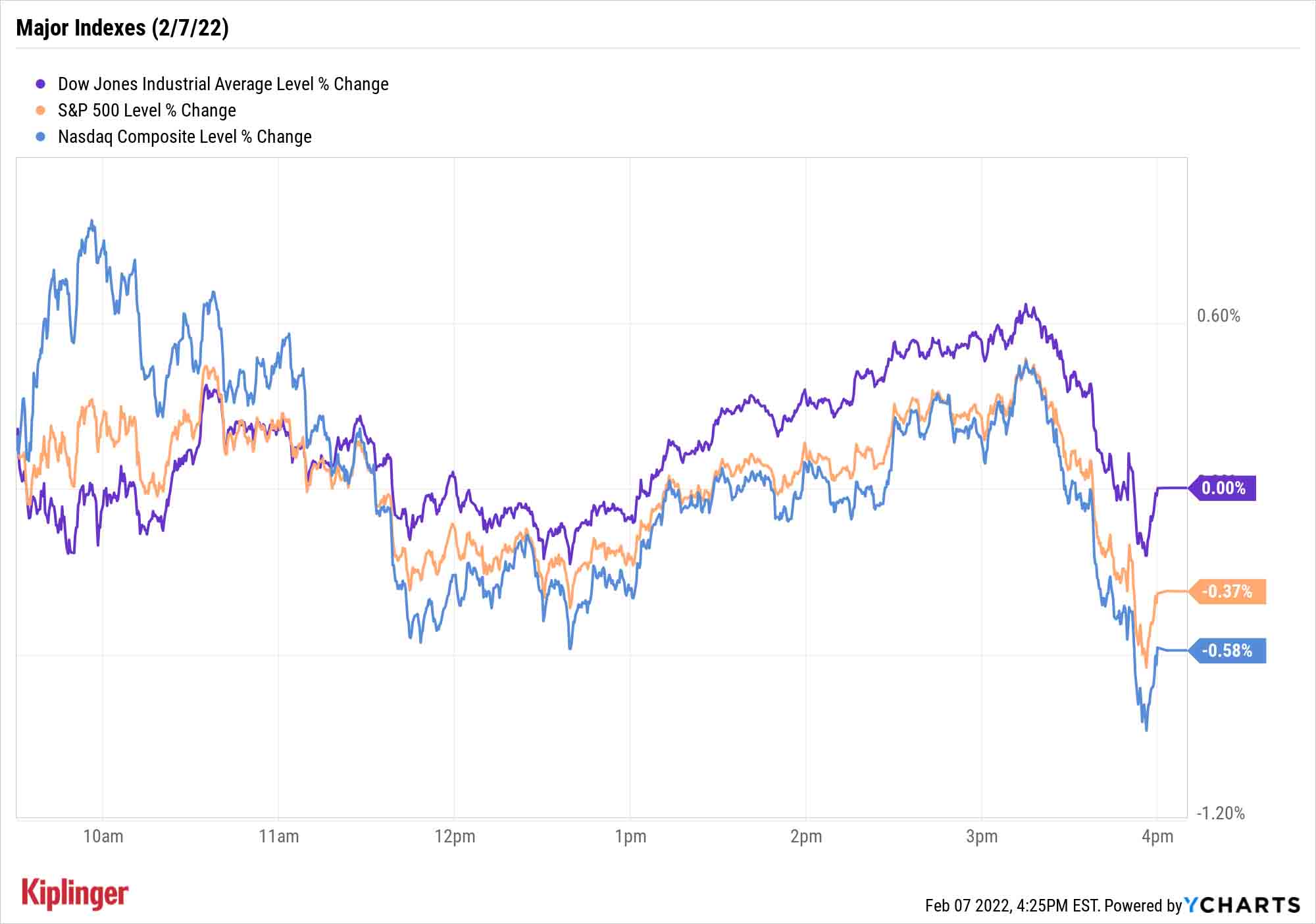

The Dow Jones Industrial Average finished marginally higher to 35,091, while the S&P 500 (-0.4% to 4,483) and Nasdaq Composite (-0.6% to 14,015) slipped, but by modest amounts.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There'll be plenty more to watch later this week, however. Walt Disney (DIS) and Coca-Cola (KO) are among the noteworthy companies reporting earnings this week, and Thursday's consumer price index report will provide another important update on America's inflation situation.

UBS estimates more big numbers for CPI – 0.4% for the month, and a 7.2% 12-month rate – and believes CPI increases will remain elevated for the next few months. However, "in Q2, with rents starting to slow, and motor vehicle production and inventories gradually rising and weighing on vehicle prices, monthly core price increases should begin to slow more rapidly," UBS analysts say.

Melissa Brown, global head of applied research at financial intelligence firm Qontigo, notes that another measure of inflation has actually remained quite low.

"The inflation issue highlights the stark contrast between Main Street and Wall Street. High reported inflation has dominated the news, and clearly consumers are hurting from higher prices. And this is what the Fed is looking to address," she says. "But breakeven inflation – a measure of future inflation expectations – remains relatively low, and has even fallen slightly since the beginning of the year.

"Investors setting the breakeven rates do not seem overly concerned and likely expect that realized inflation will fall – maybe because the effects are temporary, or maybe because the Fed acting will drive inflation back down."

Other news in the stock market today:

- The small-cap Russell 2000 finished decently in the green, gaining 0.5% to 2,012.

- Gold futures gained 0.8% to settle at $1,821.80 an ounce.

- Bitcoin continued to recover from last week's slump, rebounding 8.9% to $44,165.96. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Peloton (PTON) jumped 20.9% after a late-Friday report in The Wall Street Journal suggested the at-home fitness equipment maker has caught the eye of several high-profile suitors. The article cited people familiar with the matter, who listed e-commerce Amazon.com (AMZN) as one potential bidder, but said no deals have been made. "Assuming Peloton's founders and largest shareholders are open to a takeout (a key assumption), we would view Amazon and Apple (AAPL) as the more likely suitors for the company. For Amazon in particular, we see several potential benefits from a Peloton acquisition," says Truist Securities analyst Youssef Squali (Hold). Specifically, Squali points to the e-commerce giant's growing health and wellness segment, "clear and material synergies" with Amazon Prime and the fact that Peloton would likely win market share as a part of Amazon as reasons a potential AMZN-PTON marriage could work.

- Spirit Airlines (SAVE, +17.2%) and Frontier Group Holdings (ULCC, +3.5%) made headlines on M&A Monday after the two airlines said they agreed to combine in a cash-and-stock deal (including net debt and operating lease liabilities) worth roughly $6.6 billion. As part of the deal, SAVE shareholders will receive 1.9126 ULCC shares plus $2.13 in cash for each share owned. If the merger is approved, it will create the largest ultra low-cost airline in the U.S. The news helped boost other airline stocks today, including JetBlue Airways (JBLU, +3.6%), Southwest Airlines (LUV, +2.2%) and Alaska Air Group (ALK, +3.5%).

These Stocks Look "Agitated"

From time to time, we highlight groups of stocks that various types of experts have signed off on.

Our "Pros' Picks," for instance, detail which stocks are most popular among the Wall Street analyst crowd. We regularly keep you updated on what's floating around in Warren Buffett's Berkshire Hathaway portfolio, and we also keep tabs on stocks attracting a lot of hedge fund attention.

For the most part, all of these experts are fairly hands off – analysts research from the sidelines, and most big-money investors are typically happy to simply invest their money and leave it at that.

But a select few like to get more involved – these "activist investors" will build up stakes and agitate for changes they believe will unlock at least short-term (and sometimes long-term) value for shareholders, going so far at times as to replace board members or attempt to oust a CEO.

While they're not always successful, their mere presence can excite current and prospective shareholders alike, and sometimes, the policies they push through can result in meaningful returns. Today, we're highlighting seven stocks that have attracted activist investors, and explaining the changes that might be in store.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.