Stock Market Today: Promising Vaccine News Launches Dow to New Heights

Continued election momentum combined with COVID vaccine enthusiasm to propel many of the Dow's cyclical stocks Monday, while tech largely faltered.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The "COVID trade" went full-tilt on Monday amid a breakthrough on the coronavirus vaccine front.

This morning, Pfizer (PFE, +7.7%) and partner BioNTech (BNTX, +13.9%) announced results from an interim efficacy analysis showing their trial vaccine "to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection."

The news sparked a wild rally, albeit an imbalanced one.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

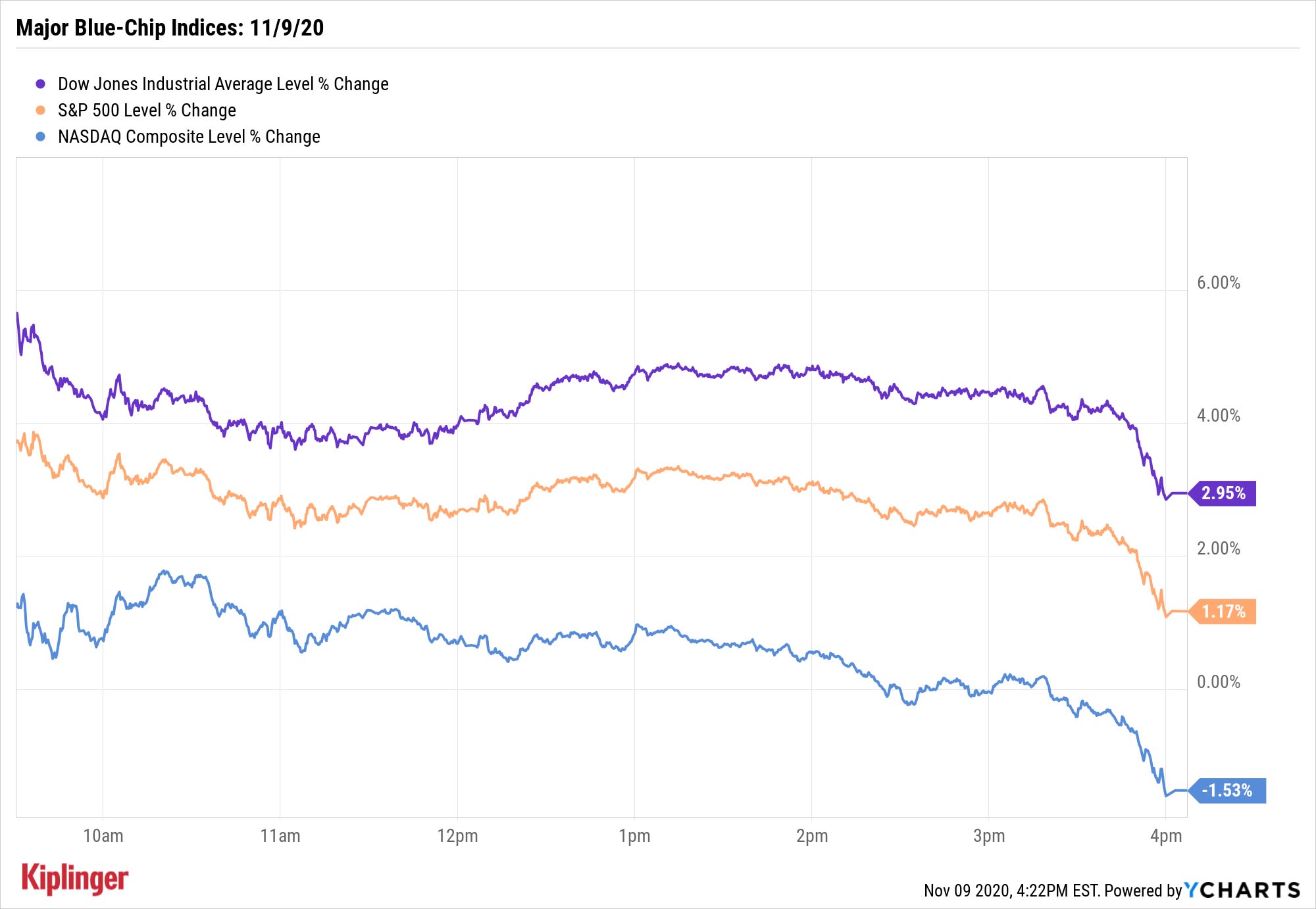

The Dow Jones Industrial Average shot 3.0% higher to 29,157, eclipsing its previous all-time high set Sept. 2, on the strength of cyclical stocks such as American Express (AXP, +21.4%), Boeing (BA, +13.7%) and JPMorgan Chase (JPM, +13.5%). Battered stocks in industries such as airlines and cruise operators soared, too – in fact, these 11 stocks for a "vaccine pop" gained 22.1% on average Monday.

"If last week's global equity rally is able to sustain this momentum it will be interesting to watch and see whether the growth trade continues or whether or not there will be a sustained rotation into cyclical and value oriented stocks," says Brian Price, head of investment management for Commonwealth Financial Network.

However, the tech-heavy Nasdaq Composite, long the hero in 2020, suffered a precipitous 1.5% drop to 11,713 amid weakness in mega-caps such as Amazon.com (AMZN, -5.1%) and Facebook (FB, -5.0%).

Other action in the stock market today:

- The small-cap Russell 2000 also rewrote the record books, gaining 3.7% to an all-time high 1,705.

- The S&P 500 gained 1.2% to 3,550.

- McDonald's (MCD) kicked off this week's earnings reports by announcing Street-beating profits and sales, as well as its plans to launch "McPlant" burgers next year. However, it still declined 1.5%.

Political Trades Continue, Too

The market's shot in the arm today wasn't solely about shots in the arms, however. Futures already were signaling gains after the media's major "decision desks" called the presidential election in favor of Joe Biden this weekend.

"Joe Biden emerged victorious, although a Democratic 'blue wave' failed to materialize," says Jeff Schulze, investment strategist at ClearBridge Investments. "Investors have initially cheered this more moderate outcome, with equities rallying and the VIX falling."

Canaccord Genuity equity strategist Tony Dwyer calls it "a market-friendly election outcome."

"The election outcome has likely neutralized the far left and far right tail risk of the political spectrum, which could allow a more centrist view and set of policy initiatives," he says. "The results suggest there is no major mandate or majority that would go right to work on big policy changes. That means investors can again focus on the most powerful influence in the world – a historically accommodative Fed and global central banks."

Various areas of the market widely believed to benefit from Biden's expected policies – industrial stocks, electric vehicles and marijuana stocks among them – finished with robust gains today.

Just how far so-called Biden stocks can go from here isn't completely clear, in large part because control of the Senate hasn't been cemented yet. Read on as we evaluate an expanded list of the best stocks to own under a Biden administration.

Kyle Woodley was long AMZN and BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.