10 Top Shorted Stocks for Longer-Term Buyers

While several of Wall Street's most shorted stocks are just a playground for traders, others sport legitimate long-term buy cases. Just beware the volatility.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

GameStop (GME) has become a top-of-mind name on Wall Street in 2021 in the most improbable of ways.

The brick-and-mortar video game retailer was among the market's most heavily shorted stocks to start the year – but a group of investors, sparked by the Reddit community r/WallStreetBets, sparked a campaign to purchase shares. The primary reasoning was that a sudden spurt of buying could trigger a "short squeeze" of people who betting against the company, driving GameStop's shares even higher.

"We think the bulk of ... gains was driven by a short squeeze and very little has changed in GME's fundamental story," says CFRA analyst Camilla Yanushevsky, who rates the stock a Sell.

GME shares had gained 1,740% between the start of the year and Jan. 27 before hitting a severe patch of volatility. At the height of the video game retailer's short interest, roughly 140% of its "float" (shares available for public trading) was being used to bet against the stock.

Many short squeezes end the same way: Buyers lock in their gains, and the stock settles back to earth. However, several heavily shorted stocks currently boast real fundamental bull cases for longer-term buyers. Some haven't yet been caught up in a short squeeze, so they could benefit from one as soon as enough investors realize the improvements they've been making. Others have already been squeezed higher and could dip once short-term traders tire, providing a better entry point for buy-and-hold investors.

Here, we look at 10 of the top shorted stocks that are worth a much more serious look. In each case, short interest accounts for at least 10% of the float – a high number that points to a greater likelihood of a short squeeze. We'll explain why each stock here could be more than just the flavor of the week.

Data is as of Jan. 31. Short interest data provided by S&P Global Market Intelligence. Stocks listed in reverse order of shares sold short as a percentage of the float.

Clorox

- Shares shorted: 12.7 million

- Percentage of float: 10.1%

We'll start with Clorox (CLX, $209.46), which hasn't drawn as bearish a crowd as these other highly shorted stocks, but still sticks out with more than 10% of its float sold short.

If you're shorting Clorox, it likely has something to do with valuation. Clorox currently trades at 3.8 sales, which is well above its five-year average. You're seeing a similar story play out in Reckitt Benckiser (RBGLY), which makes Lysol Wipes, and whose valuation has been driven above its five-year average as COVID-19 has boosted sales of its various cleaning products.

Clorox's own wipes continue to be in high demand. In December, it announced it is selling more pocket-sized packs of disinfecting wipes to ensure customers have an out-of-home supply to meet their needs while running around.

As Bloomberg reported in December, it is doing everything in its power to keep the shelves stocked with products.

"To contend with demand, Clorox already cut its range of wipes products to 14 from more than 100 earlier this year, jettisoning lower-priority items like compostable wipes," Bloomberg reported on Dec. 23. "The company has added more than 10 new third-party manufacturers and is building a new wipes line that will help it ramp up in-house capacity in early 2021 and double it by mid-year."

Credit Suisse analyst Kaumil Gajrawala believes the steps taken by the company are the right ones for meeting demand, telling Bloomberg, "If you can shrink those pack sizes, maybe not everybody gets what they want ... But at least everybody gets some."

Q1 2021 results in November included a 27% increase in sales and a 103% increase in earnings per share. Eight of 10 business units delivered double-digit sales growth. However, management is setting expectations for a more muted 2021. The company says sales should grow by 5% to 9%, while earnings per share should rise between 5% and 8%. That's a big comedown from Q1 2021.

But those short sellers had better hope the company's conservative estimate is on the money; if not, their losses could be considerable.

Anaplan

- Shares shorted: 13.7 million

- Percentage of float: 10.7%

Anaplan (PLAN, $66.70) sells subscriptions to Connected Planning, its cloud-based planning platform. It helps businesses continue their digital transformations without interrupting the planning process.

The company went public in October 2018 at $17 a share. Original IPO investors still holding those shares are sitting on a total return of 317% across just 27 months.

"Anaplan's solution is table stakes for the modern, agile enterprise,"Bill Schuh said Jan. 5 in a press release announcing his hiring as chief revenue officer. "Now more than ever, data must move across the enterprise in real-time for businesses to plan and execute effectively. By enabling this with its Connected Planning and performance orchestration capabilities, Anaplan unlocks massive value for its customers."

Many investors who don't feel this way about Anaplan's future are shorting the stock.

You wouldn't know it by the number of analysts rating PLAN a Buy at the moment. The stock has 12 Strong Buys and four Buys versus three Holds and just one Sell, with an average 12-month price target of $79.42. So the potential for a short squeeze certainly exists.

In the first nine months of fiscal 2021, Anaplan's revenues increased by 30.2%, while its non-GAAP loss shrank by 42.1% to $27.4 million. The long bet here is that it will continue to scale its business to the point where it is both non-GAAP and GAAP profitable.

Middleby

- Shares shorted: 6.3 million

- Percentage of float: 11.6%

Middleby (MIDD, $135.72) isn't exactly a household name; for the unfamiliar, it is a serial acquirer of foodservice equipment brands. Between 2006 and 2019, it completed 64 acquisitions that added $2.5 billion in annual revenue; it tacked on another four acquisitions in 2020. MIDD's brands include Blodgett, Follett, Middleby Marshall, Southbend, Star, TurboChef, Viking and Heartland.

This heavily shorted stock has nonetheless caught the attention of the bears, who have sold nearly 12% of MIDD's float short.

Middleby's stock is effectively flat over the past three years, compared to a 39% gain for the broader market. However, it is coming into its own, with a roughly 38% improvement over the past three months.

Jefferies analyst Saree Boroditsky recently upgraded Middleby to Buy from Hold and ratcheted up his price target more than 37% to $165 per share. Boroditsky believes the company's Commercial Foodservice business's sales and margins will recover faster than investors expect.

Furthermore, post-pandemic, its M&A activity ought to resume its usual brisk pace

On Jan. 13, the company's connected kitchen technology business, Powerhouse Dynamics, which it acquired in 2018, announced that it now has two internet-of-things solutions for its customers: Open Kitchen for its foodservice customers and SiteSage for its retail and industrial customers.

As automation becomes an integral part of the foodservice and hospitality industries, Middleby brings two excellent products to the table. Its customers will enhance equipment performance, reduce energy costs, and optimize facility operations.

In its latest third-quarter report, Middleby's commercial foodservice sales continued to struggle under the weight of COVID-19 (revenues fell 27.4%). But as the analyst suggests, this area of its business should quickly rebound. Its other two segments – Residential and Food Processing – enjoyed sales increases of 11.4% and 22.4%, respectively.

Viacom

- Shares shorted: 121.3 million

- Percentage of float: 22.0%

ViacomCBS (VIAC, $48.50) has been on fire so far in 2021, gaining 30% year-to-date and more than 70% over the past three months.

The entity, formed by the merger of Viacom and CBS in December 2019, delivered Q3 2020 results in November that were better than expected on both the top and bottom lines. Sales of $6.12 billion were 9% lower year-over-year but $180 million higher than the consensus estimate. Adjusted earnings of 91 cents per share were 11 cents higher than analyst estimates.

"ViacomCBS reported a strong third quarter as revenue and EBITDA beat FactSet consensus expectations," says Neil Macker, senior equity analyst at Morningstar. "While the linear networks and studio were once again negatively impacted by the pandemic, the streaming services continue to benefit from the users staying at home. We are maintaining our narrow moat rating for ViacomCBS and our $57 fair value estimate."

ViacomCBS CFI Naveen Chopra recently discussed some of the company's plans for streaming in 2021 and beyond. Chopra would like to see the company acquire more of the cord-cutters leaving traditional cable. The company's CBS All Access streaming service is being rebranded as Paramount+ early in 2021. It will get new original content revolving around entertainment, live news and sports.

"We think everyone's numbers will likely change once management sheds more light on the direct-to-consumer path ahead," says Wells Fargo media analyst Steven Cahall. "The stock could be worth more on lower numbers if the efficacy of the (direct-to-consumer) strategy is sound, but it could also be due for a derating if the way forward doesn't inspire investor confidence."

Between the streaming potential of Paramount and the cost reductions found since its merger – $800 million annually by 2022 – ViacomCBS remains an excellent value play in media.

Macy's

- Shares shorted: 88.8 million

- Percentage of float: 28.6%

Among these 10 heavily shorted stocks, Macy's (M, $15.04) is the biggest contrarian value play of the bunch. While its stock has recovered from its 52-week low of $4.38, hit in April 2020, it has a long, long way to go to reach its July 2015 all-time high of $73.61.

Of course, it doesn't need to go nearly that high to still be a fruitful holding for investors.

One possible growth strategy for the department store chain is its Market by Macy's off-mall expansion. On Jan. 13, Macy's opened its second Market by Macy's location in the WestBend lifestyle shopping center in Fort Worth, Texas. At 20,000 square feet, Market by Macy's provides customers with a curated selection of fashion in a smaller footprint making the shopping experience faster and more convenient.

"We're excited about the value and enhanced shopping experience Market by Macy's will bring to new and existing customers within the Dallas-Fort Worth community, building upon an ecosystem that gives our customers access to the fullness of the Macy's brand, from on-mall to off-mall and full-line to off-price," says John Harper, Macy's chief operations officer.

Macy's opened the first Market by Macy's in February 2020. It planned to also open stores in Atlanta and Washington D.C., but the pandemic got in the way. However, it still managed to learn a great deal from the concept's first year in operation that will enable it to create a scalable store format in the future.

The large short position is indicative of a general skepticism surrounding department stores in general. Analysts seem just as skeptical, with eight of the 18 analysts covering M shares calling it a Sell or Strong Sell, and another nine saying it's just a Hold.

What the shorts and analysts like seem to be missing is that Macy's continues to right-size its business by closing stores in underperforming markets, cutting costs both in the head office and in the stores, and continuing to build an omnichannel business that meets the needs of its customers.

CEO Jeff Gennette has a long way to go, but he appears much closer than most skeptics realize.

Beyond Meat

- Shares shorted: 15.4 million

- Percentage of float: 35.9%

Since the day Beyond Meat (BYND, $178.08) went public in May 2019, critics have pointed to its increasing competition as a prime reason its stock is overpriced. Up more than 600% since its IPO, the maker of plant-based meats continues to make inroads in both the retail and foodservice markets.

BYND shares are already up 42% in 2020 on a number of major announcements.

On Jan. 14, Taco Bell announced that it was testing one of Beyond Meat's products in the U.S., sending its shares higher on the news. Taco Bell CEO Mark King liked that Beyond Meat appeals to a younger audience in choosing it over Impossible Foods.

A day after the big Taco Bell news, Beyond Meat announced it is forging ahead with a new 300,000-square-foot state-of-the-art facility in California that will also house its headquarters. The facility will be constructed in three phases, with the first phase expected to welcome employees in spring 2021.

“The new campus and facilities will house cutting-edge fundamental and applied research, alongside globalized product development teams, all in service to a single goal: creating meat from plants that is indistinguishable from its animal protein equivalent,” says CEO Ethan Brown.

Then near the end of the month, Beyond Meat announced it would be teaming up with PepsiCo (PEP) to make snacks and beverages from plant-based protein – a major coup that could help send meatless foods even further into the mainstream.

Despite COVID-19, Beyond Meat managed to generate $45.4 million in U.S. foodservice revenues in the first nine months ended Sept. 26, 2020, up 4.0% from $43.7 million a year earlier. On the retail side, it's full speed ahead, with U.S. sales up 114.5% to $202.0 million.

International foodservice sales weren't as resilient, falling 34.3% in the first nine months of the fiscal year. BYND's overall sales nonetheless increased 52..9% through the end of September to $304.8 million, with retail representing 74% of sales and foodservice the rest.

As Beyond Meat makes more significant inroads internationally, this heavily shorted stock could work off even more of that bearish sentiment.

International Flavors & Fragrances

- Shares shorted: 30.0 million

- Percentage of float: 36.3%

International Flavors & Fragrances (IFF, $112.38) received an early Christmas present in late 2020 when the merger between IFF and DuPont's (DD) Nutrition & Biosciences unit cleared the final regulatory hurdle needed to complete its transaction.

"Having already secured the strong support of IFF's shareholders and having made tremendous progress in our integration planning efforts, today marks another great milestone that brings us one step closer to bringing this industry-leading combination to life," IFF Chairman and CEO Andreas Fibig said in a Dec. 7, 2020, press release.

It will create a combined business valued at $45 billion with annual revenue of more than $11 billion, as well as $2.6 billion in EBITDA (earnings before interest, taxes, amortization and depreciation). IFF expects to find $300 million in annual savings by the third year following the deal's close.

Shareholders of IFF will own 44.6% of the combined company, with DuPont shareholders holding 55.4%. As part of the transaction, DuPont shareholders will receive a $7.3 billion special cash payment when the deal closes sometime in the first quarter.

Stifel analyst Mark Astrachan believes the merger provides IFF with "a more complete product suite to a broader customer base."

Analyst sentiment is strong here, too. Of 18 analysts covering International Flavors & Fragrances, eight rate it a Strong Buy, with another two Overweights. Seven of the eight remaining opinions are Holds. An average price target of $138.18 provides another 23% of upside from current levels.

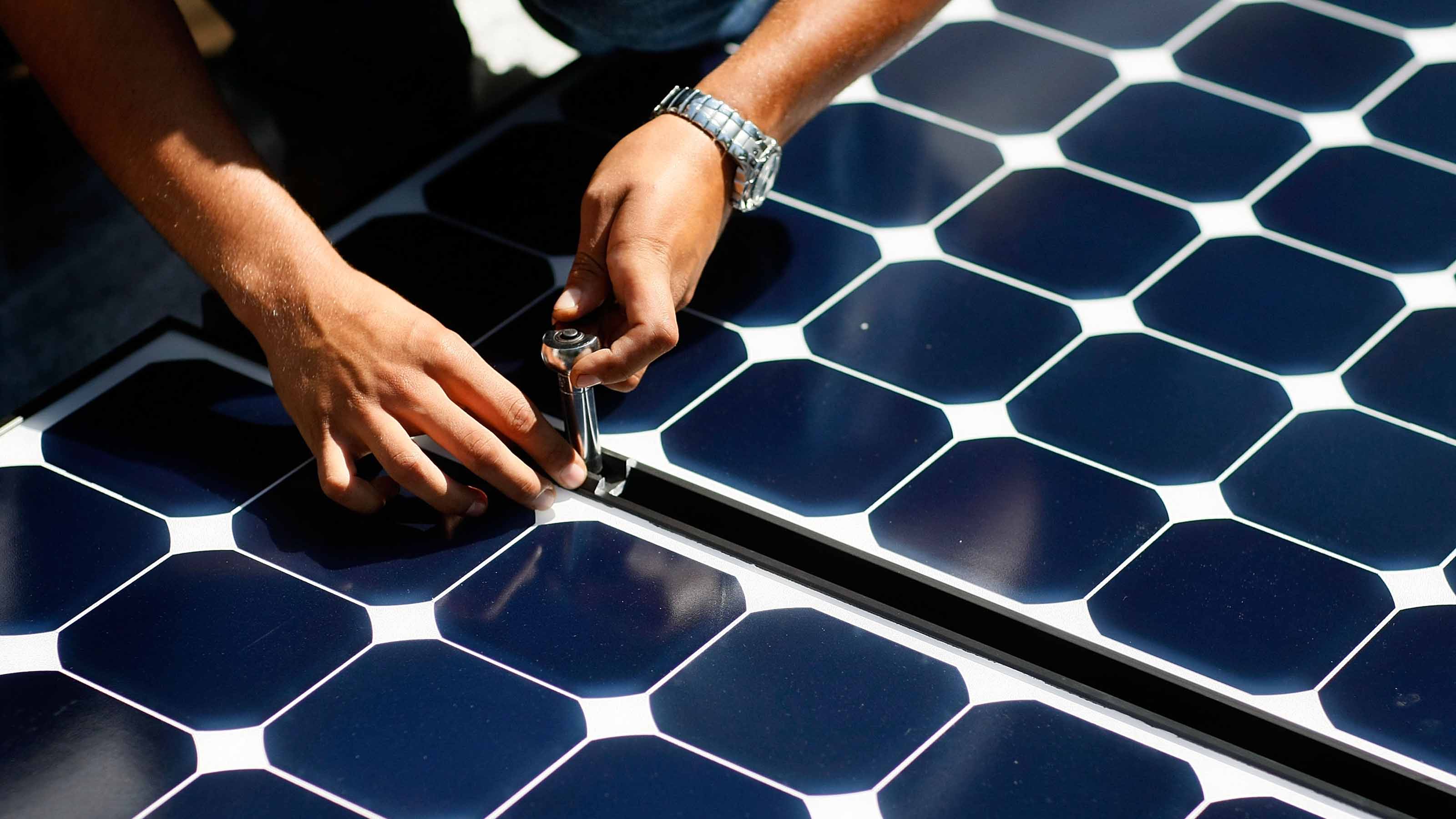

SunPower

- Shares shorted: 46.5 million

- Percentage of float: 57.5%

SunPower (SPWR, $54.01) spun off Maxeon Solar Technologies (MAXN), the company's solar panel manufacturing arm, in August 2020 to focus on designing and selling solar power and storage systems.

SunPower's stock, which is 52% owned by French energy giant Total (TOT), has come to life over the past year, gaining 870% over the past 52 weeks, including a whopping 110% for the year-to-date. The shorts are surely convinced that the valuation has gotten ahead of itself, at nearly five times sales.

The analyst community is split almost right down the middle. The stock currently garners three Strong Buys or Buys, three Strong Sells or Sells, and nine Hold ratings. But broadly speaking, they all seem to agree that the price has risen too high, too fast, with an average $23 price target.

In short, it's possible SPWR could revert violently back to the mean in the short term. But there is a real fundamental buy case brewing here.

In December, SunPower bought back 79% of its $302 million in outstanding 0.875% Convertible Senior Debentures due 2021 using cash on its balance sheet, including funds generated from the sale of 1 million Enphase Energy (ENPH) shares. This will reduce the near-term worries about its debt risk.

Excluding the $302 million in convertible debentures, SunPower had total debt of $587 million as of Sep. 27, 2020, along with $325 million in cash and cash equivalents, for net debt of $263 million compared to $1.44 billion in total assets.

Financially, its balance sheet is healthy. The backing of Total helps, as does the continuing emphasis by the Biden administration on clean energy.

Ligand Pharmaceuticals

- Shares shorted: 10.0 million

- Percentage of float: 65.2%

Ligand Pharmaceuticals (LGND, $185.35) partners with other pharmaceutical companies to discover and develop medicines. It currently has partnerships and licensing agreements with more than 120 pharmaceutical and biotechnology companies. It generates revenues from the royalties it receives from these partnerships and licensing agreements.

One partnership Ligand has benefited from during COVID-19 is the supply of Captisol, its patent-protected product that improves the solubility and stability of active pharmaceutical ingredients. It supplies Gilead Sciences (GILD) with Captisol for the coronavirus treatment remdesivir.

At the moment, Ligand has five royalty partnerships that could see drug approvals over the next 12 months, including a vaccine from Merck (MRK) meant to prevent pneumococcal disease in adults and children.

Ligand recently announced that it would get a $1.5 million milestone payment from Merck because the U.S. Food and Drug Administration (FDA) agreed to review its vaccine.

"This collaboration with Merck is one of the core assets that catalyzed our acquisition of Pfenex last October," CEO John Higgins stated on Jan. 13. "If commercially launched, Ligand is entitled to a low-single-digit royalty on net sales of V114."

In the first nine months of fiscal 2020 through the end of September, Ligand generated 59% of its $116.4 million in revenue from Captisol, another 20% from royalties, and the remaining $24.7 million from contracted research and development services.

Of the eight analysts covering this highly shorted stock, two rate it a Strong Buy, four rate it a Buy and the remaining two have it as a Hold. The shorts might not like it, but analysts seem more than happy with Ligand's pipeline of activity.

The only note here is that a price target of $185.83 leave very little room for upside. Investors will want to watch out for updates on LGND to see whether analysts peel back their ratings or upgrade their price targets from here.

Bed Bath & Beyond

- Shares shorted: 74.9 million

- Percentage of float: 68.7%

It has been a little more than a year since Bed Bath & Beyond (BBBY, $35.33) named Mark Tritton its new CEO. Tritton came over from Target (TGT), where he was the chief merchandising officer for the successful discounter. BBBY stock has gained 269% since Tritton took the helm, in some part fueled by a recent short squeeze.

The bears believe the moves Tritton has made since taking the job won't be enough in a retail environment that continues to move online and away from bricks and mortar. The pandemic has only accelerated this move.

CNBC's Mad Money host Jim Cramer recently discussed how the bull market had gotten so ahead of itself that investors are participating in short busting – the act of bidding up a stock's share price to the point the shorts are squeezed out of their positions.

"Right now, if you go to those sites (Reddit, etc.) … they're populated mostly by younger readers and participants who are plainly, openly plotting to blow up the shorts in this case by buying GameStop at any price and bidding the stock up, up and up to crush the shorts so they have to cover," Cramer said on Jan. 14. "It's incredible to watch. I think they're succeeding beyond their wildest dreams."

The CNBC analyst believes the same thing is happening with Bed Bath & Beyond. But don't let that fool you: Bed Bath is making fundamental progress, too.In its most recent quarterly report, the retailer reported strong digital sales: 77% higher across all brands, with a 94% increase at Bed Bath & Beyond, the company's primary brand for future growth. Meanwhile, BBBY is closing 200 underperforming Bed Bath & Beyond locations and selling five of its brands that account for another 340 stores.

Its Q3 2020 earnings might not have been entirely to analysts' liking, but Tritton remains on course to remake the customer experience.

Like with most of these heavily shorted stocks, timing could be difficult. BBBY shares have well exceeded analysts' average price target of $28.39, and the stock could be in for more short-term volatility to the downside once it's no longer the flavor of the week for short busters. Long-term buy-and-holders likely will have a better risk-reward proposition waiting for such a dip.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.