Stock Market Today: S&P 500 Hits Record High Ahead of Christmas

Today's onslaught of economic reports included the latest updates on inflation and consumer spending.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks suffered steep losses to start Christmas week, but a three-day recovery put one of the major benchmarks in record-high territory ahead of the long holiday weekend. (As a reminder, Christmas Eve is a full-day stock market holiday this year.)

Volume was lighter than usual Thursday, with many on Wall Street logging off to start their holiday celebrations early. However, there was still plenty of economic data to mull over for those who did stick around, including the latest reading on inflation.

The personal-consumption expenditures index – also known as the Federal Reserve's preferred price gauge – rose 5.7% year-over-year in November, the fastest pace since 1982. Excluding the volatile food and energy sectors, the index increased 4.7% on an annualized basis, the highest reading in 32 years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also seen amid the onslaught of economic data released today was the latest update on consumer spending, which rose 0.6% month-over-month in November, slower than the 1.4% increase seen in October.

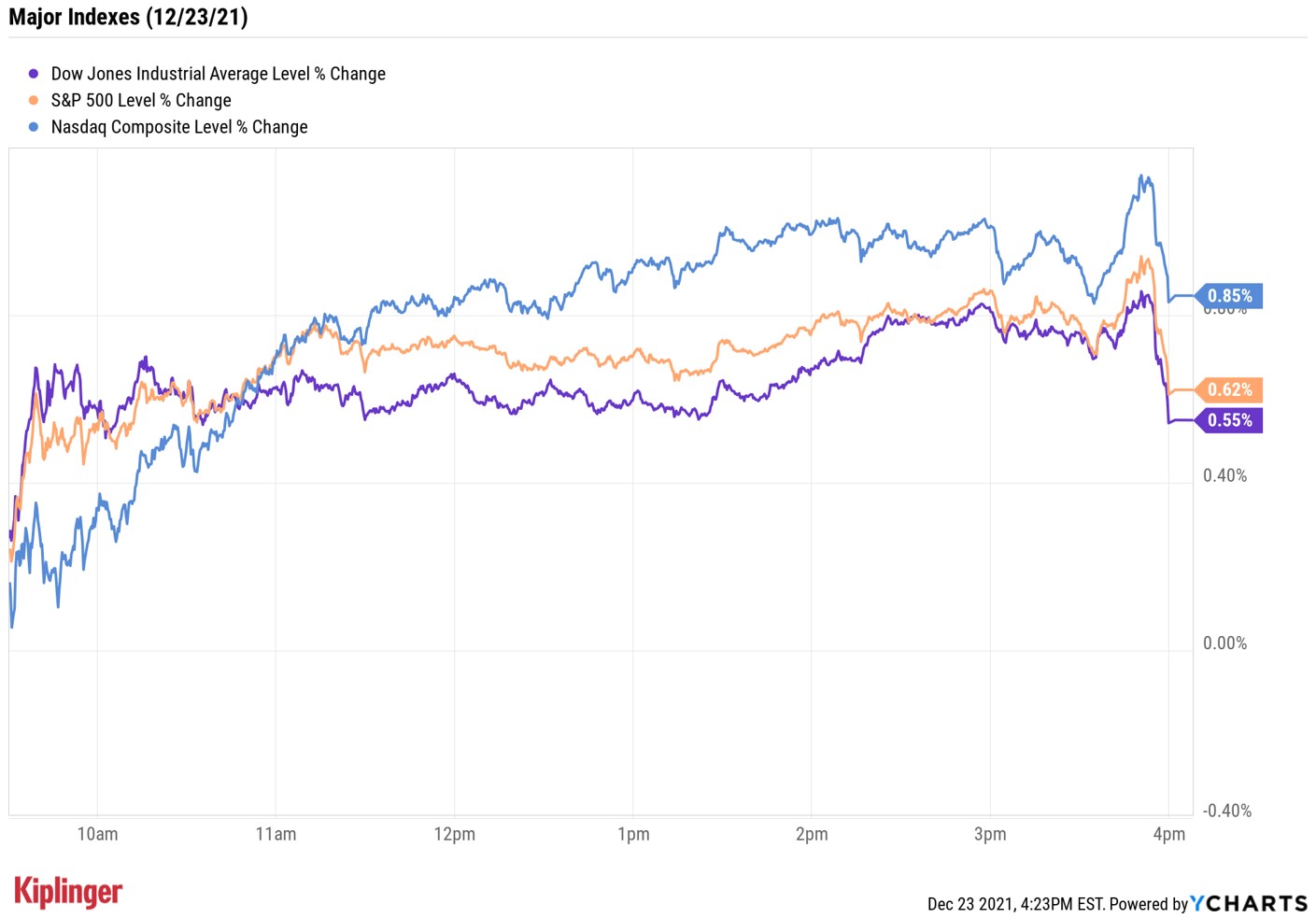

The major indexes all notched solid wins, with the S&P 500 Index's 0.6% gain to 4,725 enough for a new record high. The Dow Jones Industrial Average ended the day up 0.6% at 35,950, while the Nasdaq Composite rose 0.9% to 15,653.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 0.9% to 2,241.

- U.S. crude oil futures rose 1.4% to settle at $73.79 per barrel.

- Gold futures gained 0.5% to finish at $1,811.70 an ounce.

- Bitcoin spiked 4% to $50,959.36. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Nikola (NKLA) soared 18.0% after the electric-truck maker made a post on Twitter late Wednesday. The tweet included pictures of a customer receiving a Tre battery-electric vehicle, with the caption "Our first customer delivery done, and more to come." NKLA stock has had a rough go of it in 2021, down more than 60% from its late-January record high above $30.

- Crocs (CROX) was a big decliner in today's trading, shedding 11.6%. The footwear maker said it would buy privately held rival Heydude in a cash-and-stock deal valued at $2.5 billion. "Heydude has experienced incredible growth in revenue and profits over the past few years," said Anne Mehlman, chief financial officer at Crocs. "Heydude is expected to be immediately accretive to our high revenue growth, industry-leading operating margins and earnings. We expect the combined business to generate significant free cash flow, enabling us to quickly deleverage while investing to support future growth. We are excited about the combination and are confident in our ability to deliver long-term shareholder value." The acquisiton is expected to close in the first quarter of 2022.

Ho! Ho! Ho!

Are we seeing the start of the Santa Claus rally? The S&P 500 ended the week up 2.3% – and the momentum could just be getting started, if history is any guide.

The "Santa Claus Rally is the final five trading days of the year and first two trading days of the following year," says Ryan Detrick, chief market strategist at LPL Financial. Going back to 1950, the S&P 500 has been higher 78.9% of the time over this seven-day stretch, averaging a 1.3% return, according to Detrick.

Why are these seven days so strong? "Whether optimism over a coming new year, holiday spending, traders on vacation, institutions squaring up their books – or the holiday spirit – the bottom line is that bulls tend to believe in Santa," he adds.

Seasonal tendencies such as these are great for investors looking to make short-term tweaks or aggressive bets, but investors looking for buy-and-hold solutions may want to be more tactical in their approaches. One way to do this is to follow what the so-called "smart money" is doing.

Recently, hedge funds and other billionaire investors like Warren Buffett released information about their latest trades. Read on as we uncover the highest-conviction stock picks smart-money investors made in the third quarter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.