RBC's Top 30 Global Stock Investments for 2022

Inflation. Supply-chain issues. COVID. Investors face numerous hurdles in 2022, but RBC is confident in these 30 stocks' ability to weather the storm.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It will be tough to top the S&P 500's whopper of a performance in 2021. But investors can still look forward to "solid" if more "moderate" returns in the year ahead, says RBC Capital Markets – and perhaps even better with the right stock investments.

"The overall outlook for the next six to 12 months remains optimistic due to strong assessments for fundamentals, valuations, cash deployment and margins, balanced by more cautious views regarding fiscal policy," writes the U.S. Equity Strategy team at RBC.

True, COVID-19, inflation, labor, supply chain, pricing power and regulation remain key concerns, the strategists note. However, RBC industry analysts remain "generally confident in their companies' ability to manage through challenges, including omicron."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

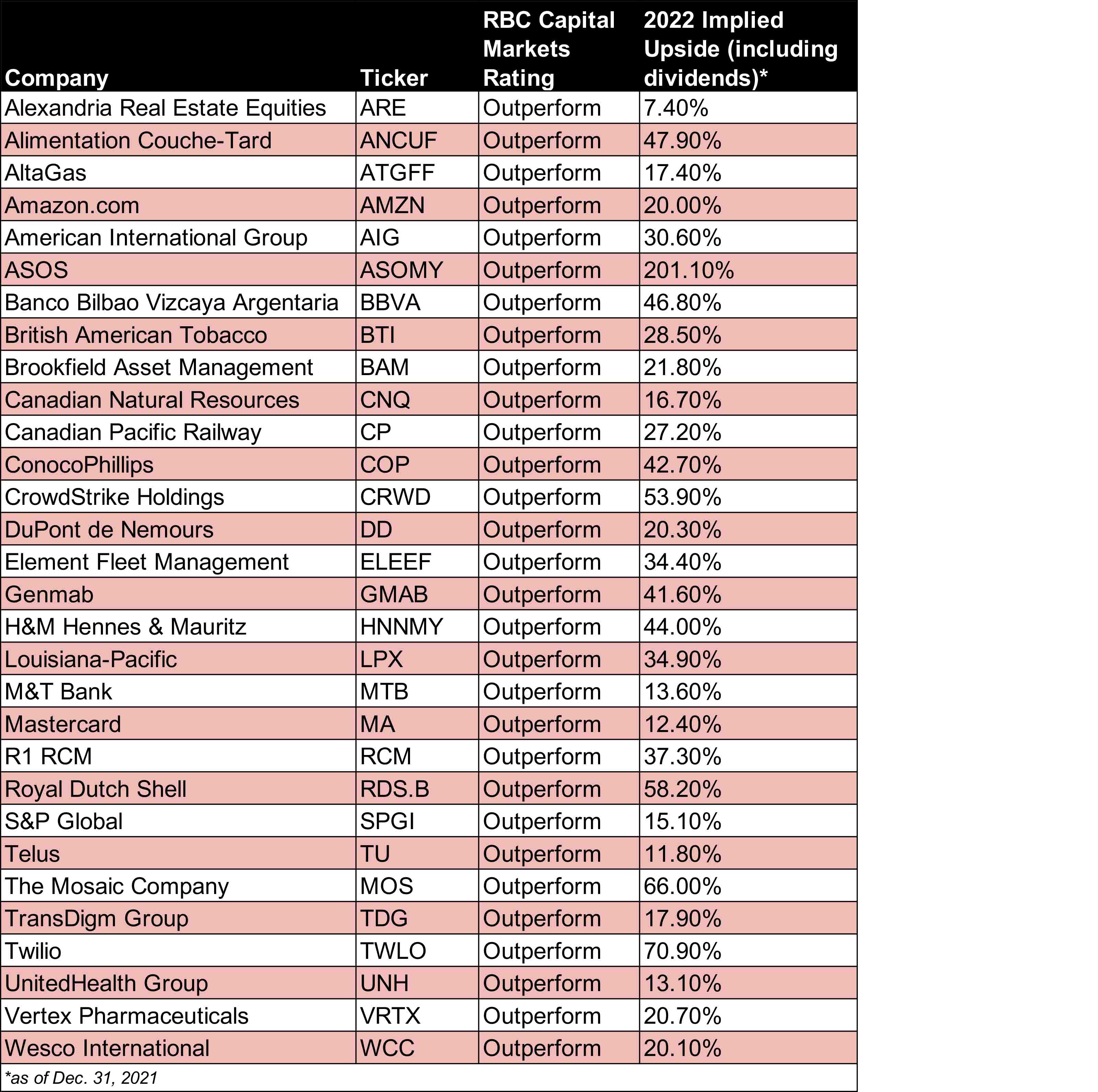

With those factors in mind, RBC Capital Markets has put together a list of their top 30 global stock investments for the year ahead. The equity strategy team's picks span the market's 11 major sectors, and in many cases overlap with Kiplinger's own 22 best stocks to buy for 2022.

Some highlights include:

- S&P Global (SPGI, $435.39). The provider of financial information, analytics and credit ratings products ranks as one of Wall Street's 12 best financial stocks. RBC is on board as well, thanks to the firm's strategic acquisition of IHS Markit (INFO). The deal, which is expected to close in the first quarter, "should accelerate [SPGI's] revenue growth profile and deliver double-digit earnings growth driven by upside to revenue and cost synergies," RBC says. (Share prices as of Jan. 10. Analysts' consensus recommendations and other data courtesy of S&P Global Market Intelligence, unless otherwise noted.)

- ConocoPhillips (COP, $81.03). The independent oil and gas exploration & production company "offers a returns-focused value proposition, a strong balance sheet, and peer-leading distributions," RBC says. The broader analyst community definitely agrees, giving COP a consensus recommendation of Buy, with high conviction, according to S&P Global Market Intelligence. Indeed, the Street is so bullish on the name that SPGI makes the list of 9 best energy stocks to buy for 2022.

- UnitedHeath Group (UNH, $465.00). The nation's largest health insurer by market value and revenue routinely ranks among analysts' top-rated Dow Jones Industrial Average stocks, and makes the list of Wall Street's 12 best healthcare stocks to buy for 2022, as well. "Despite its scale, we believe the company offers investors a strong growth profile and excellent visibility, with earnings per share increasing at a targeted 13% to 16% clip annually," notes RBC.

See the table below for RBC Capital Market's full list of 30 best global stock investments for 2022. And be sure to check out Wall Street's top stocks to buy across individual market sectors, including analysts' 12 best industrial stocks to buy for 2022, their 12 best real estate investment trusts (REITs) and their top 12 communications services stocks for the new year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

5 Actions to Set Up Your Business With Your Exit in Mind

5 Actions to Set Up Your Business With Your Exit in MindWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.