10 S&P 500 Stocks to Consider … At Much Lower Prices

The market itself is sitting at lofty valuations, but several S&P 500 stocks are extremely overheated. Consider giving these 10 picks a little time to cool off.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Analysts might have been bullish about the S&P 500's stocks heading into 2021, but they weren't exactly exuberant.

According to a December report by FactSet Vice President and Senior Earnings Analyst John Butters, analysts' average projection has the S&P 500 Index hitting 4,000.28 by the end of 2021. If the estimate pans out, 2021 would be third consecutive year of positive returns for the index … albeit at a good-but-not-great 6.5% growth rate for the year.

That same report, however, points out that between 2005 and 2019, analysts overestimated the index's end-of-year value on 12 of 15 occasions, by an average of 9.3%. Butters noted that if you applied that 9.3% overestimation to 2021 price targets, the S&P 500 would close 2021 at 3,627.96. If you applied an average 3.4% overestimation (which backs out 2018), you'd get a closing value of 3,864.07.

Either way, from current prices, that implies the S&P 500 might be overcooked.

But the aggregate analyst estimate for the S&P 500 is calculated by combining all of the analyst median target price estimates for all the companies in the index. If they're wrong about the index 80% of the time, that means they're likely wrong about many of the S&P 500's stocks themselves.

Today, we're going to look at 10 S&P 500 stocks that are sound investments for the long haul, but have gotten well ahead of themselves.

We'll look at several metrics, but one that some investors might be less familiar with is cyclically adjusted price-to-earnings ratio, or CAPE. It was created years ago by Yale University economist Robert Shiller, and thus it's also dubbed "Shiller P/E."

The CAPE metric takes a stock's average earnings for the last 10 years, adjusts those earnings for inflation, and then divides that number into its current share price. CAPE takes out any big swings in profits to give investors a more accurate picture of its current price-to-earnings valuation. The S&P 500 currently trades at a Shiller P/E of 35.7, which is among its highest valuations in history. However, eight of the 10 S&P 500 stocks on this list are far more expensive, with CAPEs in excess of 100; the other two are within striking distance.

Data is as of Feb. 11.

Illumina

- Market value: $65.5 billion

- CAPE: 100+

- Price-to-sales: 20.7

- Price-to-book: 14.0

In late November, we recommended Illumina (ILMN, $451.22) as one of the best biotech stocks to buy for 2021. It's hard to believe, but if you had bought ILMN stock on the last day of 2020, you'd already be up 22%. If you had bought as of the article's publish date, you'd be up 46%. Longer-term shareholders are sitting on 26.7% annualized total returns over the past five years.

The reality is that the San Diego-based biotech has had a lot more up days than down days ever since going public in July 2000 at $16 per share. Splitting on a 2-for-1 basis in September 2008, a $1,000 investment at the IPO price would now be worth $55,402, a 21.7% compound annual growth rate.

At its IPO, Illumina had annual revenue of $474,000 (fiscal 1999) and operating losses of $5.5 million. Its latest fiscal year (2020) had revenue of $3.2 billion and operating profits of $580 million.

Boy, have times changed. And that includes ILMN's valuation.

In 2016, Illumina traded at 8.0 times its sales and 8.4 times its book value, respectively. Four years later, its P/S and P/B are 2.6x and 1.7x more expensive. Multiple expansion isn't unusual for a growth company, but Illumina's admittedly COVID-hit operating profits are actually lower than the $587 million it earned in 2016. (But, for perspective, ILMN did bring in $985 million in 2019).

Analysts are aware that ILMN is one of the most expensive S&P 500 stocks currently. Of the 17 analysts rating ILMN who are tracked by S&P Global Market Intelligence, nine call it a Hold, four call it a Buy, but another four call it a Sell. An average price target of $387.24 is also telling – namely, at 14% current prices, it's telling new money to wait for a better entry point.

Chipotle Mexican Grill

- Market value: $43.4 billion

- CAPE: 100+

- Price-to-sales: 7.3

- Price-to-book: 21.5

Billionaire investor Bill Ackman's investment firm, Pershing Square Capital Management LP, filed a Form 4 in early January. It indicates that it sold 75,096 shares of Chipotle Mexican Grill (CMG, $1,543.11) at prices between $1,333.29 and $1,345.01 per share.

Investors sell shares from time to time for all kinds of reasons. Pershing Square still held almost 1.1 million Chipotle shares after the divestiture. But that was down from the beginning of 2020, when the investment firm had a little more than 1.7 million shares of the fast-casual Mexican restaurant concept.

When you consider that CMG stock is up 84% since Jan. 1, 2020, Ackman's profit-taking doesn't seem so unreasonable. After the year he had in 2020 – Pershing Square's 70.2% return in 2020 significantly outperformed the S&P 500's 18.4% total return (price plus dividends) and the Nasdaq Composite's 44.9% total return – few people would quibble with his decision.

That's especially true when you consider that Chipotle is among the more expensive S&P 500 stocks. CMG shares trade at 7.3 times sales – roughly double their five-year average and more than 50% higher from 2019. That's even tougher to swallow when you consider that Chipotle reported earnings Feb. 2 that fell short of analyst estimates, with $3.48 in profits missing estimates for $3.78 per share.

"I love the company. I love what they've done, I love what they're doing right now with rolling out these new stores, but I don't love the valuation," Mark Tepper, president of Strategic Wealth Partners, told CNBC on Feb. 2. "They're doing everything right, but the price in my opinion already reflects that."

MSCI

- Market value: $35.3 billion

- CAPE: 100+

- Price-to-sales: 21.3

- Price-to-book: 39.1

Best known as the "Index" company, MSCI (MSCI, $426.86) has delivered for shareholders (and then some!) since Morgan Stanley (MS) spun the company off in November 2007. MSCI, which originally traded with the ticker MXB, sold 14 million shares at $18 apiece.

Over the past decade, MSCI has generated an annualized total return of 28.3% – more than double the U.S. markets (13.7%) as a whole.

Although MSCI reported Q4 2020 results at the end of January that missed analyst revenue and profit estimates, it still managed to grow both metrics by a significant amount. Q4 sales of $433.7 million were up 9.1% year-over-year, while adjusted earnings of $1.96 per share were 17.4% better.

Share repurchases were toned down quite a bit in 2020 because many companies had to conserve cash. Nonetheless, MSCI managed to repurchase 471,591 shares in the fourth quarter at an average price of $347.78. It has approximately $1.7 billion left on its latest share repurchase authorization.

The company's free cash flow in fiscal 2020 was $760.1 million. Based on an enterprise value of $33.8 billion, MSCI has a current free cash flow yield of 2.2%. Generally, anything above 8% is considered value territory.

When you consider that virtually every one of its valuation metrics is higher than its five-year averages, this S&P 500 stock isn't what you would think to be fair value. MSCI is a high-quality company, but investors should look to enter at more attractive prices.

ResMed

- Market value: $29.2 billion

- CAPE: 77.1

- Price-to-sales: 9.5

- Price-to-book: 10.2

ResMed (RMD, $200.53), a medical-equipment company specializing in sleep apnea and COPD, reported its Q2 2021 results at the end of January. They included a healthy 9% increase in sales year-over-year and a 16% increase in its operating profits on a non-GAAP (generally accepted accounting principles) basis.

Analysts seemed to have liked what they read. The average analyst estimate for fiscal 2021 increased by 5 cents over the past month to $5.21 a share. For fiscal 2022, the average estimate increased by 4 cents to $5.57.

Despite the outlook, analysts are mixed about RMD's next 12 months. The average target price of $202.07, according to S&P Global Market Intelligence-surveyed analysts, is less than 1% higher than its current share price. Moreover, just three of the 10 analysts covering the stock give it a Buy – another five say Hold and two say Sell.

The company is adapting to the new world of telemedicine. CEO Mick Farrell discussed its growth strategy in its Q2 2021 conference call.

"We have sold over 13.5 million 100% cloud connectable medical devices into the market from ResMed, and we have over 15 million patients enrolled in our AirView Solutions in the cloud. With these data liberated to the cloud, we can unlock value for all of our customer groups," Farrell said on Jan. 28.

While there's no question ResMed's core markets are very attractive, the valuation has steadily rolled higher over the past five years. In 2016, it had a price-to-sales ratio of 4.6. Today, it's 9.5 – more than double 2016 valuations, and well above most S&P 500 stocks.

Fortinet

- Market value: $26.3 billion

- CAPE: 100+

- Price-to-sales: 10.5

- Price-to-book: 30.9

As publicly traded cybersecurity stocks go, Fortinet (FTNT, $163.01) would have to be considered a grandfather of the industry. Its history goes back to October 2000, when CEO Ken Xie founded the company.

Xie took Fortinet public in November 2009, selling 12.5 million shares of Fortinet stock at $12.50 each. Investors who bought its IPO shares and still own them have achieved a compound annual growth rate of 25.7%. Over the past three years, FTNT has delivered even better returns, up 51.9% on an annualized basis – more than 14 percentage points better than its tech-sector peers.

Operationally, the business has been profitable. In its most recent quarterly report, Fortinet's revenues increased 21% year-over-year to $748.0 million while its non-GAAP net profit was $1.06 per share – 31% higher than in the same quarter a year earlier. Its Secure SD-WAN offering accounted for $339.9 million, or 11%, of billings in 2020, doubling YoY.

"In a crisp finish to CY20, FTNT's 4Q delivered an across the board beat and impressive acceleration on revenues, product, billings, and key profitability metrics, successfully tapping budget flushes," writes UBS's Fatima Boolani, who nonetheless rates the stock at Neutral with a $166 target that's not much higher than current prices.

Fortinet has simply gotten expensive. Its P/S and P/B ratios are currently much higher than their five-year averages of 7.0 and 14.8 times, respectively.

Zebra Technologies

- Market value: $25.3 billion

- CAPE: 100+

- Price-to-sales: 5.6

- Price-to-book: 13.0

Suppose you run an e-commerce or logistics-related business. In that case, you're likely familiar with Zebra Technologies' (ZBRA, $470.08) barcode scanners, specialty printers, RFID readers and all the other enterprise solutions it has become known for over its half-century history.

Fiscal 2020 wasn't easy for the Illinois-based company, with COVID-19 acting as a significant headwind to its growth. For the year, revenues declined nearly 1% to $4.4 billion, while net income declined 7.4% to $504 million.

However, the digitization of businesses during the pandemic has helped reduce the downside it might have faced in 2020.

"We entered the new year with a strong order backlog as small business demand recovers and business with our large customers continues to be robust," says CEO Anders Gustafsson. "This positions us well for double-digit sales growth for the first quarter and full year 2021. We continue to be excited about our unique capability to digitize and automate our customers' workflows in an increasingly on-demand economy."

ZBRA shares are up nearly 90% over the past year, so investors are clearly buying into the growth story despite the headwinds it has faced. But as a result, their valuation is high among S&P 500 stocks, and way ahead of historical norms. For instance, Zebra's current price-to-sales ratio of 5.6 is more than double its five-year average. Its enterprise value (EV) to earnings before interest, taxes, depreciation and amortization (EBITDA) is 33.7, almost double its five-year average of 17.8.

Meanwhile, analysts' average 12-month price target of $427.73 is 9% below current prices.

Teradyne

- Market value: $22.5 billion

- CAPE: 94.6

- Price-to-sales: 7.9

- Price-to-book: 10.2

Don't tell ARK Invest CEO and CIO Cathie Wood that Teradyne (TER, $135.04) is too expensive. In the last week of January, the ARK Autonomous Technology & Robotics ETF (ARKQ) bought 180,400 shares of the maker of testing equipment and industrial automation solutions.

The company reported healthy fourth-quarter results on Jan. 27. For the full year in 2020, Teradyne's revenues grew 36% to $3.12 billion, while its non-GAAP earnings per share of $4.62 were 62% higher than a year earlier. Not only were its Q4 results ahead of analyst estimates, but TER expects to achieve record sales and earnings in Q1 2021.

And yet, Teradyne stock fell sharply on the news and hasn't quite recovered to its previous levels.

Perhaps the hiccup in its 87% run over the past year has something to do with its valuation. Most of this S&P 500 stock's financial valuation metrics are at or near record levels. P/S, for example, is more than 75% higher than its five-year average. Its free cash flow in the trailing 12 months is $650 million, which, based on an enterprise value of $19.1 billion, gives it a FCF yield of 3.4%.

Analysts seem generally optimistic about Teradyne stock. Of the 18 that cover it, 11 rate it a Buy, versus six Holds and one Sell. But an average price target of $137.28 per share indicates there's not much upside from here. "We boost our 12-month target by $25 to $125, 26.1x our 2021 EPS estimate, above TER's 5-year historical average of 18.9x - shares remain near fair value currently, in our view," CFRA David Holt wrote shortly after the company's report – shares are about 8% above that target at the moment.

We recommended TER as one of our best industrial stocks of 2021. But after a quick run-up, new money might be better off waiting for a dip and buying in more reasonable territory.

Rollins

- Market value: $18.5 billion

- CAPE: 100+

- Price-to-sales: 8.6

- Price-to-book: 19.7

It appears the momentum that Rollins (ROL, $37.65) stock had in 2020 has come to a grinding halt early in 2021. While the stock is still up 43% over the past year, shares of the provider of pest and termite control services – you're likely familiar with its Orkin brand – has gotten expensive, and investors have sent it to roughly 4% declines versus a 4% improvement for the S&P 500.

Valuation-wise, all of its major metrics are significantly higher than its five-year average. For example, its 8.6 P/E is nearly 40% higher than its five-year average and roughly three times the P/S for the U.S. markets as a whole.

The increase in Rollins' valuation multiples in 2020 is likely due to investors moving to quality.

The company reported strong fourth-quarter results on Jan. 27. For fiscal 2020, revenues improved by 7.2% to $2.2 billion while adjusted net income climbed 16.4% to $267.5 million. During is conference call, Rollins emphasized that the 10 strategic acquisitions it made during the quarter are vital to its growth strategy. Investors can expect more of the same in 2021 and beyond.

But it's difficult to find analysts to confirm that Rollins is a buy at current prices. Rollins is among the most thinly covered S&P 500 stocks; only three analysts tracked by S&P Global Market Intelligence cover ROL, and two of those call it a Hold. As a group, the trio have a 12-month price target of $36 per share.

Abiomed

- Market value: $14.6 billion

- CAPE: 100+

- Price-to-sales: 18.1

- Price-to-book: 11.6

Abiomed (ABMD, $322.93), the Massachusetts-based medical devices manufacturer, reported record fiscal Q3 2021 revenues on Jan. 28. It gained as much as 18% on the news.

The past year was a tough one for most healthcare businesses as hospitals and medical practitioners were more focused on COVID-19 and less able to perform surgeries involving medical devices.

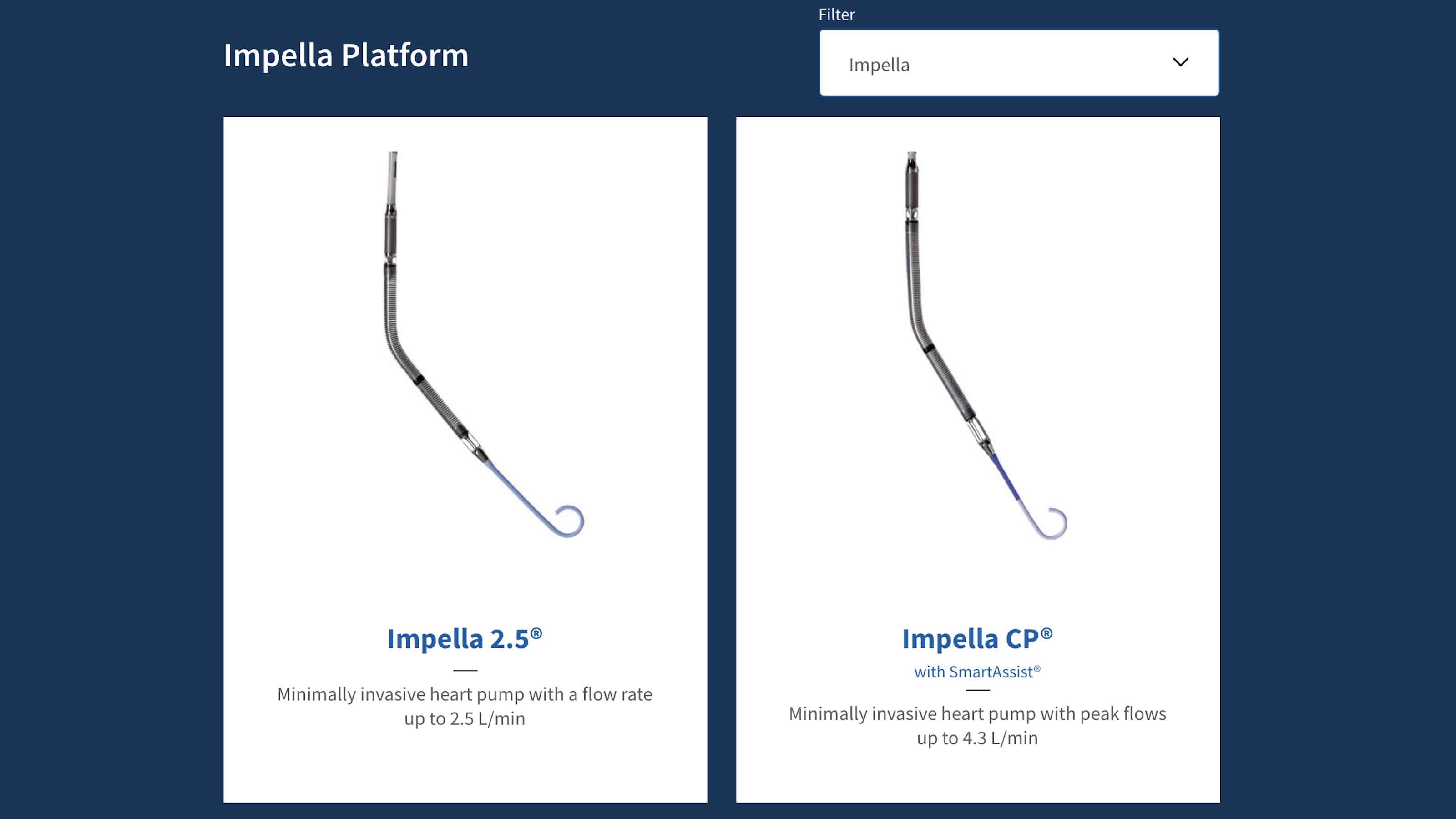

Despite this reality, Abiomed still managed to increase its third-quarter revenues by 5% to $231.7 million while growing operating income 2% to $71.4 million. A massive chunk of its sales in the quarter came from Impella heart pumps, which accounted for 95% of its overall revenue.

"Abiomed delivered a record revenue quarter as we continue to remain both focused and committed to our mission of recovering hearts and saving lives despite the challenging COVID environment," Michael R. Minogue, Abiomed's CEO, said about the quarter.

With a sound balance sheet and plenty of growth potential in 2021 and beyond, ABMD will continue to be a popular stock in the healthcare sector. In fact, it already is. Abiomed shares have run up 84% over the past year, rebounding nicely after its fall from grace, which saw the stock fall from $450 in September 2018 to a 52-week low of $119.01 during the March 2020 correction.

But the valuation has jumped higher, too. In 2019, you could have paid 9.6 times sales for Abiomed stock. Today, you'll pay 18.1 times sales, almost double the amount. The same thing applies to all the financial metrics you might use to value its stock.

Under Armour

- Market value: $10.3 billion

- CAPE: 100+

- Price-to-sales: 2.3

- Price-to-book: 6.2

Anyone who bought shares of Under Armour (UAA, $22.99) during the March 2020 correction has done exceptionally well with their bet on the beleaguered athletic apparel manufacturer. UAA shares are up 185% from the S&P 500 low on March 23, 2020.

In terms of valuation, this S&P 500 stock isn't obscenely expensive at 2.3 times sales and 6.2 times book, both right around UAA's five-year average. However, its price/earnings-to-growth ratio of 4.6 is almost twice the five-year average, which means investors are paying a lot for whatever growth Under Armour can muster in the next few years.

That's not good to see when you consider that the company just ended its on-field contract with the NFL. And while it will retain Tom Brady to endorse the brand, too much cost-cutting and not enough promotion and endorsement work with the major leagues is likely to put it even farther behind Nike (NKE) in the race for athletic apparel domination.

In December, Under Armour completed the sale of its MyFitnessPal platform to Francisco Partners for $345 million. It paid $475 million for it in 2015. The company has said that it will focus its attention on MapMyFitness, the digital app it acquired for $150 million in 2013.

Mostly due to restructuring and impairment charges, Under Armour lost $549 million on a GAAP basis in 2020, or $1.21 per share. If you adjust for those charges, the loss was just 26 cents.

"UAA's 4Q report demonstrated the company is improving its business in key areas, justifying a higher PT in our view," writes UBS's Jay Sole. "However, things like better brand management likely take a long time to translate into big EPS gains and the market may be anticipating more growth sooner. For example, we model $0.65 in FY24 EPS. If that estimate is correct and the stock trades at 40x P/E that year, then it would be worth $26/sh., just 16% above today's price.

"This indicates to us the stock already prices in much good news and thus our rating stays Neutral."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.