Stock Market Today: Stocks End Mixed After Data Dump

Initial unemployment claims fell to a 52-year low last week.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors had plenty to think about ahead of the Thanksgiving holiday, chewing through a huge helping of economic data.

Kicking things off were weekly jobless claims – released a day early due to tomorrow's holiday – which plunged to 199,000 in the week ended Nov. 20, well below last week's 270,000 and economists' forecast for 260,000 claims. What's more, this was the lowest level for initial unemployment applications since 1969.

Also in focus were October's personal income and spending data, which came in above estimates (up 0.5% and 1.3%, respectively, from September), and an upwardly revised reading on third-quarter gross domestic product (to 2.1% versus an initial estimate of 2.0%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, it wasn't all roses. The University of Michigan's consumer sentiment index arrived at its lowest level in 10 years in November and the core personal consumption expenditures (PCE) index – a key inflation measure used by the Federal Reserve – rose 4.1% year-over-year in October, the quickest annual pace since 1991.

Plus, the release of the minutes from the latest Fed meeting showed several members of the committee said the central bank "should be prepared to adjust the pace of asset purchases" and/or raise interest rates sooner than anticipated if inflation continues to run hot.

"In terms of the Fed's economic outlook, it's clear that inflation has accelerated more than anyone expected it to, and the breadth of rising prices has increased substantially," writes Bob Miller, BlackRock's Head of Americas Fundamental Fixed Income.

"While the bar for an acceleration in the tapering of asset purchases is high, it is not insurmountable and looks reasonably likely to be cleared should we see another solid payroll report and inflation data release in December," he adds. "Accelerating the asset purchase tapering would potentially end purchases in March 2022 and would then open the door for the Committee to consider lift off from the zero policy rate sometime in the second quarter of the year."

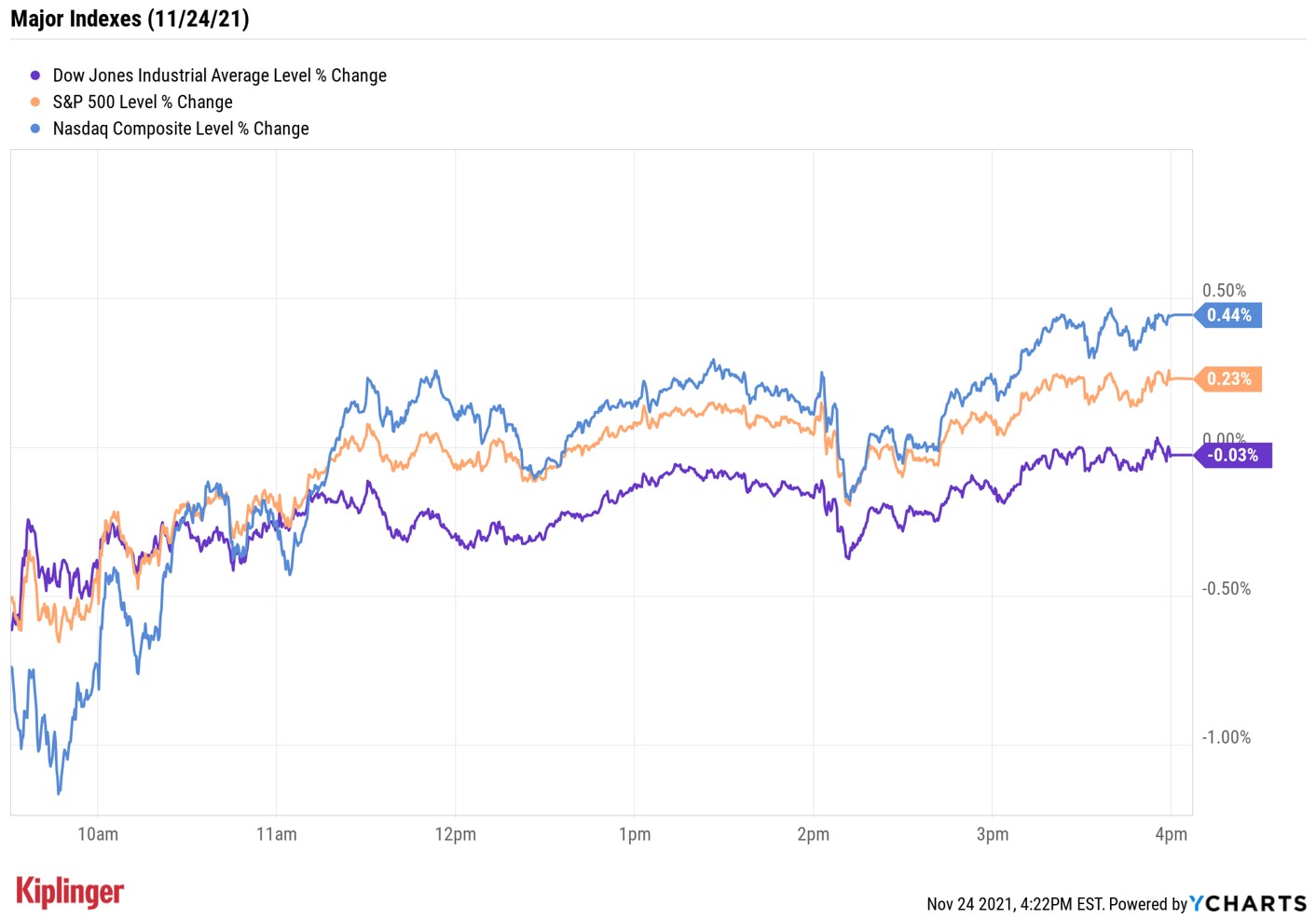

At the close, the S&P 500 Index was up 0.2% at 4,701 and the Nasdaq Composite had gained 0.4% at 15,845. The Dow Jones Industrial Average wasn't as resilient, falling 0.03% to 35,804.

As a reminder, the U.S. stock market will be closed tomorrow for Thanksgiving and trading will end early on Black Friday.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.2% to 2,331.

- U.S. crude futures slipped 0.1% to end at $78.39 per barrel.

- Gold futures eked out a marginal gain to settle at $1,784.30 an ounce.

- Bitcoin retreated 0.7% to $57,453.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Gap (GPS) took it in the chin after earnings, with shares sliding 24.1%. In its third quarter, the clothing retailer reported adjusted earnings of 27 cents per share on $3.94 billion in revenue, well below the 50 cents a share and $4.43 billion in sales analysts were expecting. GPS also lowered its full-year forecast, citing rising freight costs and supply-chain disruptions due to factory closures in Vietnam. "In the third quarter, the Athleta and Gap brands continued to be the bright spots for GPS, as the brands have grown 48% and 8%, respectfully, compared to fiscal 2020," says CFRA Research analyst Zachary Warring, who maintained his Hold rating on the stock while lowering his price target by $8 to $22. "The company reiterated its plan to open between 30 and 40 Old Navy stores and 20-30 Athleta stores in 2021 while closing 75 Gap and Banana Republic stores. We need to see how sales and margins hold up in fiscal 2023 to get more bullish on shares of GPS."

- Supply-chain issues were also a noted in Nordstrom's (JWN) quarterly update. "While many retailers are dealing with macro-related supply chain disruptions, Rack [the retailer's off-price chain] faces a unique challenge as off-price procurement of the same top brands we carry at Nordstrom is particularly difficult in an environment with production constraints and lower levels of clearance product," said CEO Erik Nordstrom in the earnings call. While Rack contributed to roughly 50% of total sales in 2019, he added, it's only brought in 42% of sales for the year-to-date. Overall, the company reported earnings of 39 cents a share and revenue of $3.6 billion in its third quarter, missing analysts' estimates for earnings of 57 cents per share and revenue of $3.5 billion. The stock plunged 29% today.

The Pricing Power Advantage

Some of the best stocks to buy now are those that are able to navigate higher inflation.

Pricing power should be an important theme for investors when assessing relative returns of stocks, says a group of analysts at global research firm UBS, especially given the current environment of "surging shipping costs, rising raw materials, supply chain issues and accelerating wage growth."

The team has been studying the share performance of companies with pricing power for some time. They found that shares of firms that can raise prices without consumers balking and taking their business elsewhere and that have solid margin momentum tend to outperform those without by around 20%, on average, over 12 months once inflation rises above 3% on an annualized basis.

So, if you're looking for ways to protect your portfolio against rising inflation, consider this list of the stocks with a pricing power advantage, according to UBS. Each of these names has a high-conviction Buy rating from the research firm and ranks in the top third of its sector for pricing power, margin momentum and input cost exposure.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.