Stock Market Today: Stocks Sluggish, But Nasdaq Claws Out a Fresh High

Mixed signals on the economic front mostly muted the broader indexes, but a strong day from Tesla helped get the Nasdaq over the hump yet again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A so-so set of economic data didn't give investors much to get excited about Wednesday, but the Nasdaq Composite still managed to post another new high thanks to a strong day from Tesla (TSLA).

A day after existing-home sales came up weak, the Census Bureau reported a 5.9% month-over-month decline in new-home sales, to 769,000, which drooped well below the consensus estimate for 873,000 in the month.

"We reckon the trend will continue to grind higher given that, int he existing home segment, months’ supply was 2.3 in May, having hovered in a record-low 2.2-to-2.3 range (seasonally adjusted) for the past six months," says Michael Gregory, deputy chief economist for BMO Capital Markets. "Although housing demand has cooled from its torrid pace, the relative inventory situation has barely budged. This means would-be homebuyers will be keeping the new home segment in mind."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, IHS Markit's preliminary manufacturing purchasing managers' index (PMI) reading for July rose to 62.6 from 62.1 in May, beating expectations for 61.4. (Any reading over 50 signals expansion.)

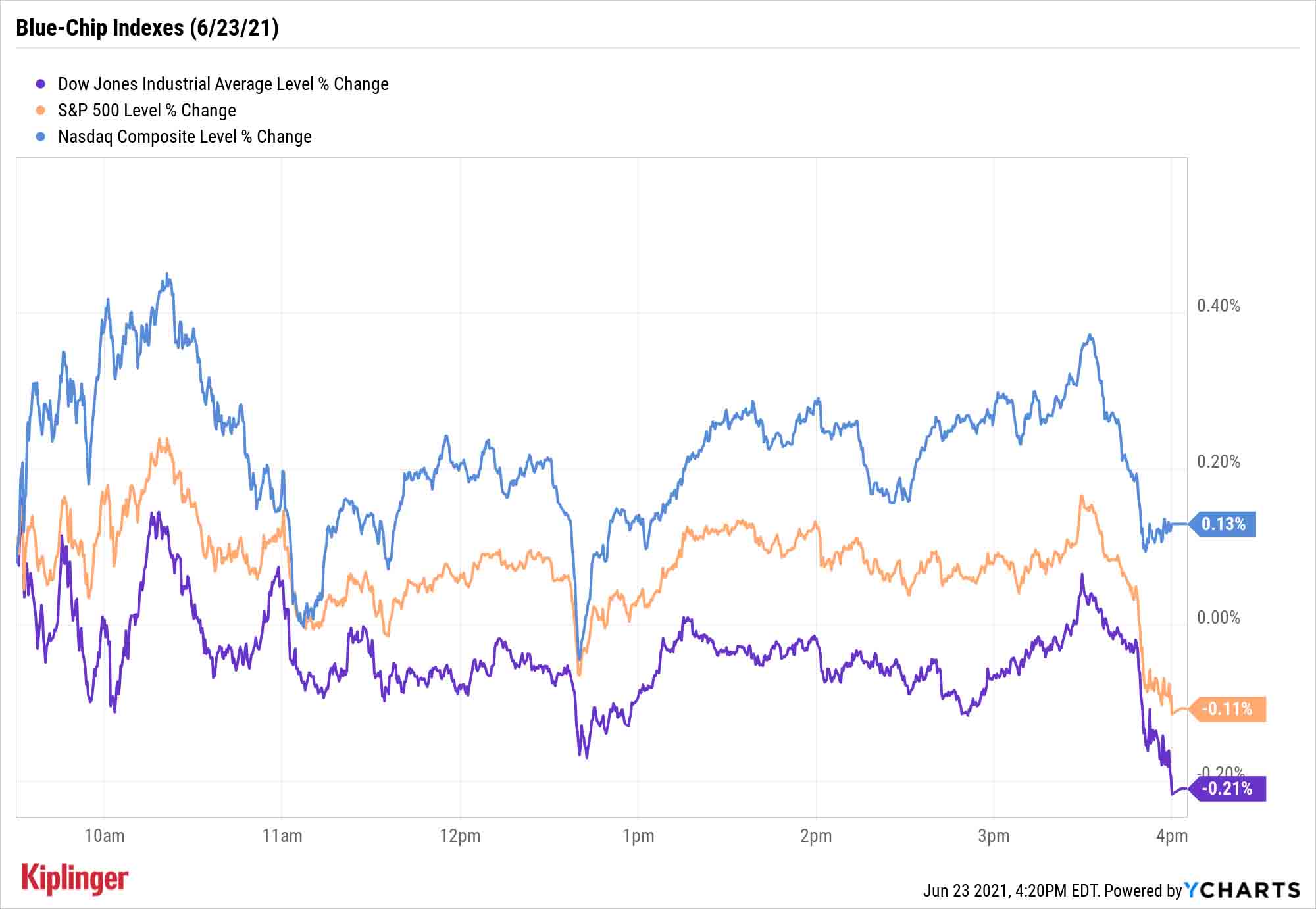

Few areas of the market stood out Wednesday, though a few auto manufacturers enjoyed a productive session. Ford (F, +3.4%) climbed after the EPA estimated that its Mustang Mach-E GT would get 270 miles from a full battery, above the automaker's forecast of 250 miles. Tesla (+5.3%) also popped, albeit on no news, but that helped lift the Nasdaq 0.1% to a new high of 14,271.

The S&P 500, up for most of the day, slipped late and finished off 0.1% to 4,241, while the Dow Jones Industrial Average was off 0.2% to 33,874.

Other action in the stock market today:

- The small-cap Russell 2000 cleared the 2,300 mark again, climbing 0.3% to 2,303..

- Streaming video stocks Roku (ROKU, +4.5%) and ViacomCBS (VIAC, +2.7%) popped today after The Wall Street Journal suggested Comcast (CMCSA, -3.7%) CEO Brian Roberts is "scoping out options" to expand its footprint in the streaming space. According to the report, people close to Roberts, who has been in the top spot at CMCSA since 1990, said a possible purchase of ROKU or partnership with VIAC were two of the potential ideas floating around.

- The U.S.-listed shares of Xpeng (XPEV) jumped more than 4.1% today after Chinese electric vehicle (EV) name said it was given the OK for its initial public offering (IPO) in Hong Kong, which could raise up to $2 billion for the firm.

- Gold futures rose 0.3% to settle at $1,783.40 an ounce.

- The CBOE Volatility Index (VIX) slipped again, by 2% to 16.33.

- Bitcoin advanced 1.1% to $32,935.50. (Cryptocurrencies trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Keep Your Eyes on Oil

Sure, "black gold" didn't do much on Wednesday, with U.S. crude oil futures climbing just 0.3% to $73.08 per barrel on the back of a fifth consecutive weekly inventory decline. But oil is now up more than 90% from this same point in 2020, and Wall Street thinks the commodity might have more runway.

"We believe that demand will be the key driver (of oil prices) because suppliers have a strong incentive to keep the status quo – to match current demand, but not much more," says John LaForge, head of real asset strategy for Wells Fargo Investment Institute. "Suppliers are realizing that the more patient they are, the higher oil prices will likely go, and the more money that can be made.

"We believe oil prices should rise as long as global demand growth remains slow and consistent."

Perhaps counterintuitively, that's good news for solar firms and other green energy picks; higher oil prices have traditionally driven interest in alternative energy.

More directly, however, that's a boon for plain ol' energy stocks. Oil firms have been dealing with lower crude prices for years, forcing them to streamline their operations to squeeze whatever profits they can out of a difficult market. But the violent snapback in prices should put more cash in their pockets … and if oil can indeed keep climbing, these 10 energy stocks should dazzle for the rest of the year.

Kyle Woodley was long TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.