Stock Market Today: Stocks Resume Slide on Busy News Day

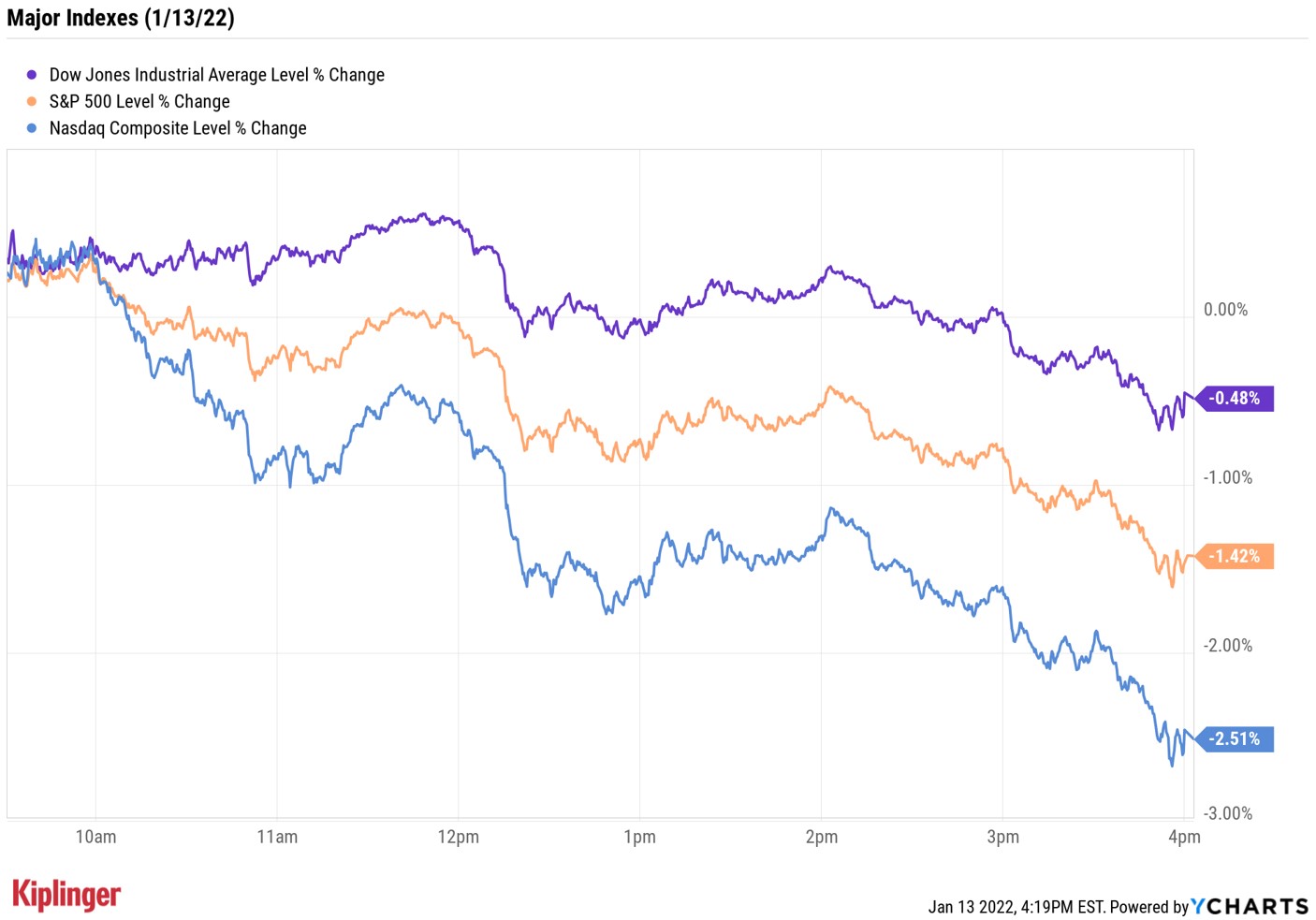

The major benchmarks started the day in positive territory, but were bathed in red ink by the close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Choppy trading continued on Wall Street as investors balanced good news, bad news headlines.

On the economic front, weekly jobless claims edged up a seasonally adjusted 230,000 last week – more than economists were expecting – though the four-week moving average remained near a record low.

The Labor Department also said that December's producer price index – which measures how much suppliers are charging businesses for goods – was up 9.7% annually and 0.2% sequentially. While the former was the highest annual increase since the year-over-year data were first tracked in 2010, the latter marked the slowest month-over-month rise since November 2020.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors also got their first look at the fourth-quarter earnings season, which kicks off in earnest tomorrow morning when several big banks report.

This morning, though, Delta Air Lines (DAL, +2.1%) reported a larger-than-anticipated adjusted profit for its fourth quarter and its highest quarterly revenue since the pandemic began. However, for the current quarter, CEO Ed Bastian warned the omicron variant of COVID-19 "is expected to temporarily delay the demand recovery" into February.

By the close, markets had erased earlier gains to end solidly in the red. The Nasdaq Composite suffered the worst, shedding 2.5% to 14,806. The S&P 500 Index lost 1.4% to 4,659 and the Dow Jones Industrial Average gave back 0.5% to 36,113.

Other news in the stock market today:

- The small-cap Russell 2000 dropped 0.8% to 2,159.

- A day after reporting low crude oil inventories, the Energy Information Administration said gasoline supplies had risen by 8 million barrels, much more than expected. That sent U.S. crude oil futures 0.6% lower to $82.12 per barrel.

- Gold futures snapped a four-day win streak, declining 0.3% to $1,821.40 per ounce.

- Bitcoin wasn't immune to the selling, giving back 2.4% to $42,803.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Large-cap technology and tech-esque stocks were among the worst performers of the day. Among notable decliners were ServiceNow (NOW, -9.1%), Tesla (TSLA, -6.8%), Nvidia (NVDA, -5.1%), Microsoft (MSFT, -4.2%), Salesforce.com (CRM, -3.9%), Netflix (NFLX, -3.4%) and Broadcom (AVGO, -4.0%).

- KB Home (KBH, +16.5%) rocketed higher Thursday as Street-beating profits more than overshadowed a miss in revenues. KBH reported fourth-quarter sales growth of 40% year-over-year to $1.68 billion, which was slightly less than estimates for $1.71 billion. That said, profits of $1.91 per share easily topped expectations for $1.76 per share, thanks in large part to a 9% pop in average selling price, to $451,000. "We expect strong demand in 2022 as KBH's pricing power is able to pass on higher costs to higher prices with limited supply," says CFRA analyst Kenneth Leon, who reiterated his Buy rating on KBH shares and raised his price target to $59 per share from $49 previously.

Bumps Equal Opportunities for Investors

Now is the time for conviction. That's according to Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

As we enter the part of the economic cycle where the Federal Reserve is beginning to normalize its policy after years of providing support and concerns over growth begin to emerge, it's understandable if investors feel unnerved.

"Investors need to go through a mental adjustment process and realize that the road ahead is likely to feature a few more bumps than the one traveled over the past 20 months," he says. But bumps, Wren adds, also offer opportunities.

We at Kiplinger have been busy compiling plenty of potential investing ideas for the new year – including the top financial stocks and the best tech names.

We've also highlighted numerous high-conviction picks from the analyst community; most recently, breaking down RBC Capital Markets' top 30 global stock investments for 2022. Despite the numerous hurdles investors are facing in the new year, industry analysts are "generally confident" these picks can clear them. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.