Stock Market Today: Stocks Start the Week Sluggishly, But Earnings Await

Investors and traders had little to focus on, and equities traded lethargically as a result. That could change as Q3 earnings get underway.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market was indeed open for Columbus Day, but it sure didn't do much. Equities were mixed for most of Monday amid a slow news day with no significant economic data.

U.S. crude oil prices tagged $84.60 per barrel at one point -- their highest price since late 2014 -- before settling at $83.78, up 2.0%. Although the bump in crude prices helped oil stocks such as Halliburton (HAL, +3.1%) and Schlumberger (SLB, +2.5%), the energy sector actually finished 0.4% in the red.

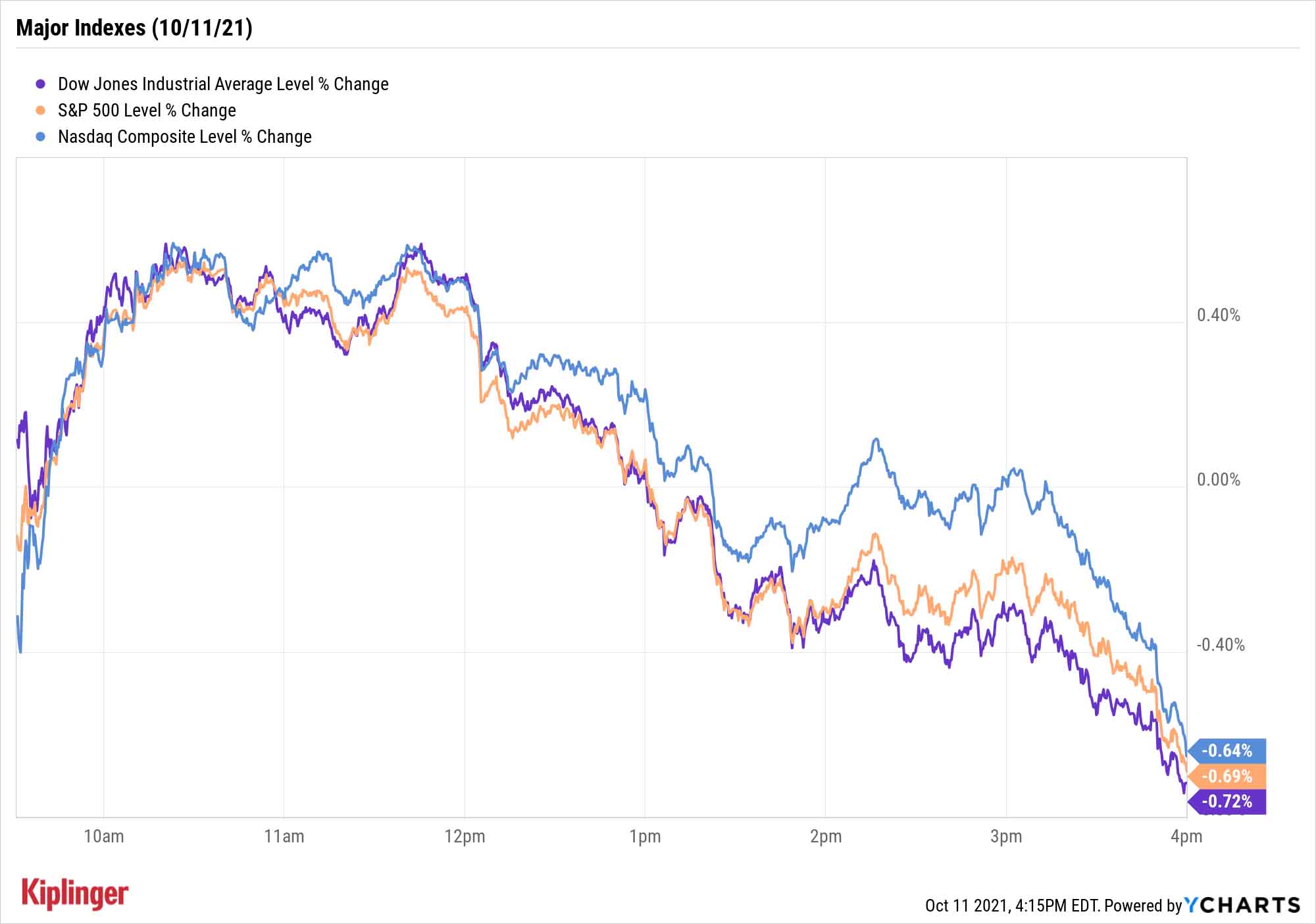

An afternoon swoon sent the Dow Jones Industrial Average 0.7% lower to 34,496. The S&P 500 declined 0.7% to 4,361, and the Nasdaq Composite slipped 0.6% to 14,486.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Potentially spicing things up later this week: The start of the third-quarter earnings season, including reports by JPMorgan Chase (JPM), Delta Air Lines (DAL) and UnitedHealth Group (UNH). FactSet Senior Earnings Analyst John Butters says the S&P 500 is expected to report year-over-year profit growth of 27.6%.

"We think earnings growth will be strong again this quarter," adds LPL Financial Equity Strategist Jeffrey Buchbinder. "But those looking for massive upside surprises and big increases in estimates will probably be disappointed. The COVID-related supply chain disruptions and labor and materials shortages have held corporate America back some in recent months."

"Beyond those widely-reported supply chain challenges facing corporate America, there are other reasons to expect results this quarter to be closer to expectations," he continues. "The latest batch of company pre-announcements has been less positive than in recent quarters, and estimates have stopped rising."

Other news in the stock market today:

- The small-cap Russell 2000 was off 0.6% to 2,220.

- Southwest Airlines (LUV, -4.2%) shares slipped Monday as the carrier has been forced to cancel more than 2,000 flights since Saturday amid a slew of issues. Southwest cited air traffic control issues and inclement weather. However, its pilot union said in a statement that "(Southwest Airlines) has claimed that the immediate causes of this weekend's meltdown were staffing at Jacksonville Center and weather in the southeast U.S., but what was a minor temporary event for other carriers devastated Southwest Airlines because our operation has become brittle and subject to massive failures under the slightest pressure." Now, LUV is considering making additional cuts from a fall flight schedule it has already trimmed.

- Gold futures settled with a modest 0.1% decline to $1,755.70.

- The CBOE Volatility Index (VIX) climbed 6.8% to 20.05.

- Bitcoin prices bucked equities' trend, climbing 5.2% to $57,494.47. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Turn Your Gaze Away From Washington

One thing we'll likely hear less about in the days ahead: The debt ceiling.

Last week, the Senate agreed upon a stopgap bill that will effectively push the issue off into December, with the House expected to vote on the measure Tuesday. As a result, Democrats should be able to concentrate on one of their top priorities.

"Democrats have yet to unify behind their multitrillion-dollar spending plans on infrastructure, social policy and climate change, [but] the temporary debt ceiling increase will likely allow the Democratic Party to focus on rallying its members in Congress around the spending plans – key legislative priorities ahead of the 2022 midterm elections," write analysts at BlackRock Investment Institute.

While BII notes that "the $3.5 trillion price tag of the bill on social policy and climate change is being scaled down to help ensure the support of party moderates," any progress on that is likely to add more fuel to green energy and electric-vehicle plays.

Investors no doubt are also looking for a positive conclusion to infrastructure-bill negotiations, which have gone through various fits and starts for months. But if Congressional momentum picks up once more, expect the market to return yet again to the infrastructure trade -- which investors can hop on via a few exchange-traded funds (ETFs), as well as these 14 appropriately positioned stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.