Stock Market Today: Stocks Finish Mixed Ahead of Fed

The latest Fed policy announcement is due out tomorrow afternoon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks were on track to stage a modest bounce in the wake of Monday's drubbing as bargain hunters swooped in to buy the dip.

A solid reading on August housing starts and building permits – which rose at higher-than-expected sequential rates of 3.9% and 6%, respectively – only lifted the collective mood on Wall Street for most of the day.

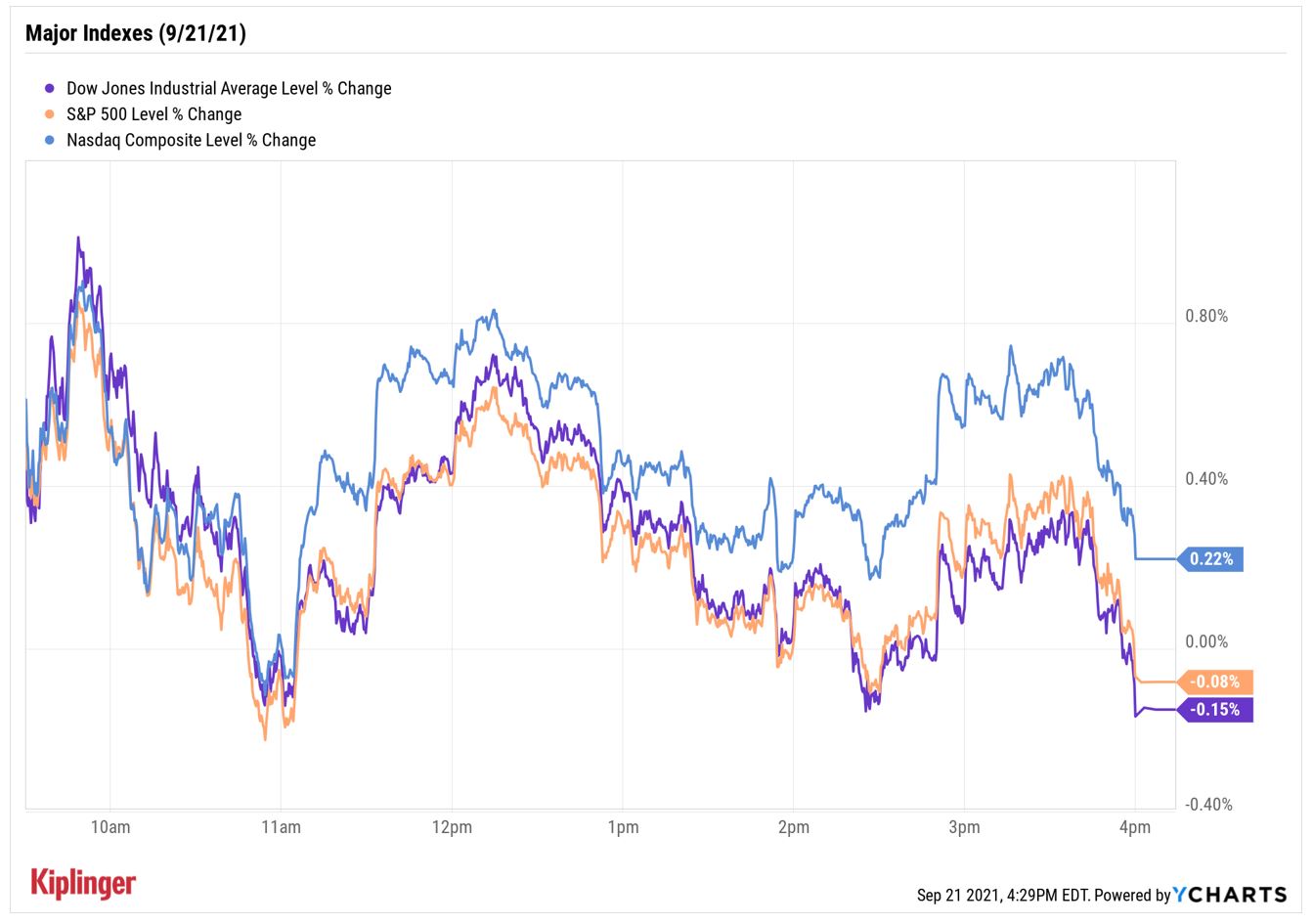

The Nasdaq Composite held onto its gains through session's end, adding 0.2% to 14,746. The Dow Jones Industrial Average (-0.2% to 33,919) and S&P 500 Index (-0.1% to 4,354) weren't so resilient, slipping into negative territory by the close.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In focus tomorrow: the Fed's latest policy announcement.

Danielle DiMartino Booth, CEO and chief strategist of Dallas-based Quill Intelligence, isn't expecting a taper announcement just yet considering there are several "unresolved issues" in Washington D.C. at the moment. "Between the debt ceiling, budget resolution and potential for a government shutdown, there are plenty of political reasons for the Fed to not change policy," she says.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.2% to 2,186.

- Walt Disney (DIS) was the worst Dow stock today, shedding 4.2%. This came after the entertainment giant's CEO Bob Chapek warned of slowing Disney+ subscriber growth in the fiscal fourth quarter, which ends on Sept. 30. Speaking at the Goldman Sachs Communacopia Conference, Chapek said he sees paid subscribers growing in the "low single-digit millions." For the sake of comparison, DIS added 12.4 million net new Disney+ subscribers in its fiscal third quarter.

- Uber Technologies (UBER, +11.5%) was a notable gainer after the ride-hailing firm boosted its third-quarter guidance. For the three-month period, UBER now expects gross bookings to land between $22.8 billion and $23.2 billion – up from its prior forecast of $22 billion to $24 billion. Additionally, adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) is projected to range from a $25 million loss to a $25 million profit. The previous estimate was for Q3 adjusted EBITDA to arrive somewhere ahead of a $100 million loss. CFRA analyst Angelo Zino maintained his Strong Buy rating on the stock after the update, noting "this partly reflects an improving supply driver network, which will allow UBER to taper investments."

- U.S. crude oil futures rose 0.4% to settle at $70.56 per barrel.

- Gold futures gained 0.8% to finish at $1,778.20 an ounce.

- The CBOE Volatility Index (VIX) fell 5.3% to 24.36.

- Bitcoin retreated 4.1% to $42,014.08. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

"Stay Calm and Carry On"

Should U.S. investors add Evergrande (EGRNY, -11.7%) to their growing list of worries? Not at the moment, says Brad McMillan, chief investment officer for Commonwealth Financial Network.

Yes, a debt default from the Shenzhen-based real estate developer could disrupt Chinese markets, but it would likely have a minor impact on U.S. investors. Instead, Monday's drop represents "normal behavior for markets on bad news" and was a "rational response to real, but contained risk," McMillan says.

So while it's prudent to pay attention to the news, he advises investors "keep calm and carry on."

One way to stay the course is with the market's blue-chip stocks. A number of these names can help guard against volatility-inducing headlines by providing reliability and stability over a long-term horizon – with many offering a healthy and growing dividend to boot.

Certainly there are some Dow Jones stocks that are more attractive than others right now, and we've taken a fresh look to see how Wall Street analysts rate the 30 blue chips. Here's what the pros have to say.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.