The Best Money Advice My Dad Ever Gave Me

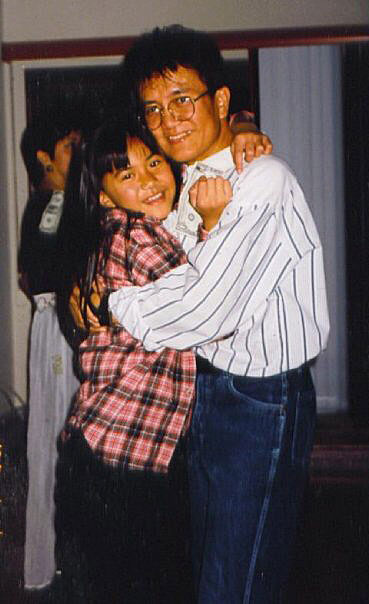

Papa Rapacon has successfully retired by taking calculated risks and educating himself about finances.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

My father, who my sisters and I have always lovingly called Papa, enjoyed a long and happy career. Now he gets to enjoy the fruits of his labor: a long and happy retirement (hopefully).

To reach this major milestone and ensure the financial security of his senior years as well as his estate, he made a lot of smart money moves throughout his life. And he's never been shy about sharing his wisdom with others, especially his children. Here are the seven best financial lessons he's taught me throughout my life:

1. Take calculated risks.

At age 24, with a new and pregnant wife and just $50 in his pocket, Papa moved from the Philippines to the United States. To be clear, theirs was not a dramatic and scrappy immigrant story. Yes, their move came with risks. They journeyed halfway around the world, leaving behind their beloved home country and betting on the American dream—a better life for their kids. But their route was well planned. He was prepared with a medical degree and a residency waiting for him in Ohio, so the odds of succeeding in a new land were in his favor.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Especially when you're young, you need to be willing to take risks. Whether it's moving to a new city or investing in stocks for the first time, doing something new may be scary, but it might also offer the greatest rewards. The trick is to have a well-devised plan. And remember: If you fail, your youth affords you plenty of time to recover.

2. Pick the right partner.

My dad would not have made it to the States or to retirement (or through breakfast) without the help of my mom. She was actually the one who pushed him to take the leap overseas, having learned from her dad that the U.S. is the land of opportunity. She supported him throughout his career, taking care of their home and family so he could focus first on studying and then on working. She also managed the household budget, including balancing their accounts (with an actual checkbook—so old school) and handling the banking (with actual tellers—super old school).

We can't all be lucky enough to find one special person to be a complete support staff. But you can be smart enough to look for a partner who will help you reach your maximum potential. Before you marry someone or otherwise tether your life to another person, be sure you're on the same page when it comes to career and finances. You don't have to agree on all money matters, of course. For example, my dad has always been a saver while my mom tends to be a spender, but they've made their marriage work for nearly 45 years. What's most important is that you are open with each other and agree on common goals. These four critical questions can help you get the conversation rolling.

3. Education is key.

My dad's MD was his ticket to a comfortable life in the U.S. But his schooling didn't stop there. After his residency and before starting practice as an anesthesiologist, he furthered his education with additional post-doctoral training in neonatal intensive care and pediatric anesthesia. Adding these skills to his resume took just six extra months of study—plus a brief move to Los Angeles, sadly before I was around to enjoy living there—but forever boosted his career opportunities.

Indeed, more education tends to lead to bigger paychecks. According to the U.S. Census Bureau, the median annual pay for high school graduates is $27,528; a Bachelor's degree bumps that median up to $50,254, and a graduate or professional degree does even better with $66,493. If more formal education isn't in the cards for you (see Should You Go to Grad School?), you can still expand your skill set and increase your earning power with free online classes on anything from coding to public speaking.

4. Financial education is also key.

Ever the studious nerd, my dad reads everything he can about—well, everything; he is an avid reader who loves to learn and believes that knowledge is power. He takes a special interest in reading about personal finance and investing. He reads Kiplinger's Personal Finance, of course, as well as competing magazines (which shall not be named), newspapers, books and a variety of Web sites. He even holds onto key stories—including those not written by his daughter—and makes notes in the margins. "Talk to planner about this," he'll scribble. On Kiplinger.com, he used our Retiree Tax Map to compare states' tax policy for retirees—and determined that moving out of New Jersey in retirement would pay off.

Financial literacy is empowering. With an understanding of how money works, you can build a smart budget, pay off debt responsibly, retire comfortably and, you know, afford stuff. The subject might be intimidating, but once you get started, you'll find that the basics are simpler than you might have thought. You know that Kiplinger's Starting Out column is a great free resource for financial education. Also check out our Basics collection to help you get started.

[page break]

5. Start saving early.

My dad started to practice medicine in 1974. So when did he start saving for retirement? In 1974. And he preached what he practiced. Before I started my first full-time job, he made sure I knew to enroll in my company's 401(k) plan and to contribute enough to receive the full employer match. I hardly even knew I had the option not to do this. He also nagged… er, I mean, encouraged—strongly, repeatedly, incessantly encouraged—me to open a Roth IRA as soon as I could.

Time is your greatest asset when it comes to saving for retirement. Given enough time, even a relatively small sum can grow into a sizable nest egg. For example, if a 25-year-old saves just $101 a month in a 401(k) plan, assuming an 8% return and a full employer match, she'll have $1 million by the time she turns 65 if her salary and contributions increase by 3% annually. Bump it up to $202 a month to hit $2 million by age 65. Plus, starting to save at a young age helps you develop the habit and makes it easier to squirrel away cash as time goes on.

6. Live within your means.

Debt was a foreign concept to my dad. Growing up, if he couldn't afford something, he didn't buy it. When he finally did need to take out loans for big-ticket items (first a car and later a house), his discomfort with living with credit made him control his debts very carefully. His reward: a stellar credit score and access to the best rates on the loans he has taken.

While it's often necessary to take on some financial burdens—to pay for your education, for example (see money lesson number two above)—you must be careful about not taking on too much and about managing your repayments wisely. The key to doing that is to spend less than you earn. And the key to doing that is to have a budget. Knowing where your money is going helps you identify where you can save. When you're building your budget, be sure to include paying off your credit cards in full every month, as well as making other debt payments. For more, see How to Handle Debt.

7. Love your job.

Though my dad is now happily retired, he might have been just as happy to keep working for the rest of his life. He learned from an early age to enjoy work in general and to take pleasure in a job well done. In fact, his first job as a kid was shining shoes, which he did with his friends. Doing it together—they competed to see who could get the most customers—they found a way to make even a seemingly menial task fun.

Also, he worked at the same hospital with many of the same people for more than 30 years (as long as I've lived). His coworkers were his second family. Because he loved the job, putting in extra hours whenever possible and bringing in extra income was an easy choice. And because he invested that extra time early in his career, he afforded himself more flexibility later. He was able to schedule his work around his family—and rarely missed a tennis match, basketball game, piano recital or choral concert.

I didn't take all of my dad's financial advice—I did major in English, much to his chagrin. But I recognize the wisdom of the path he took and have followed him in finding a career I wouldn't mind doing for the rest of my life. After all, working past retirement age comes with many benefits, including boosting Social Security payouts and giving you more time to build a comfortable nest egg. I've also managed to score a gig that allows me a flexible schedule that helps me balance work and family, including more time to enjoy my dad in his retirement.

P.S. See, Papa; I was totally listening.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rapacon joined Kiplinger in October 2007 as a reporter with Kiplinger's Personal Finance magazine and became an online editor for Kiplinger.com in June 2010. She previously served as editor of the "Starting Out" column, focusing on personal finance advice for people in their twenties and thirties.

Before joining Kiplinger, Rapacon worked as a senior research associate at b2b publishing house Judy Diamond Associates. She holds a B.A. degree in English from the George Washington University.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Debit Cards vs Charge Cards

Debit Cards vs Charge Cardscredit & debt Whether sticking to a budget or reaping big rewards, understand whether debit cards vs charge cards are right for you.

-

Four Smart Steps To Take Before Buying Your First Home

Four Smart Steps To Take Before Buying Your First Homehome Buying your first home can be daunting. Here are four things you need to do years before you start house-hunting to prepare financially for the biggest purchase of your life.

-

The 15 Cheapest Places to Live: US Cities Edition

The 15 Cheapest Places to Live: US Cities Editionplaces to live Have a look at the cheapest places to live in America for city dwellers. Is one of the cheapest places to live in the U.S. right for you?

-

Sharing His Path to Success

Sharing His Path to SuccessStarting Out: New Grads and Young Professionals This Native American studied tech in the Air Force and landed his dream job. Now he’s giving back.

-

PODCAST: How to Find a Job After Graduation, with Beth Hendler-Grunt

PODCAST: How to Find a Job After Graduation, with Beth Hendler-GruntStarting Out: New Grads and Young Professionals Today’s successful job applicants need to know how to ace the virtual interview and be prepared to do good old-fashioned research and networking. Also, gas prices are high, but try a little global perspective.

-

Preparing for a New Life

Preparing for a New LifeStarting Out: New Grads and Young Professionals While this Afghan refugee waits for resettlement, she is working to bring her family to the U.S.

-

When It’s Time to Drop Your Parents’ Health Insurance

When It’s Time to Drop Your Parents’ Health InsuranceStarting Out: New Grads and Young Professionals Thanks to the Affordable Care Act, the uninsured rate for twenty-somethings has plummeted.

-

Financial Planning We Can Afford

Financial Planning We Can AffordFinancial Planning You don't have to be a wealthy baby boomer to hire a financial adviser.