Stock Market Today: Dow Stumbles After Sprinting Out of the Blocks

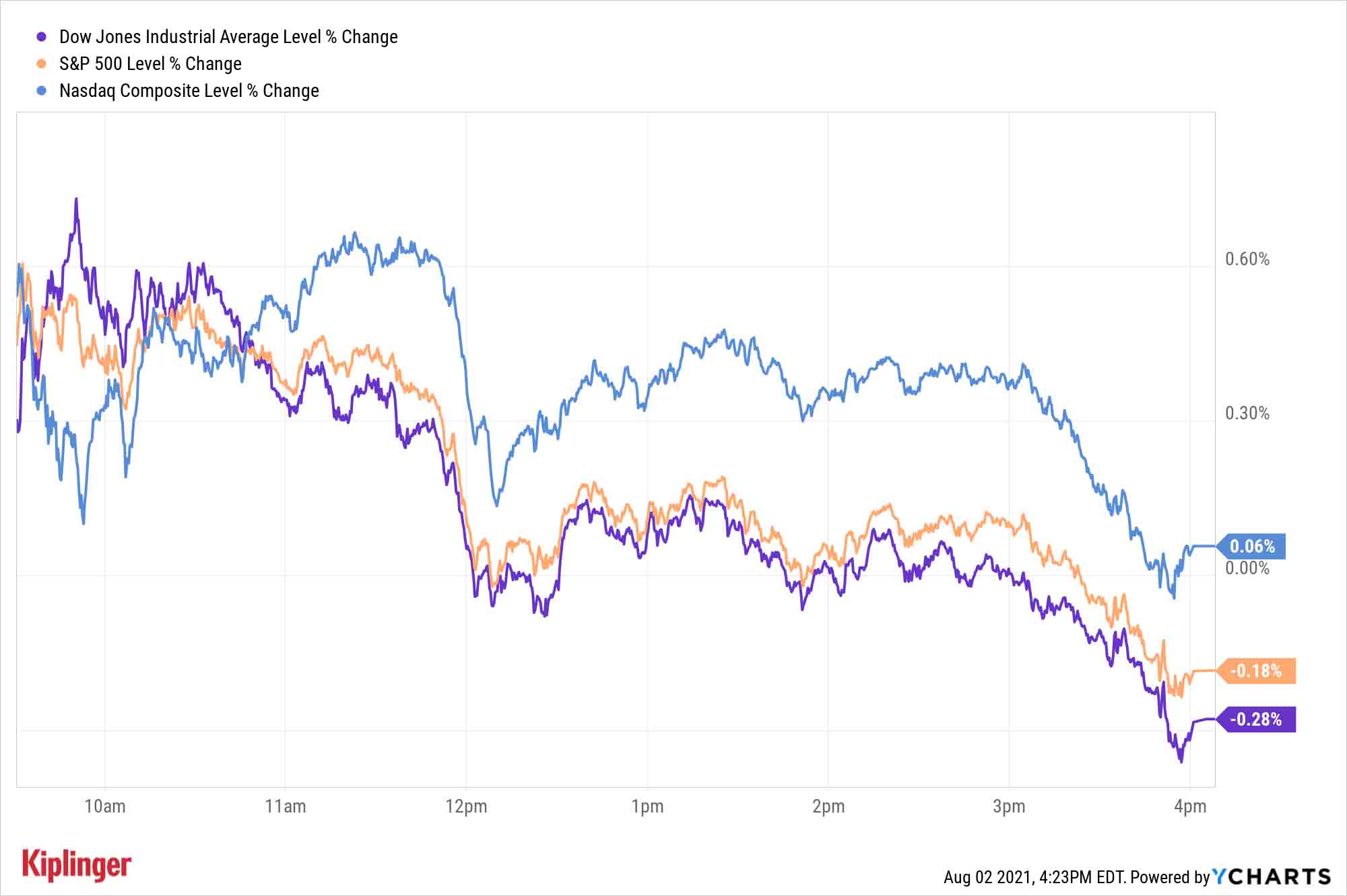

Weak economic data sent the Dow and S&P 500 to small losses on Monday, though the Nasdaq managed a marginal gain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks were on pace for a broadly positive session Monday, but they ended up turning in a mixed performance by the close as investors chewed on a number of headlines.

Over the weekend, the Senate unveiled the full text of a roughly $1 trillion bipartisan infrastructure bill, helping provide a lift in today's early trade, including for a number of infrastructure-related picks.

But things turned after the open amid a few economic data releases. While a US Markit purchasing manager's index reading for July showed that manufacturing activity grew at its fastest pace in 14 years, another gauge, from the Institute for Supply Management, showed growth in American manufacturing cooling off a little last month.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also, construction spending improved in June, but only by 0.1% month-over-month, less than economists expected.

"That said, there were upward revisions to the data starting with April, leaving the average level of spending in Q2 broadly in line with expectations," says Barclays economist Pooja Sriram. "The rebound in June came from the residential sector as expected, which rose 1.1% m/m."

The Nasdaq Composite managed to finish with an a marginal gain to 14,681 thanks to a strong move by Tesla (TSLA, +3.3%), as well as semiconductor stocks such as Advanced Micro Devices (AMD, +2.3%) and Nvidia (NVDA, +1.3%). But the Dow Jones Industrial Average finished with a 0.3% dip to 34,838, and the S&P 500 declined 0.2% to 4,387.

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.5% to 2,215.

- Square (SQ) stock had quite the day. The company unexpectedly unveiled its second-quarter earnings report – which showed the fintech firm took in better-than-expected adjusted earnings of 66 cents per share on lower-than-anticipated revenues of $4.7 billion – ahead of schedule, reporting Sunday rather than the scheduled Wednesday release. Square also said it is buying Australian "buy now, pay later" company Afterpay (AFTPY, +35.2%) for $29 billion in stock. SQ stock ended the day up 10.2%.

- Electric vehicle (EV) stocks got a lift after several Chinese firms reported impressive July delivery numbers. Specifically, Li Auto (LI, +0.9%) and Nio (NIO, +2.6%) delivered 8,589 and 7,931 vehicles, respectively, last month – both figures up 125% year-over-year. Meanwhile, XPeng (XPEV, +7.1%) delivered 8,040 vehicles over the same time frame, a 228% improvement from the year-ago period.

- U.S. crude oil futures plunged 3.6% to end at $71.26 per barrel.

- Gold futures rose 0.3% to settle at $1,822.20 an ounce.

- The CBOE Volatility Index (VIX) jumped 6.7% to 19.46.

- Bitcoin declined 1.4% over the weekend to $39,172.80. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

It's Not Time to Get Complacent

Welcome to August … a not terribly pleasant month for equity investors. Says Ryan Detrick, chief market strategist for LPL Financial:

"The good news is stocks are still firmly in a bull market, but the bad news is the calendar is a potential worry now. August and September have been historically two of the weakest months of the year. In fact, during a post-election year, August has been historically quite poor, with only February worse on average.

"Turning to September, it has indeed been historically the worst month of the year on average. Don’t forget that last year stocks saw nearly a 10% correction during this troublesome month."

But rather than bracing for impact, Detrick appears cheerful.

"With the economy rebounding and earnings soaring," he says, "should we see any seasonal weakness, we'd use that as an opportunity to add to core equity positions."

Any dip would naturally make any value stock look even more economically priced – thus, it's a perfect chance to swoop in on these 16 value-minded picks, or these 11 growth-at-a-reasonable-price (GARP) stocks. Or, you could use a downturn to get stock pickers' favorites at more attractive levels. If you're not the type to sweat the coming robopocalypse, these 10 artificial-intelligence-generated picks could follow in the tracks of their successful predecessors.

But if you prefer a human hand at the helm, consider tapping the wisdom of the crowd. These 25 blue-chip stocks are the preferred holdings of a number of billionaires and other high-net-worth investors, including Ray Dalio, Chris Hohn and, of course, Warren Buffett. Check them out.

Kyle Woodley was long NIO, NVDA, SQ and TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.