Stock Market Today: Stocks Take Jobs-Report Disappointment in Stride

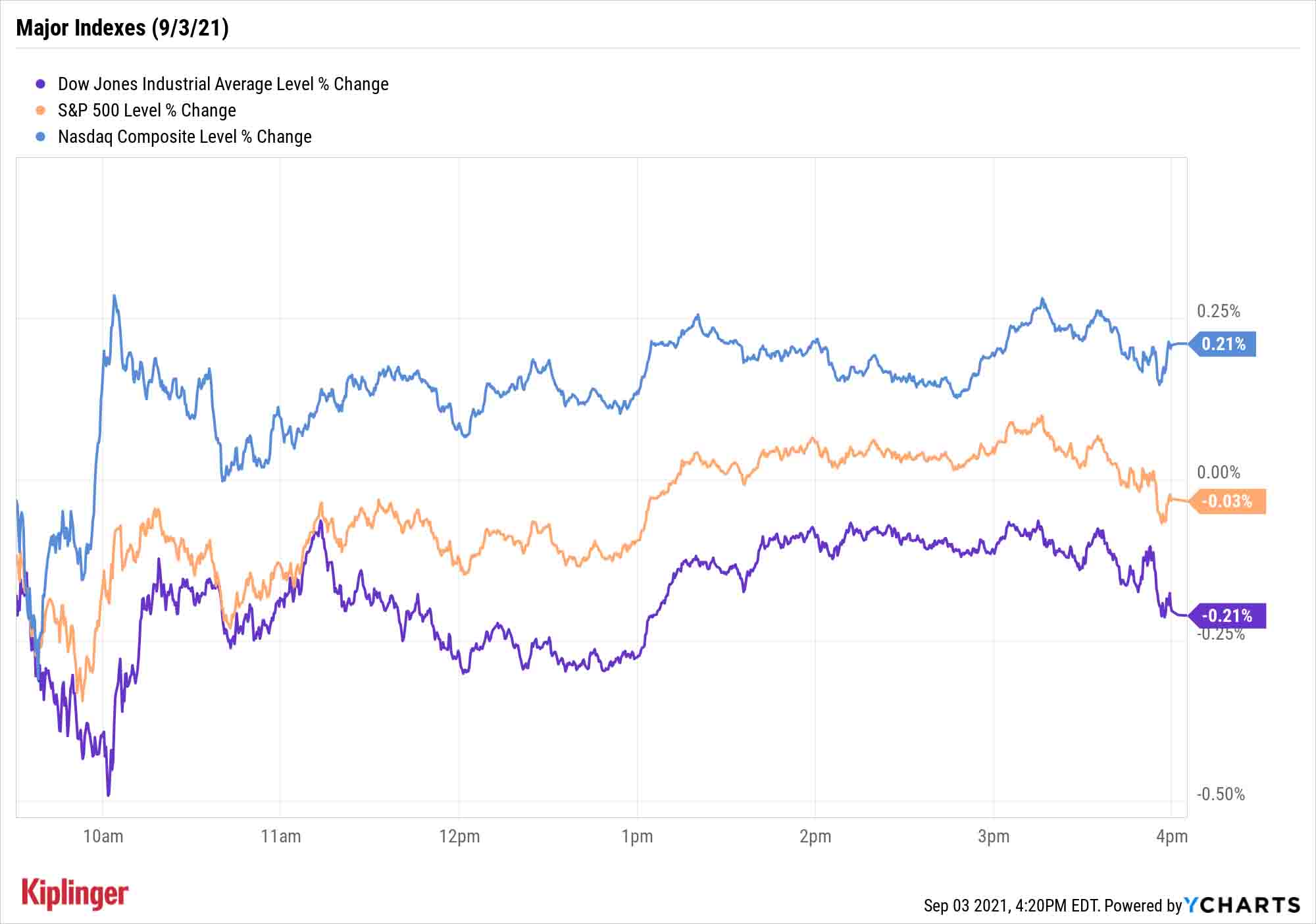

The major indexes produced another so-so session Friday as a big August jobs miss likely pushed the Fed's tapering plans out a few months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The much-anticipated August jobs report wasn't much to crow about.

The Bureau of Labor Statistics revealed Friday that U.S. nonfarm payrolls expanded by just 235,000 last month – while Kiplinger had forecast a "hiccup" in hiring because of the Delta COVID variant, economists still had set a high bar of 720,000 jobs added.

The unemployment rate did tick lower, to 5.2% from 5.4% in July, matching estimates, and year-over-year wage growth of 4.3% was higher than expected. Still, the widely held belief entering Friday was that a strong headline job-growth number would have prompted the Federal Reserve to announce the tapering of its bond purchases later this month, but "that is no longer likely," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Instead, the Fed is going to need to wait to see further improvement in the job market and may not be able to announce their taper plans until the November meeting," he says.

Rick Rieder, BlackRock's chief investment officer of Global Fixed Income, points out a number of factors that might have played a role in dragging down the August data, including Delta-variant uncertainty, expanded unemployment insurance benefits and parents still tending to children who weren't yet back in school.

"September data will be fascinating to examine, in terms of how these things potentially transition (UI benefits ending, Summer weather cools, hospitalizations potentially abate, children return to school, etc.) and how quickly the momentum toward full employment accelerates again," he says.

Investors, weighing a significant slowdown in labor momentum but potentially a few months more of maximum market stimulus, settled for inertia.

The Nasdaq Composite (+0.2% to 15,363) modestly advanced to another fresh high thanks to the technology sector's (+0.4%) leadership Friday. The S&P 500 recorded a marginal decline off yesterday's highs to 4,535, while the Dow Jones Industrial Average declined a mere 0.2% to 35,369.

And a reminder: The stock market is closed on Monday, Sept. 6, in observance of Labor Day.

Other news in the stock market today:

- The small-cap Russell 2000 retreated 0.5% to 2,292.

- Open-source database developer MongoDB (MDB) jumped more than 26% after the company reported a 44% year-over-year spike in revenues to $199 million. What's more, revenue from its Atlas cloud database surged 83% from the year prior, and now accounts for 56% of total revenue. The company also reported an adjusted per-share loss of 22 cents. Analysts, on average, were expecting $184.2 million in revenue and a 39-cent per-share loss. "MongoDB not only

continues to build its developer base with new capabilities, but is also seeing rising interest from large enterprises, which increasingly view it as a strategic partner supporting a growing list of use cases, the result of years of go-to-market investment that are now bearing fruit," Oppenheimer analysts wrote in a note. They maintained their Outperform rating, which is the equivalent of a Buy. - DiDi Global (DIDI) got a lift today after a Bloomberg News report suggested several state-run firms in China – including Shouqi Group, a Beijing-based transportation company – were considering an investment in the ride-hailing service. The report cited people close to the matter, though no details have been given or confirmed. DIDI stock rose 2.4% today to close at $9.02, which is still well below its late-June initial public offering (IPO) price of $14 per share.

- U.S. crude futures gave back 1.0% to settle at $69.29 per barrel.

- Gold futures popped 1.2% to end at $1,833.70 – their highest settlement price since mid-June.

- The CBOE Volatility Index (VIX) slipped 0.6% to 16.32.

- Bitcoin crossed the $50k threshold on Friday, advancing 2.3% to $50,457.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

10 Ways to Improve Your Retirement Portfolio

When you think of building a portfolio for retirement, what comes to mind? We're willing to wager that two words will pop up quickly: "income" and "safety."

No wonder there – once you've put your career in the rear-view, you'll need regular payouts from dividend stocks and bonds alike to replace your salary and keep up with your expenses. And naturally, you can't afford for your nest egg to implode overnight, so investments with relative stability will also look attractive.

But another factor in the retirement equation you shouldn't overlook? Growth.

"Our clients love income," says Rachel Klinger, president of McCann Wealth Strategies, a registered investment adviser headquartered in State College, Pennsylvania. "But if we don't give them growth as well, their accounts won't keep up with inflation. So we consider growth to be a critically important part of the plan."

Thus, if you're evaluating funds to carry you through retirement, make sure to keep income, safety and growth in mind. That's precisely what we did as we evaluated this short list of retirement-focused funds that can meet just about any objective you have.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.