Stock Market Today: Stocks Weeble, Wobble, But Finish Mostly Flat

An up-and-down session Thursday finished with muted results despite a volley of encouraging economic signals.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

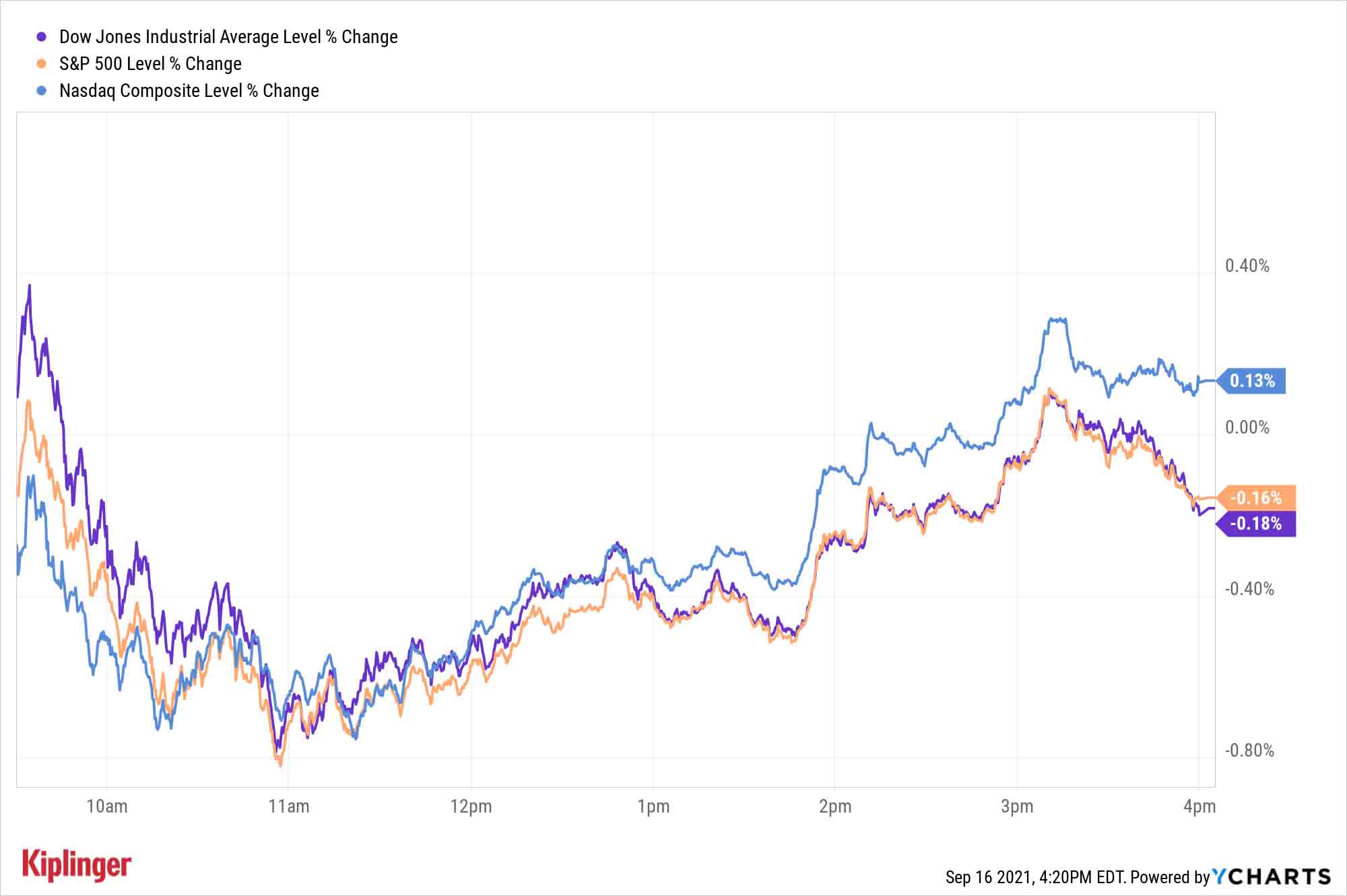

Stocks struggled to find direction despite mostly positive vibes from Thursday’s economic data dump.

New unemployment-benefits filings for the week ended Sept. 11 rose by 20,000 claims to 332,000 – slightly higher than expected, but still near the pandemic-era lows. Moreover, the four-week moving average for claims declined to 335,750, which is the lowest such figure since March 2020.

More clearly positive were August headline retail sales, which rose 0.7% month-over-month, surprising economists who on average had forecast a 0.7% decline.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“American shoppers bounced back nicely in August even as another wave of the virus sent confidence plunging, suggesting decent underlying support from growing employment and excess savings,” says Sal Guatieri, senior economist for BMO Capital Markets. “Strength in general merchandise (3.5%) and furniture (3.7%) was tempered by virtually no change in clothing and food services.”

Another upside surprise came from the Philadelphia Fed factory index, which came in at 30.7 in September from 19.4 in August, signaling a sizable jump in the region’s manufacturing activity.

Investors weren’t quite sure what to do with the info.

The Dow Jones Industrial Average swung from an early 129-point gain to a 274-point loss before stabilizing to a mere 63-point (0.2%) decline to 34,751. The S&P 500 (-0.2% to 4,473) and Nasdaq Composite (+0.1% to 15,181) experienced similar up-and-down rides.

Other news in the stock market today:

- The small-cap Russell 2000 posted a marginal decline to 2,232.

- Beyond Meat (BYND, -2.3%) took a notable dive today after Piper Sandler analyst Michael Lavery downgraded the stock to Underweight from Neutral – the equivalent of Sell and Hold, respectively. While noting that BYND is an early leader in the plant-based protein market, "we believe its current all-channel retail momentum lags consensus expectations, and our foodservice estimates may be high," Lavery wrote in a note to clients.

- Food delivery firm DoorDash (DASH, +5.6%), on the other hand, got a boost after a bullish brokerage note. Specifically, BofA Global Research analyst Michael McGovern upgraded DASH to Buy, citing expectations for "significant three-year revenue upside potential from non-restaurant delivery." He also pointed to higher-than-expected core restaurant growth and online penetration as reasons for the upgrade.

- U.S. crude oil futures finished flat at $72.61 per barrel.

- Gold futures fell 2.1% to settle at $1,756.70 an ounce.

- The CBOE Volatility Index (VIX) climbed by 2.9% to 18.71.

- Bitcoin declined by 1.4% to $47,443.29. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Get Ready for a New Batch of IPOs

Fall is here, which means the turning of the leaves, pumpkin-spicing of everything … and likely one last batch of new stocks hitting the public markets.

2021 has seen an explosion in initial public offerings. IPO investment advisory firm Renaissance Capital says that new offerings have raised more than $100 billion so far this year – already surpassing the record $97 billion raised across the entirety of 2000.

Much of that has come thanks to the rise of special-purpose acquisition companies (SPACs) – a process that some companies use to list on major exchanges while bypassing the usual IPO route.

However, traditional IPOs have had quite the year too, including the debuts of well-known names such as Weber (WEBR), Bumble (BMBL) and Duolingo (DUOL).

Investors still have a few chances to get in more offerings before 2021 comes to a close. We’ve recently added a host of new names to our list of hot upcoming IPOs, and all told, we’ve identified 14 must-see potential listings that are expected to launch sometime before the end of the year. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.