Stock Market Today: Dow Closes Up, But Turbulent Tech Trips Up Nasdaq

Energy made a surprising move higher Tuesday despite President Biden ordering oil released from America's strategic reserves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The market continued its recent split, with cyclical sectors such as energy (+3.0%) and financials (+1.5%) building upon yesterday's gains while mega-cap technology and tech-esque stocks receded again.

President Joe Biden on Tuesday announced the release of 50 million barrels of oil from the nation's strategic reserves to rein in high gas prices. And yet, U.S. crude oil futures jumped 2.3% to $78.50 per barrel, buoying most of the energy sector, especially exploration and production plays such as Occidental Petroleum (OXY, +6.4%) and EOG Resources (EOG, +5.8%).

Michael Reinking, senior market strategist for the New York Stock Exchange, lays out three potential reasons for the counterintuitive move:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"First, there is the 'sell the rumor, buy the news'; second, there is the belief that this will not have a long-term impact on prices; and lastly, there is some concern that this could lead to a showdown with OPEC+, who warned there would be a response if this action was taken," he says.

Also Tuesday, IHS Market's flash purchasing managers' index for November showed slowing but still strong private-sector growth in November, with its reading declining to 56.5 from 57.6 in October. (Any reading above 50 indicates expansion.)

Rising Treasury rates – the 10-year T-note's yield climbed to just under 1.67% – helped keep financials such as Bank of America (BAC, +2.6%) and JPMorgan Chase (JPM, +2.4%) aloft. But they weighed on tech names such as Advanced Micro Devices (AMD, -1.7%) and Adobe (ADBE, -1.3%).

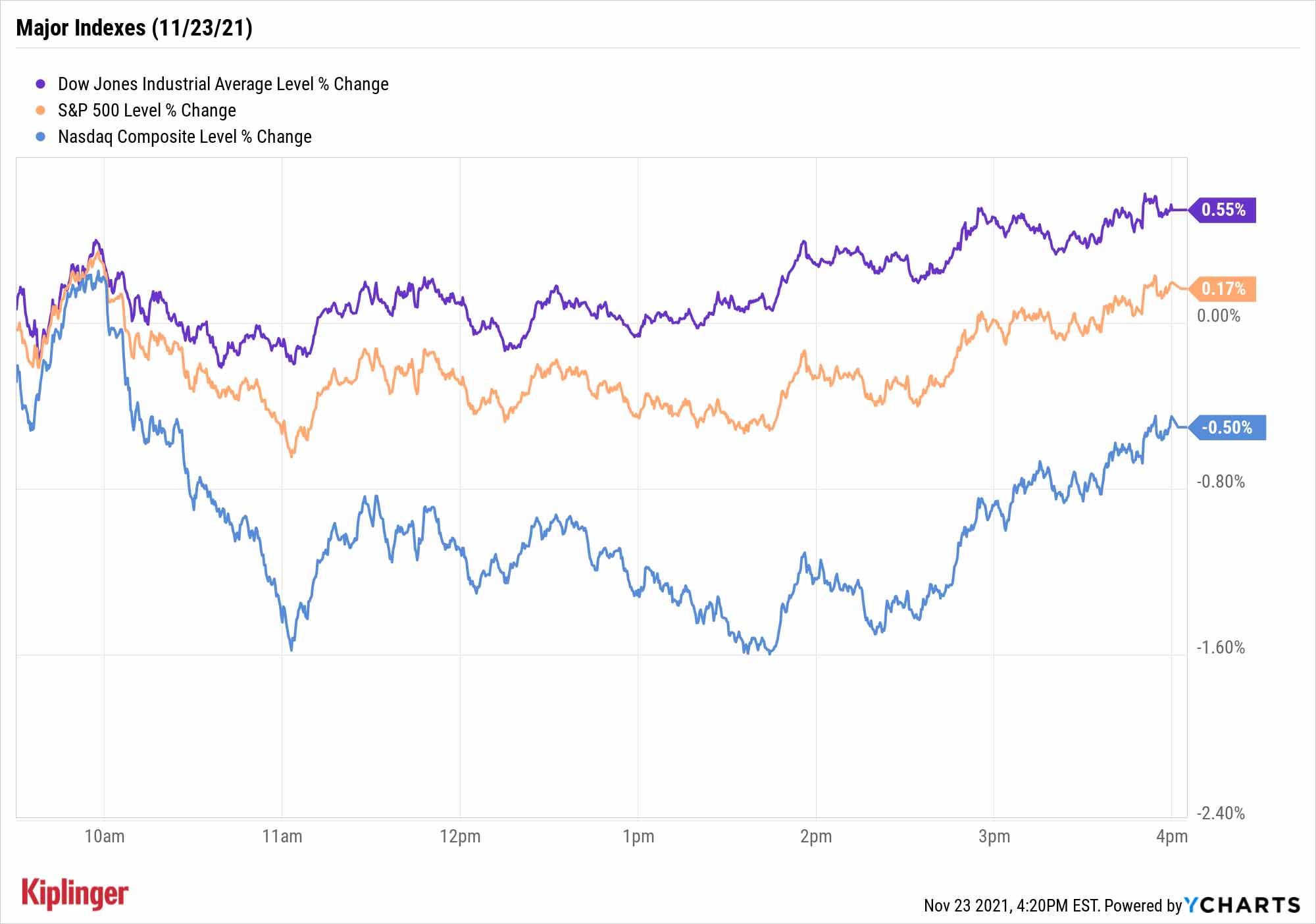

The end result was a 0.6% gain to 35,813 for the Dow Jones Industrial Average, and a more modest 0.2% improvement to 4,690 for the S&P 500. Tech weakness, and a 4.1% shot to Tesla (TSLA), pulled the Nasdaq Composite 0.5% lower to 15,775.

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.2% to 2,327.

- Gold futures notched a fourth straight loss, falling 1.2% to settle at $1,783.80 an ounce.

- Bitcoin finally gained some footing, rebounding 3.7% to $57,886.03. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Zoom Video Communications (ZM) slumped after the video conferencing company reported earnings after Monday's close. In its third quarter, ZM recorded adjusted earnings of $1.11 per share on $1.05 billion in revenue, both figures higher than analysts were expecting. However, "Revenue from customers with under 10 employees was down sequentially in the third quarter and should be again in the fourth quarter," says UBS analyst Karl Keirstead. He also pointed to concerns over deferred revenue for the fourth quarter, after Kelly Steckelberg, Zoom's chief financial officer, said in the earnings call that growth in this segment should fall to the mid-20s in Q4 after being up by 39% in Q3. While the analyst maintained his Neutral (Hold) rating on ZM, he joined several other firms in lowering his price target – specifically, to $250 from $285. ZM closed today down 14.7% to $206.64.

- Best Buy (BBY) was another post-earnings loser, sinking 12.3% in the wake of its results. The big-box retailer reported higher than anticipated adjusted earnings of $2.08 per share and revenue of $11.91 billion in its third quarter and lifted its full-year revenue forecast, now expecting sales to arrive between $51.8 billion and $52.3 billion compared to its previous forecast for $51 billion and $52 billion. As for today's selloff? "BBY's comparable sales year-over-year were disappointing, up only 2.0%, as online sales were 10.2% lower," says CFRA Research analyst Kenneth Leon. "There was also a sales drag from Best Buy's largest product category, computing and mobile phones." Leon also pointed to declining gross margins in the quarter as he downgraded the stock to Hold from Buy.

The Best Mutual Funds in 401(k) Plans

Make today the day you firmly grip the reins of your 401(k).

While simply routing money from your regular paycheck into your retirement portfolio is half the battle, a critical next step is ensuring you're invested in the best mutual funds that your workplace plan provides.

That's precisely why, every year around this time, we take a deep dive into the nation's most popular mutual funds in 401(k) plans.

Over the past few weeks, we've delved into a range of options served up by some of Wall Street's top fund providers: Vanguard, Fidelity, T. Rowe Price and American Funds. And today, we present the capstone of our 401(k) series – the crème de la crème of the 100 most popular retirement-plan offerings, regardless of fund family.

Whatever your goal, and however you're trying to get there, this list of 30 Buy-rated actively managed mutual funds examines the tools most likely to be at your disposal.

Kyle Woodley was long AMD and TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.