Stock Market Today: Tech Recovers in Broad-Market Bounce-Back

Better-than-expected U.S. services data and fresh firepower in the fight against COVID helped stocks claw back much of Monday's losses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

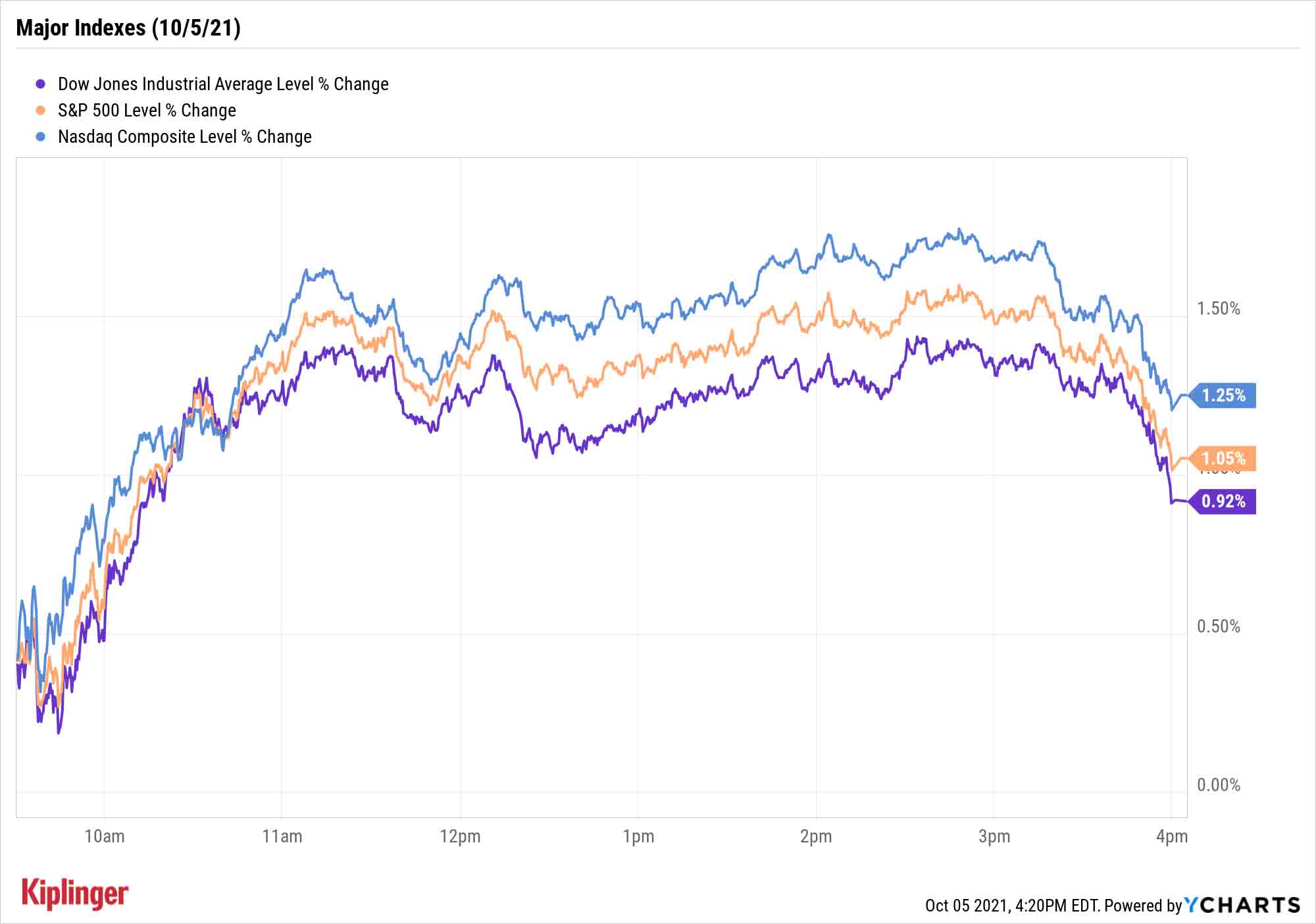

Stocks' autumnal volatility continued Tuesday, with equities ricocheting well into the green after a dreadful start to the week.

Among the reasons for optimism: a report from Institute for Supply Management that showed a better-than-expected September reading from the services sector (61.9, up from 61.7 in August and versus 59.9 expected).

"Overall, we view today's ISM services reading as encouraging, suggesting that overall service sector activity has weathered the recent re-intensification of the COVID-19 pandemic better than expected," says Barclays economist Jonathan Millar.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also on Tuesday, AstraZeneca (AZN, -1.1%) requested emergency-use authorization of an antibody treatment that would offer additional protection from COVID-19 to people with compromised immune systems, while Johnson & Johnson (JNJ, +0.2%) requested similar emergency approval for its COVID vaccine booster shot.

Debt-ceiling concerns appeared to be relegated to the background Tuesday. The latest development: Late Monday, Senate Majority Leader Chuck Schumer said he would schedule a Wednesday vote to raise the debt limit – a vote that Minority Leader Mitch McConnell has already threatened to torpedo. While most analysts remain confident that Congress will raise the debt ceiling, the risks of not doing so are palpable:

"In 2011, Congress waited until the very last minute to fix the debt ceiling issues and S&P downgraded the country's debt rating to AA+ from AAA because of the questions surrounding that willingness to pay its obligations," says independent broker-dealer LPL Financial. "Now, another rating agency, Fitch, has threatened to do something similar if Congress fails to act soon."

The technology sector, which was punished the most in Monday's rout, rebounded thanks to gains in the likes of Microsoft (MSFT, +2.0%) and Nvidia (NVDA, +3.6%). This came despite another push in the 10-year Treasury yield to as high as 1.54%; rising rates have been blamed for tech's struggles of late.

The sector's surge helped power a 1.3% advance in the Nasdaq Composite to 14,433; the Dow Jones Industrial Average (+0.9% to 34,314) and S&P 500 (+1.1% to 4,345) also produced sizable gains.

Other news in the stock market today:

- The small-cap Russell 2000 produced a more muted 0.5% improvement to 2,228.

- Lordstown Motors (RIDE, -11.1%) took another dive today after Morgan Stanley analyst Adam Jonas downgraded the electric vehicle (EV) stock to Underweight from Equal Weight (the equivalents of Sell and Hold, respectively). He also slashed his target price for RIDE to $2 from $6, well below today's close at $5.20, saying the company's recent sale of its Lordstown, Ohio, plant to Foxconn for $230 million is roughly 20% below what he estimates the value of the facility to be. With today's slide, shares of RIDE are now down 74.2% for the year-to-date.

- Southwest Gas Holdings (SWX, +6.6%) got a big boost after the Wall Street Journal reported activist investor Carl Icahn has a substantial stake in the Las Vegas-based utility company. The activist investor reportedly wants to dissuade SWX from buying Questar Pipeline Company – a gas transportation and storage business owned by Dominion Energy (D) and a previous M&A target of Berkshire Hathaway's (BRK.B) energy division – writing that "it's no time to embark on a major new investment" given current share underperformance, according to the WSJ.

- U.S. crude oil futures jumped 1.7% to end at $78.93 per barrel.

- Gold futures slipped 0.4% to $1,760.90 an ounce to snap a four-session winning streak.

- The CBOE Volatility Index (VIX) declined 6.8% to 21.39.

- Bitcoin prices climbed another 3.7% to $51,210.36, crossing the $50,000 threshold for the first time in roughly a month. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Let Up Your Guard

Please, please, keep the sighs of relief to a dull roar. Potential short-term risks that could keep the market zigging and zagging are lurking.

As mentioned above, analysts remain optimistic about Congress's ability to solve its latest debt-ceiling squabble, but a deal is far from done. The same can be said about a long-awaited infrastructure bill. You can also add fears of a China real estate bubble burst and tooth-grinding over the Fed's plans to the list.

While you can't completely insulate your portfolio from this or any other turbulence, you can do a few things to smooth out returns over the long haul – and among them is generating some of your returns from consistent dividend payments.

We've recently extolled the virtues of the Dow's above-average dividend payers, and highlighted seven bond funds that offer a combination of stability and income. Another way to keep the boat from rocking – too much, at least – is a heaping helping of pharmaceutical stocks.

The healthcare sector broadly provides both offensive and defensive properties given both the growth and necessity of health spending. Big Pharma often adds another element, with many mega-cap pharmaceutical firms delivering high yields to boot. Read on as we highlight nine Big Pharma stocks that should be on any income investor's radar:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.