Stock Market Today: Alphabet, Growth Names Add More Fuel to the Rally

Earnings beats by Google's parent company, as well as other technology and communications stocks, helped lift the major indexes Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

So far, so good in February's early days, as Wednesday's session saw stocks continue their recent rebound on the back of encouraging corporate earnings.

The day started off with a potential blow to the nascent rally: ADP reported that private payrolls dropped by 301,000 in January – a huge whiff from estimates for 200,000 and the first decline since December 2020.

"The details of the ADP employment report indicate a large and likely temporary drag from omicron on January employment," say Goldman Sachs Economics Research strategists. "We continue to expect a 250,000 decline in nonfarm payrolls in Friday's report."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, "expectations for the January jobs data have ratcheted lower due to the recent omicron wave," says New York Stock Exchange Senior Market Strategist Michael Reinking, which could explain the market's lack of a reaction to the downbeat news. Reinking adds that small businesses accounted for half of the overall job losses.

Rather, investors were more interested in the earnings calendar.

Alphabet (GOOGL, +7.5%) made a splash by announcing a 20-for-1 stock split that, if approved, would take place in July. Moreover, the tech giant easily eclipsed Wall Street estimates for fourth-quarter income and revenue, thanks to a strong performance and upbeat outlook in search.

"We expect search to continue to gain relevance as commerce continues to shift to omnichannel," says Wedbush analyst Ygal Arounian, noting that GOOGL remains the firm's favorite large-cap stock.

Match Group (MTCH, +5.3%) and Advanced Micro Devices (AMD, +5.1%) also helped propel Wednesday's session with Street-beating results of their own.

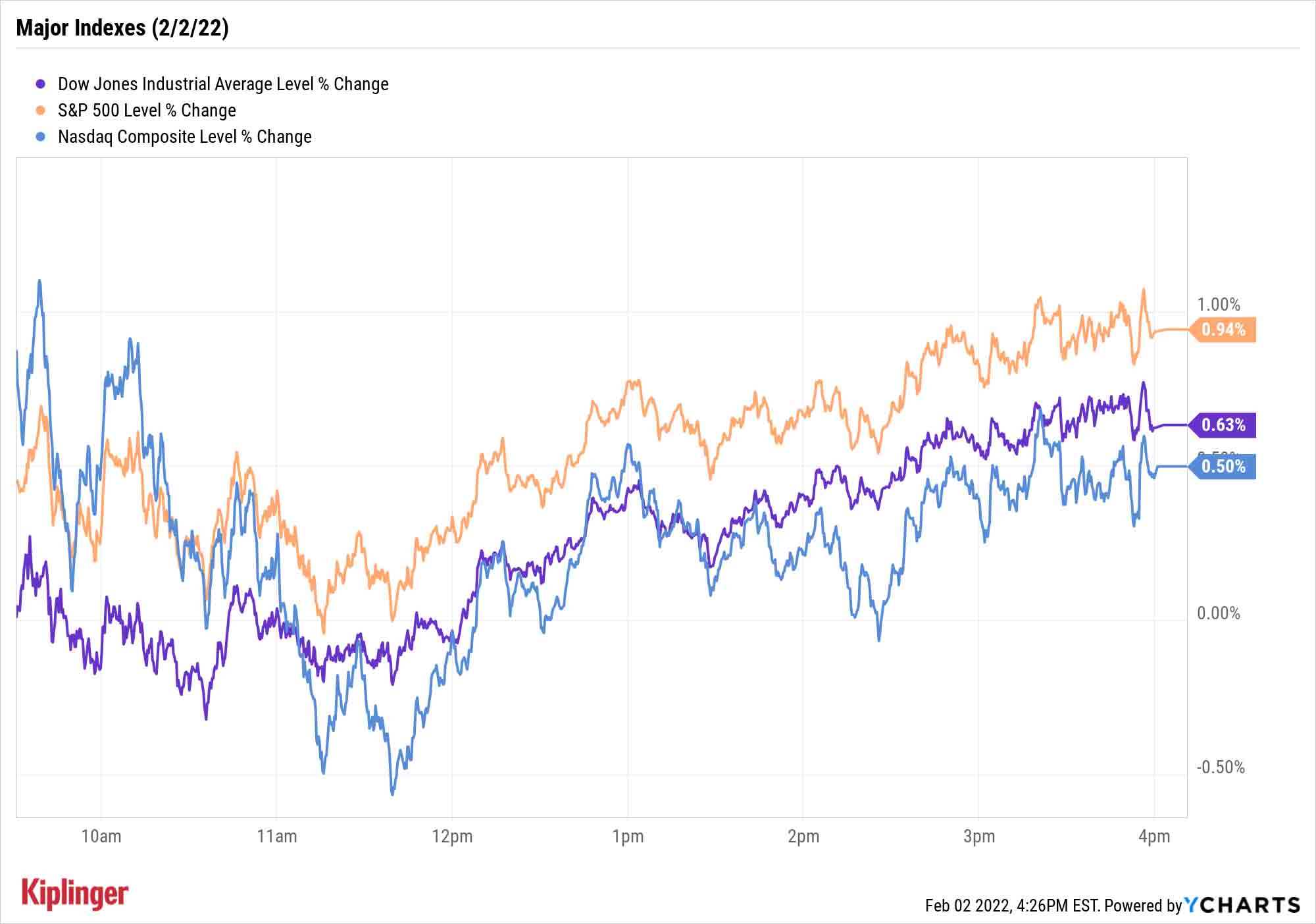

The S&P 500 led the major indexes with a 0.9% gain to 4,589, while the Dow Jones Industrial Average (+0.6% to 35,629) and Nasdaq Composite (+0.5% to 14,417) also closed higher.

Other news in the stock market today:

- The small-cap Russell 2000 didn't join its larger-cap brethren, declining 1.0% to 2,029.

- U.S. crude oil futures posted a modest gain to settle at $88.26 per barrel after the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to increase output by an additional 400,000 barrels in March – in line with their previously outlined plan.

- Gold futures edged up 0.5% to finish at $1,810.30 an ounce.

- Bitcoin did not join the markets in their rally, declining 2.4% to $37,606.65. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- It was a bruising session for PayPal Holdings (PYPL), which plunged 24.6% after earnings. While the digital payments company reported better-than-expected revenue in its fourth quarter ($6.92 billion actual vs. $6.87 billion expected), adjusted earnings per share of $1.11 fell short of the $1.12 per share anticipated. PYPL also projected current-quarter earnings of 87 cents per share, well below analysts' consensus estimate of $1.16 per share, and said revenue is likely to grow at a slower-than-expected pace in fiscal 2022. This soft forecast comes amid eBay's (EBAY, -3.2%) challenging migration to its own payments processor and other factors like inflation negatively impacting cross-border payments, according to PayPal CEO Dan Schulman. PYPL's really bad day spread to other fintech stocks, with Block (SQ, -10.6%) and Shopify (SHOP, -10.0%) also ending the day solidly in the red.

- Under Armour (UAA) rose 2.7% today after Morgan Stanley analyst Kimberly Greenberger upgraded the athletic apparel and footwear maker to Overweight from Equalweight (the equivalents of Buy and Hold, respectively). "Current trading levels suggest the market 1) may have unfairly penalized UAA's stock for holiday weakness in specialty retail without considering its differentiated model and product exposure, and 2) may not recognize the opportunity for positive 2022 earnings per share revisions," the note says. As such, Under Armour could be poised for a first-half outperformance relative to its sportswear peers. On Tuesday, UBS analyst Jay Sole reiterated his Buy rating on UAA, saying its "turnaround story continues." Sole expects Under Armour to turn in a solid earnings beat when it reports earnings the morning of Friday, Feb. 11, which he believes will "boost sentiment" on the stock.

Can Growth Pick Up the Slack?

The market's weak start to 2022 is partly due to the underperformance of the growth investing style, which relies on many of the S&P 500's biggest companies. But at least the beginnings of a shift are starting to appear.

"Both Apple (AAPL) and Microsoft (MSFT) are performing well after their earnings releases last week, with both stocks regaining much of their losses from the first few weeks of 2022," says David Keller, chief market strategist for financial charting platform StockCharts.com.

He adds that, in the short term, this week's reports from Alphabet, Facebook (FB) and Amazon.com (AMZN) could be pivotal in where the broader market goes from here.

Heading into the new year, most picks for the best stocks for 2022 came from the value camp. And thus far that investing style has lived up to its promise, with value outperforming growth by nearly 9 percentage points. However, strong returns from the aforementioned mega-caps offer reassuring signs that growth stocks still have life in them.

UBS analysts, for example, say growth stocks' year-to-date weakness affords investors a prime opportunity to buy high-upside stocks on the cheap. These 15 growth investing names in particular look like bargains, notes UBS.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.